Subject Matter Experts at SamacheerKalvi.Guide have created Tamil Nadu State Board Samacheer Kalvi 11th Computer Applications Book Answers Solutions Guide Pdf Free Download of Volume 1 and Volume 2 in English Medium and Tamil Medium are part of Samacheer Kalvi 11th Books Solutions.

Let us look at these TN State Board New Syllabus Samacheer Kalvi 11th Std Computer Applications Guide Pdf of Text Book Back Questions and Answers, Notes, Chapter Wise Important Questions, Model Question Papers with Answers, Study Material, Question Bank and revise our understanding of the subject.

Students can also read Tamil Nadu 11th Computer Applications Model Question Papers 2020-2021 English & Tamil Medium.

Samacheer Kalvi 11th Computer Applications Book Solutions Answers Guide

Tamilnadu State Board Samacheer Kalvi 11th Computer Applications Book Back Answers Solutions Guide Volume 1 and Volume 2.

Samacheer Kalvi 11th Computer Applications Book Back Answers

- Chapter 1 Introduction to Computers

- Chapter 2 Number Systems

- Chapter 3 Computer Organisation

- Chapter 4 Theoretical Concepts of Operating System

- Chapter 5 Working with Typical Operating System (Windows & Linux)

Unit 2 Office Automation Tools (Word Processor, Spreadsheet and Presentation)

- Chapter 6 Word Processor Basics (OpenOffice Writer)

- Chapter 7 Spreadsheets Basics (OpenOffice Calc)

- Chapter 8 Presentation Basics (OpenOffice Impress)

Unit 3 Web Page Development Using HTML and CSS

- Chapter 9 Introduction to Internet and Email

- Chapter 10 HTML – Structural Tags

- Chapter 11 HTML – Formatting Text, Creating Tables, List and Links

- Chapter 12 HTML – Adding Multimedia Elements and Forms

- Chapter 13 CSS – Cascading Style Sheets

Unit 4 Javascript

- Chapter 14 Introduction to Javascript

- Chapter 15 Control Structure in JavaScript

- Chapter 16 Javascript Functions

Unit 5 Computer Ethics and Cyber Security

Unit 6 Tamil Computing

We hope these Tamilnadu State Board Samacheer Kalvi Class 11th Computer Applications Book Solutions Answers Guide Volume 1 and Volume 2 Pdf Free Download in English Medium and Tamil Medium will help you get through your subjective questions in the exam.

Let us know if you have any concerns regarding TN State Board New Syllabus Samacheer Kalvi 11th Standard Computer Applications Guide Pdf of Text Book Back Questions and Answers, Notes, Chapter Wise Important Questions, Model Question Papers with Answers, Study Material, Question Bank, drop a comment below and we will get back to you as soon as possible.

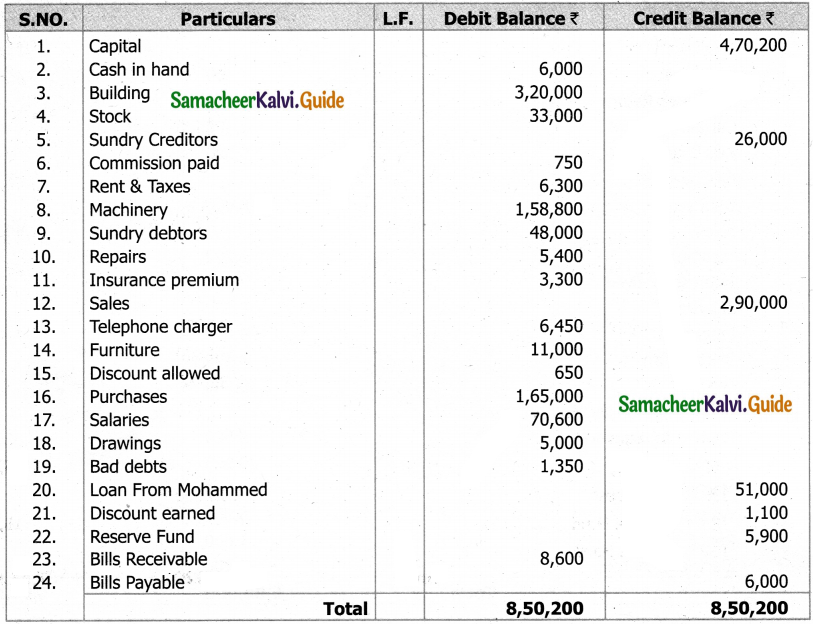

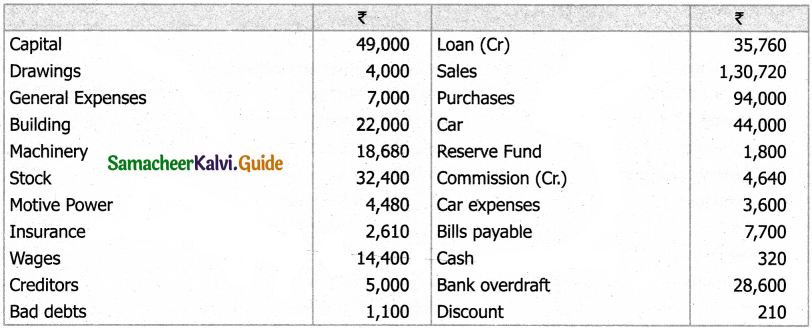

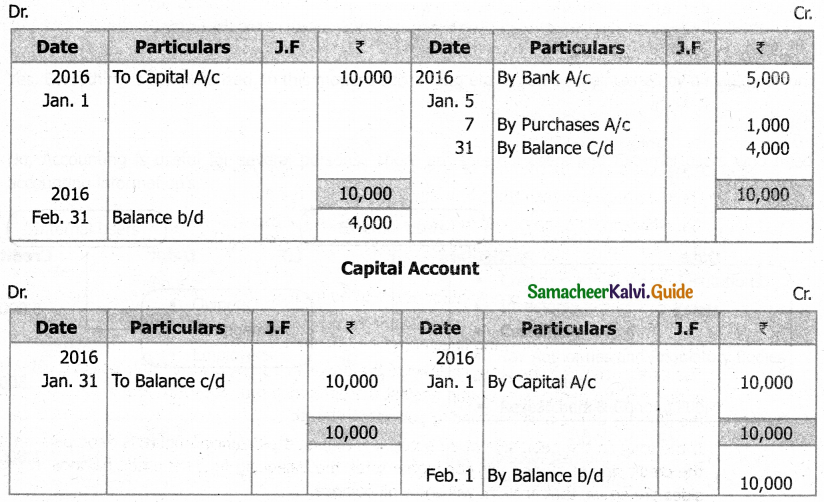

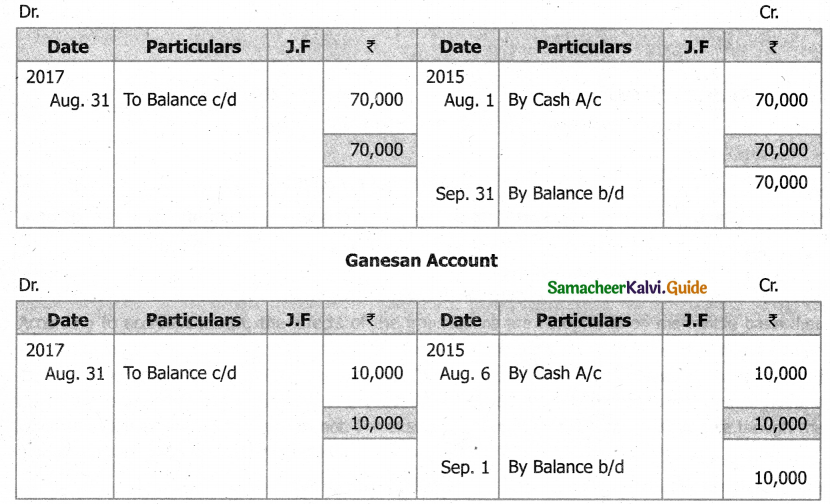

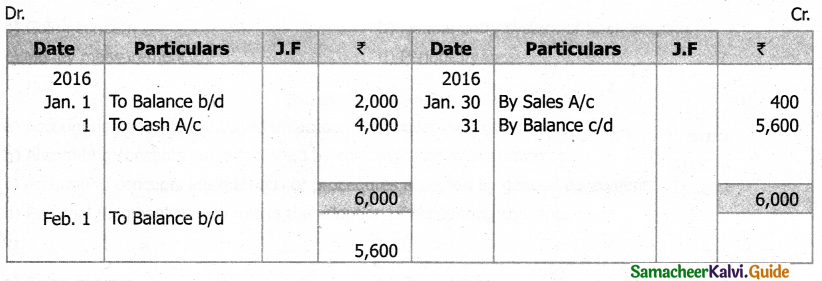

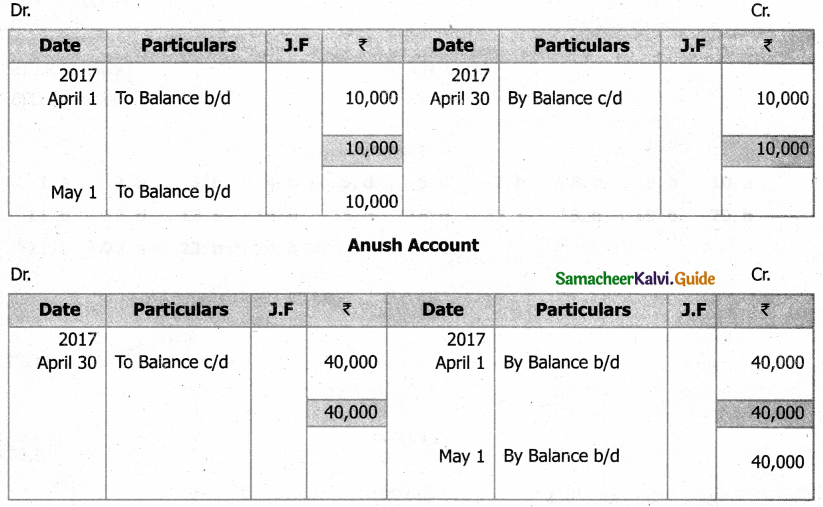

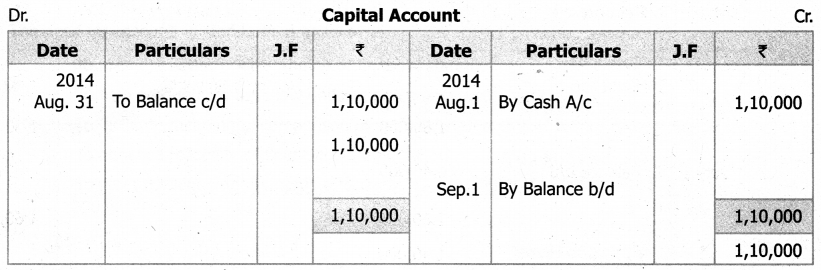

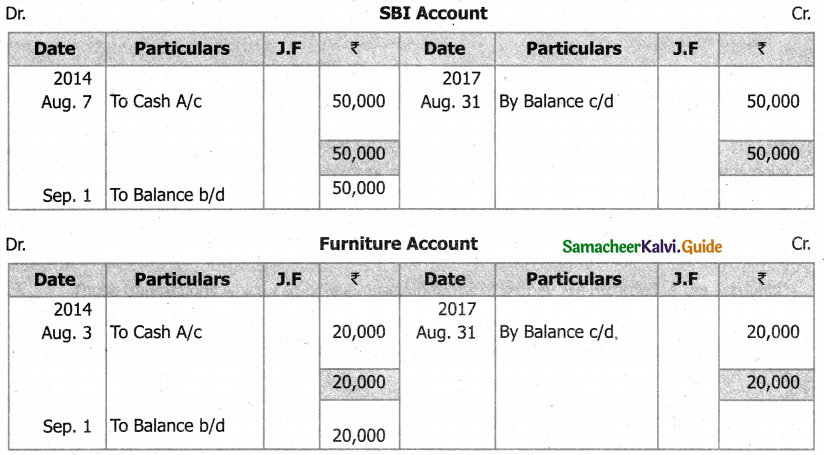

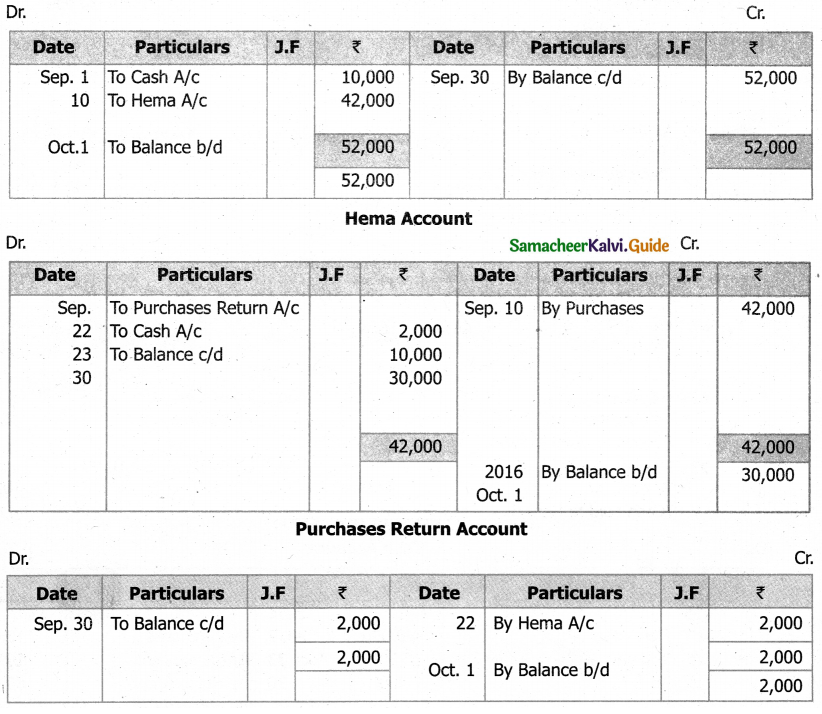

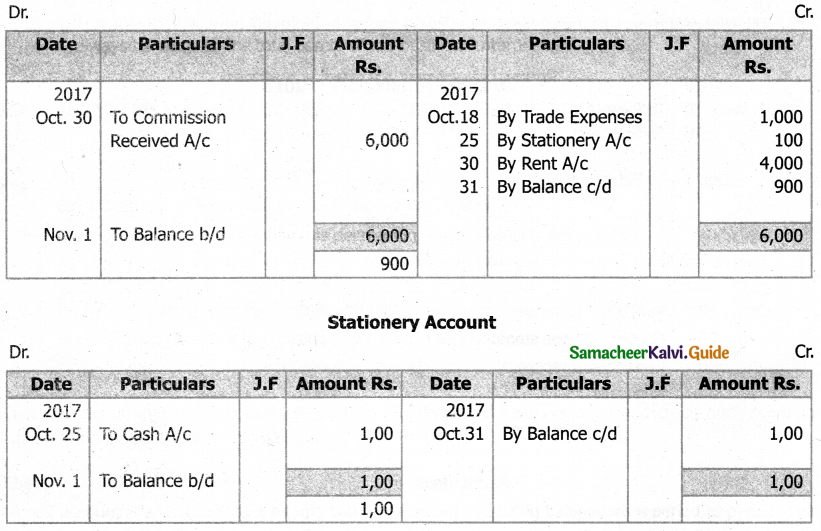

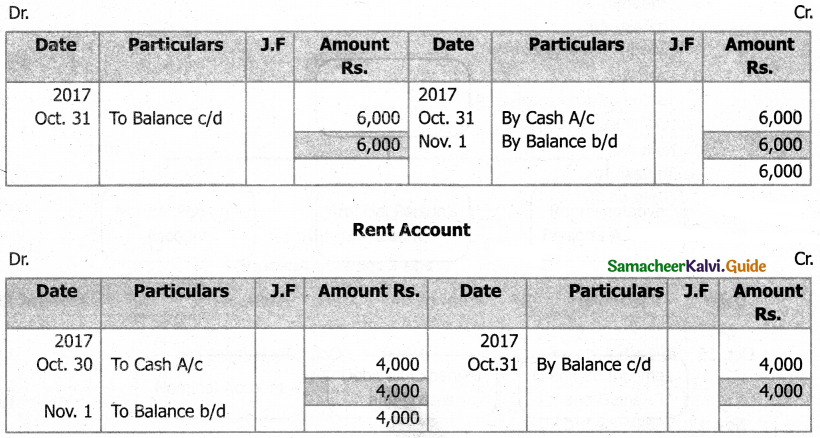

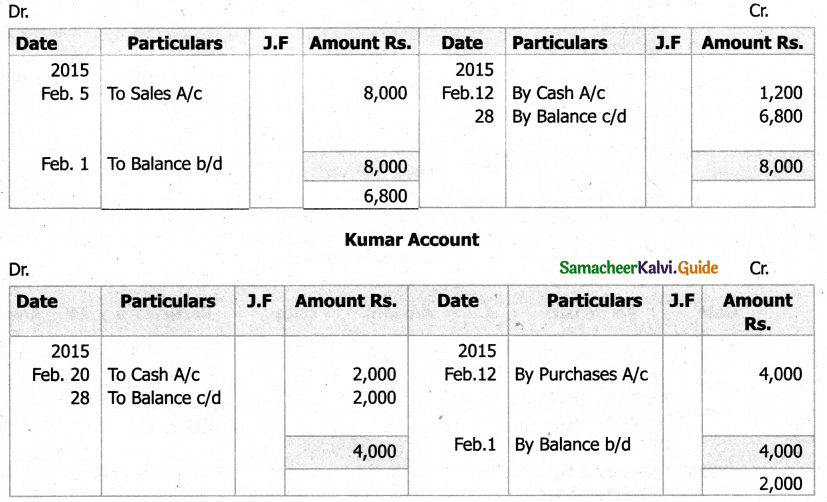

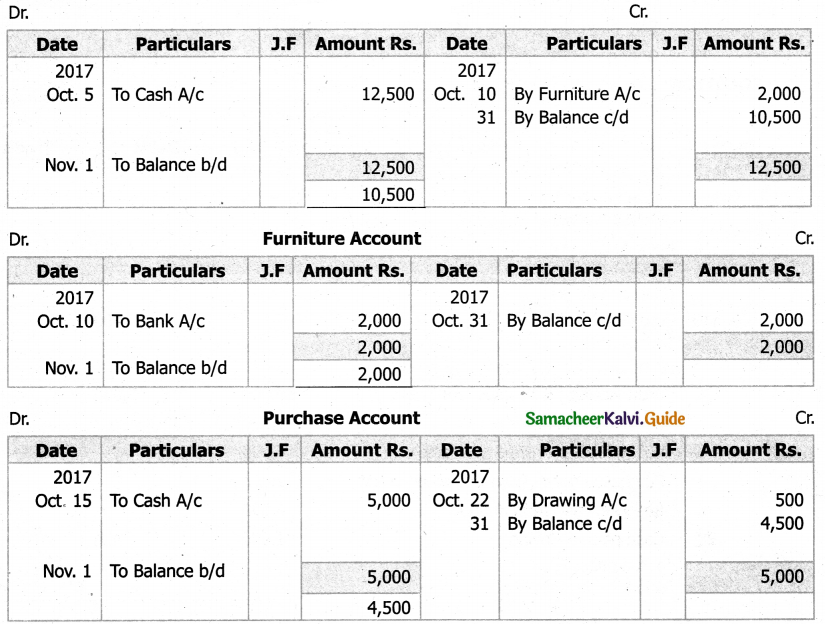

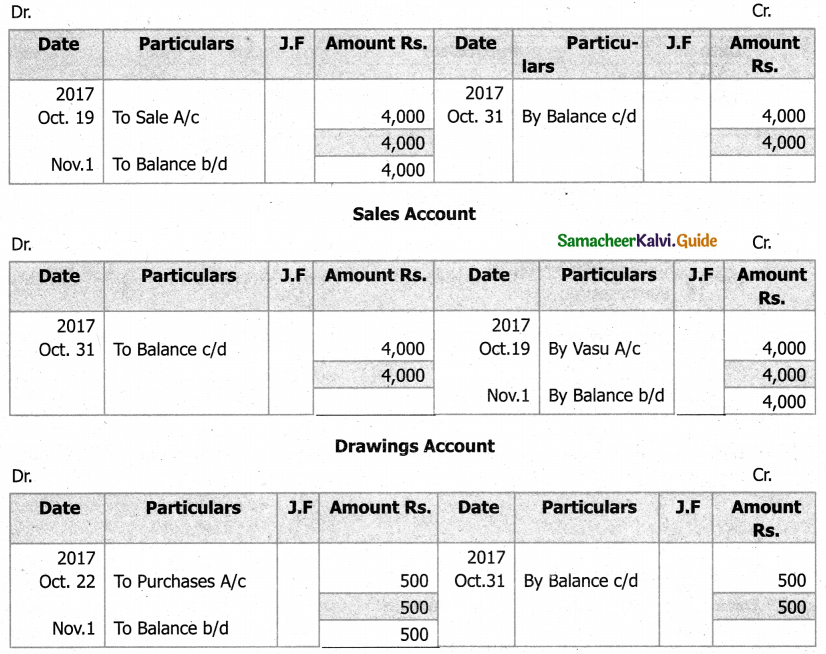

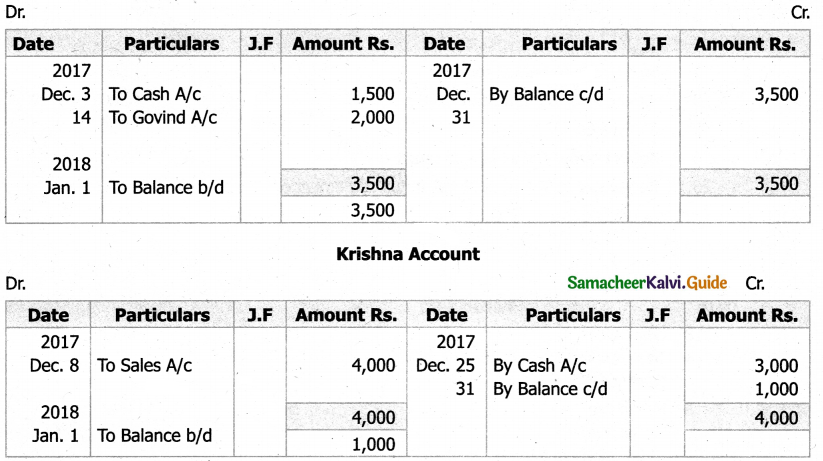

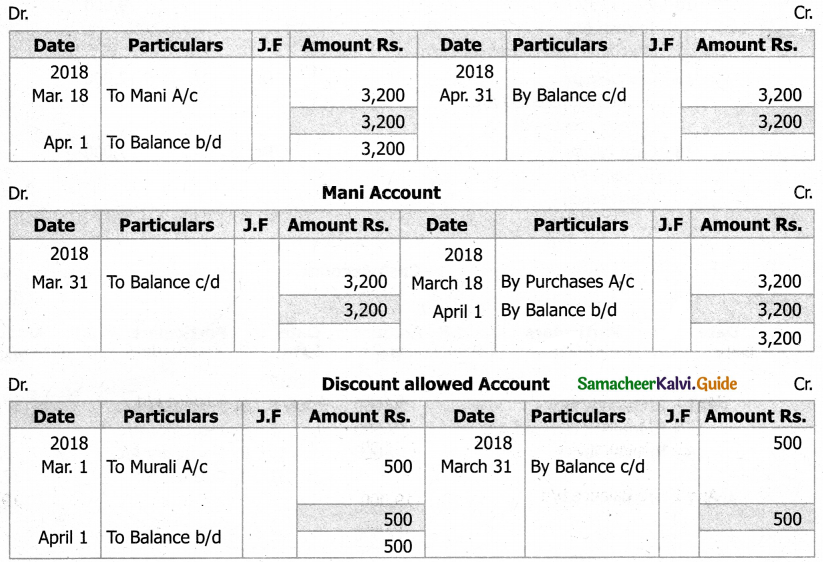

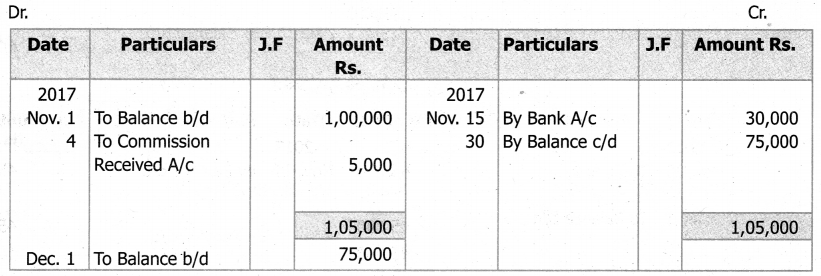

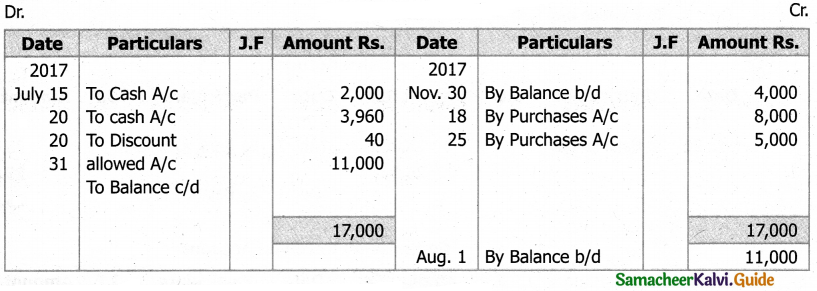

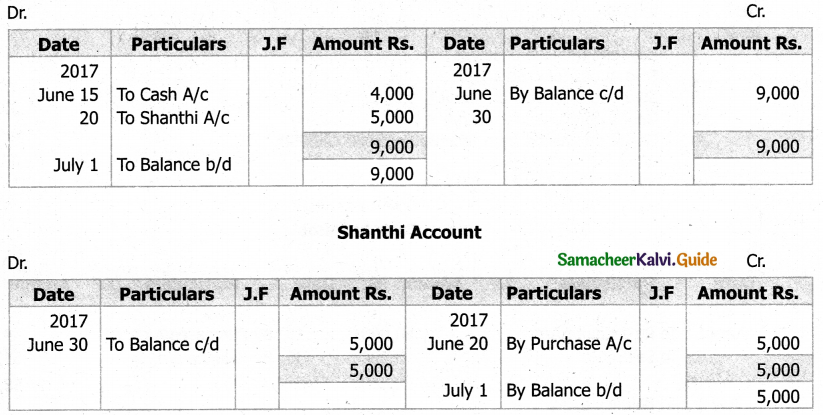

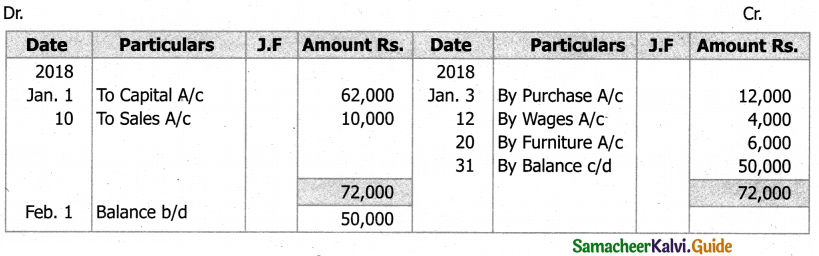

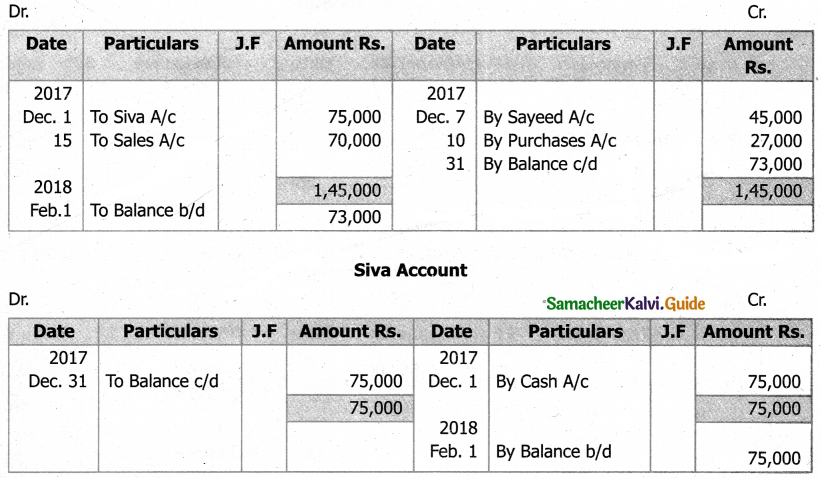

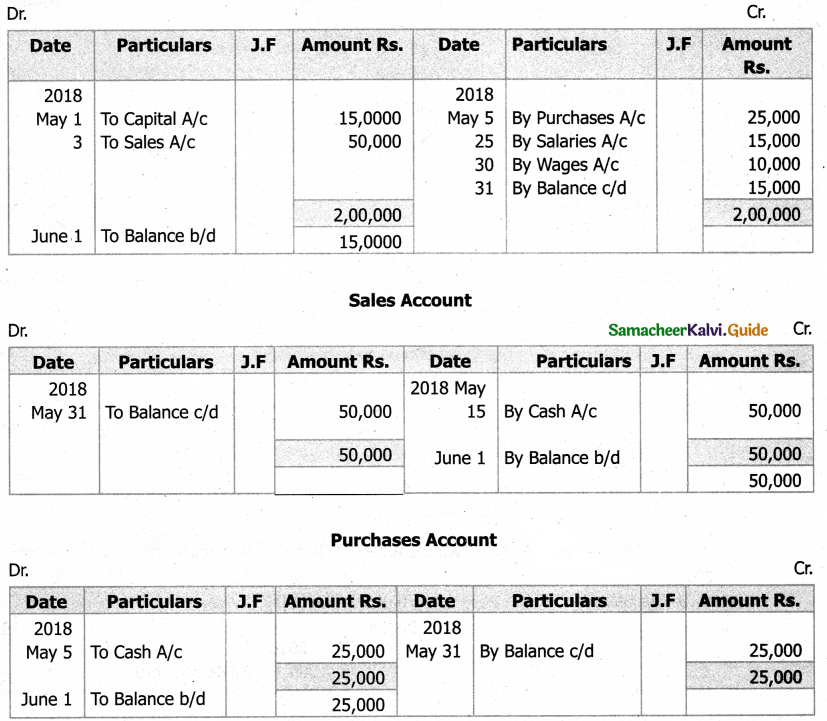

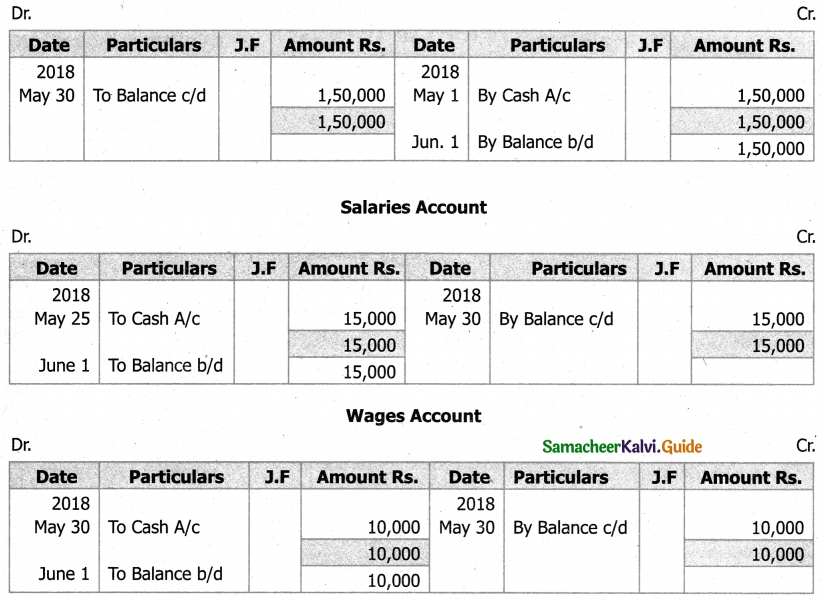

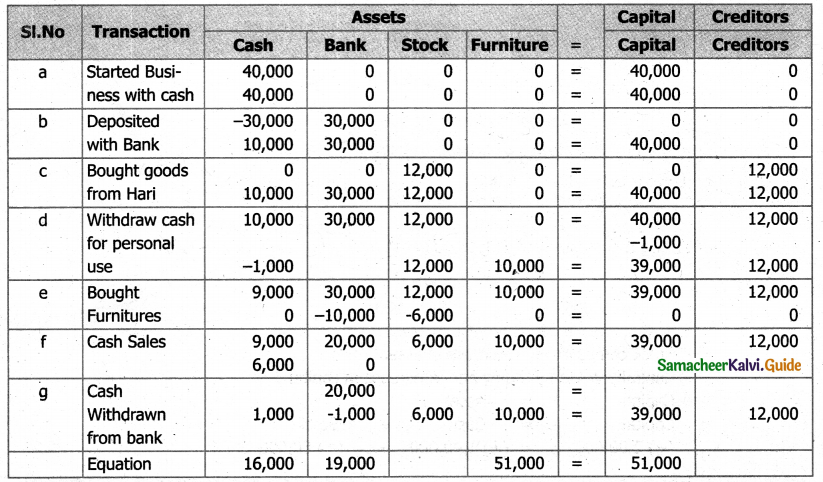

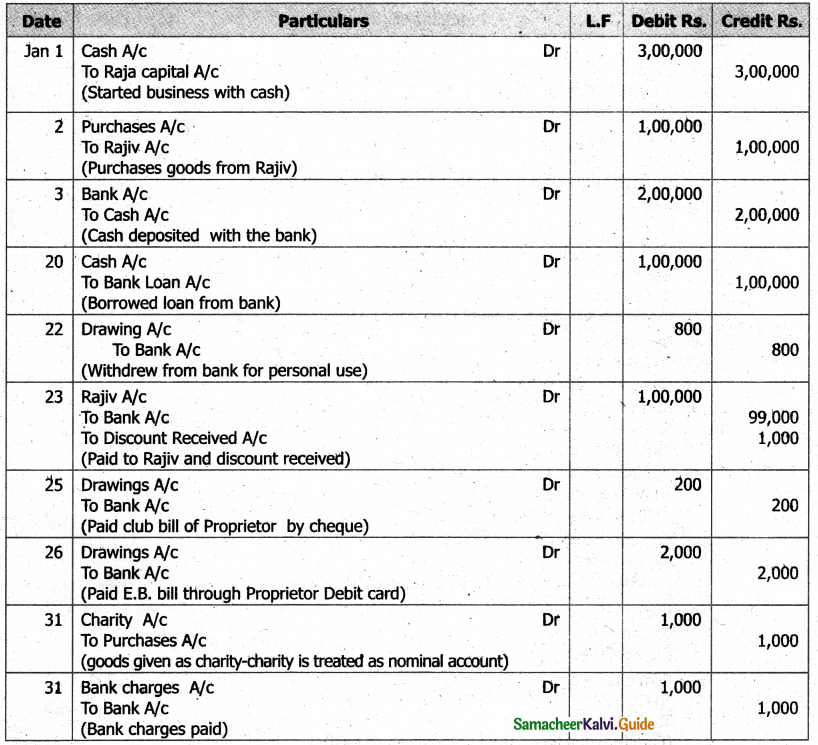

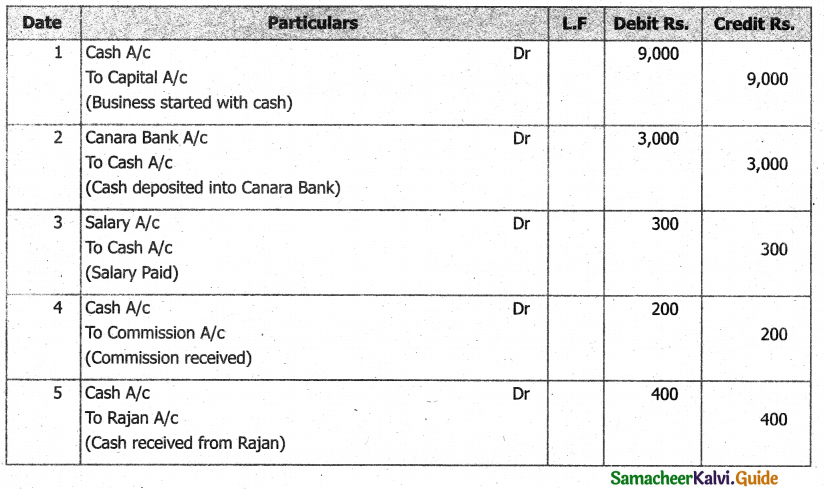

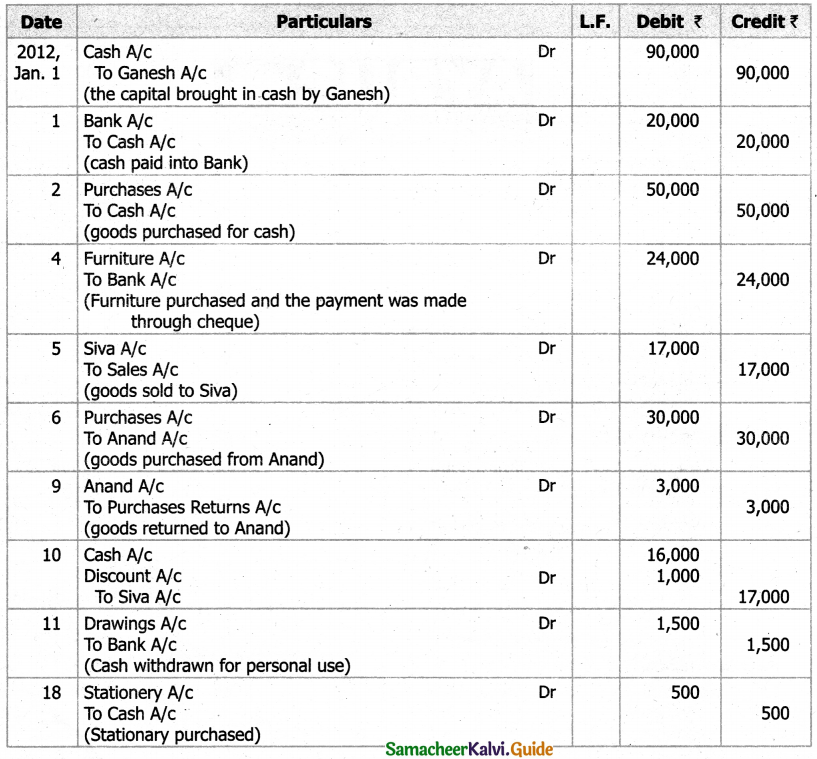

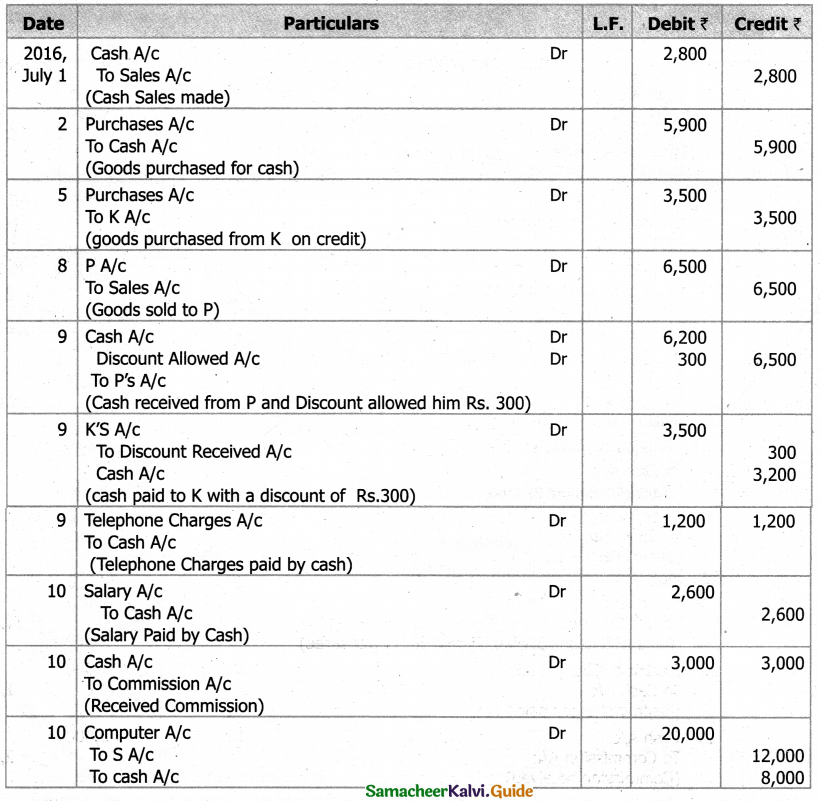

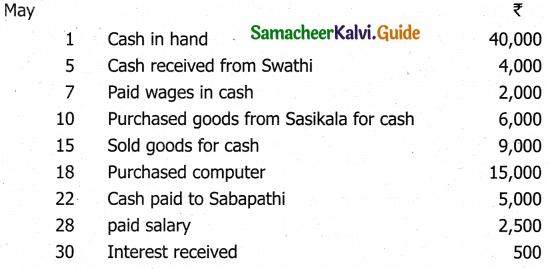

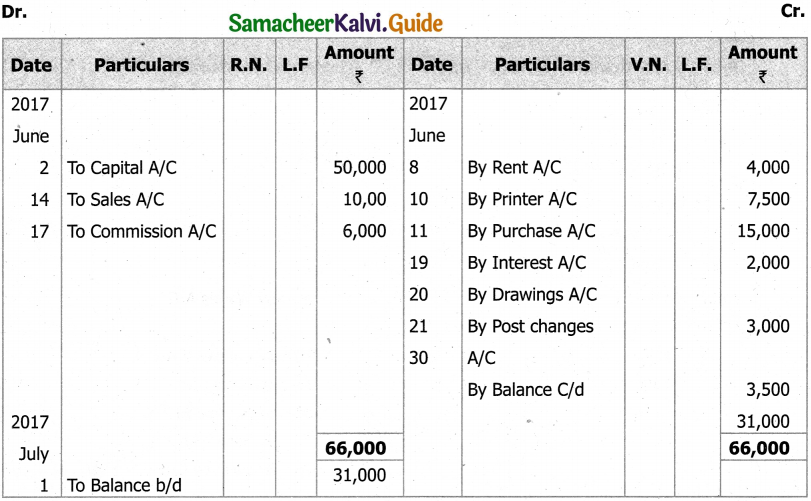

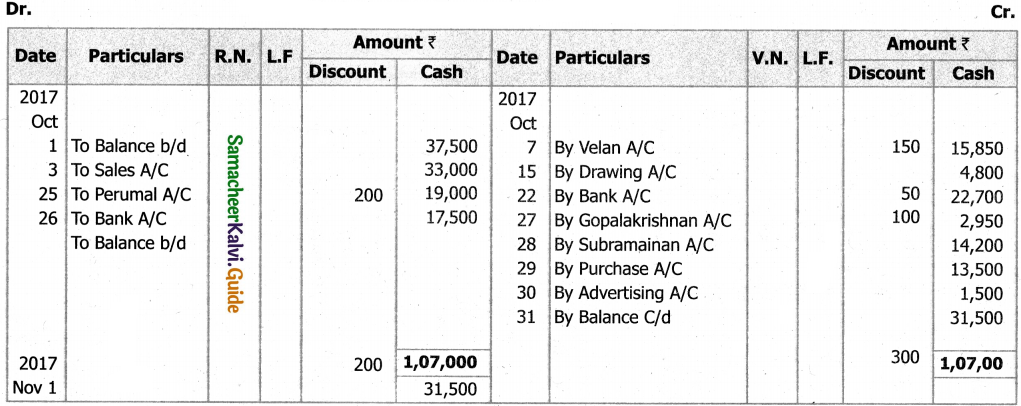

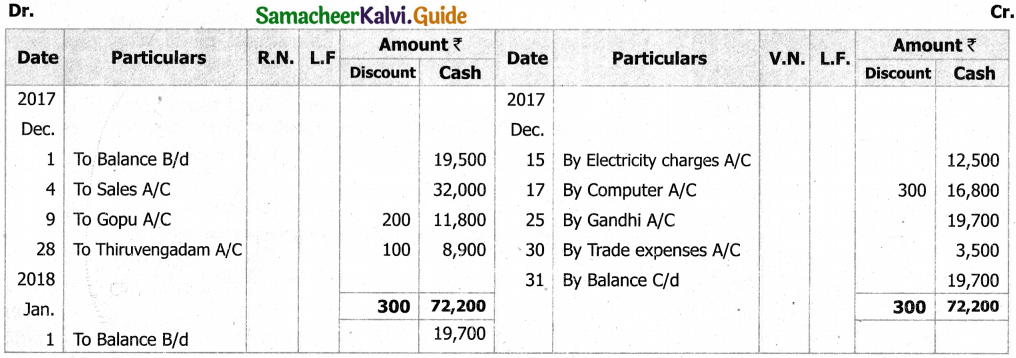

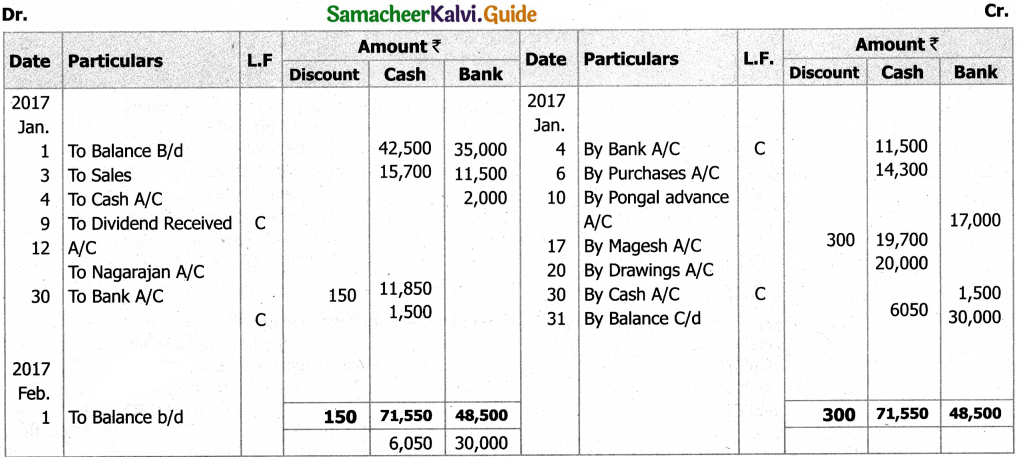

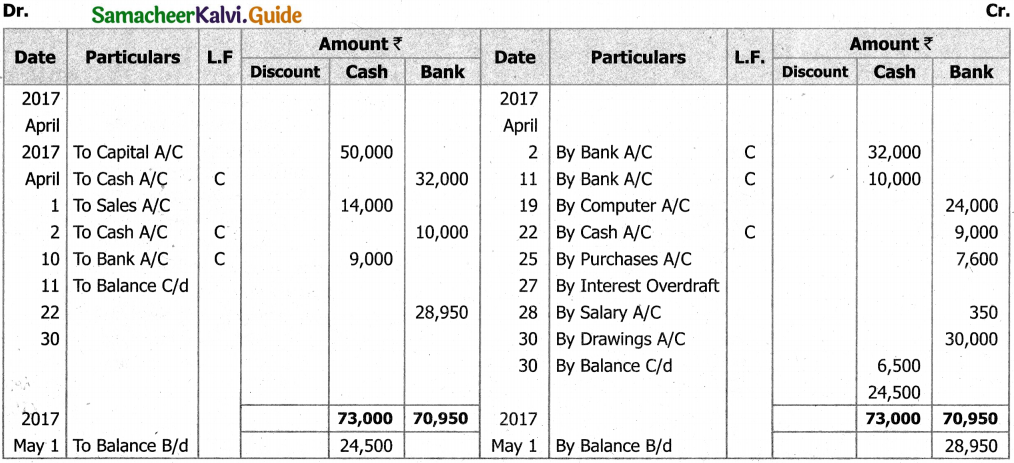

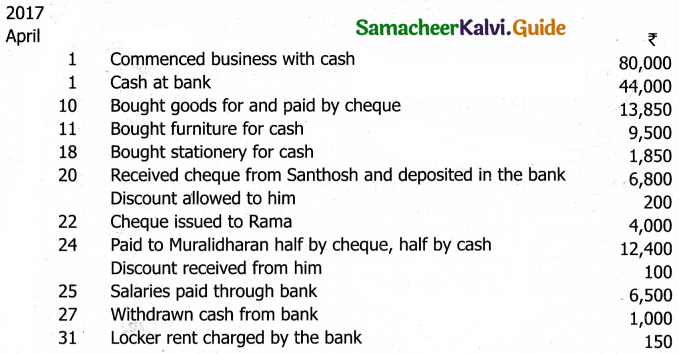

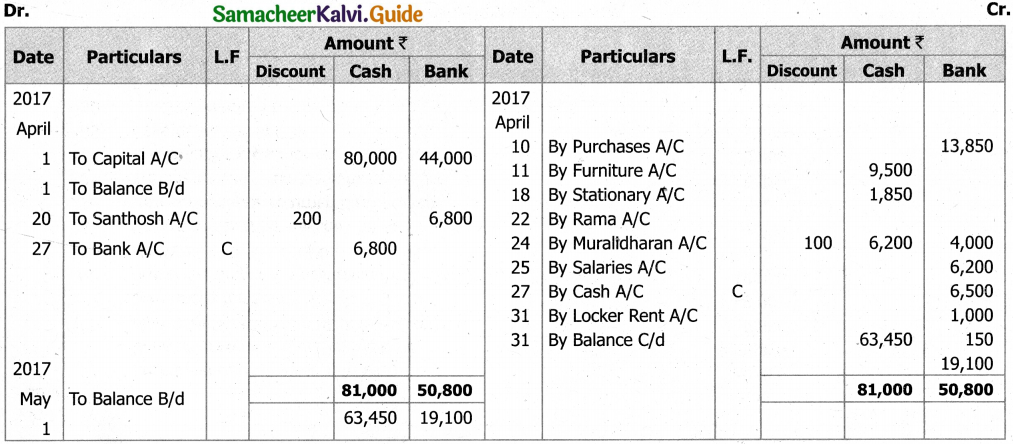

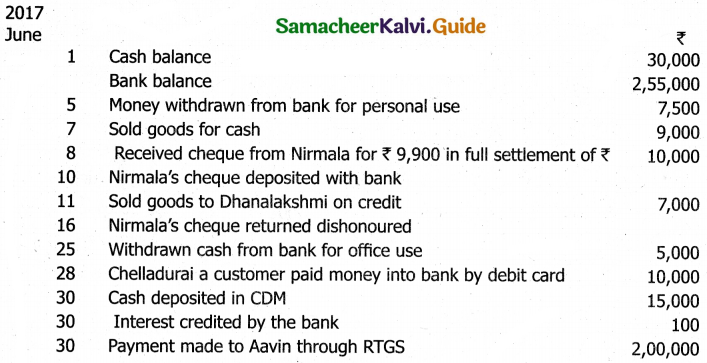

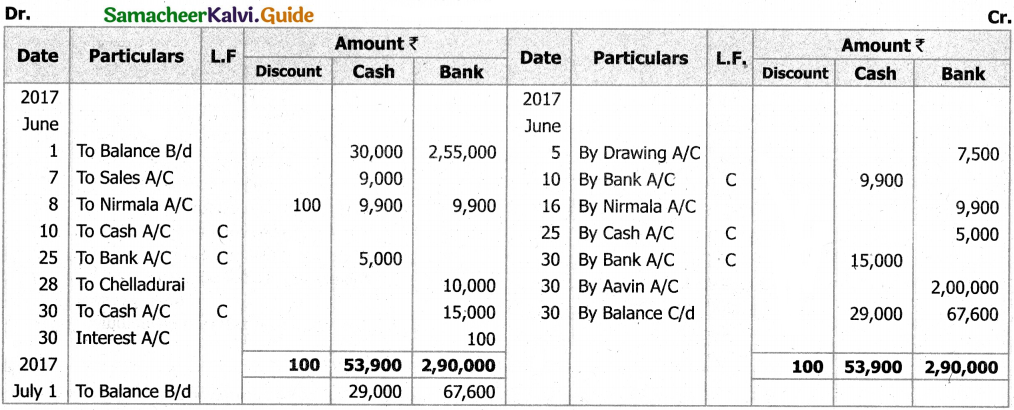

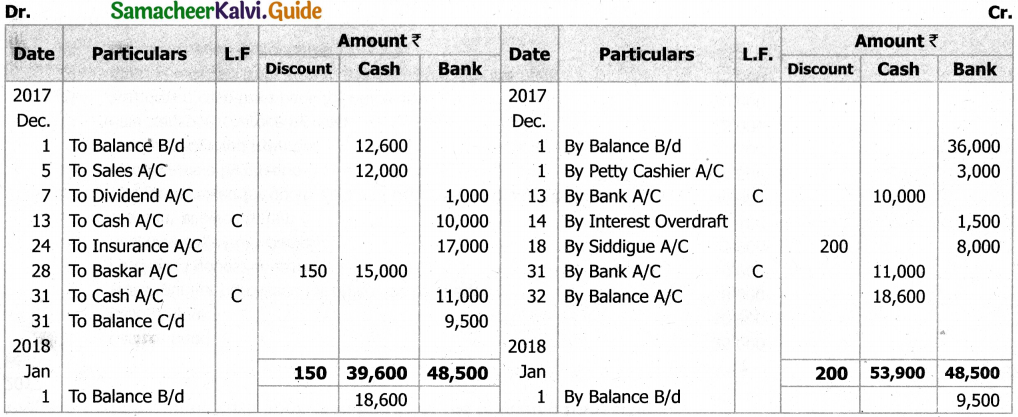

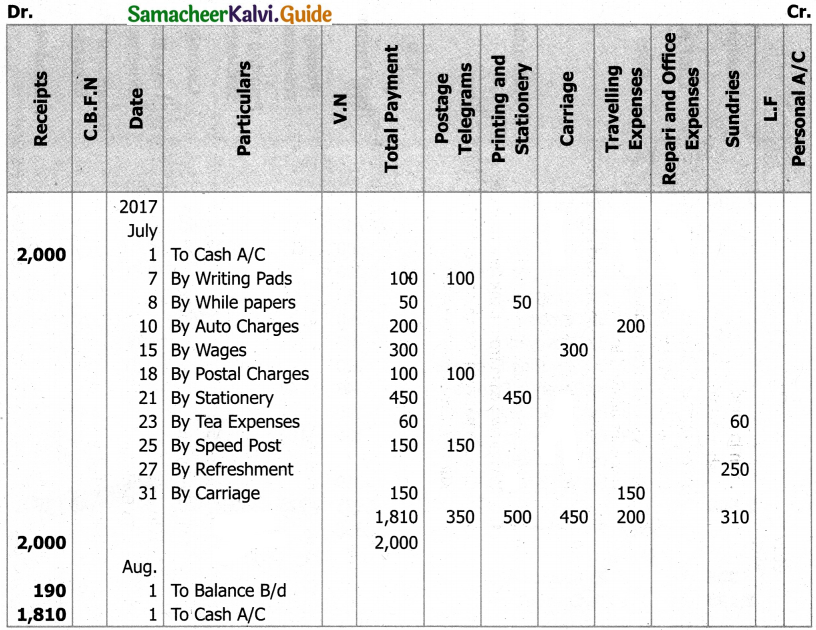

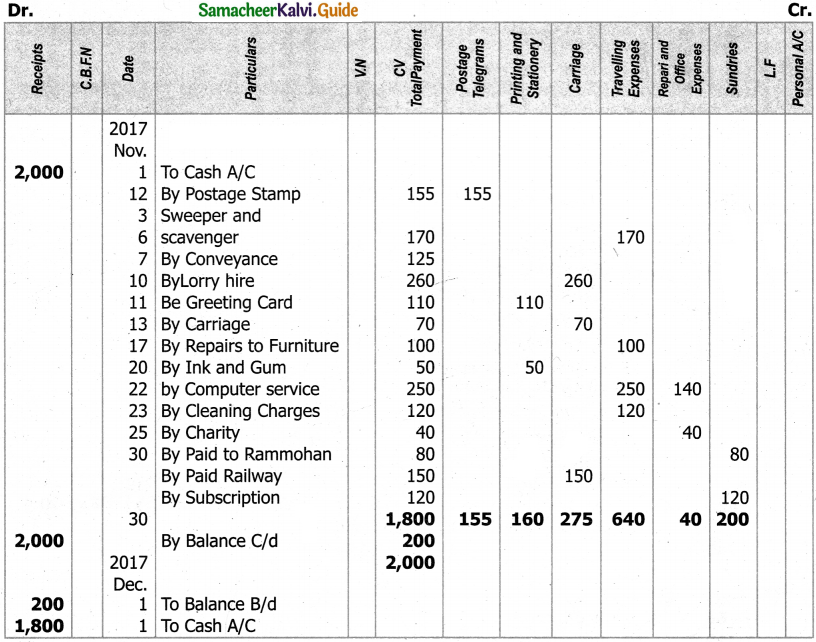

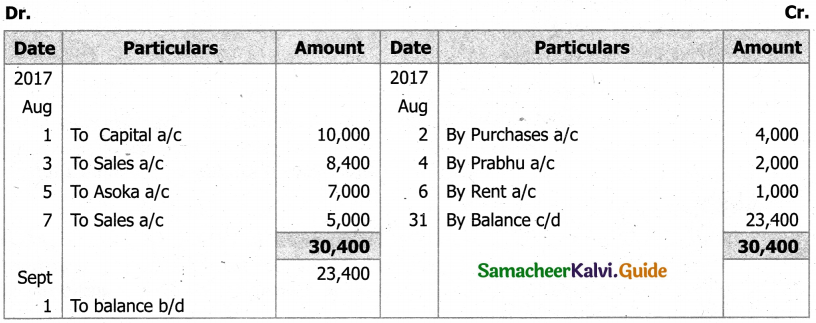

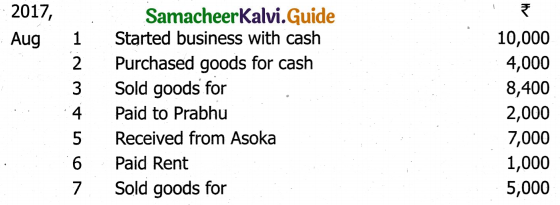

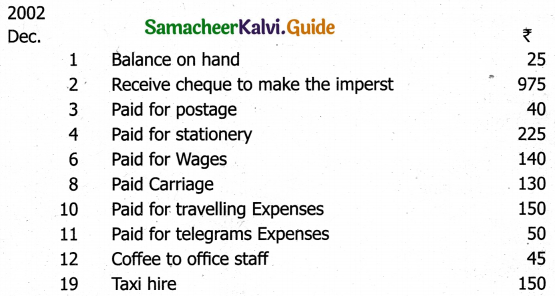

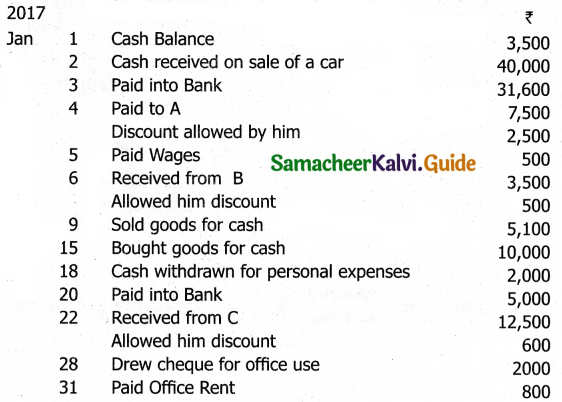

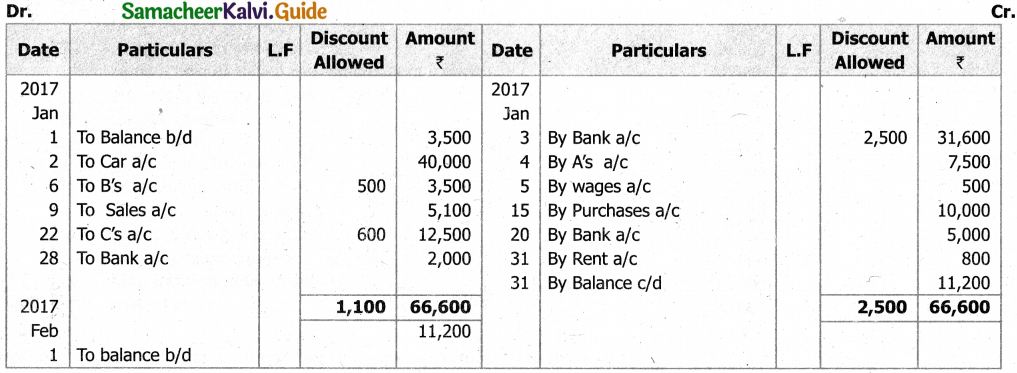

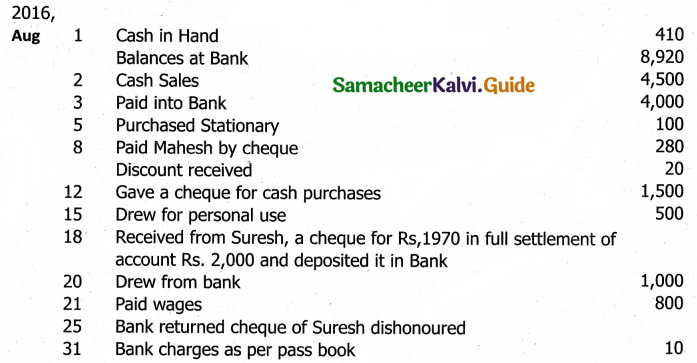

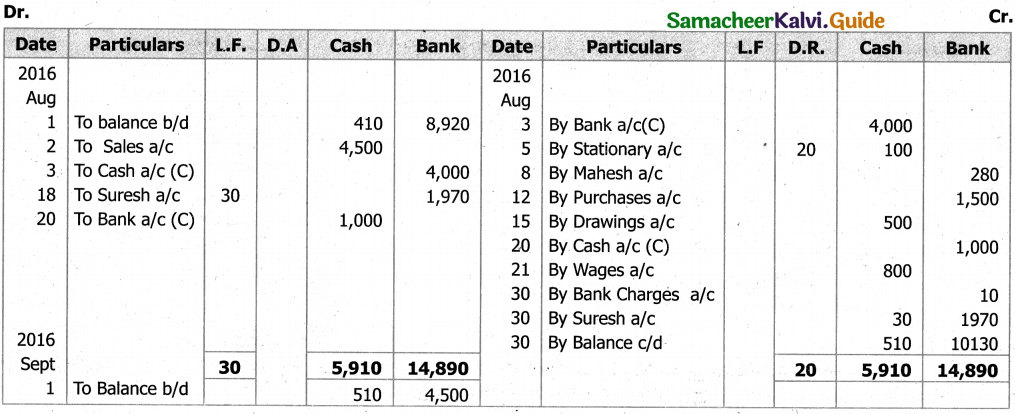

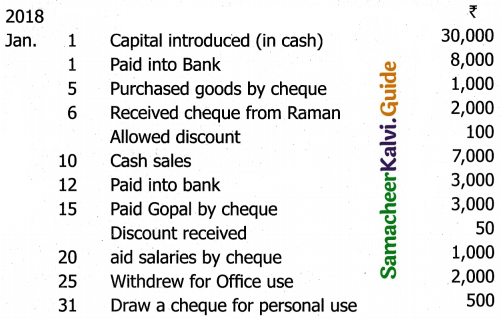

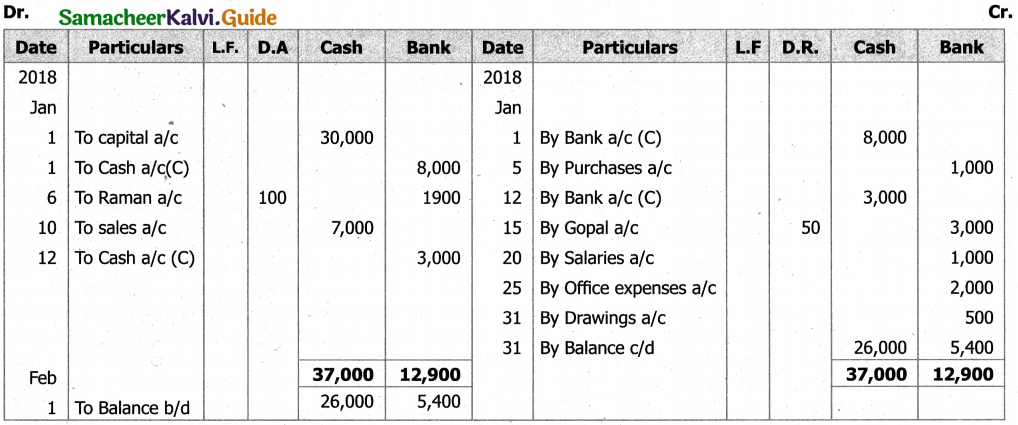

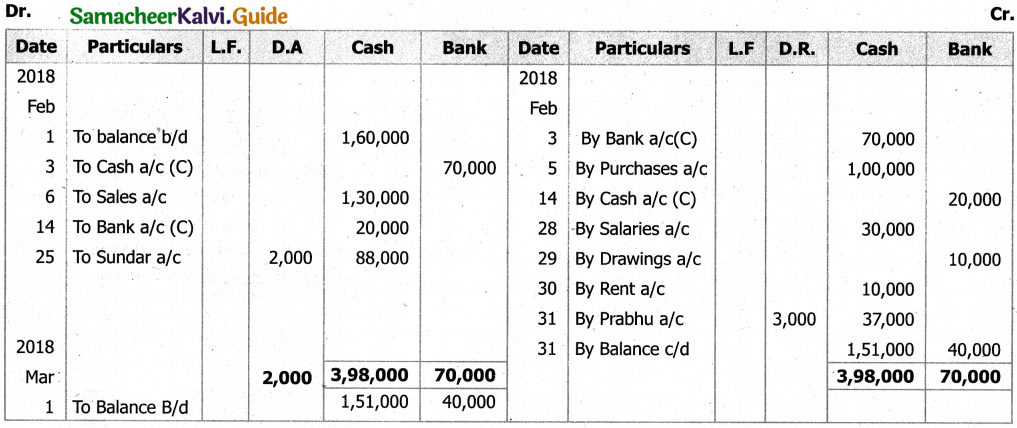

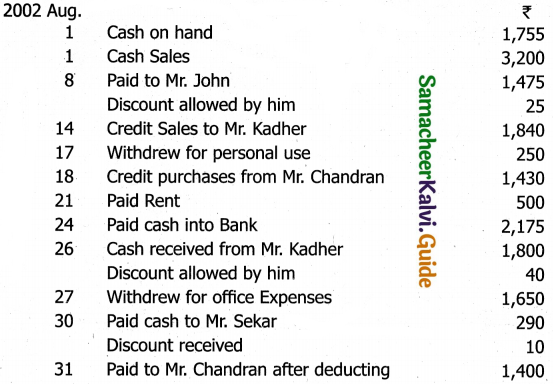

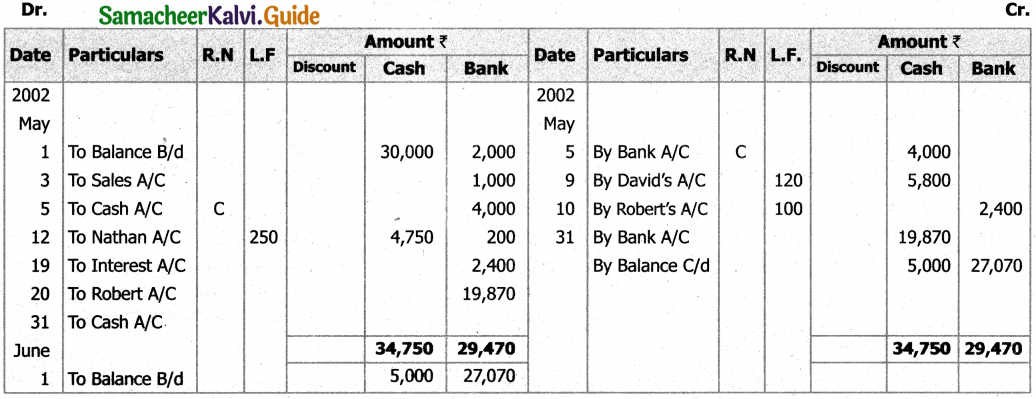

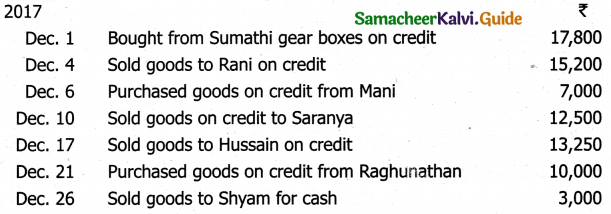

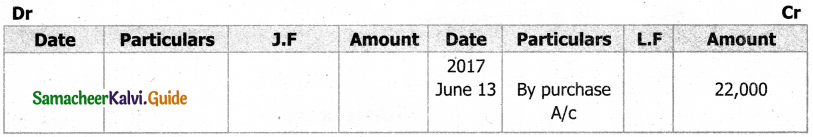

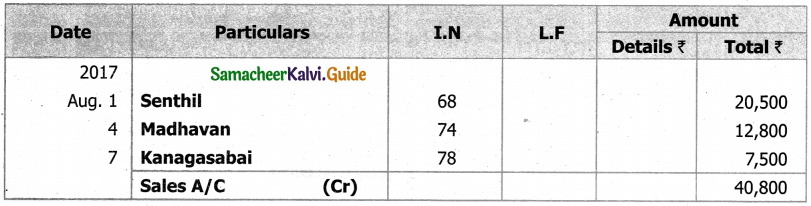

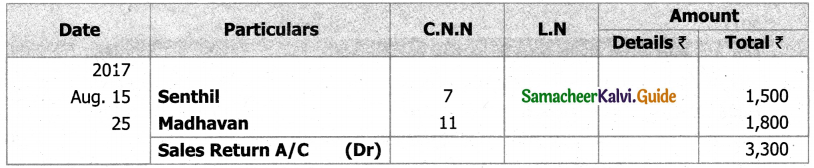

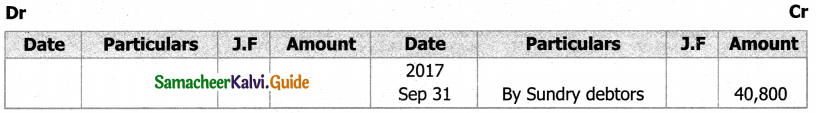

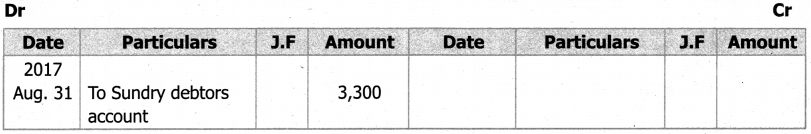

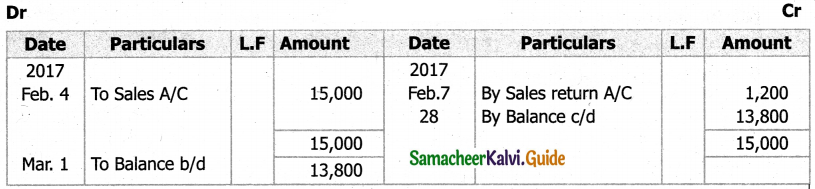

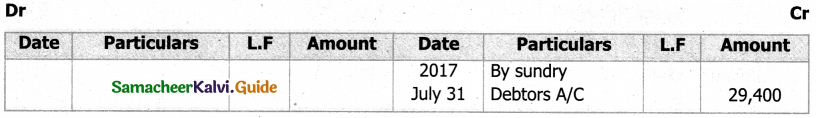

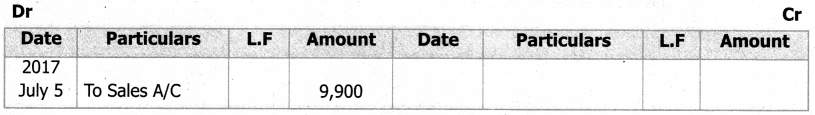

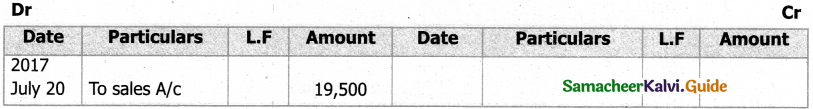

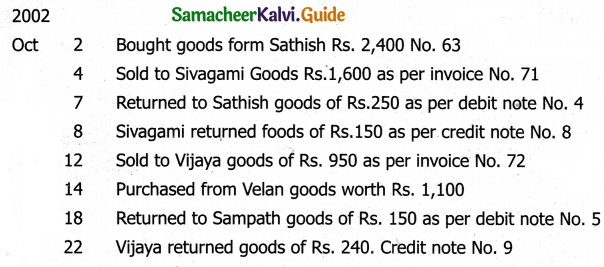

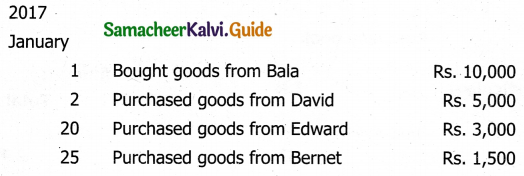

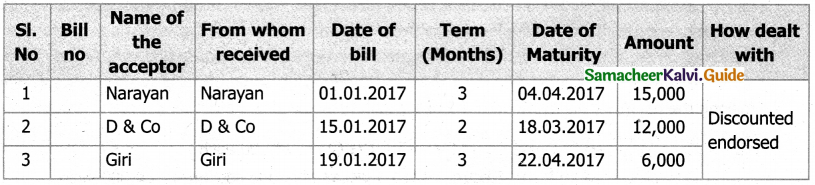

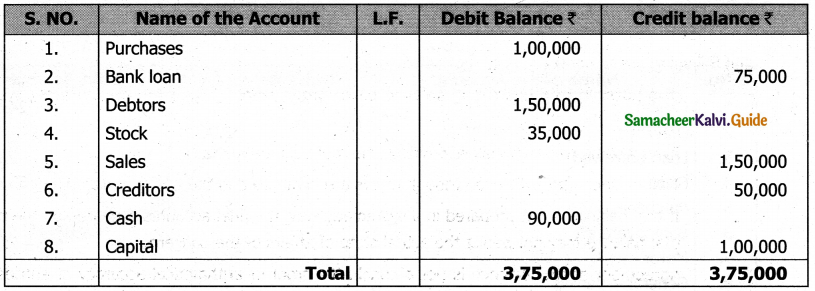

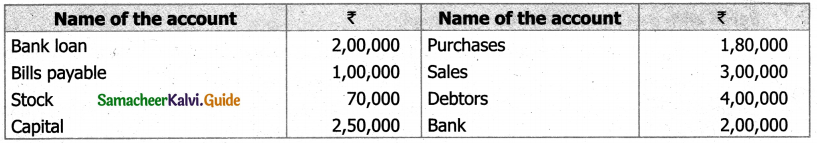

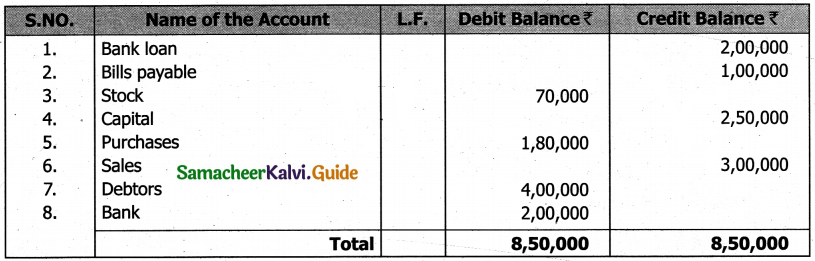

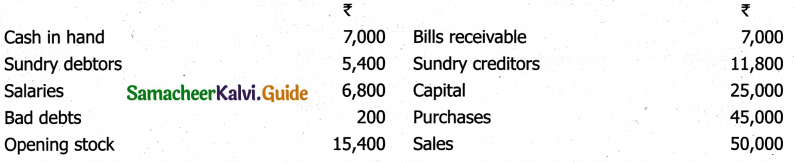

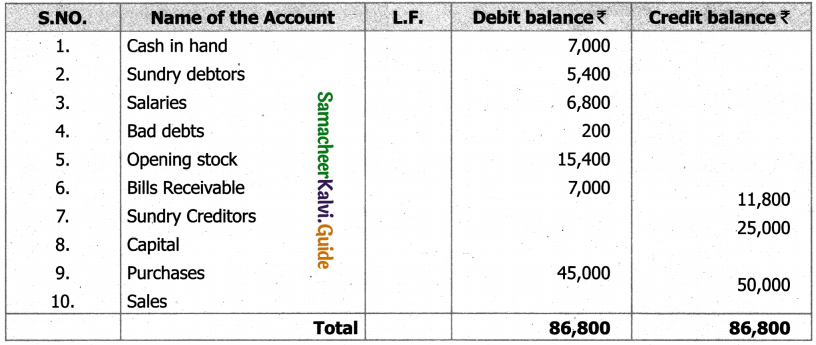

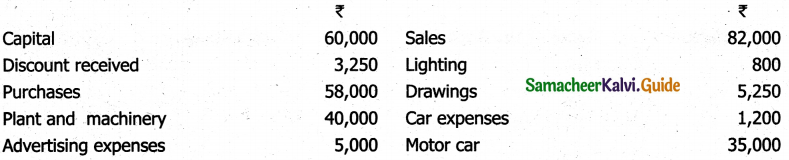

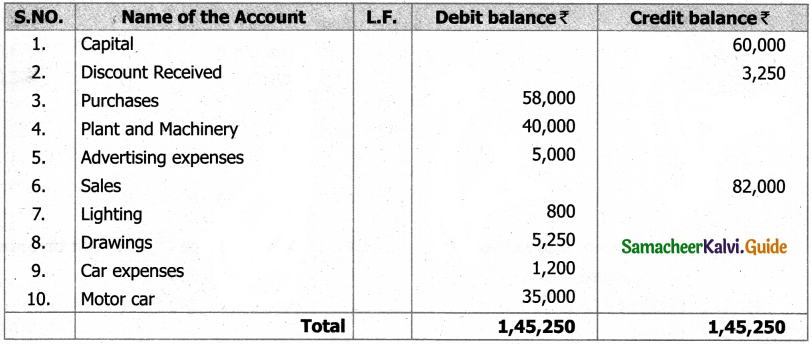

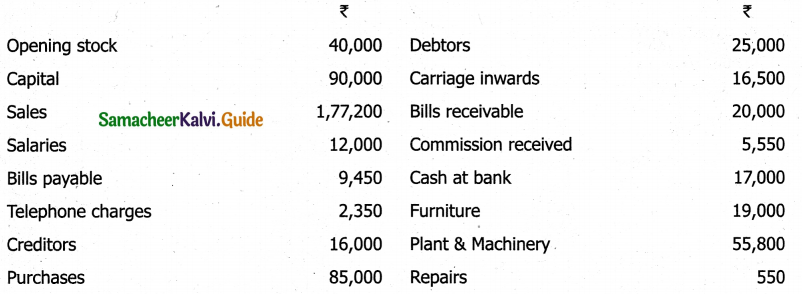

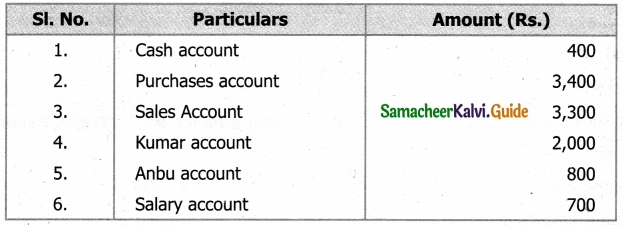

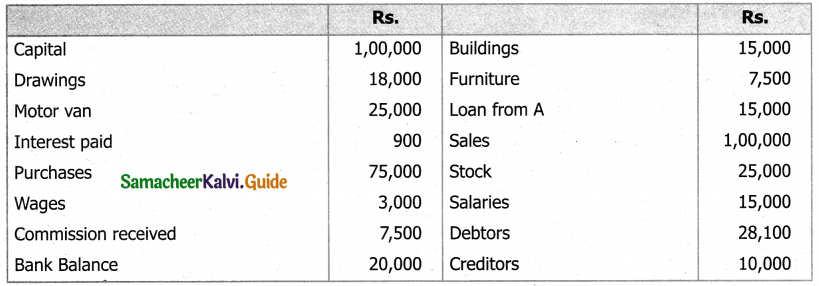

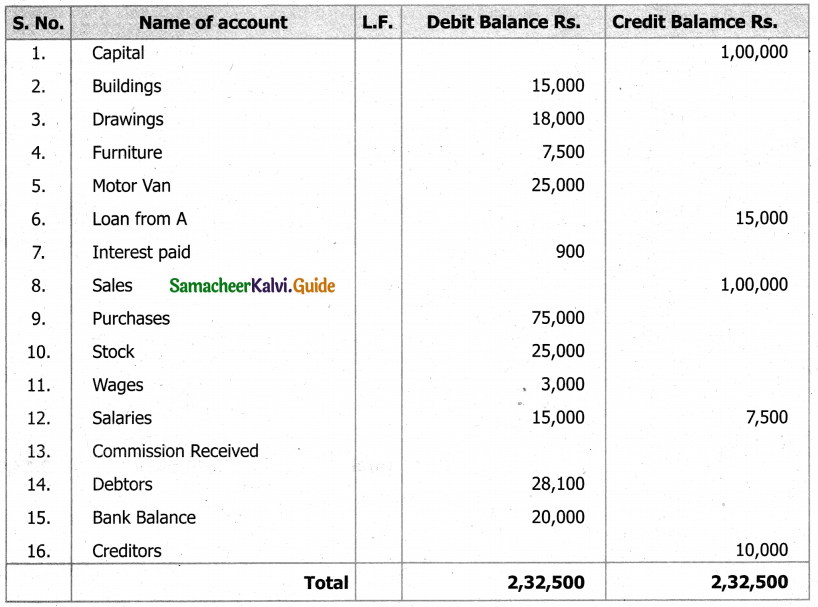

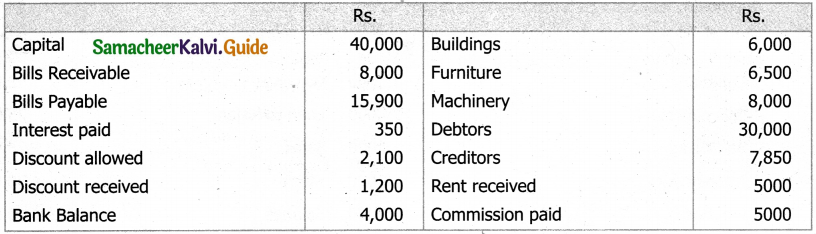

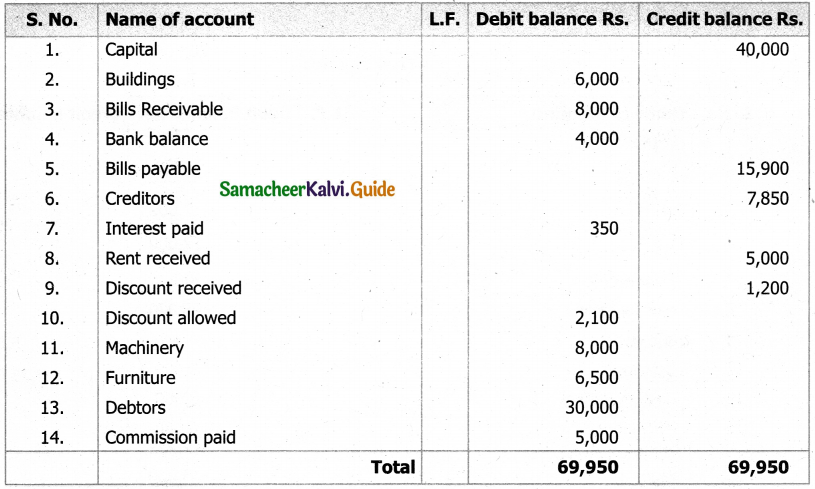

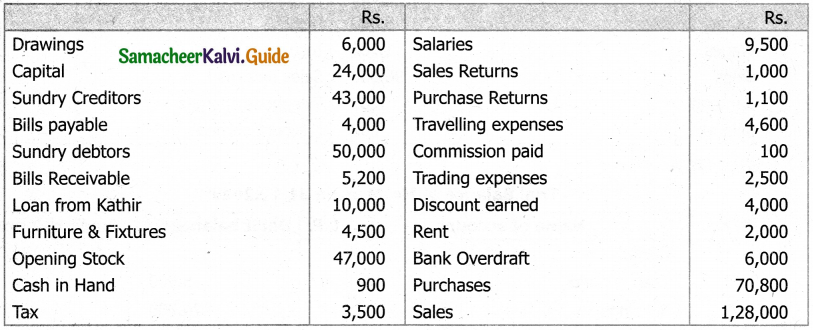

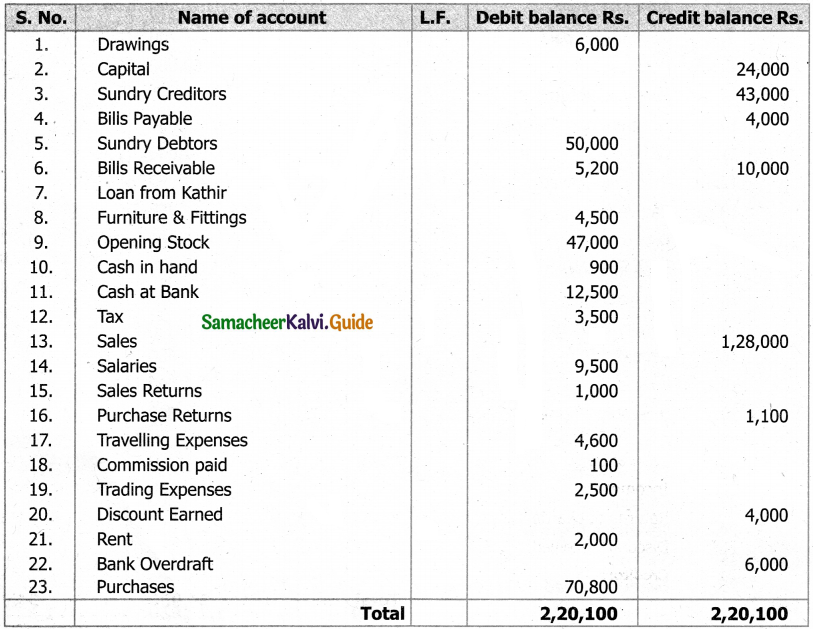

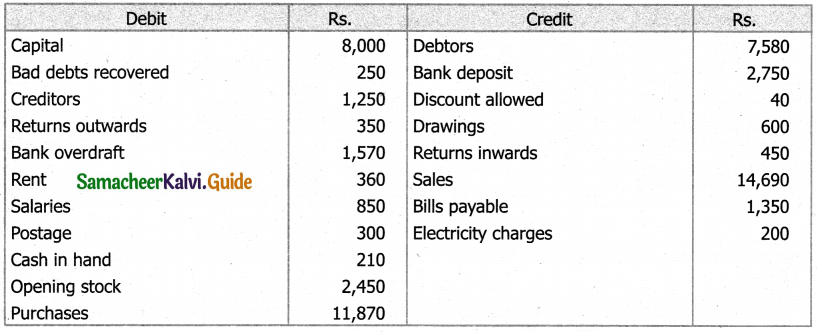

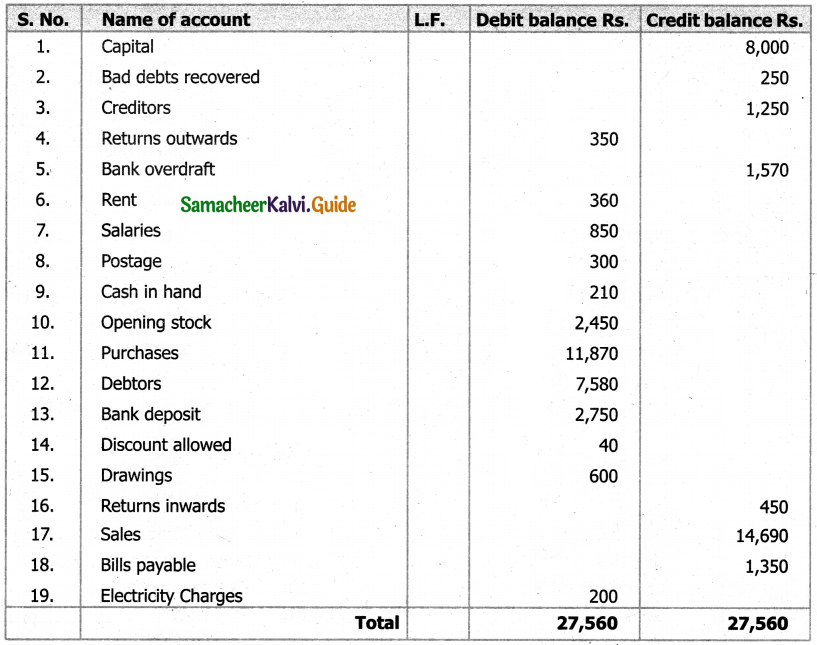

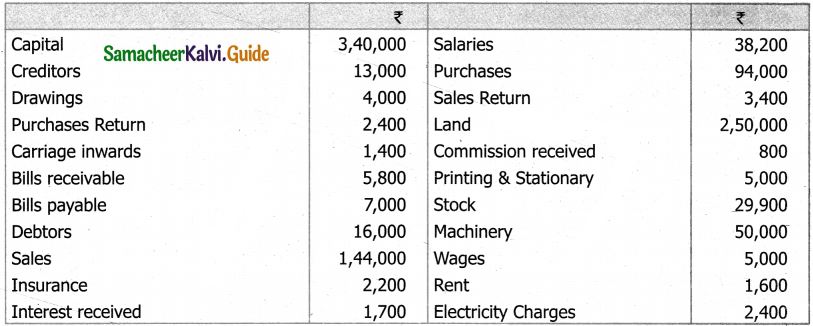

Kanagasabai Account

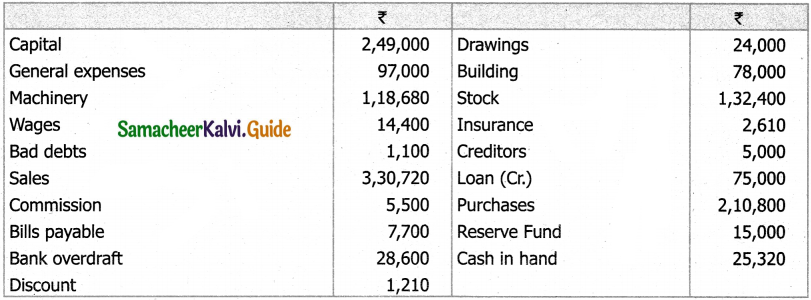

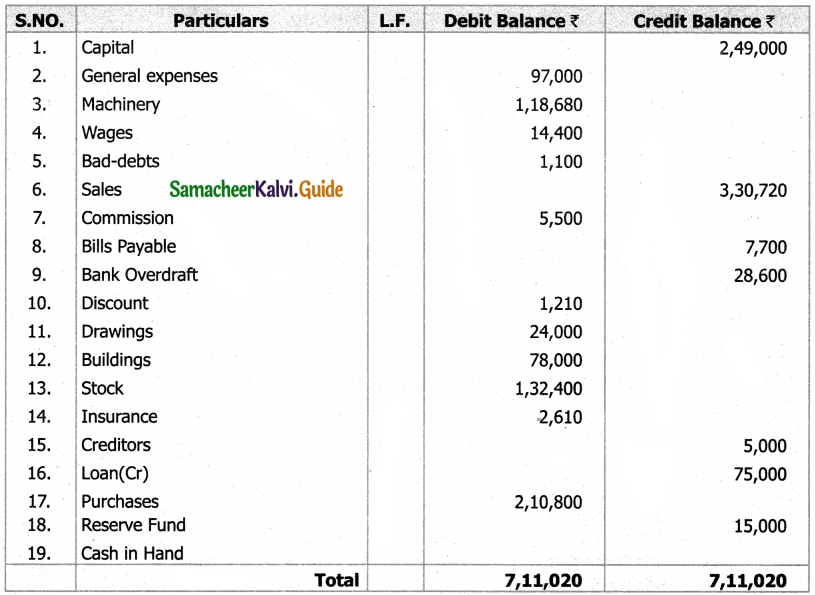

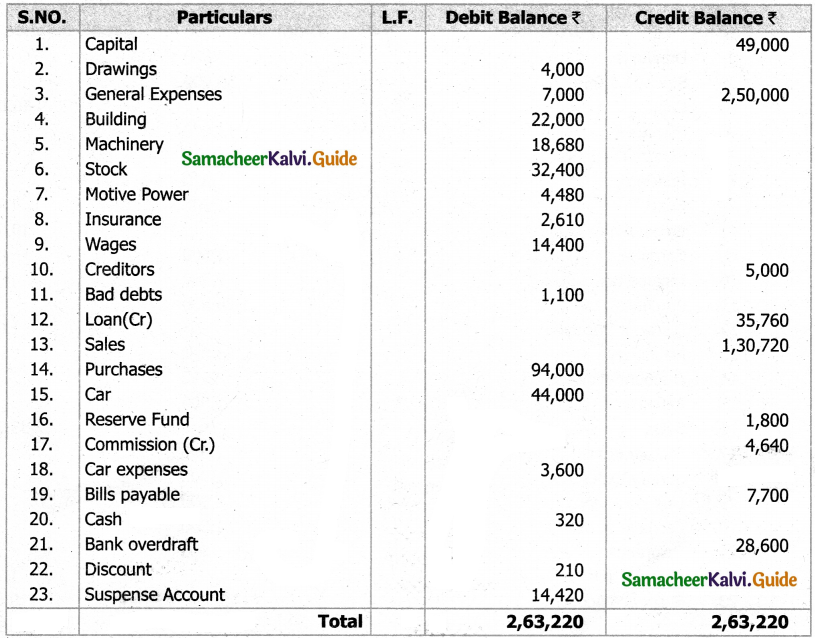

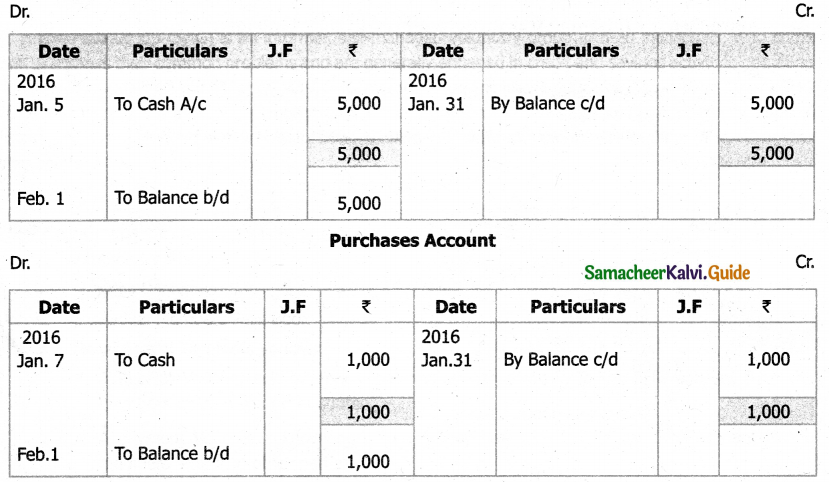

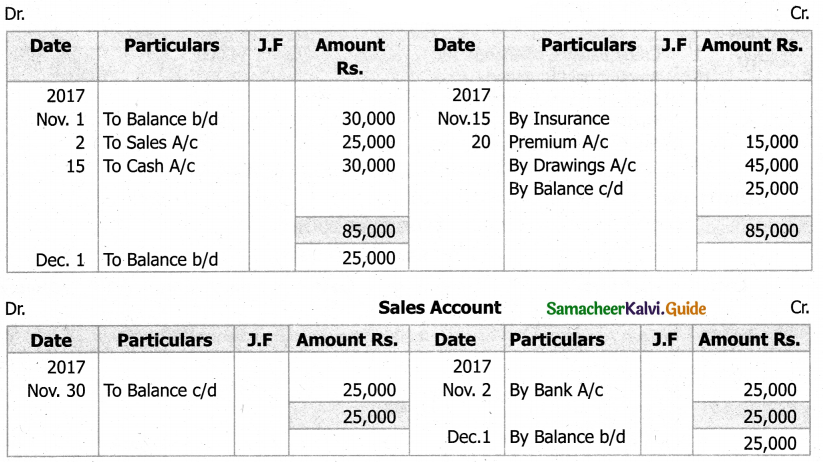

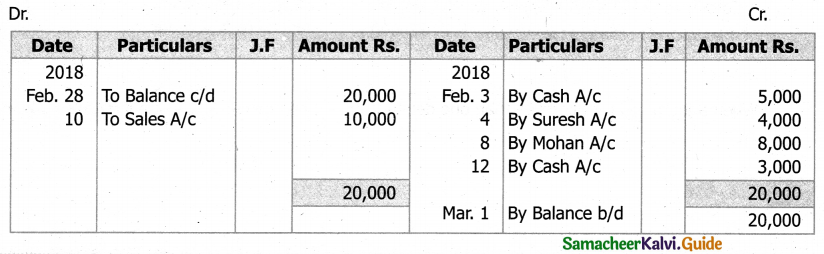

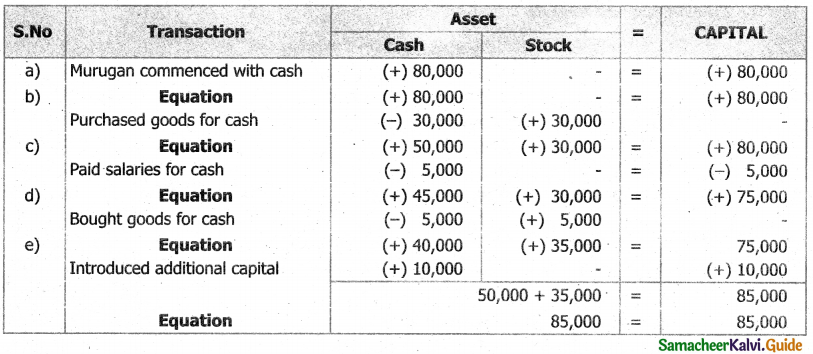

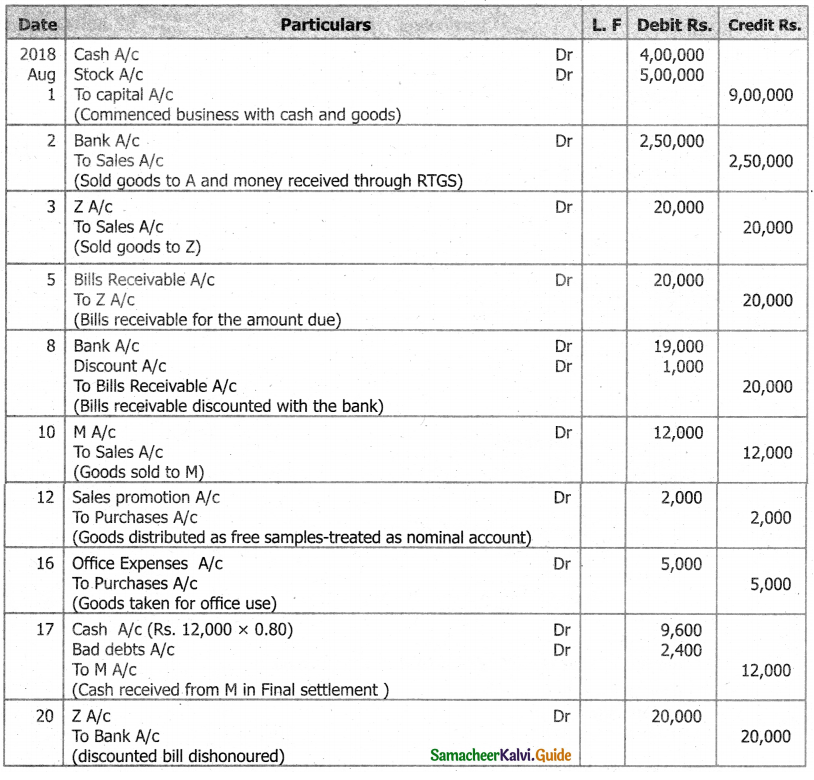

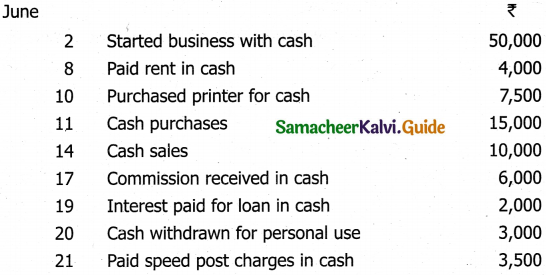

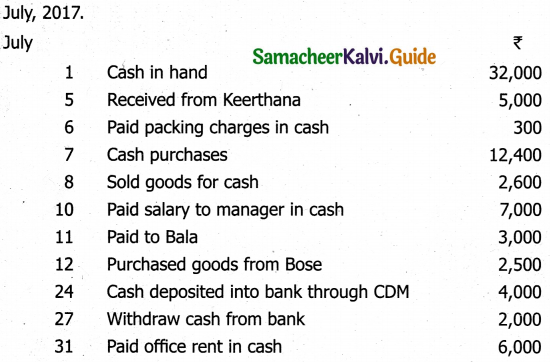

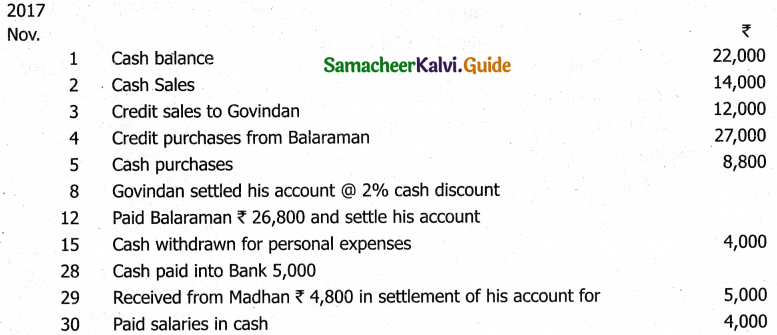

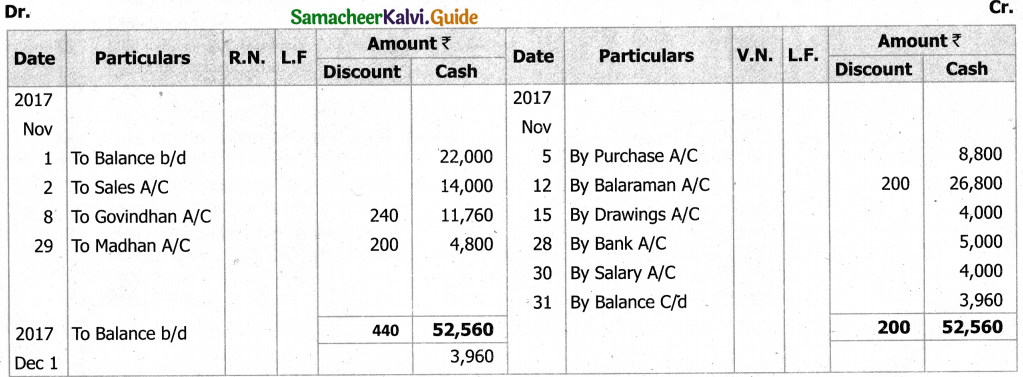

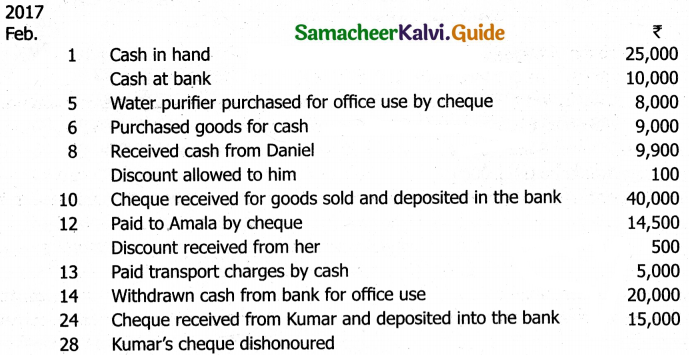

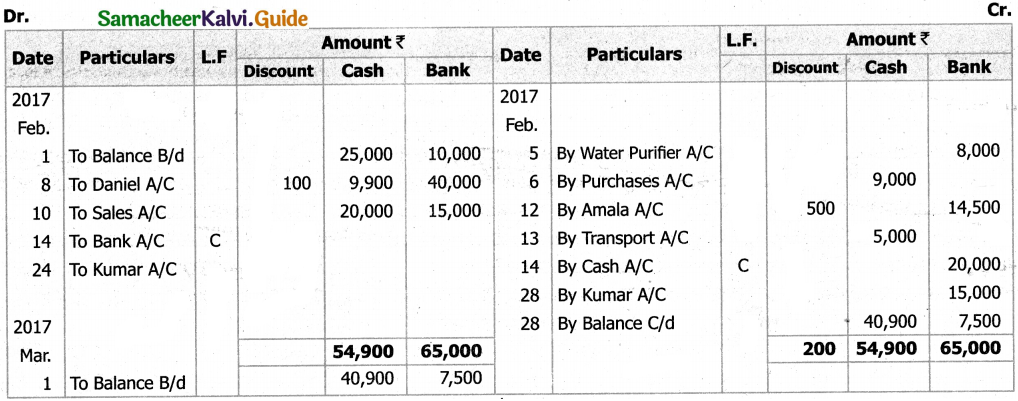

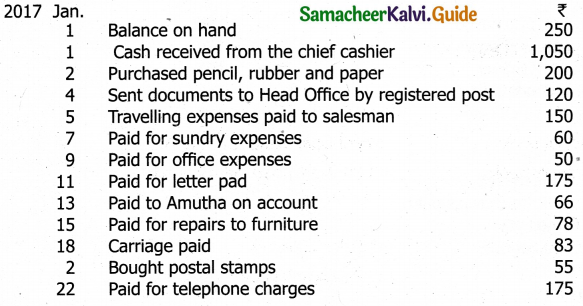

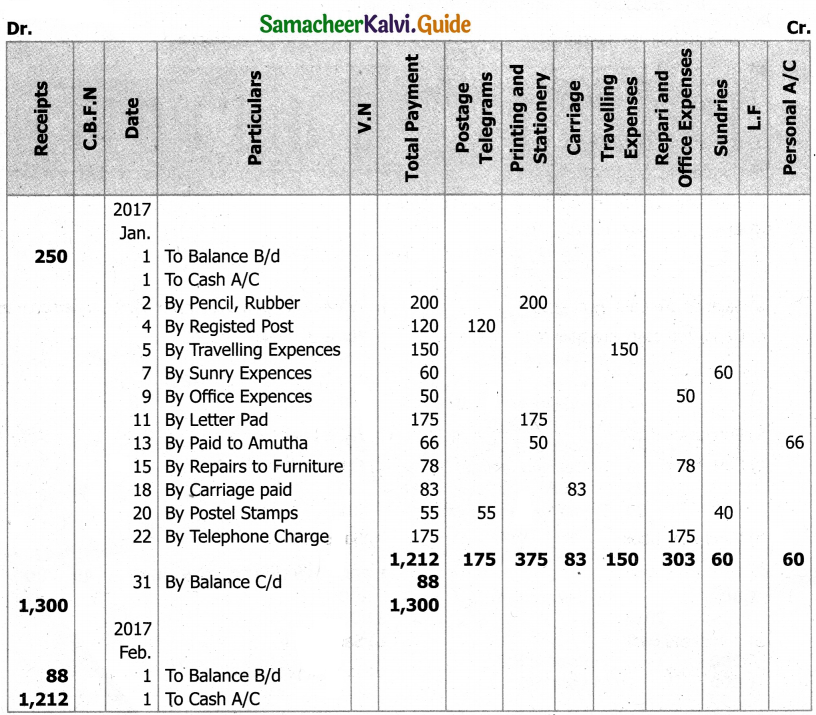

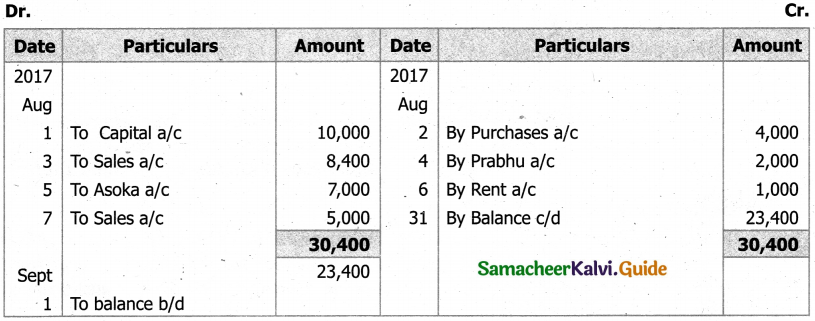

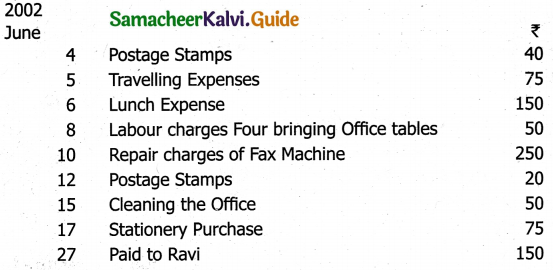

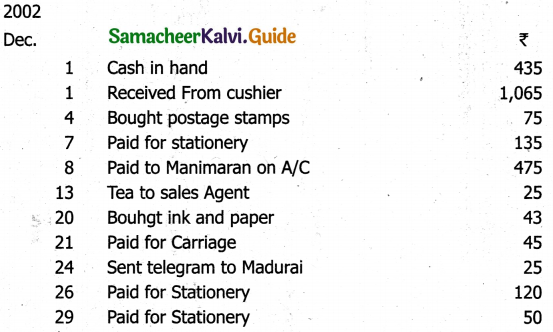

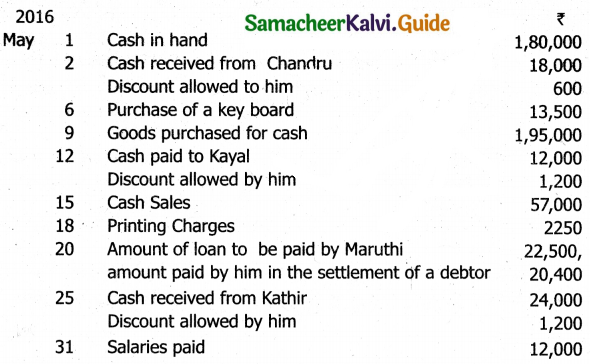

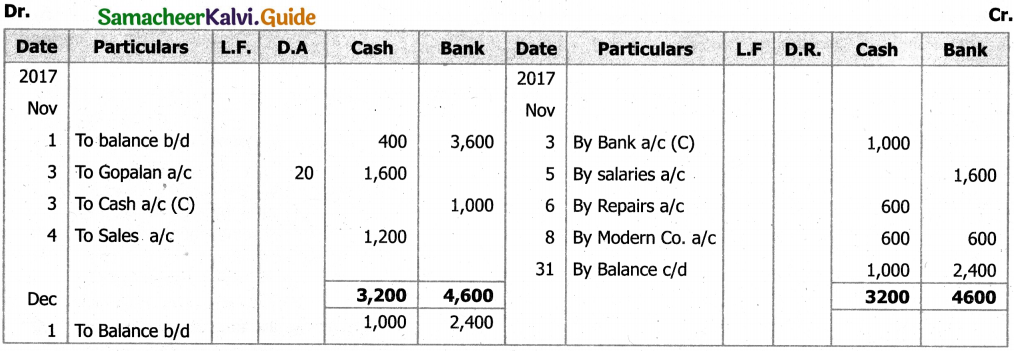

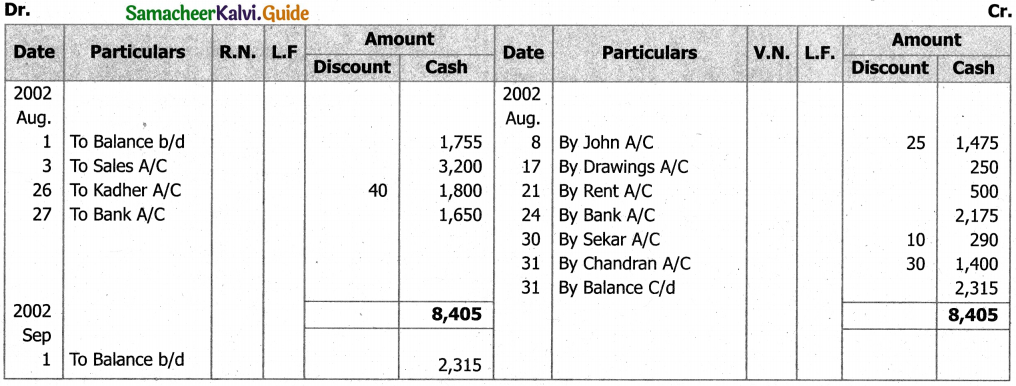

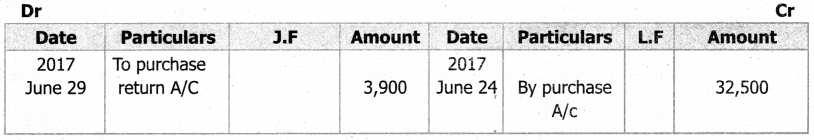

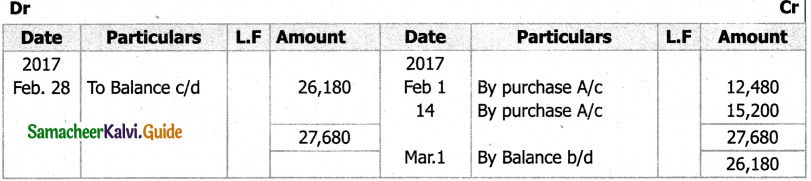

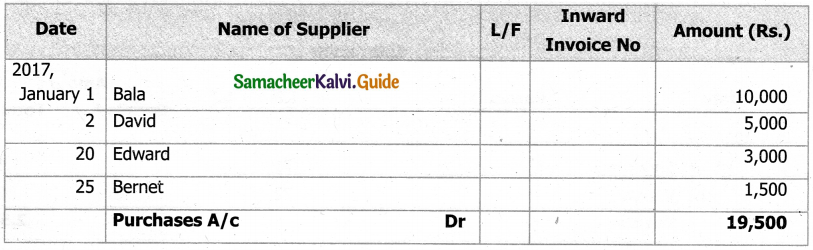

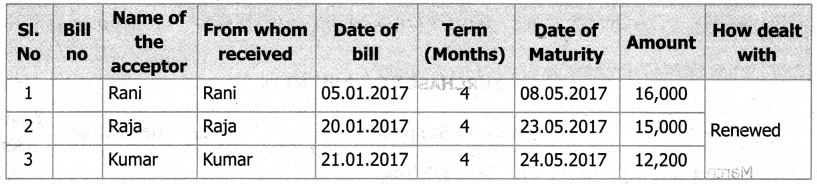

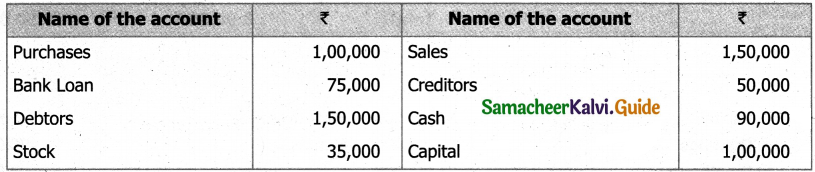

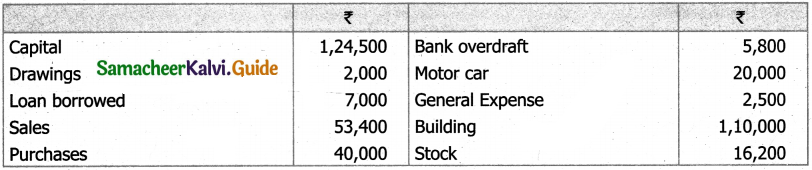

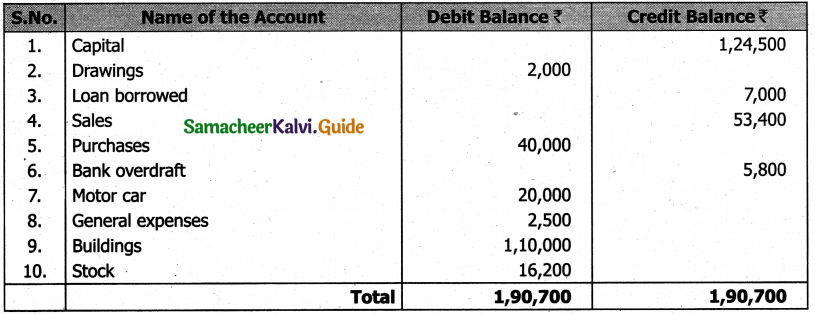

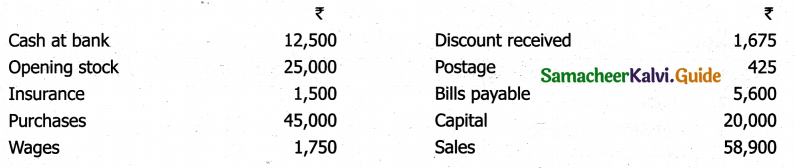

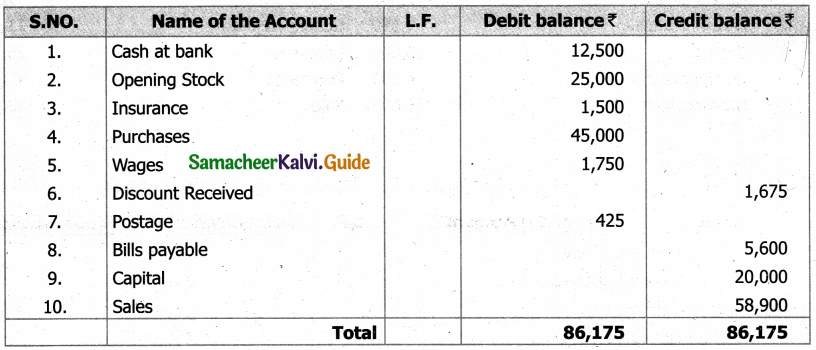

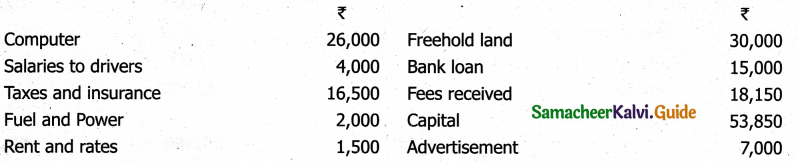

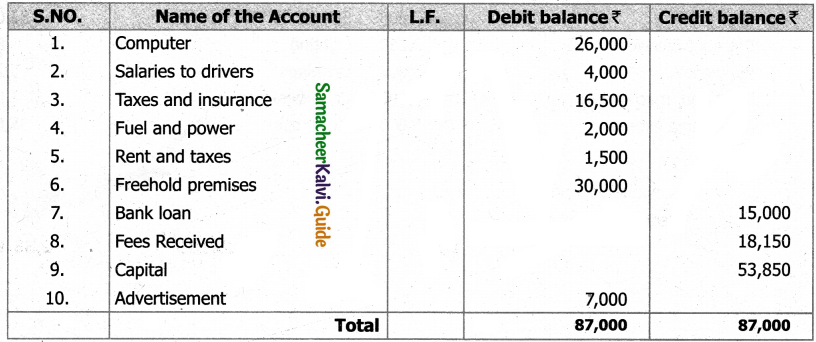

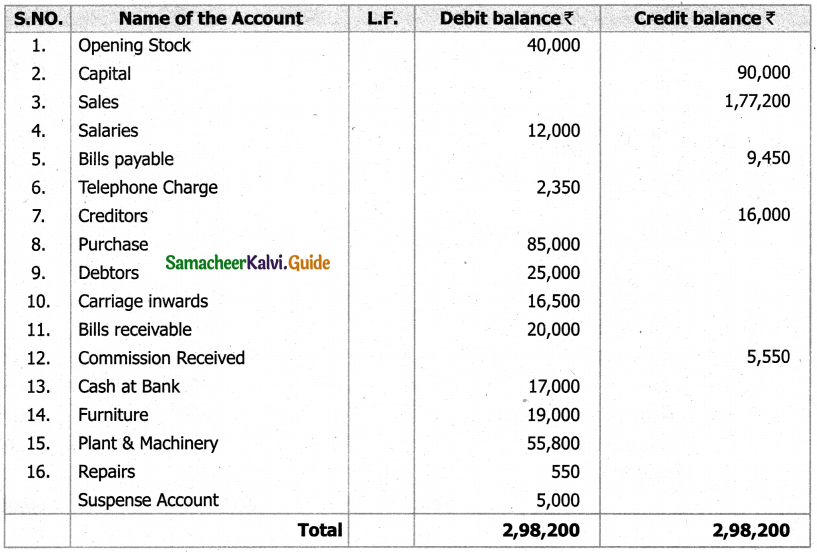

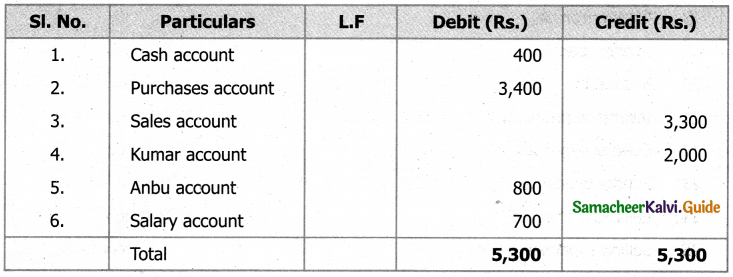

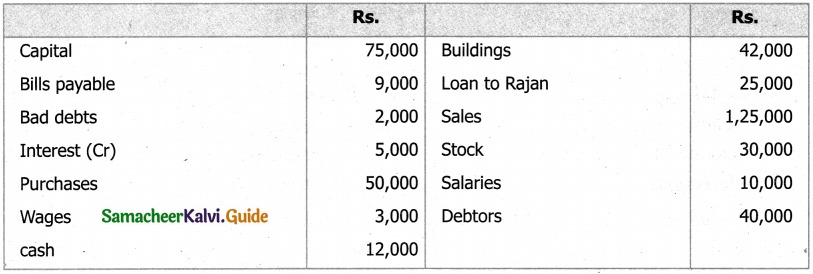

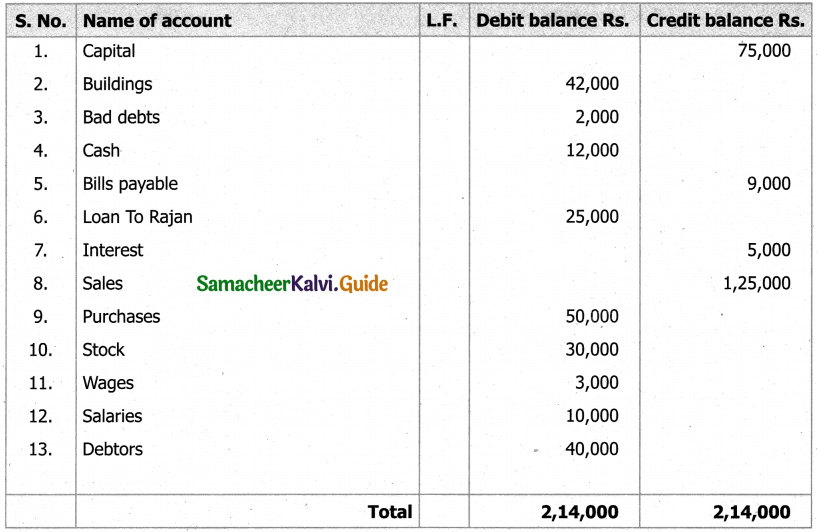

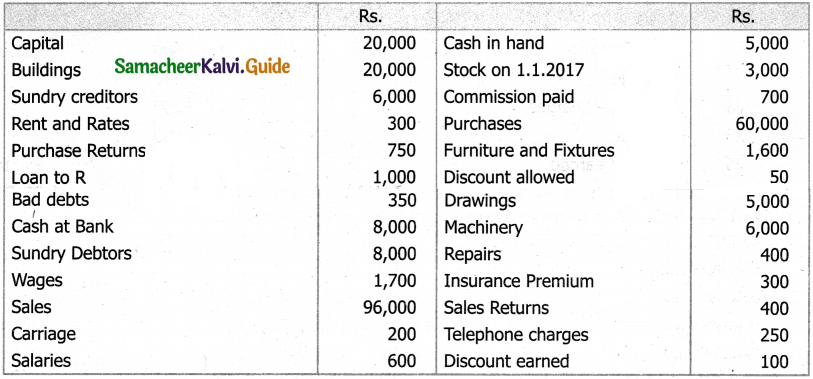

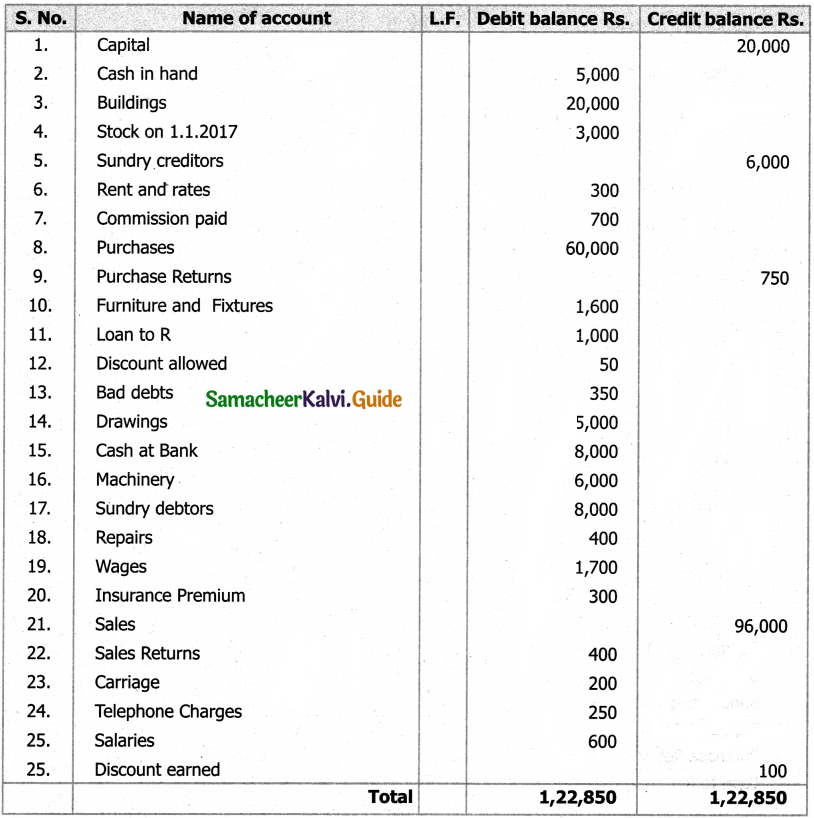

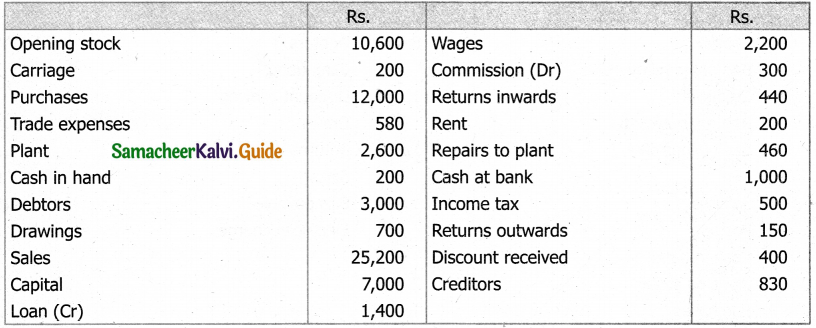

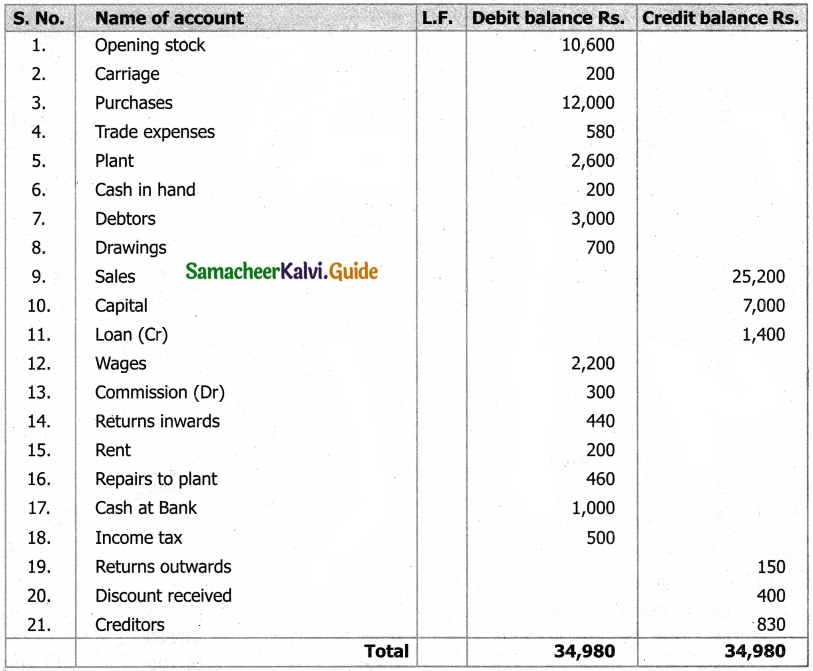

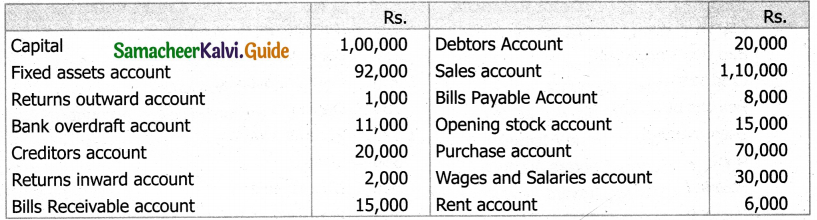

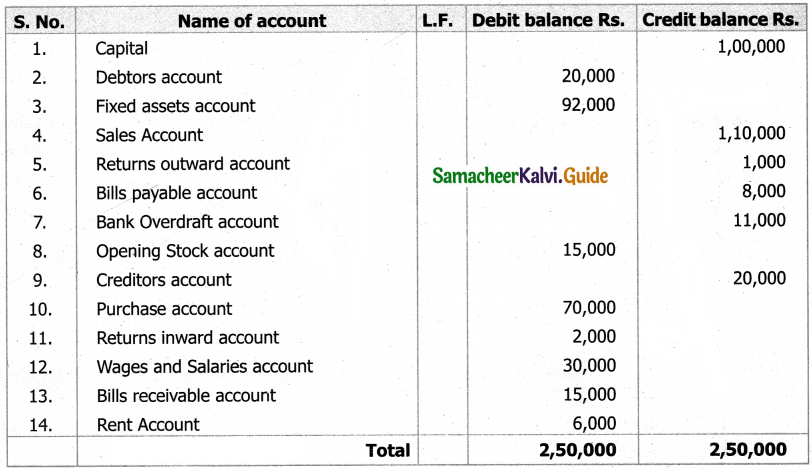

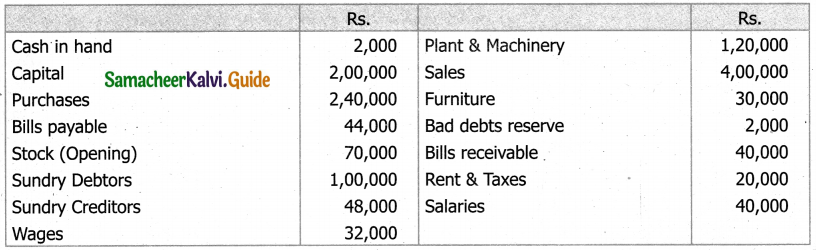

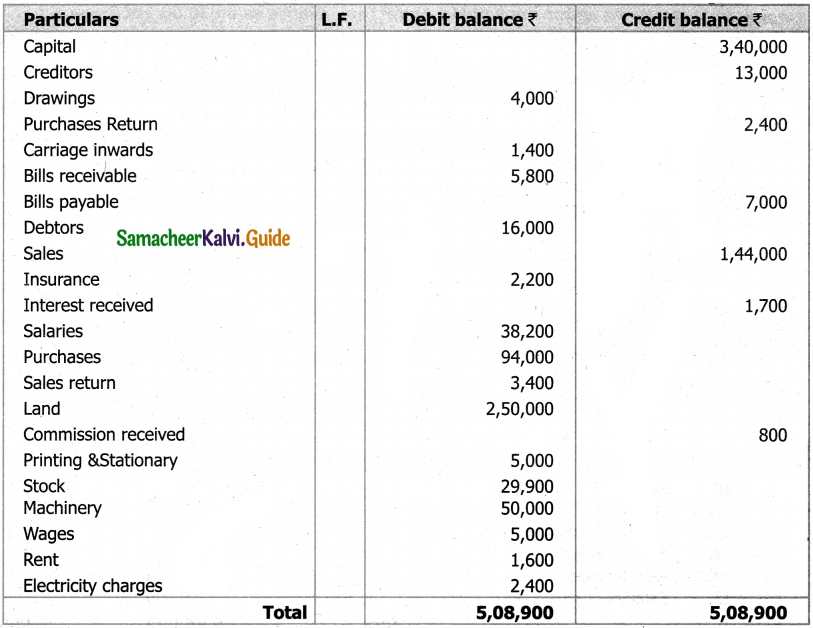

Kanagasabai Account

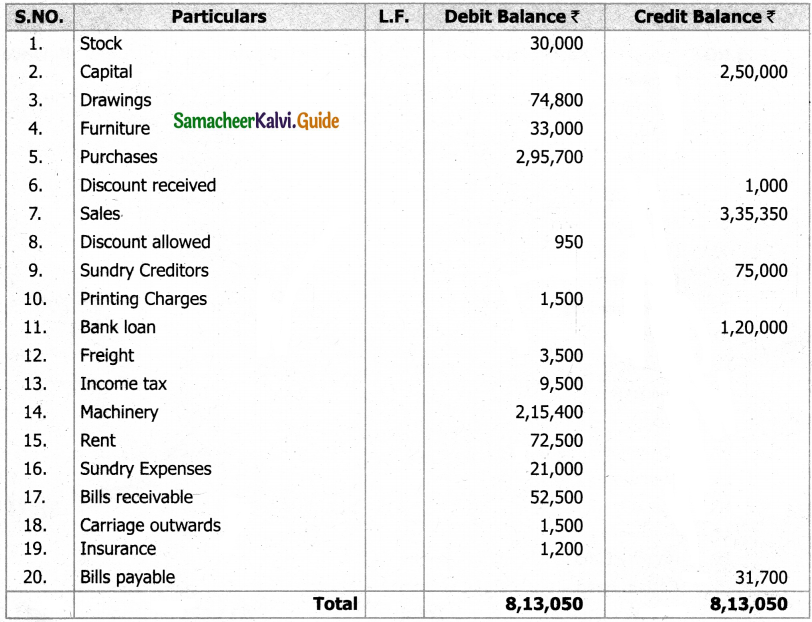

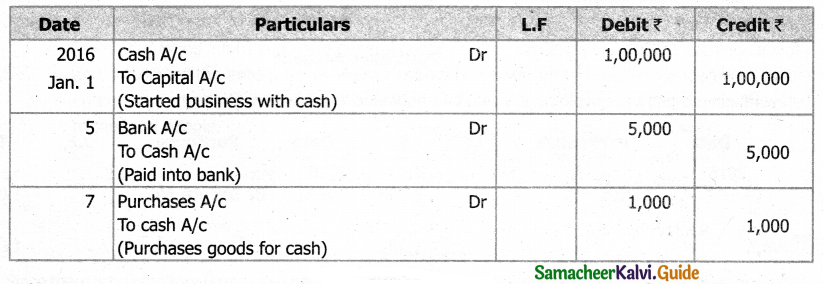

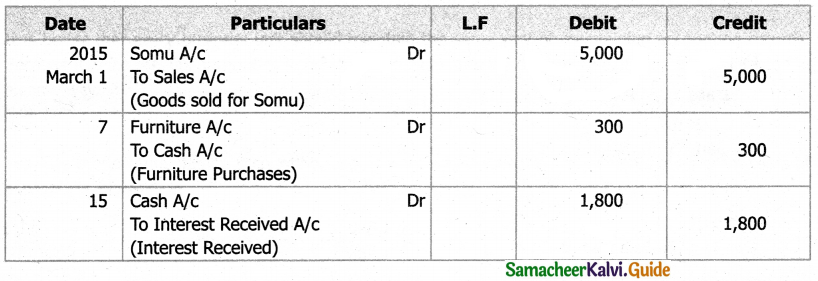

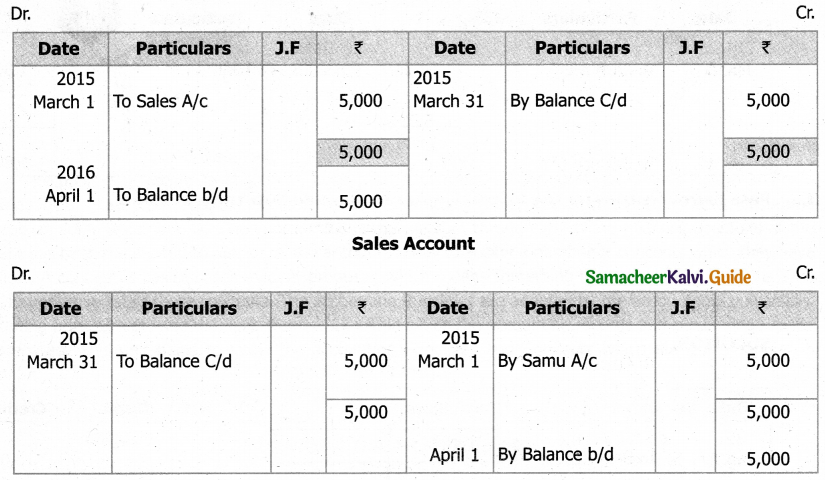

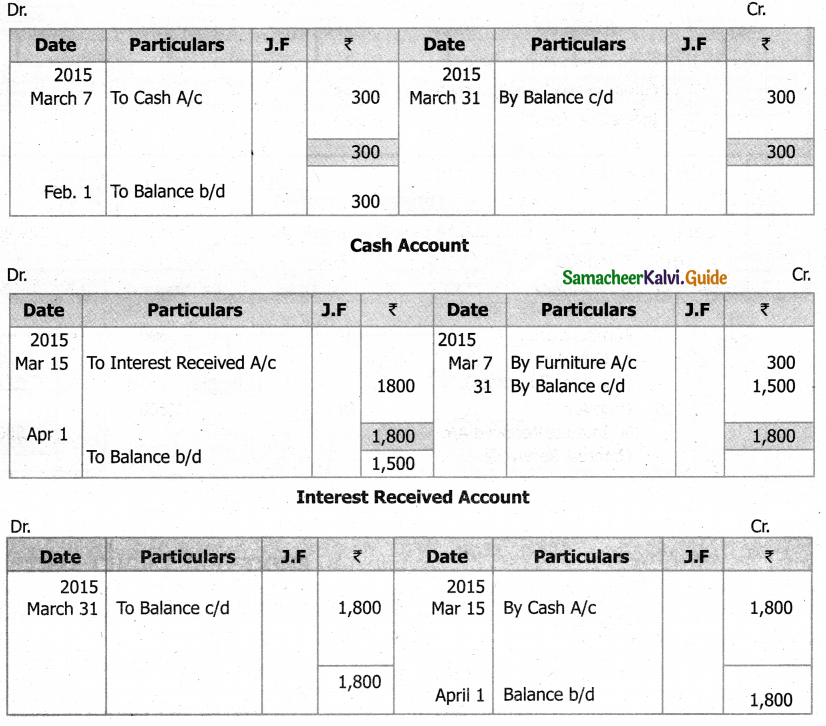

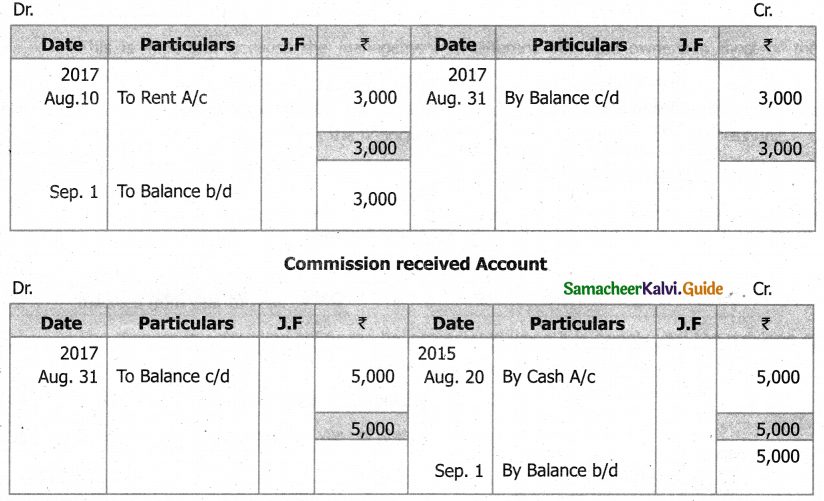

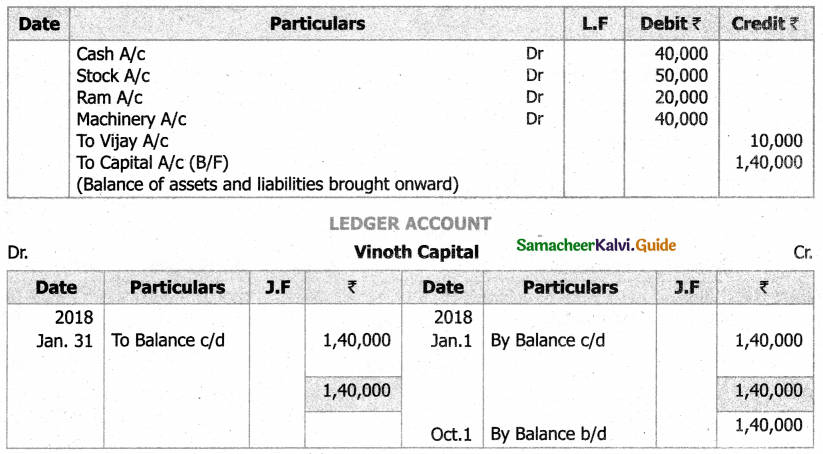

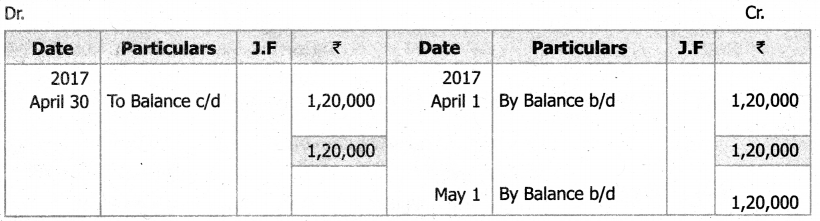

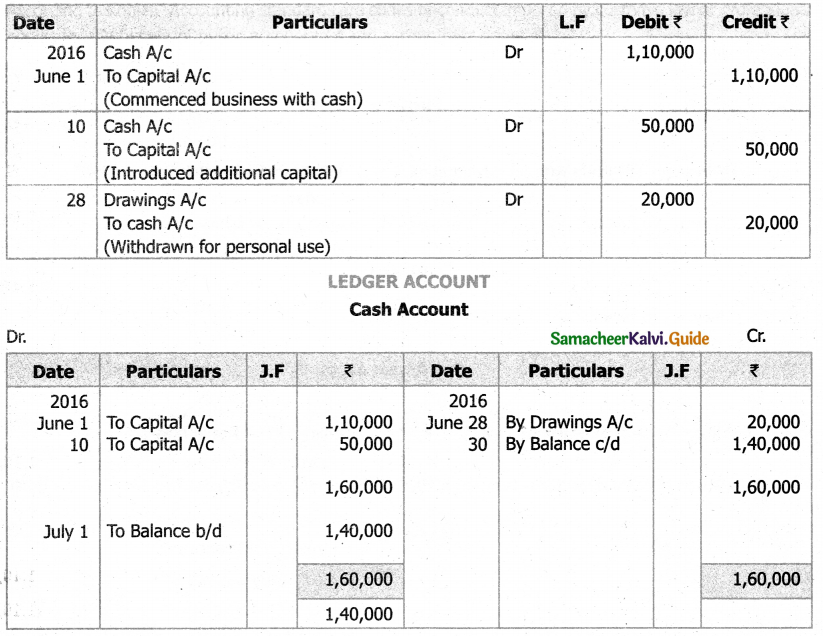

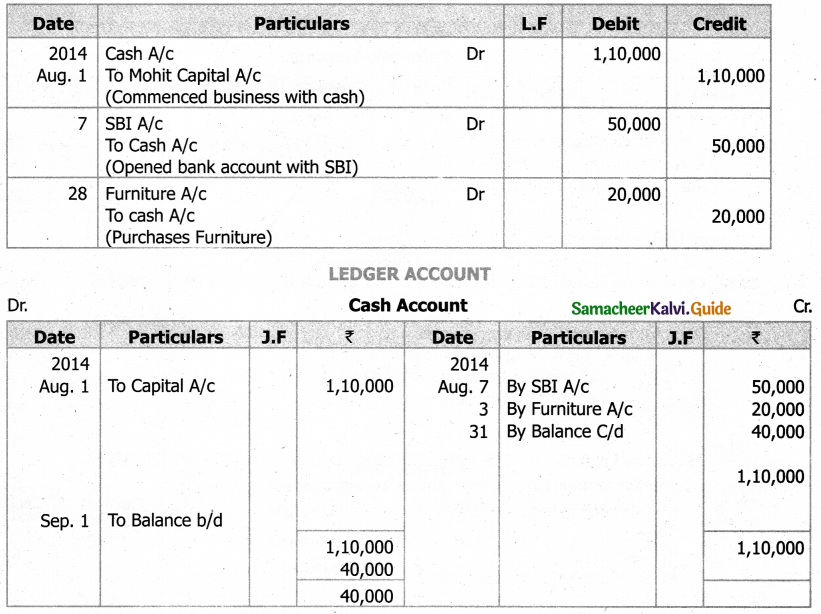

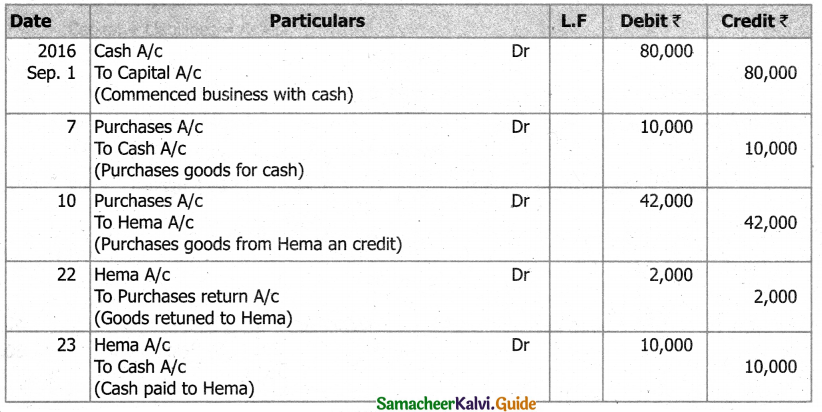

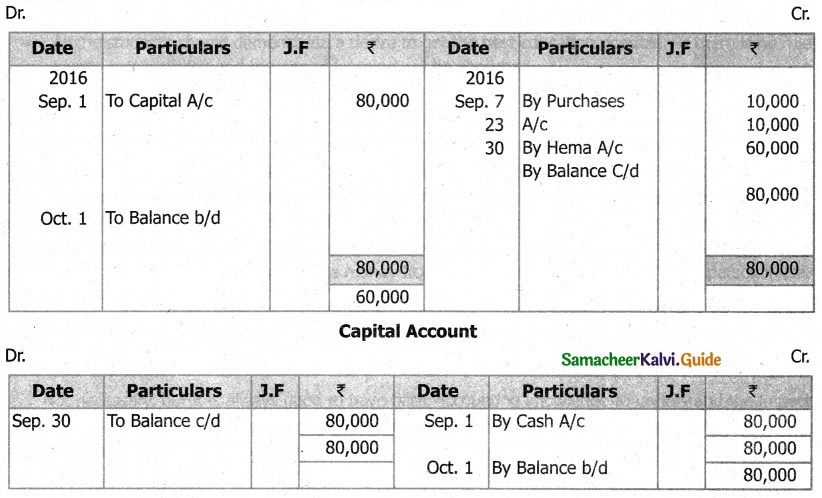

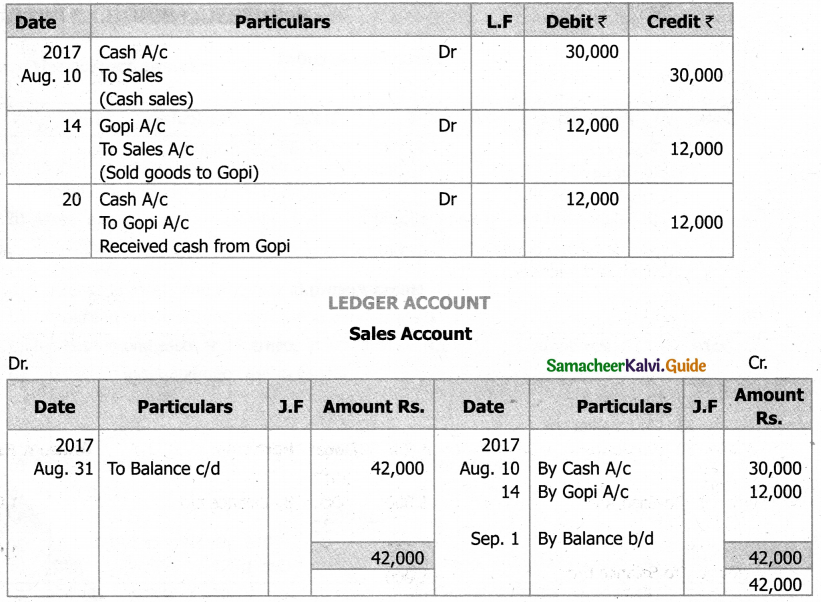

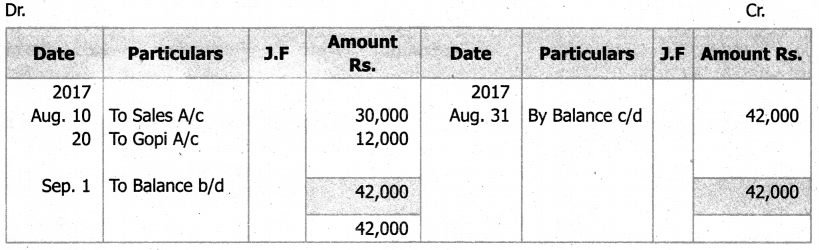

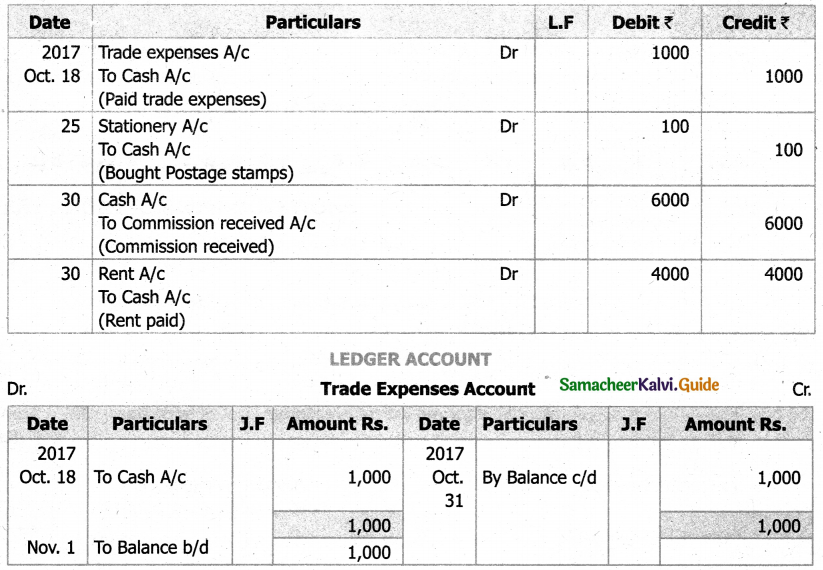

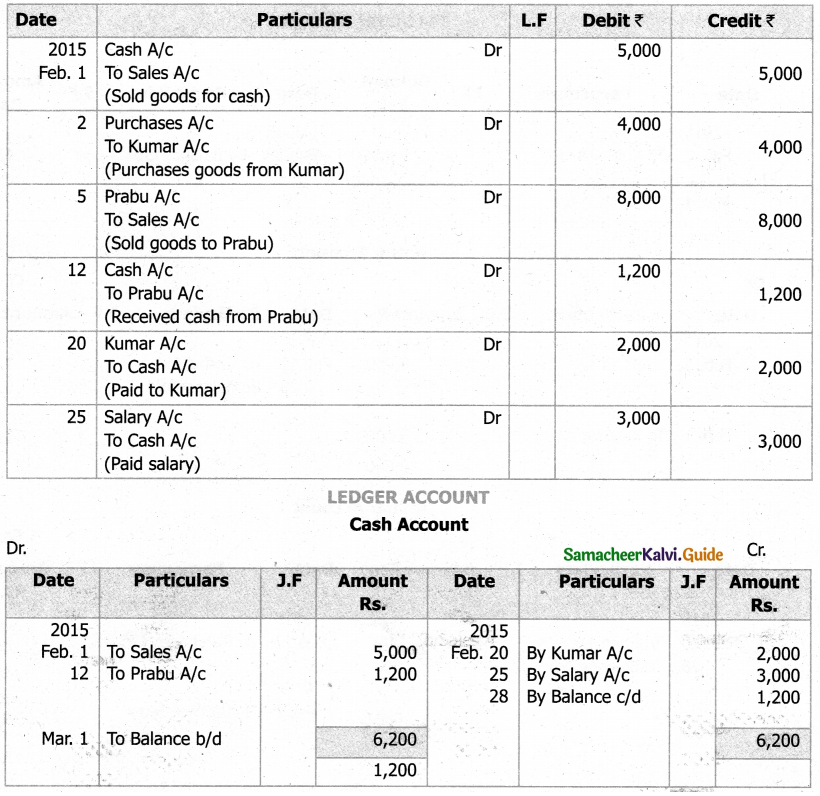

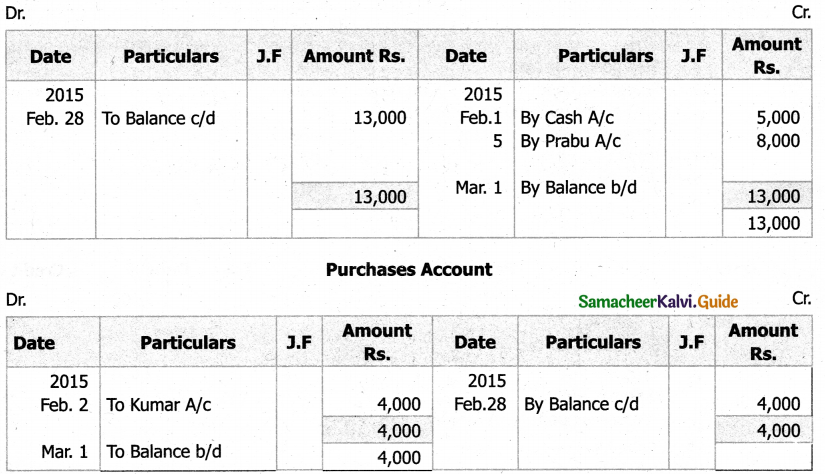

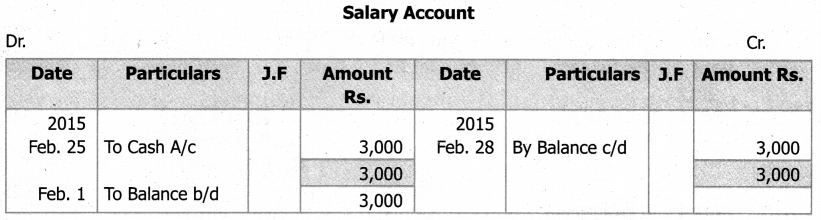

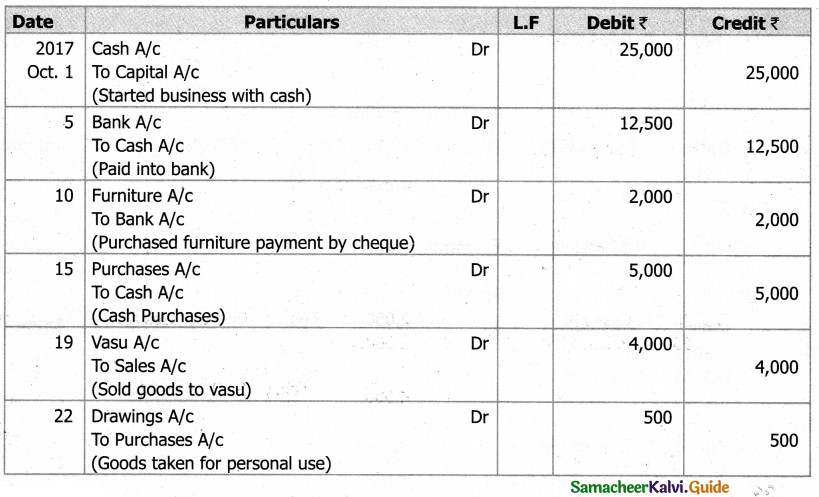

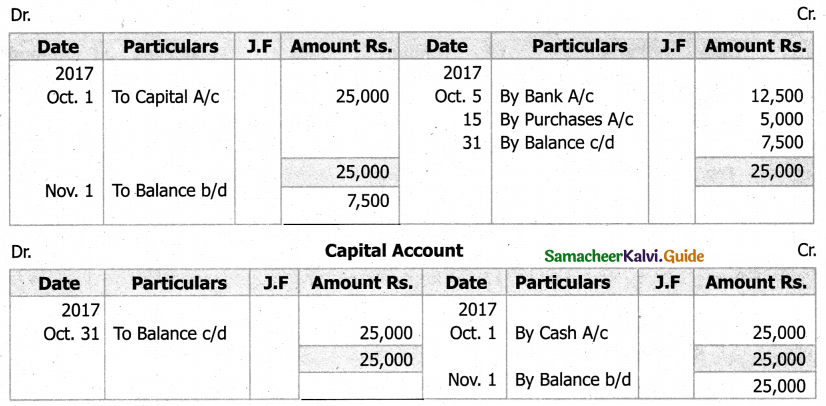

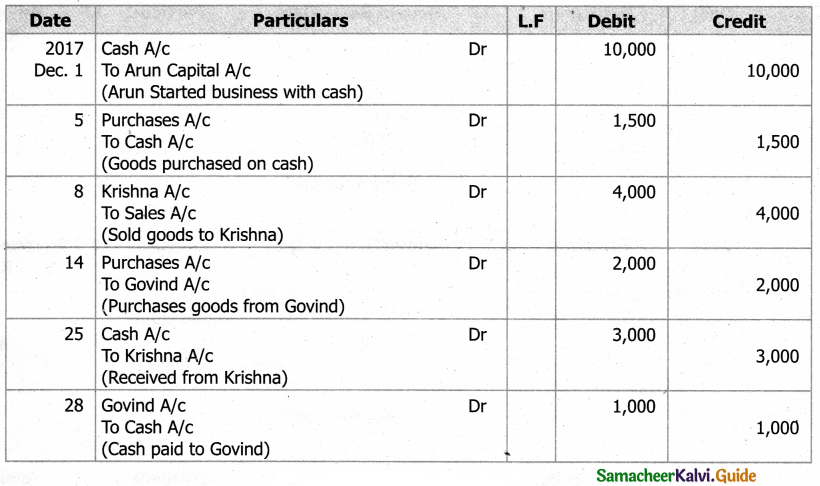

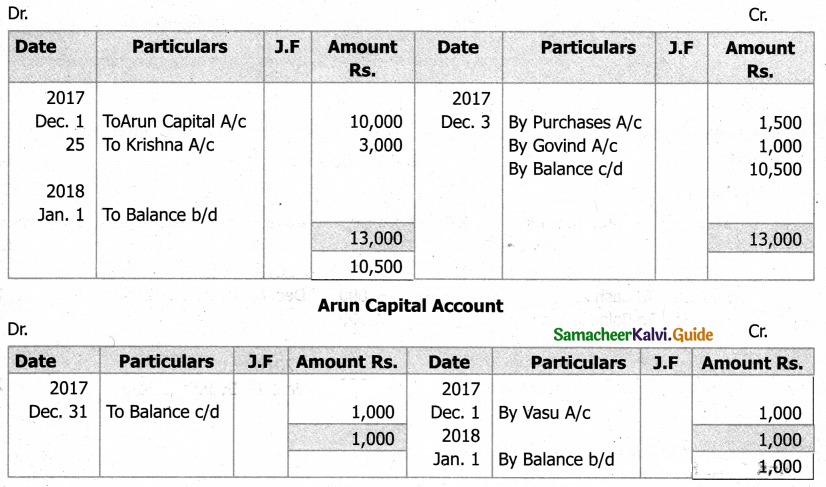

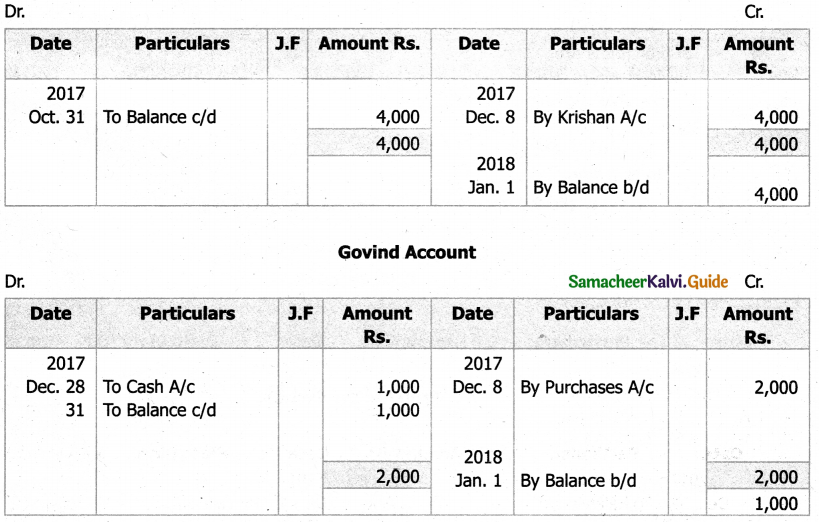

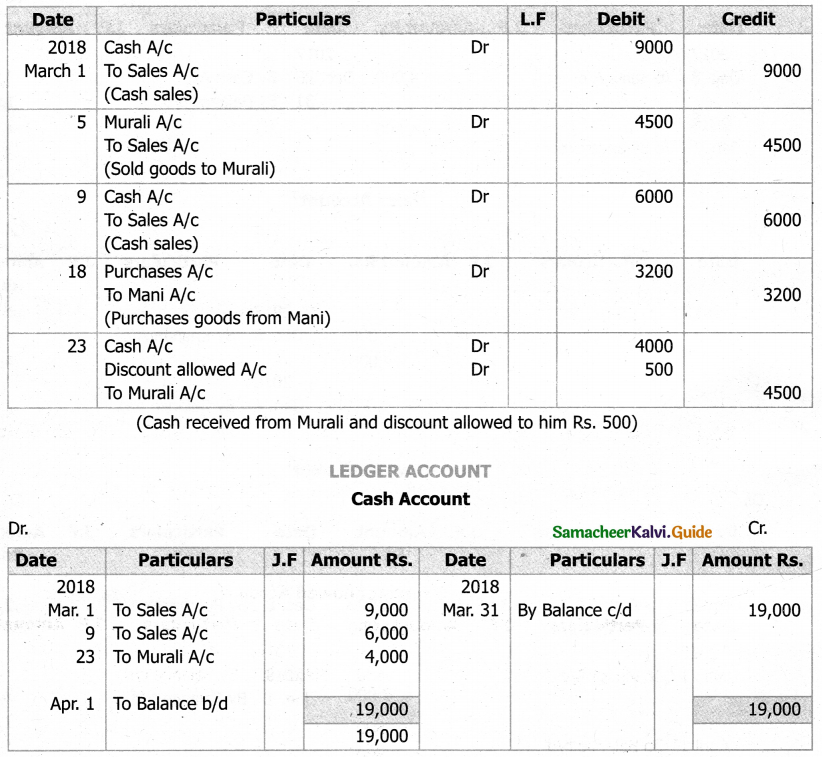

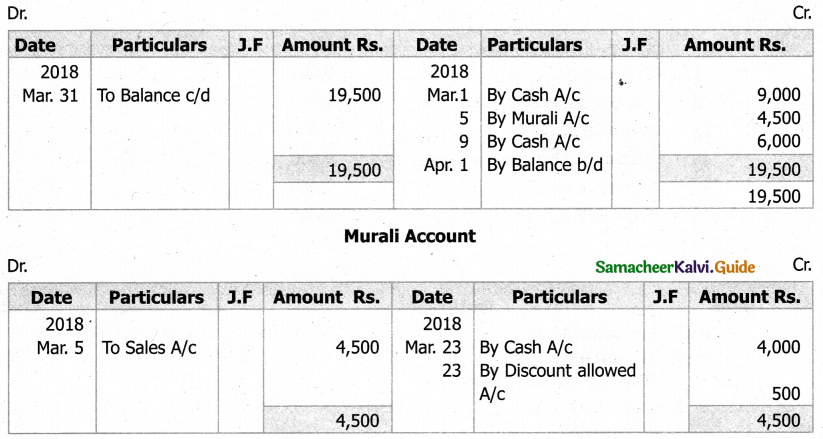

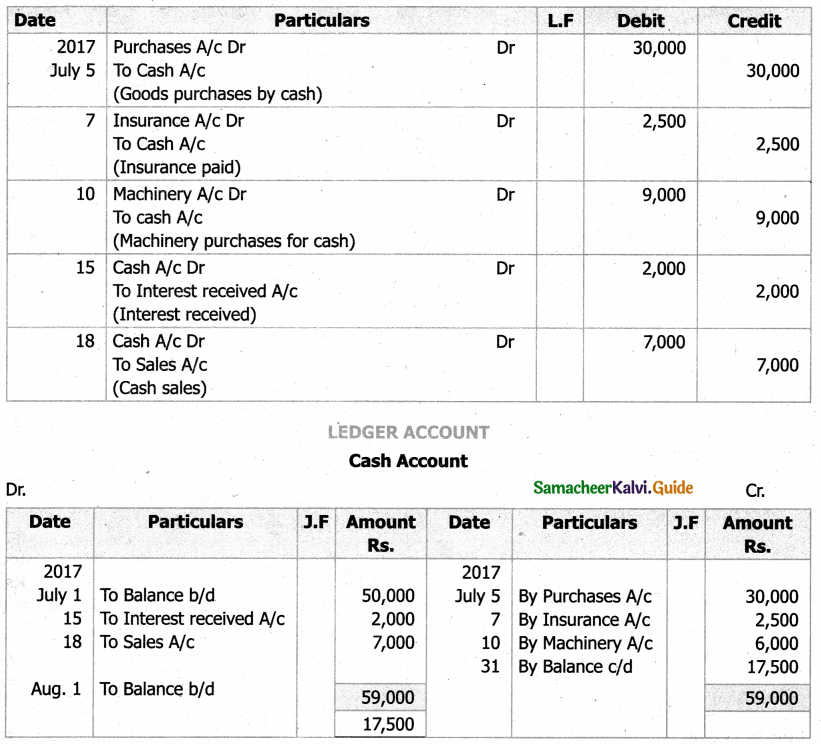

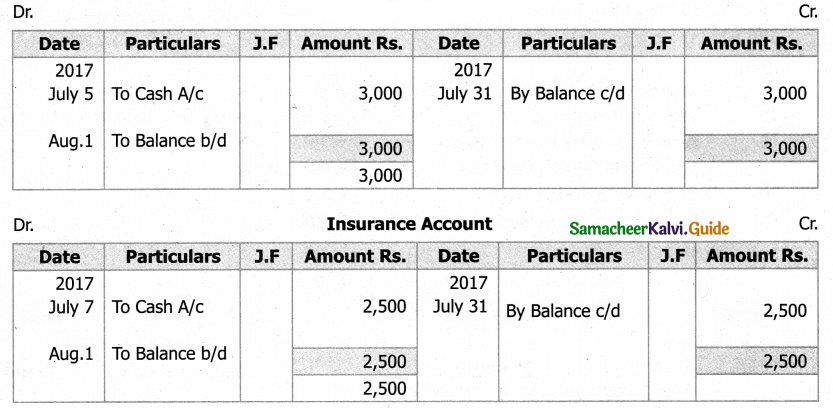

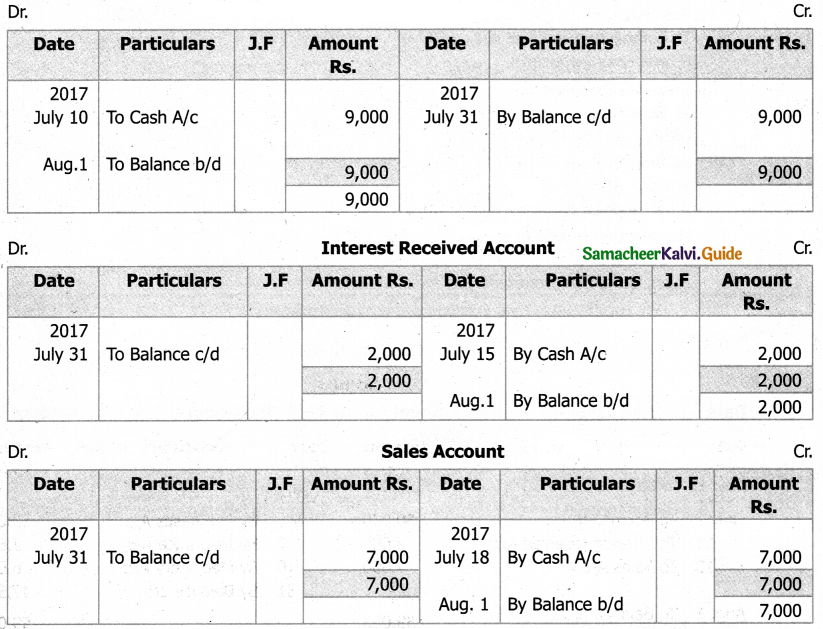

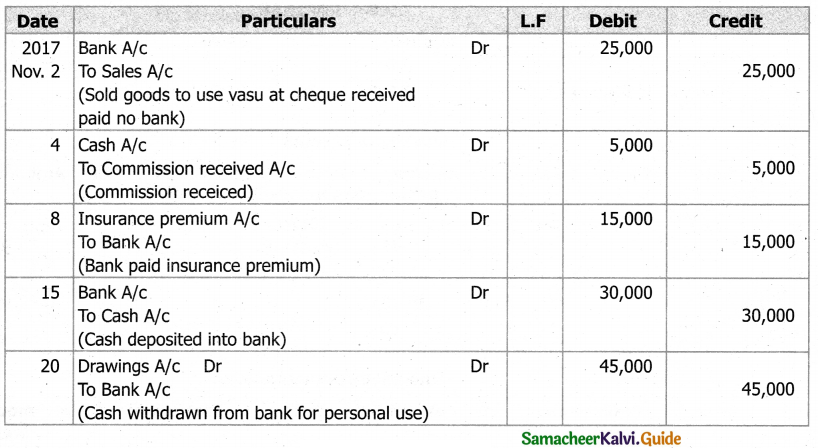

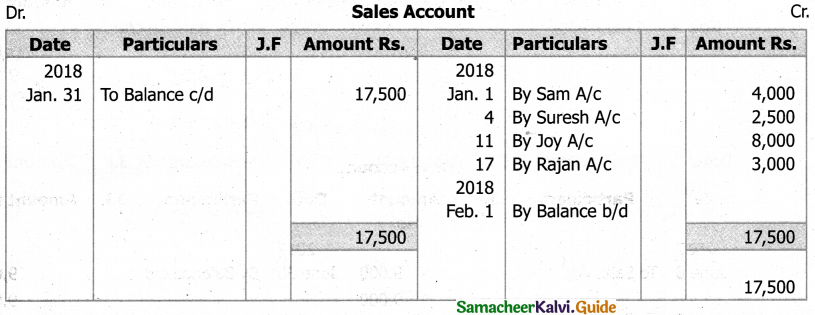

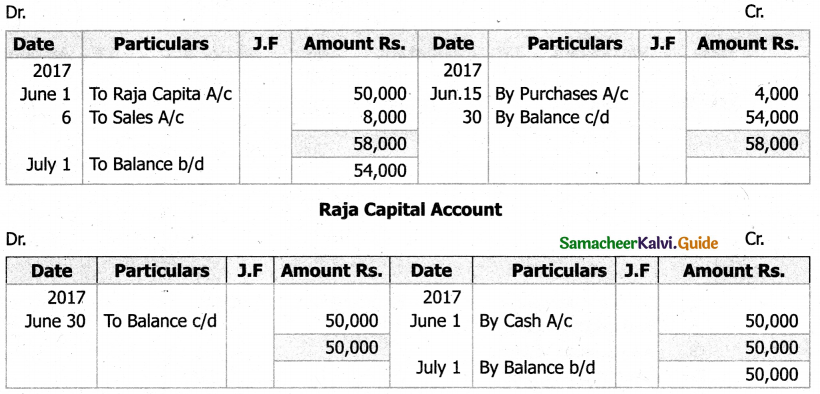

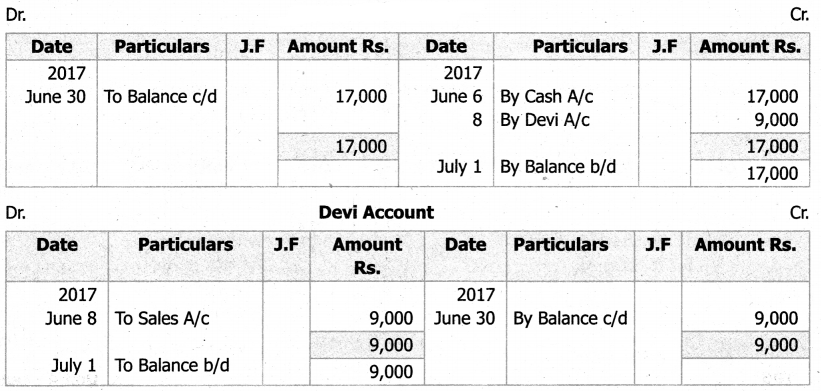

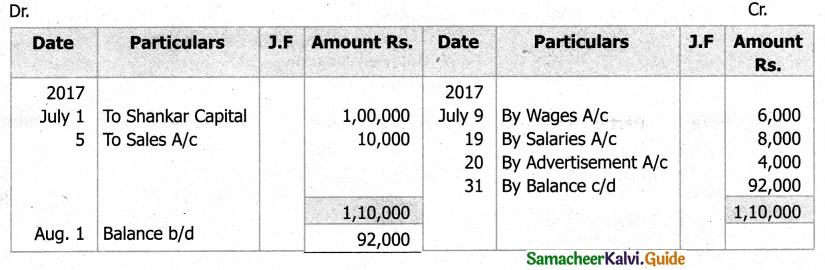

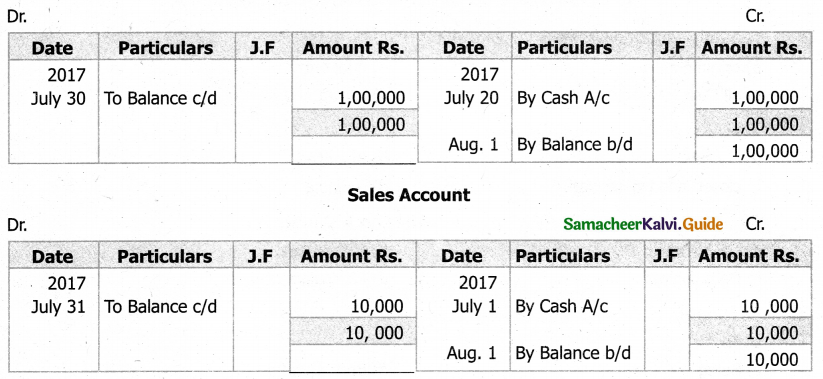

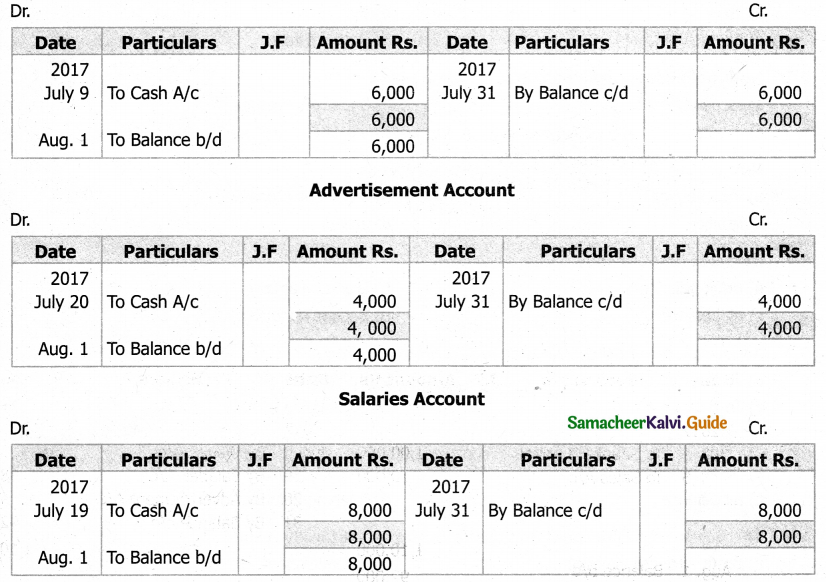

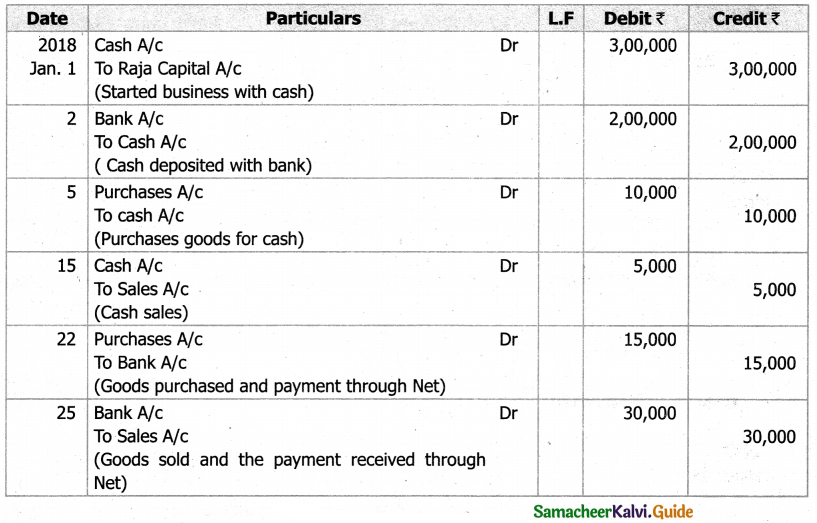

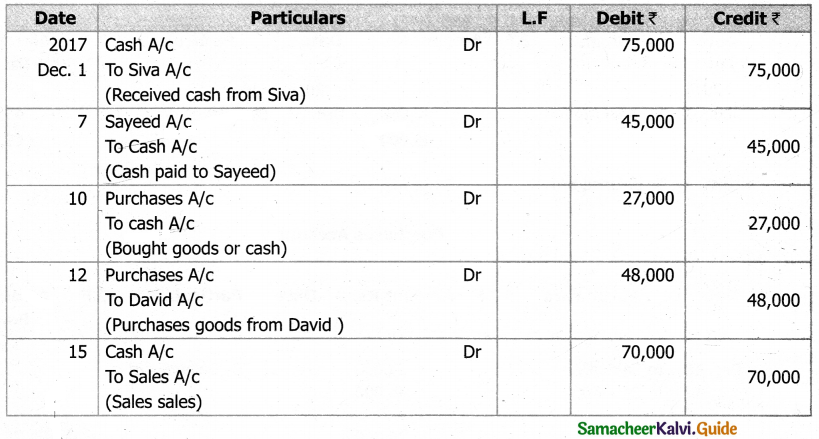

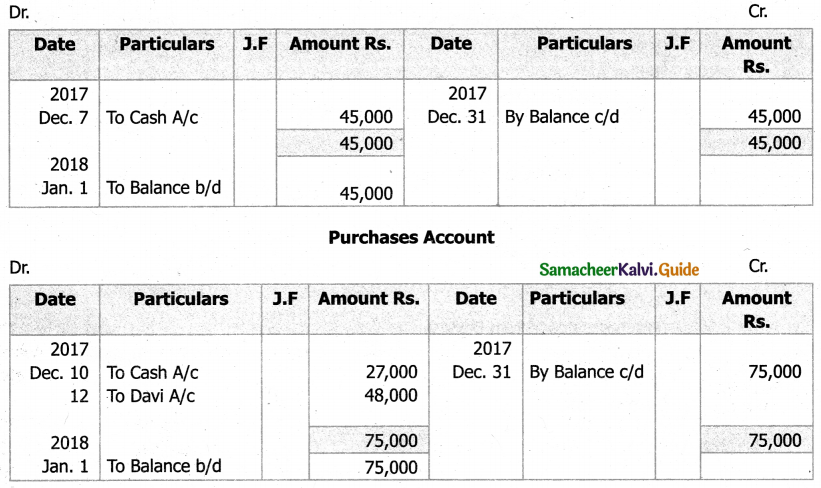

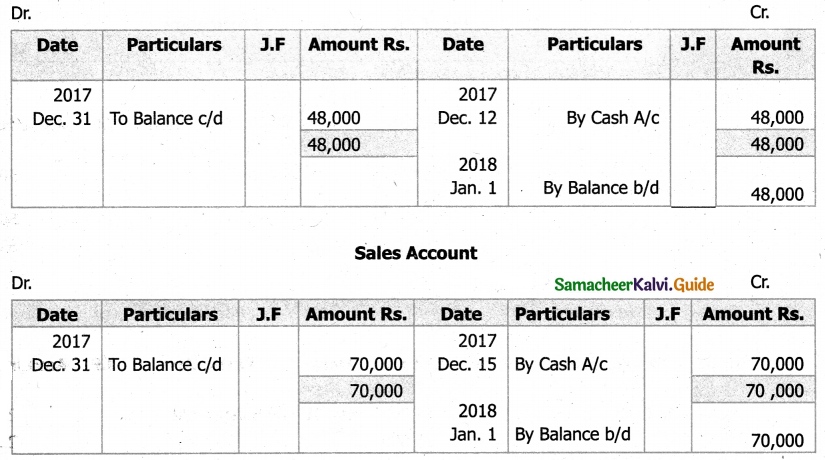

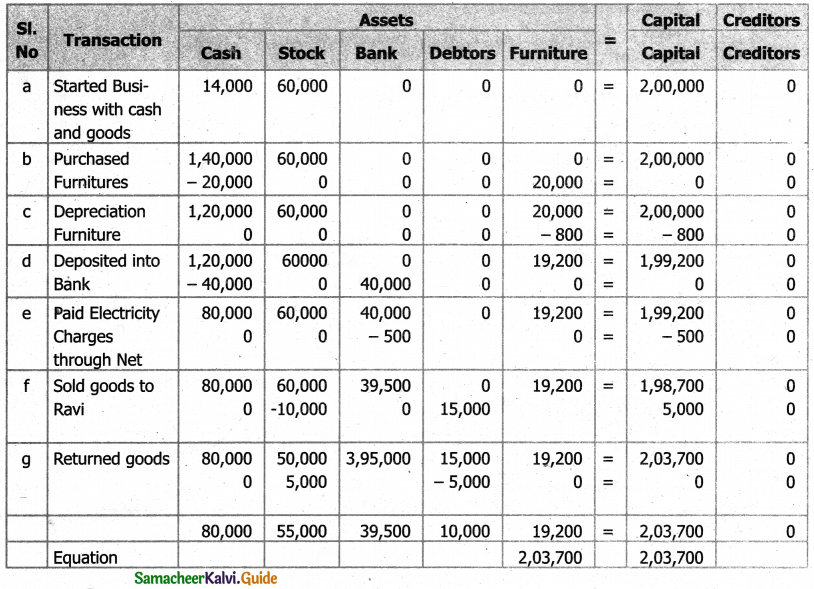

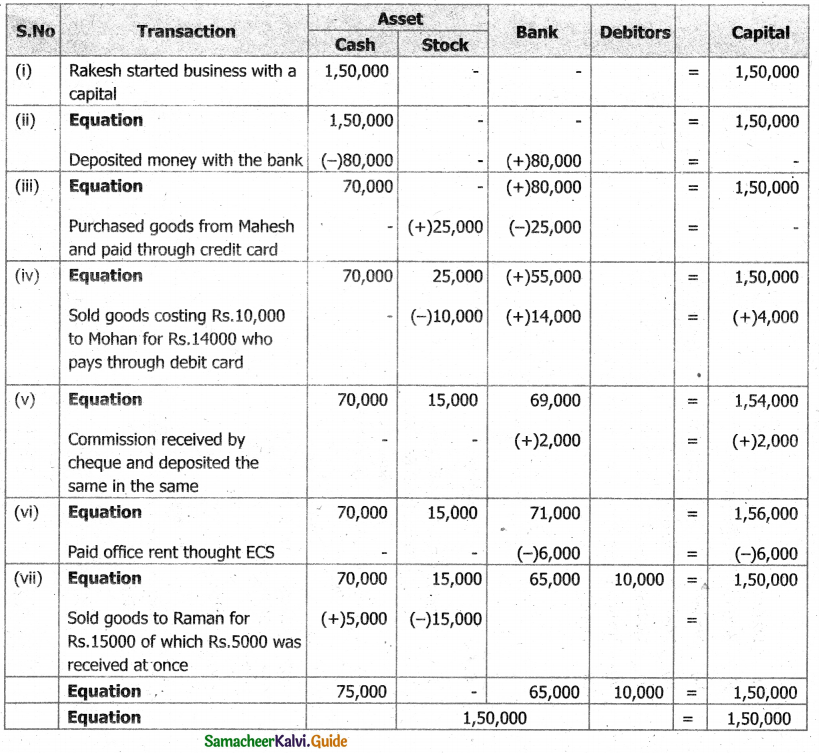

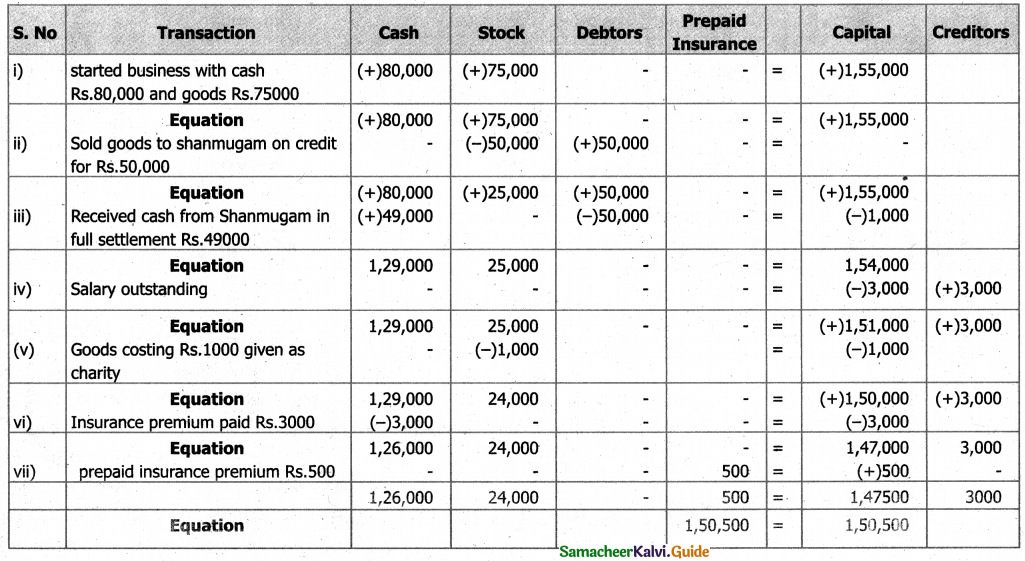

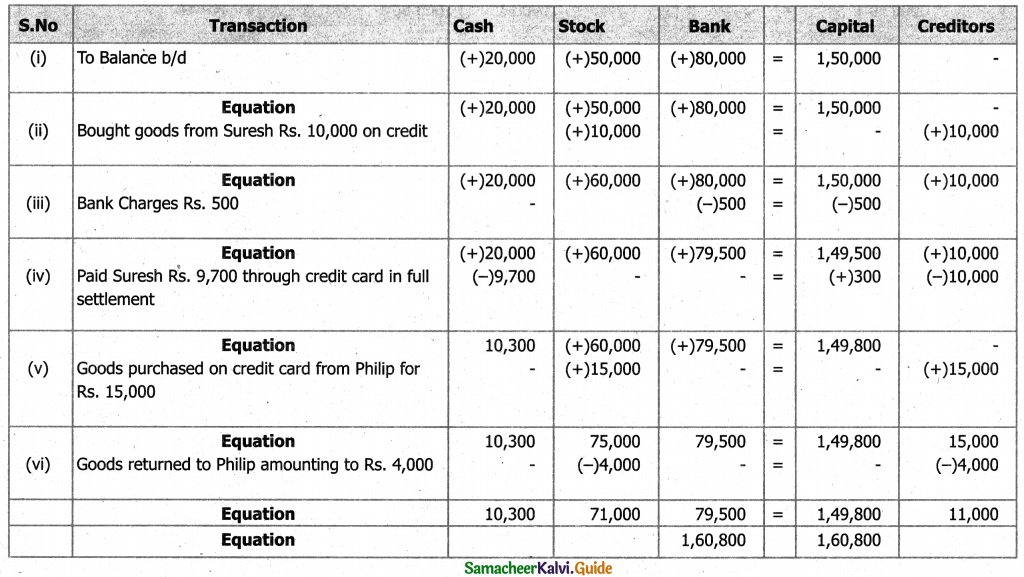

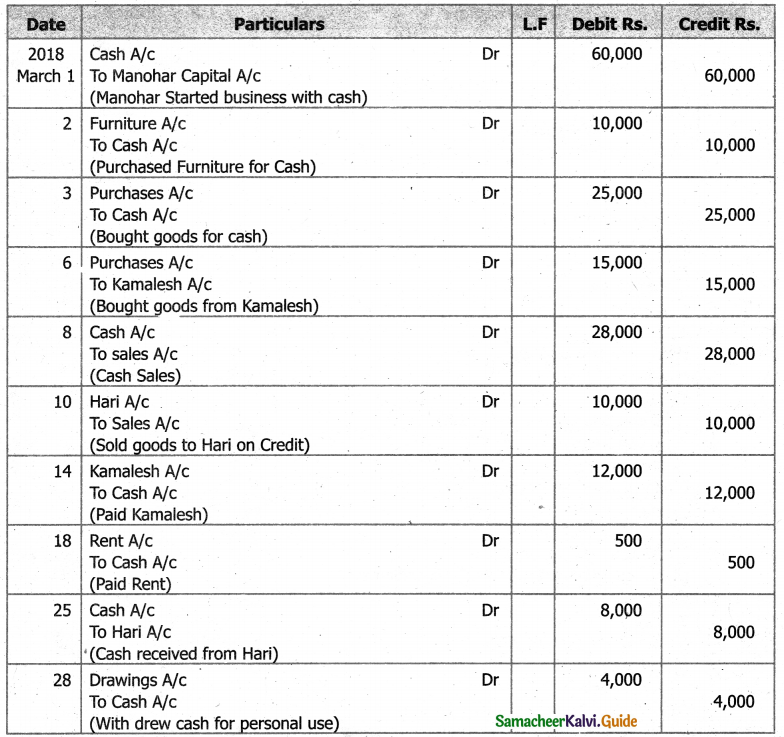

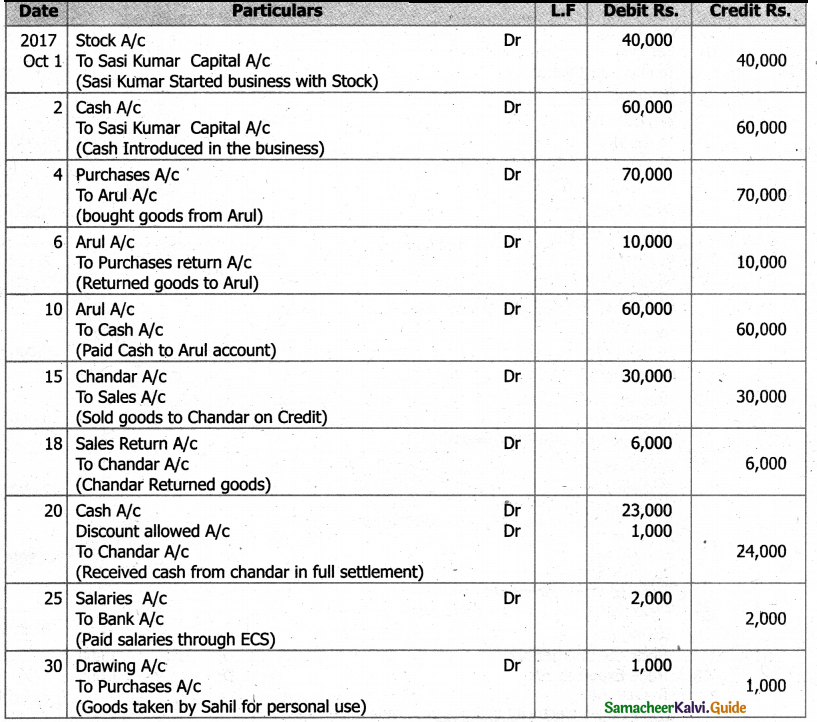

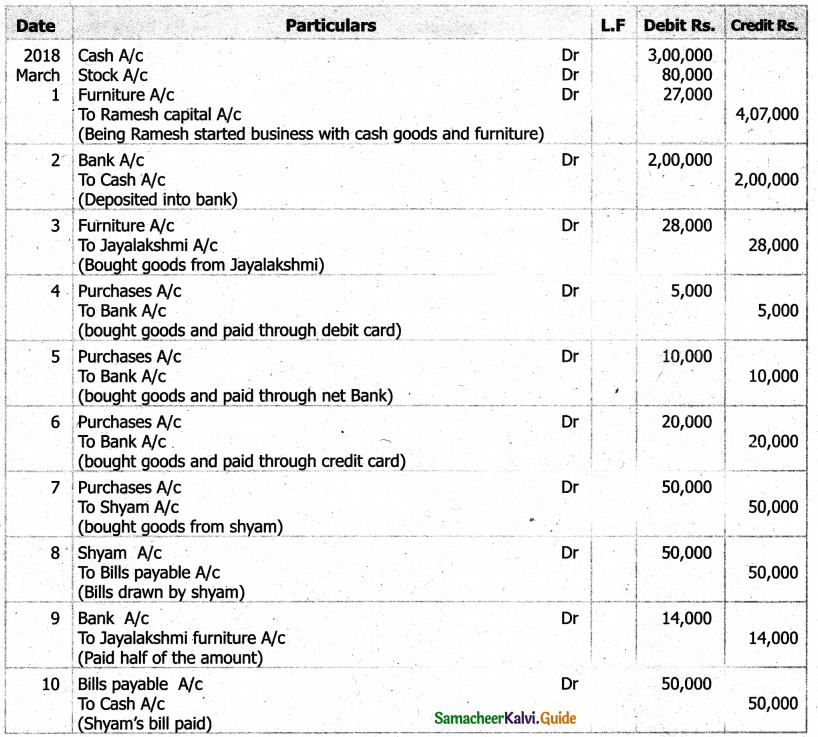

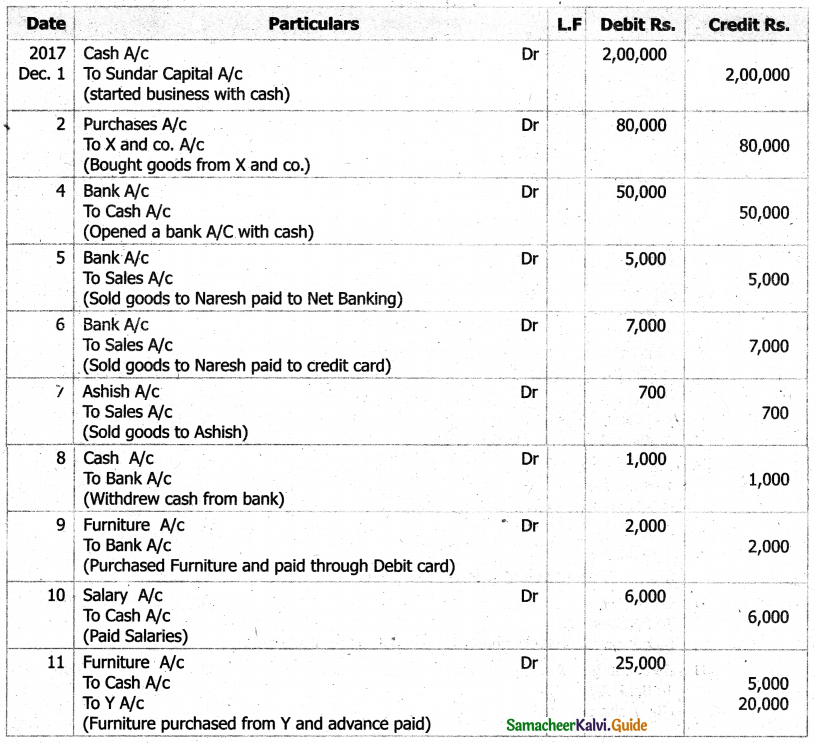

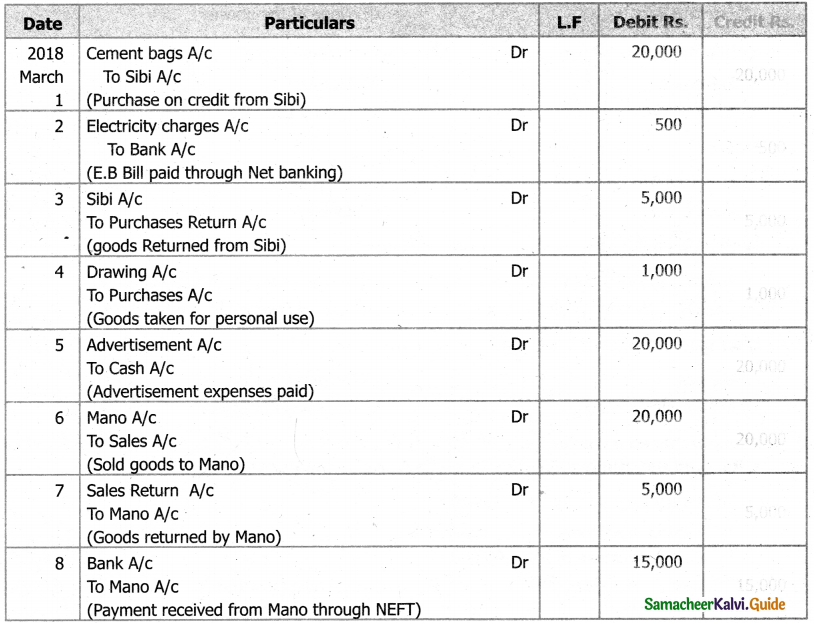

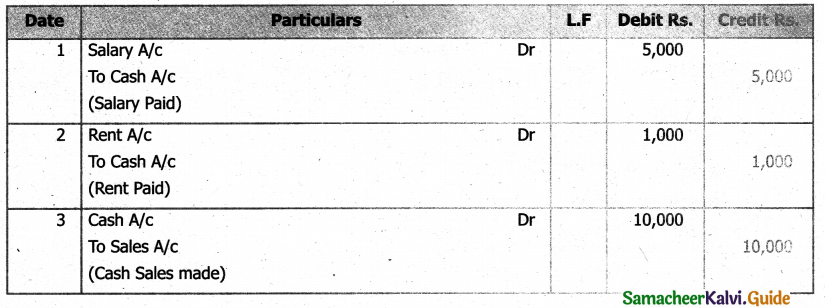

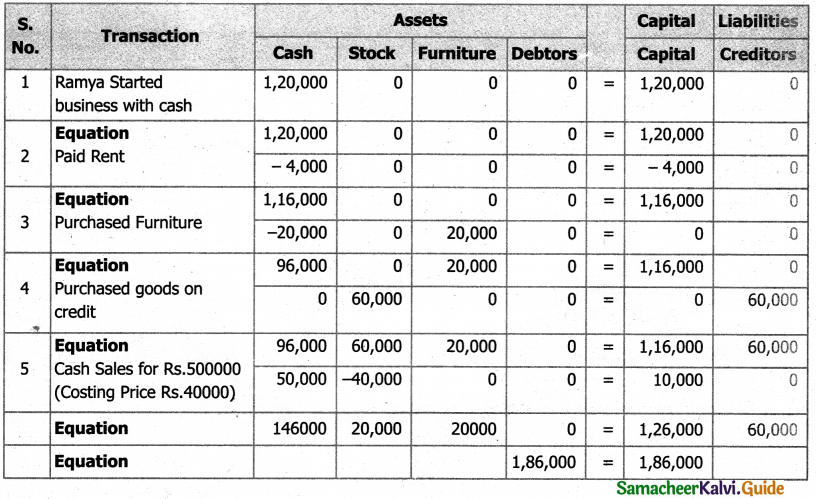

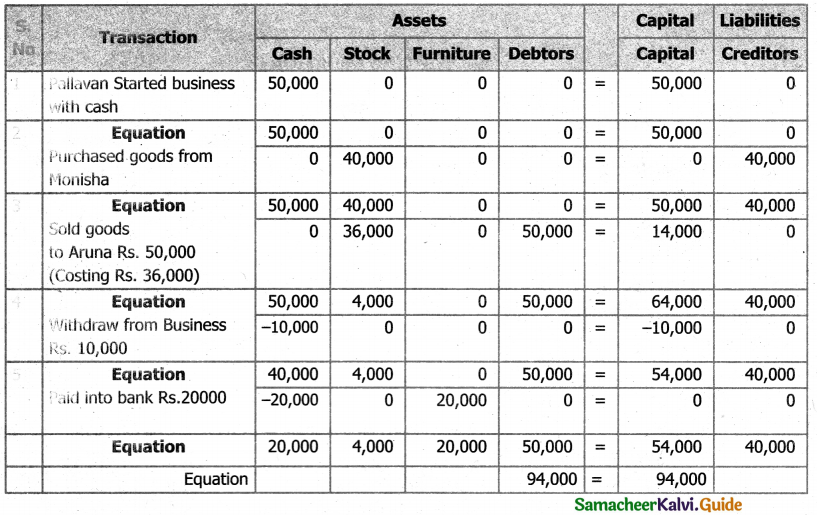

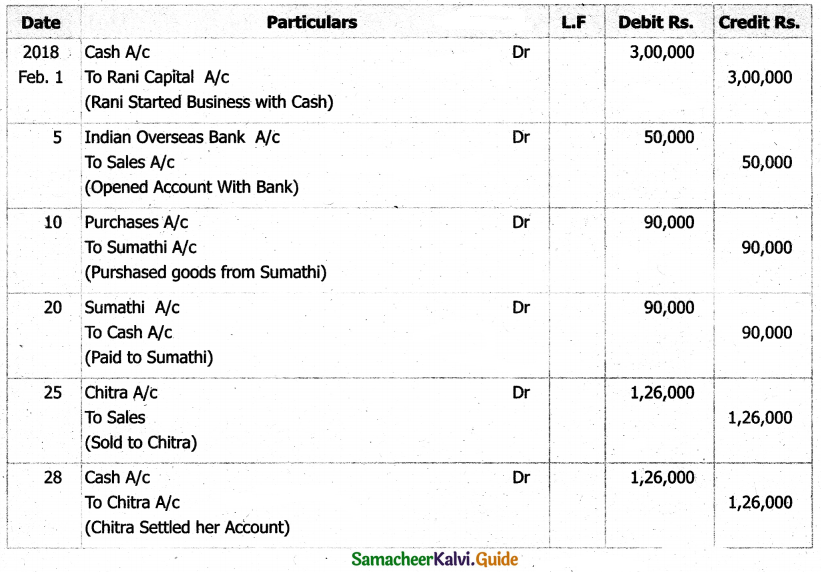

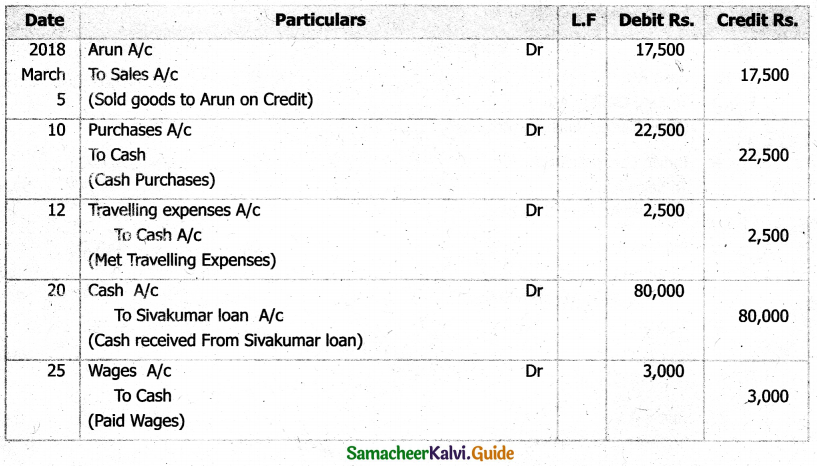

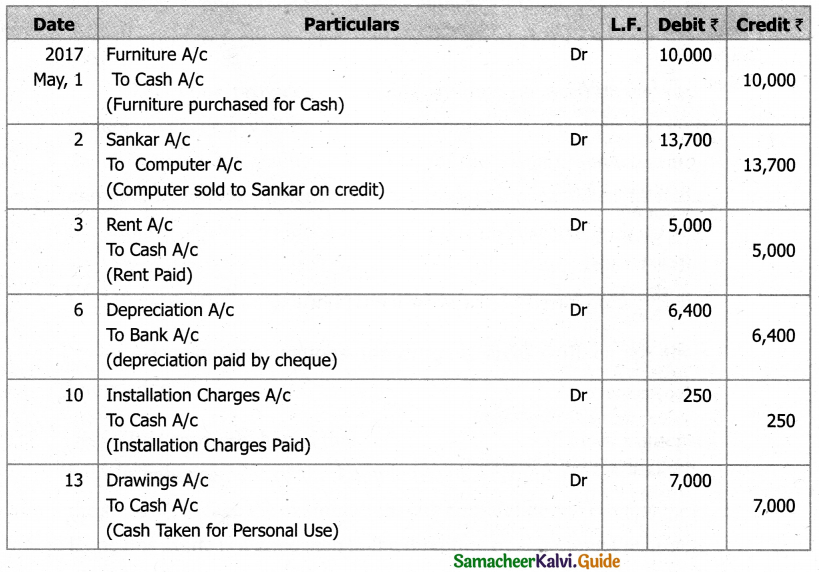

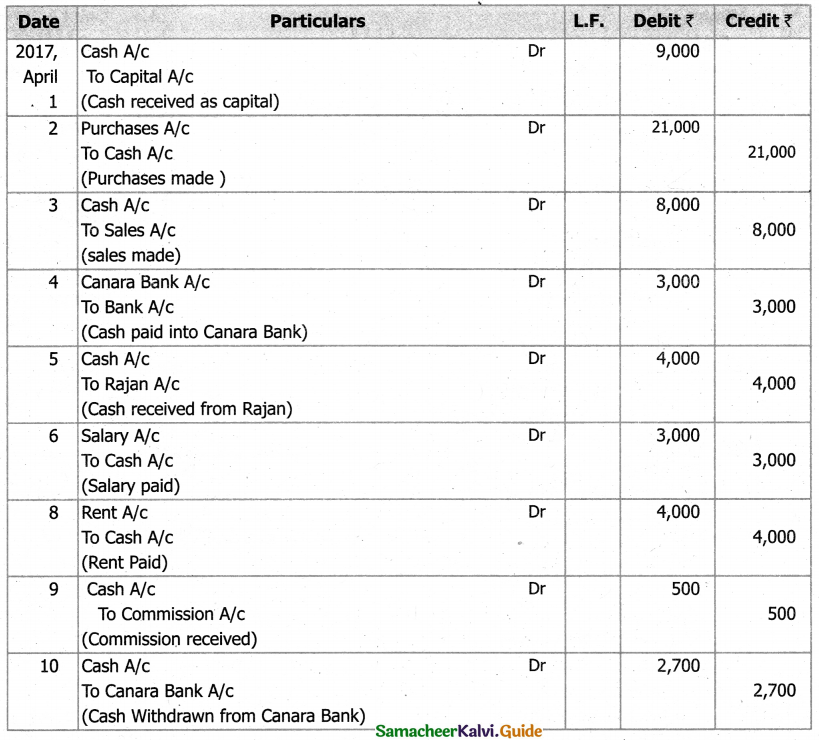

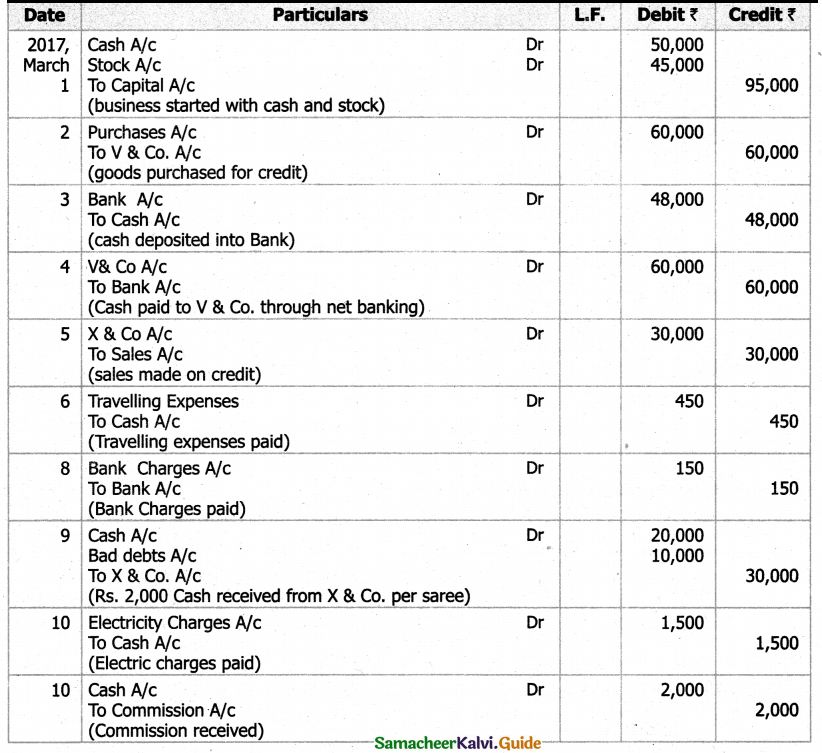

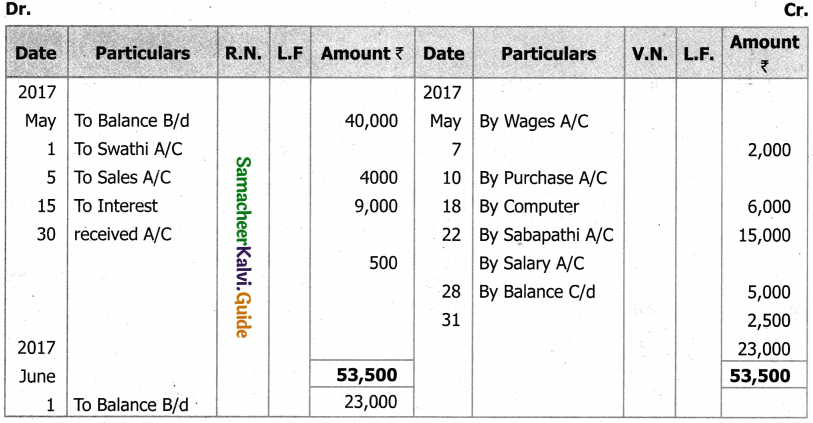

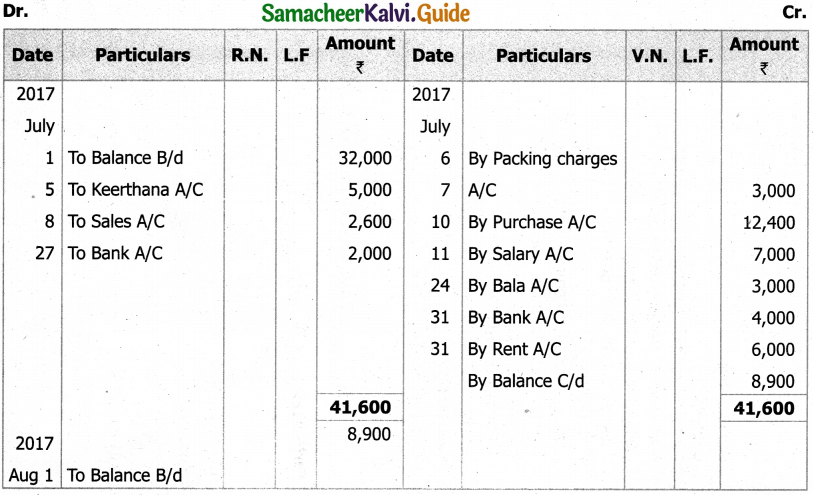

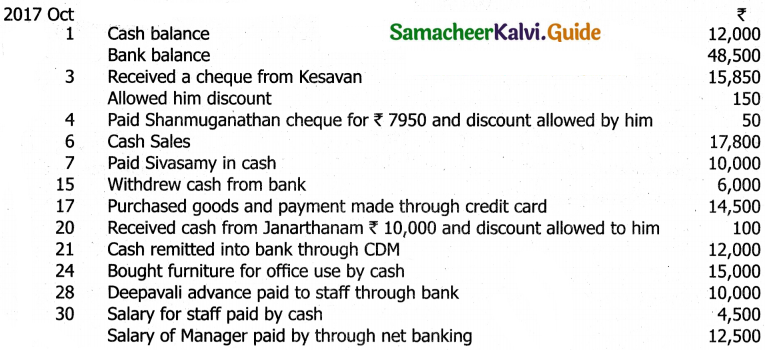

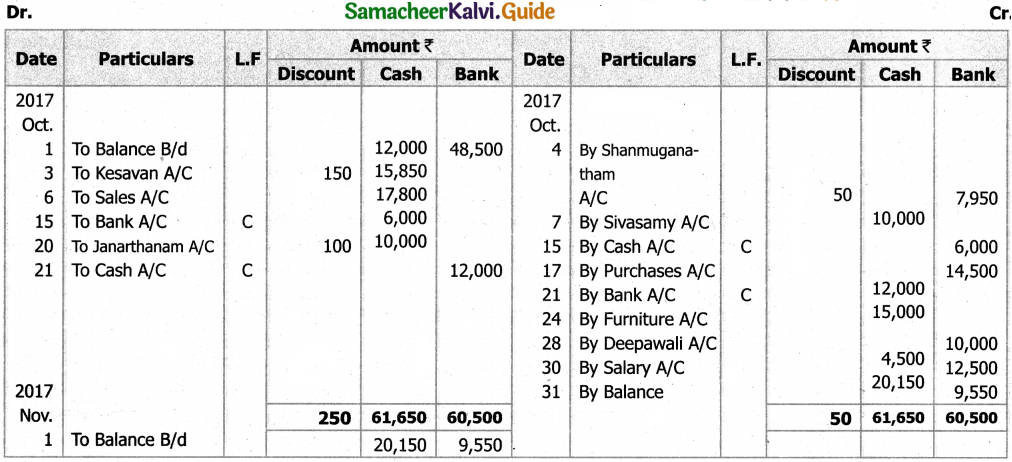

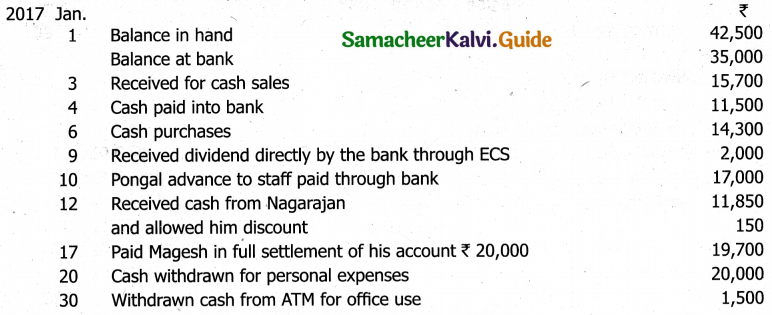

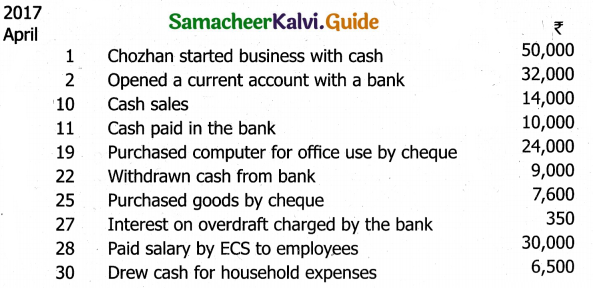

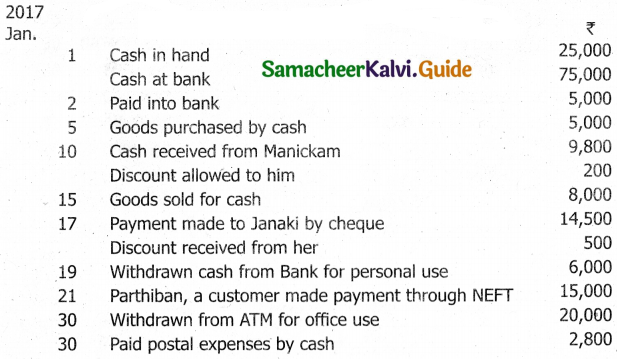

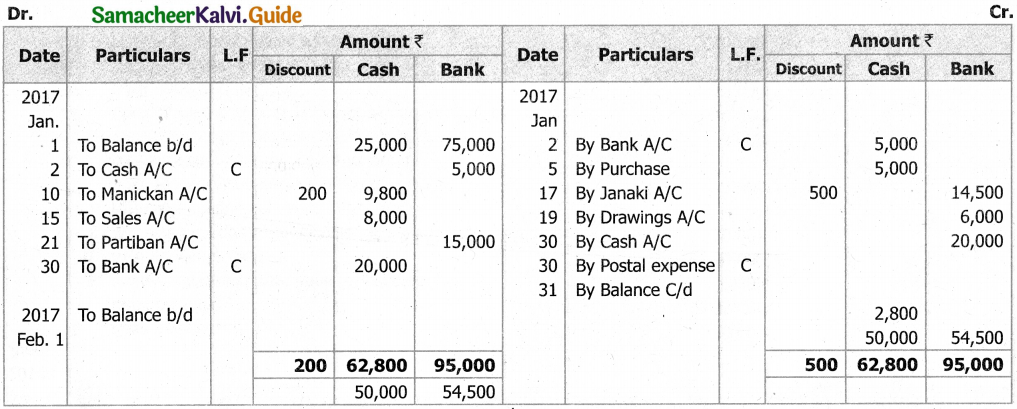

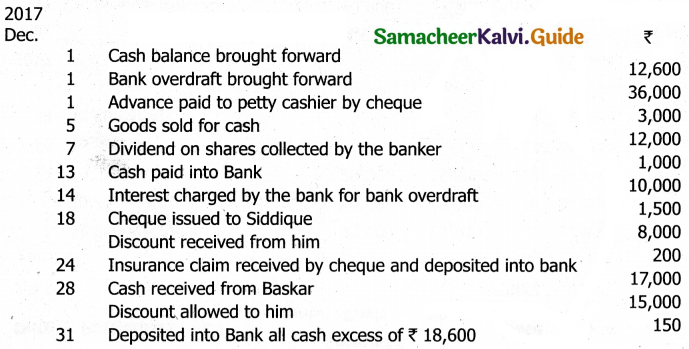

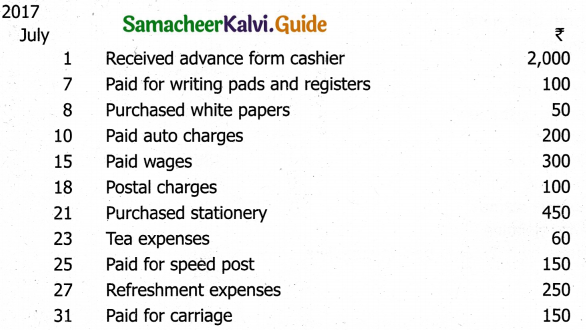

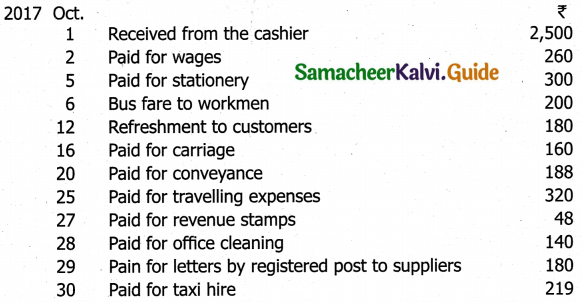

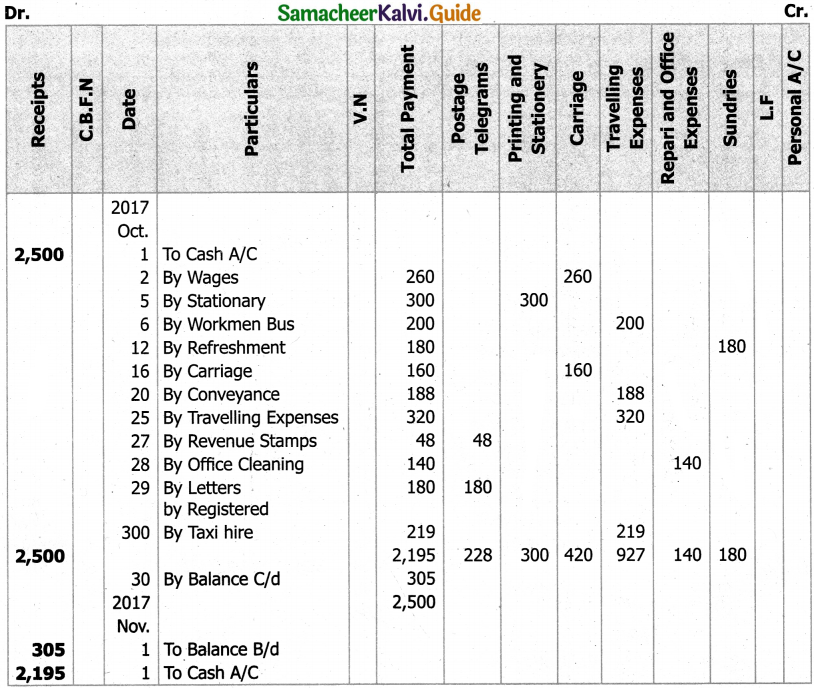

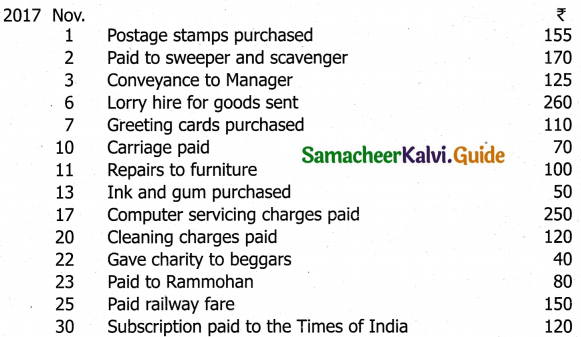

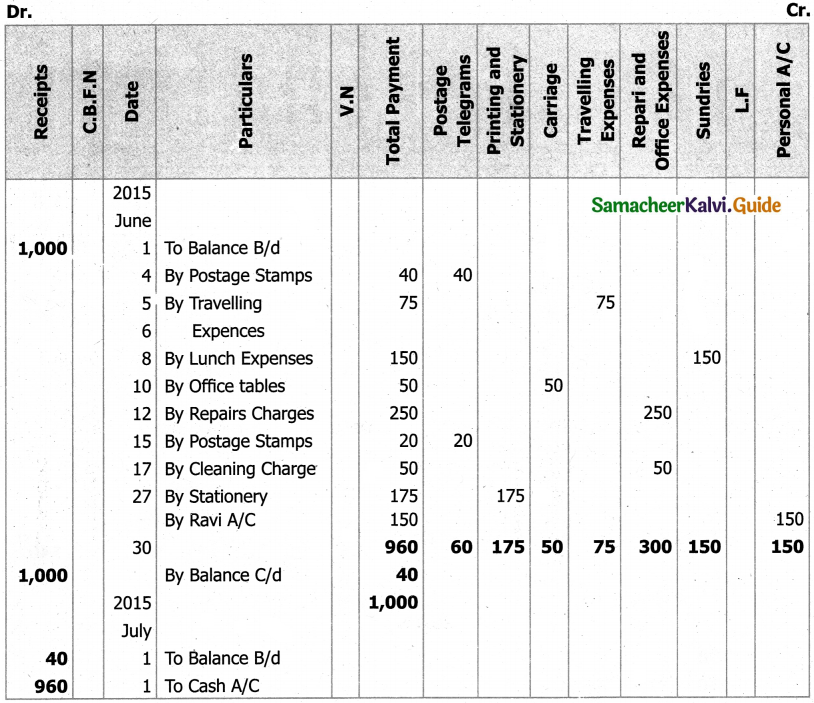

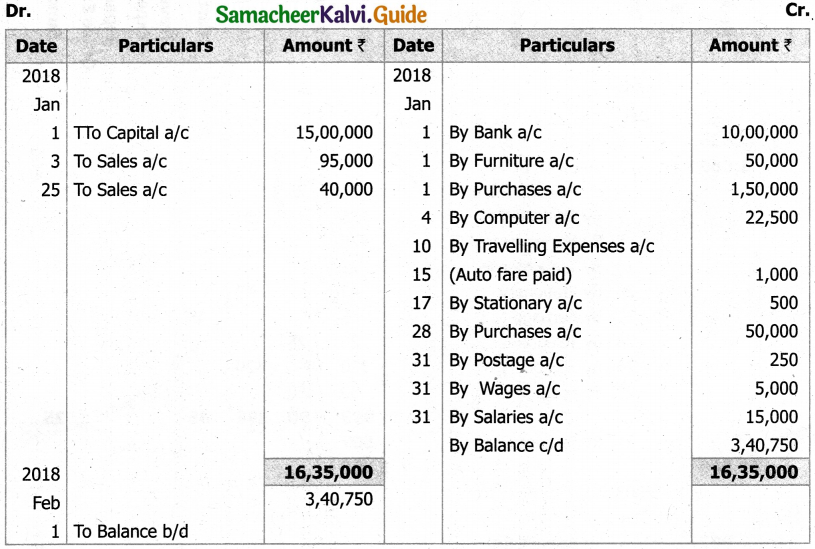

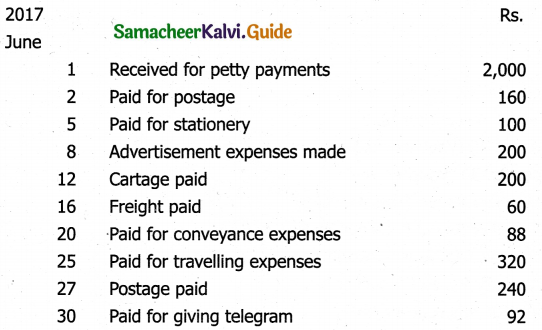

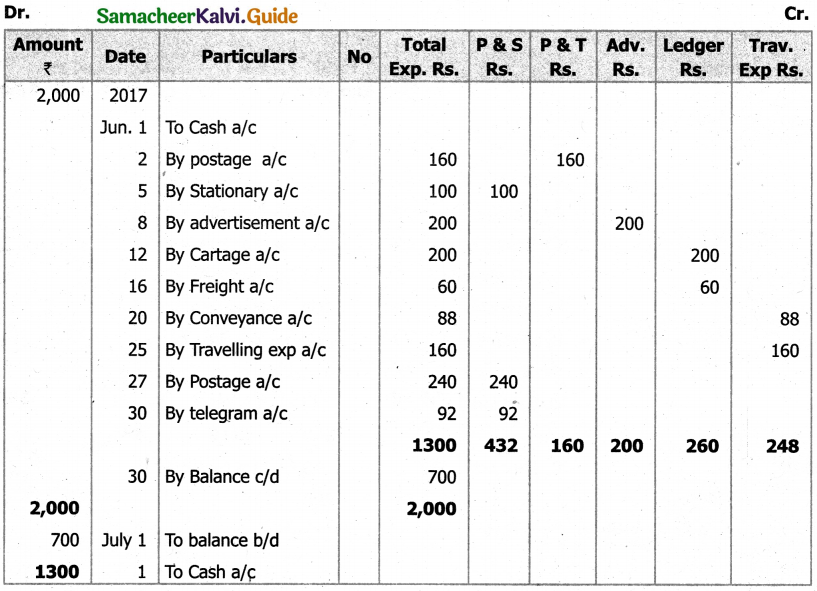

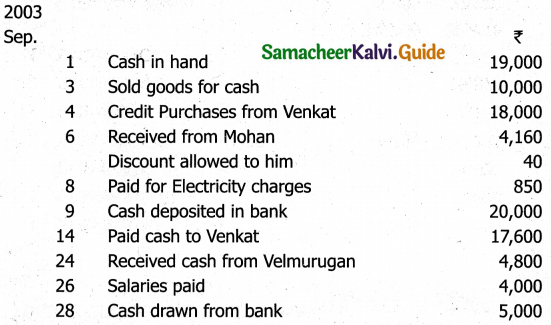

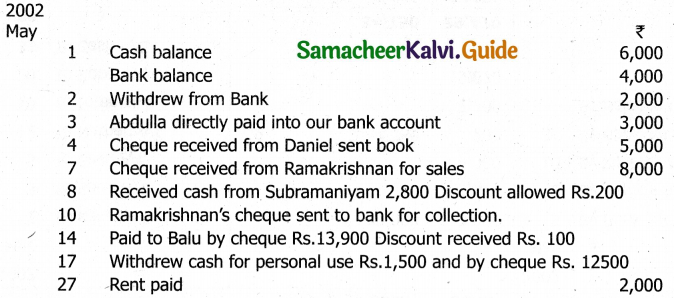

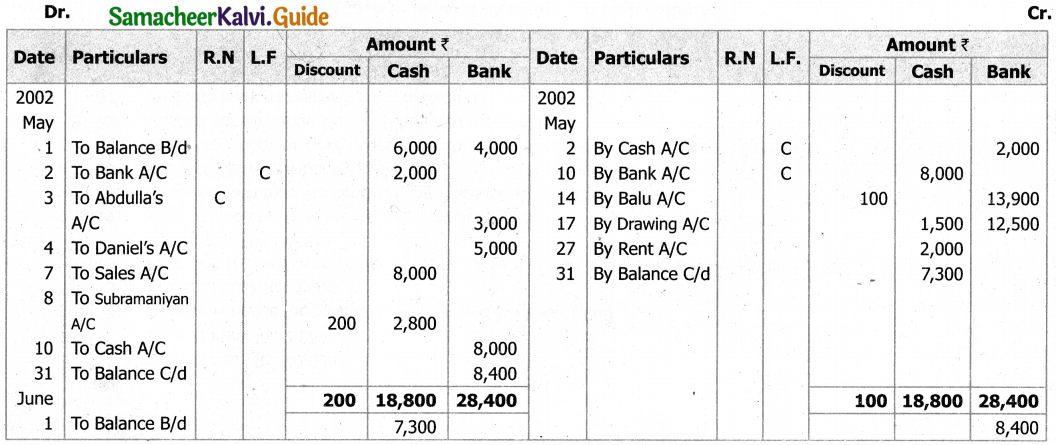

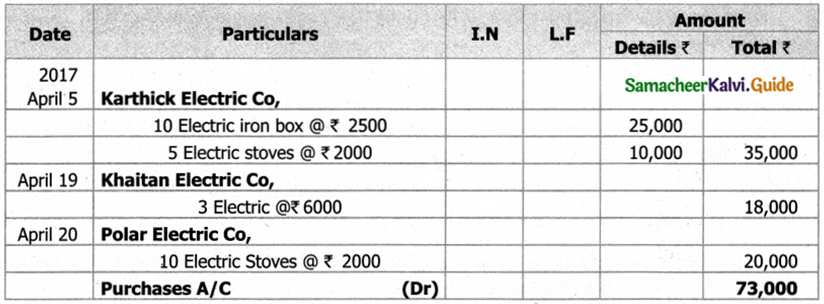

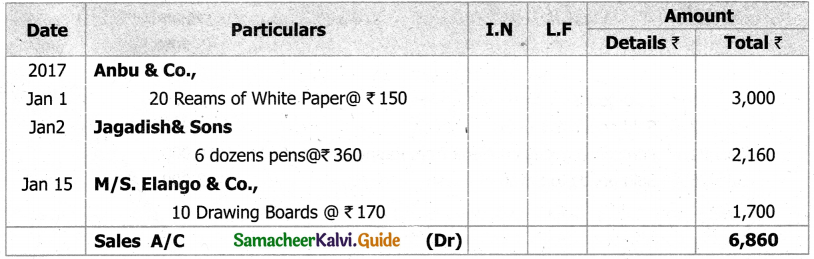

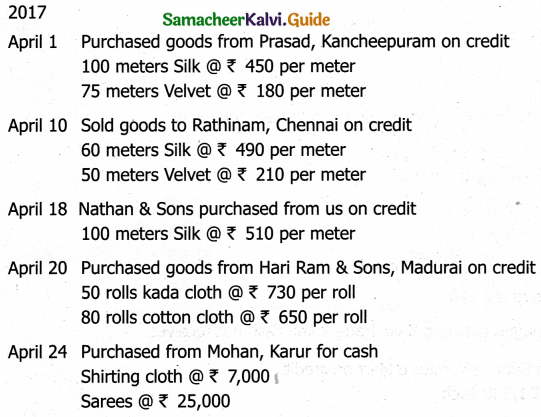

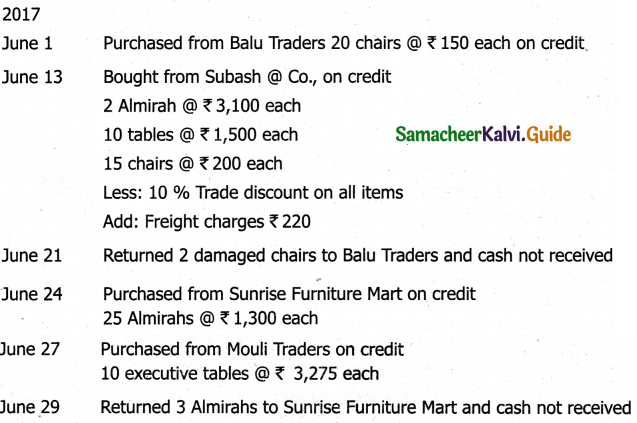

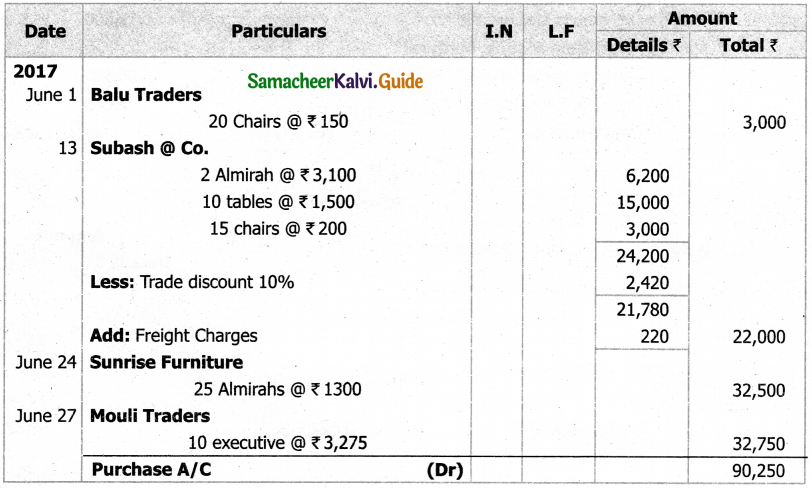

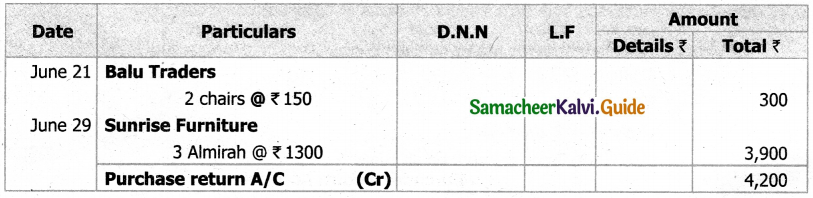

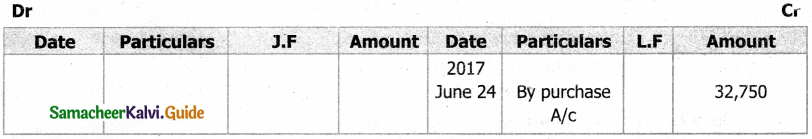

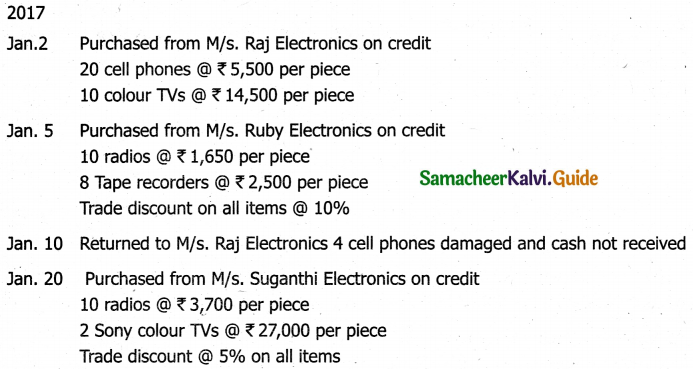

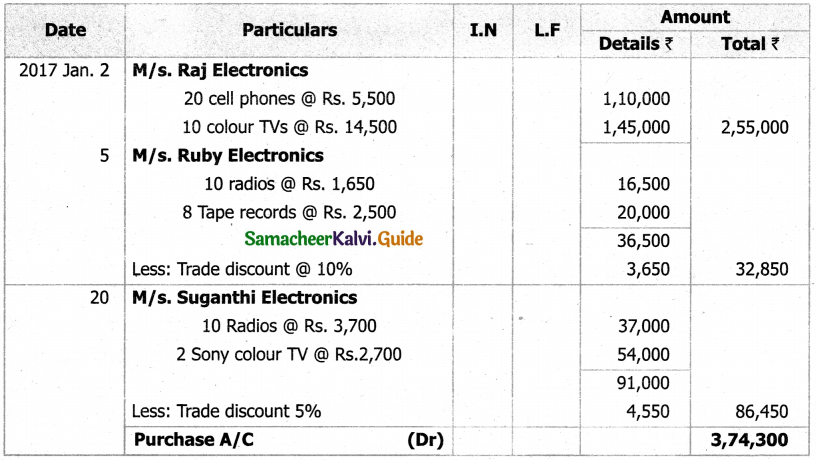

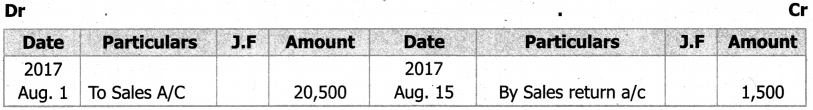

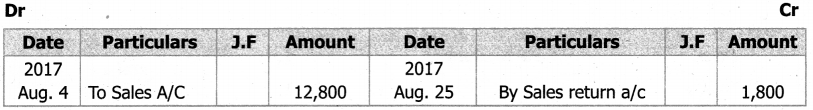

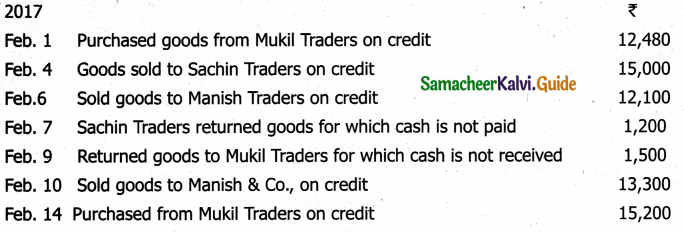

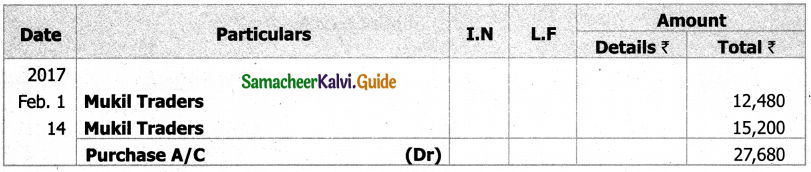

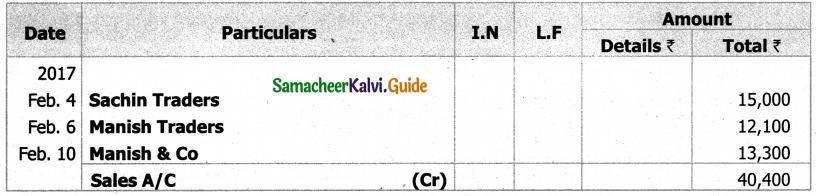

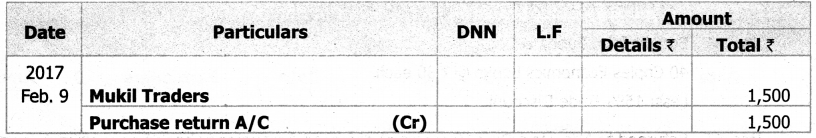

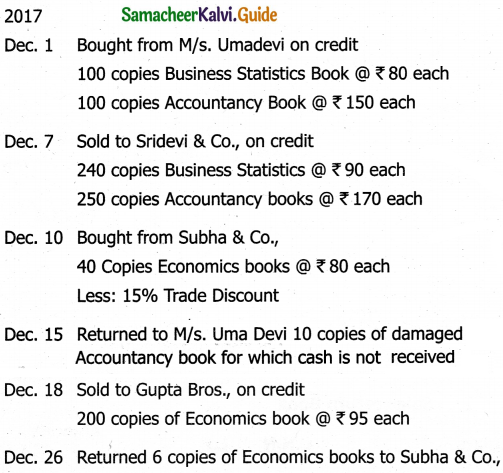

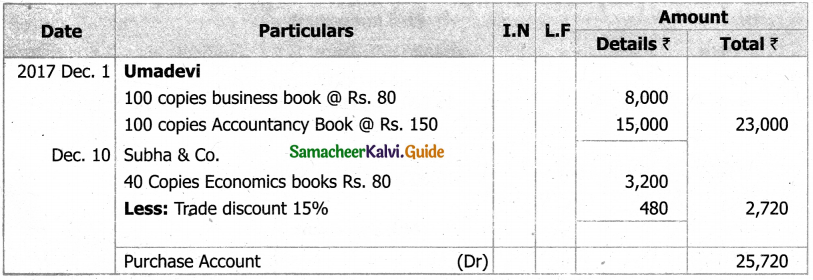

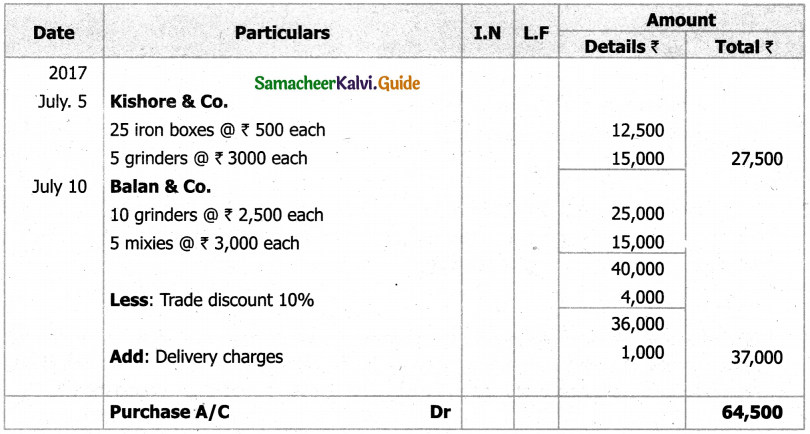

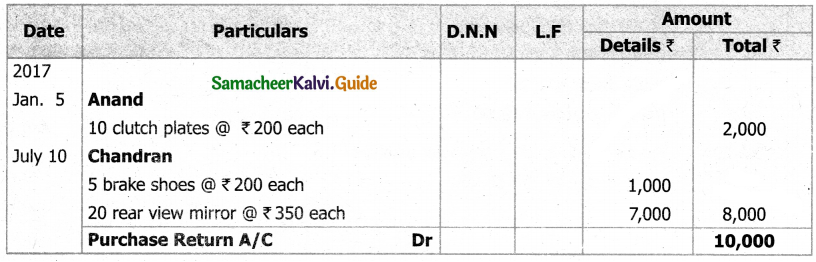

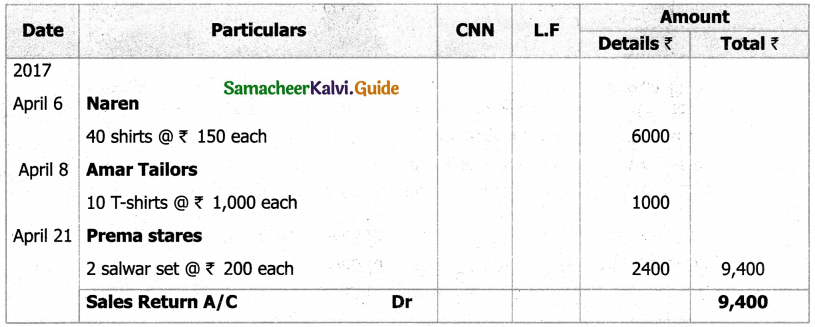

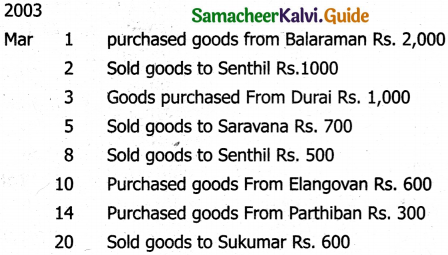

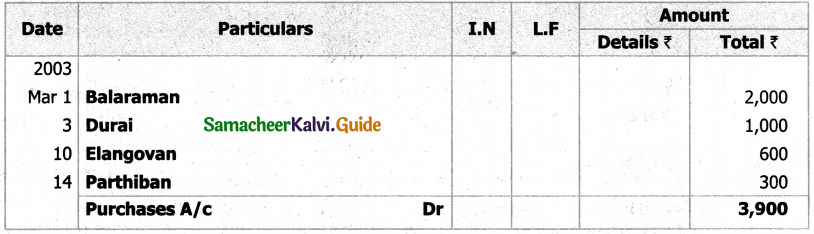

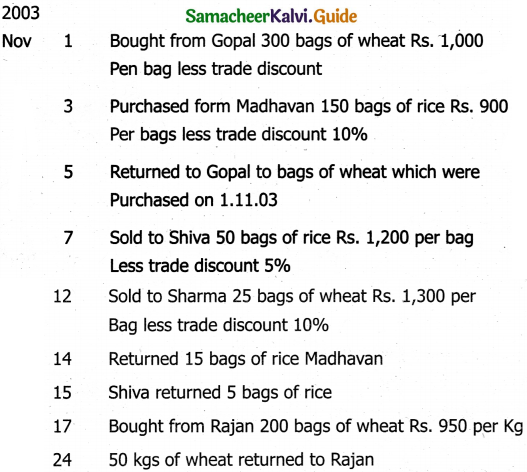

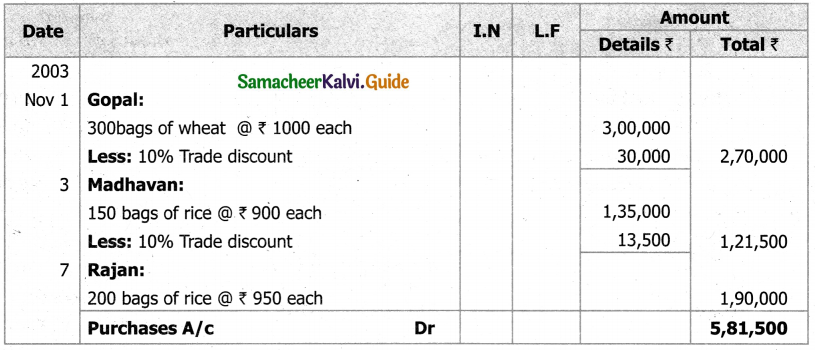

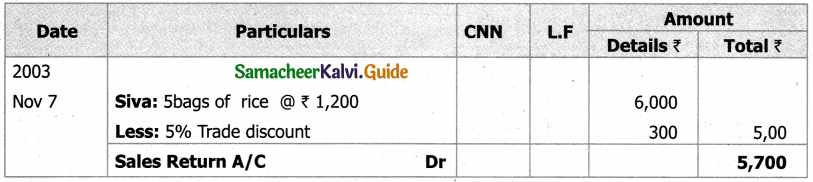

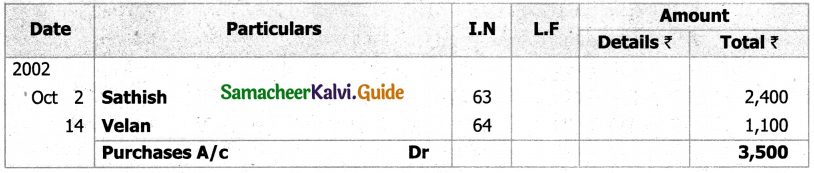

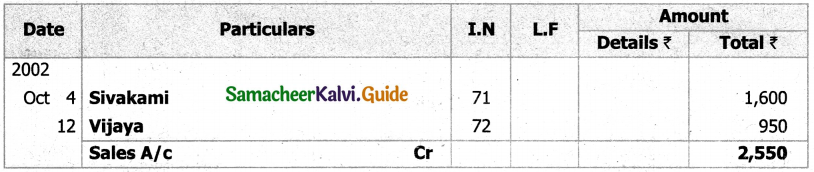

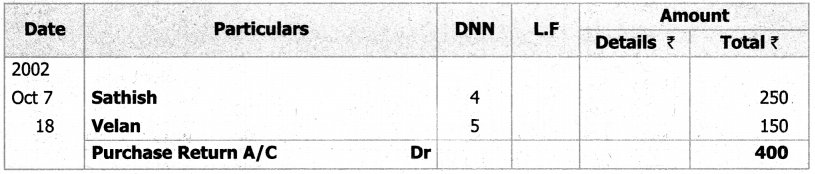

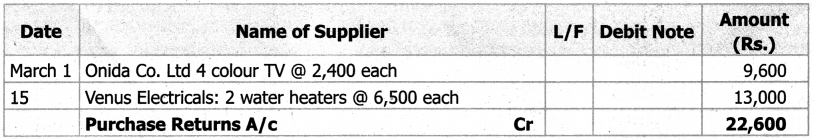

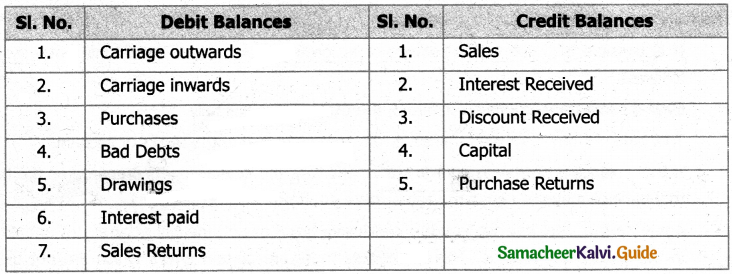

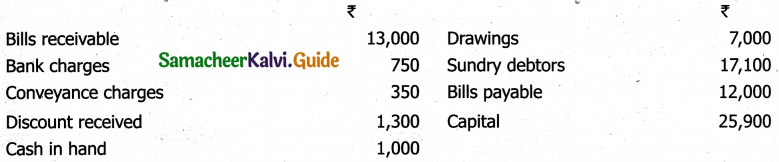

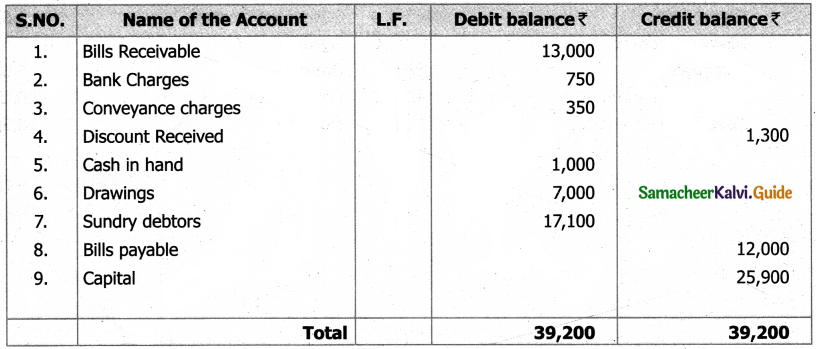

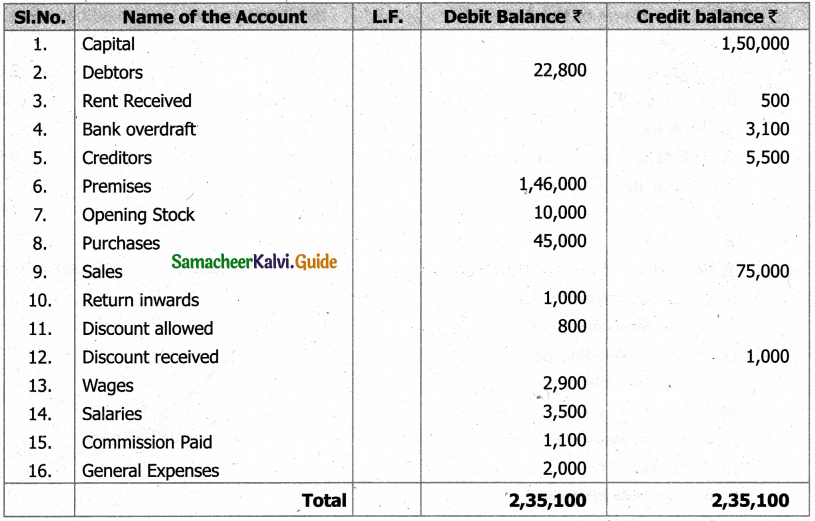

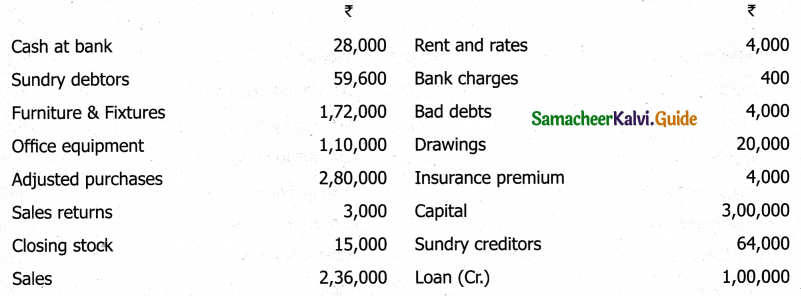

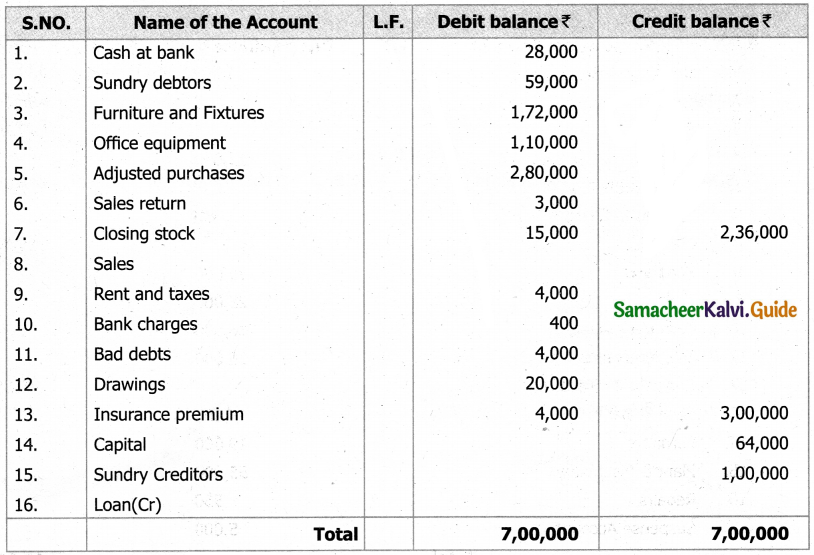

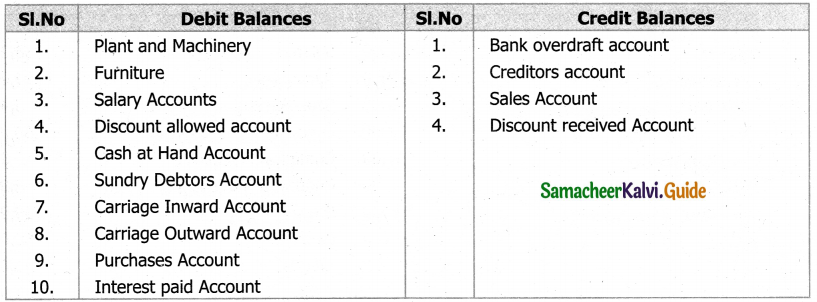

Solution:

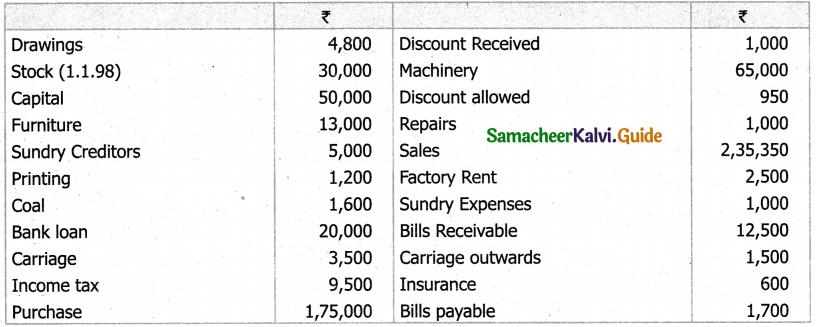

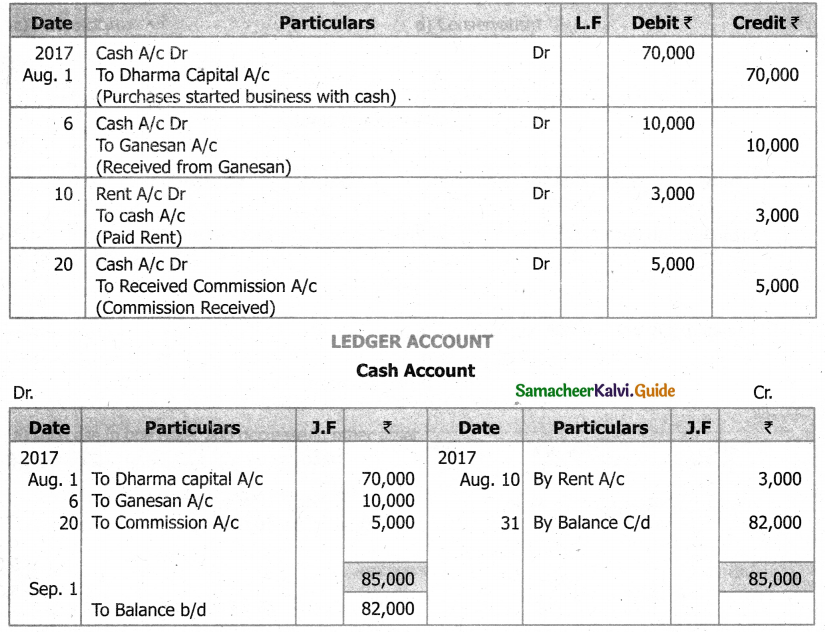

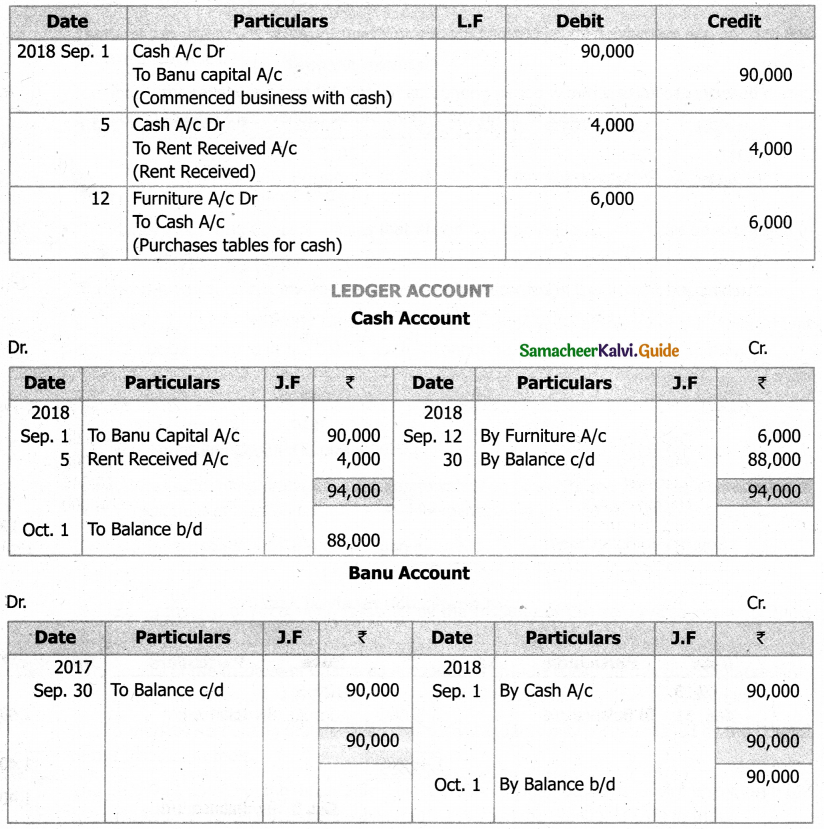

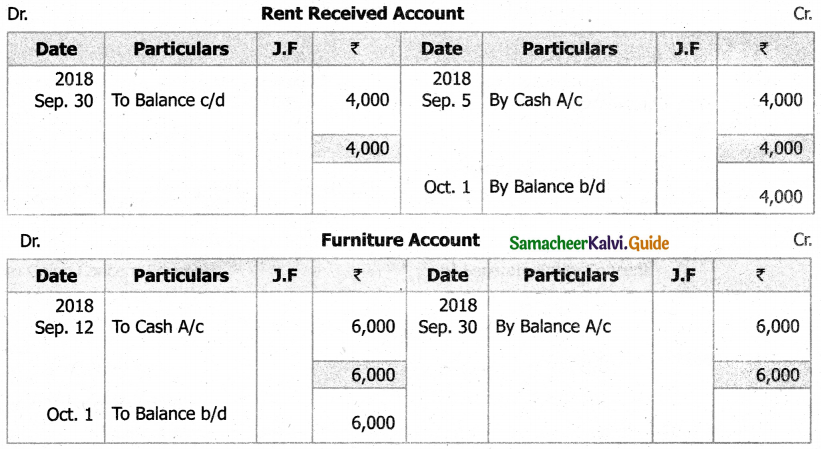

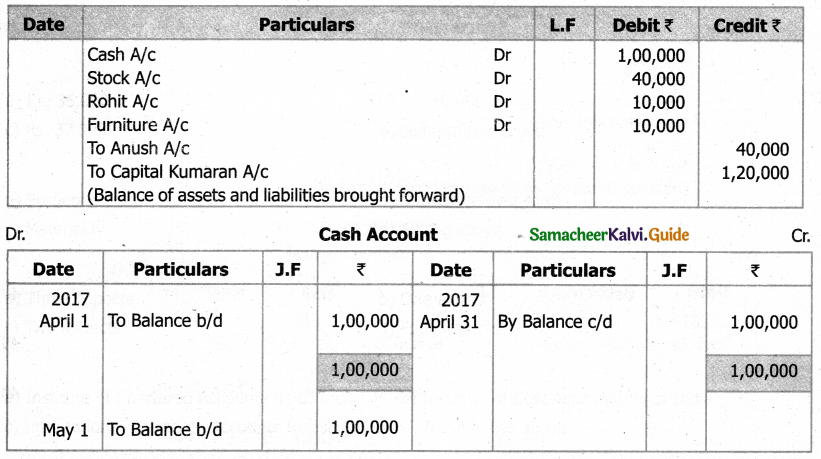

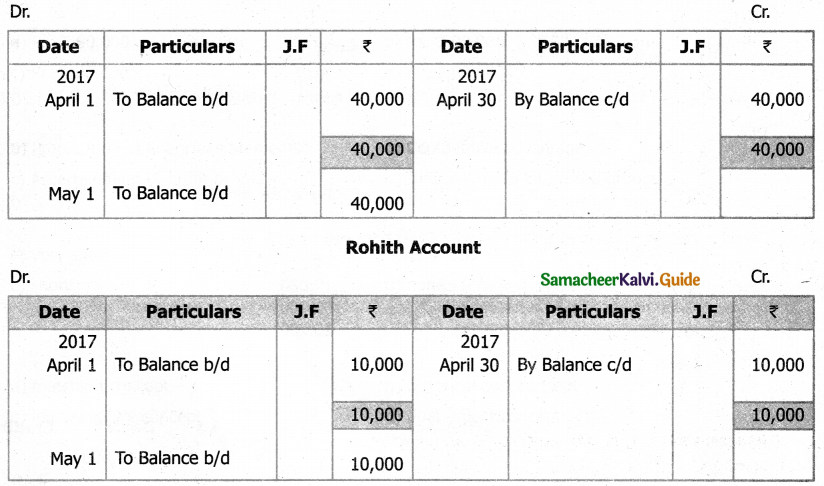

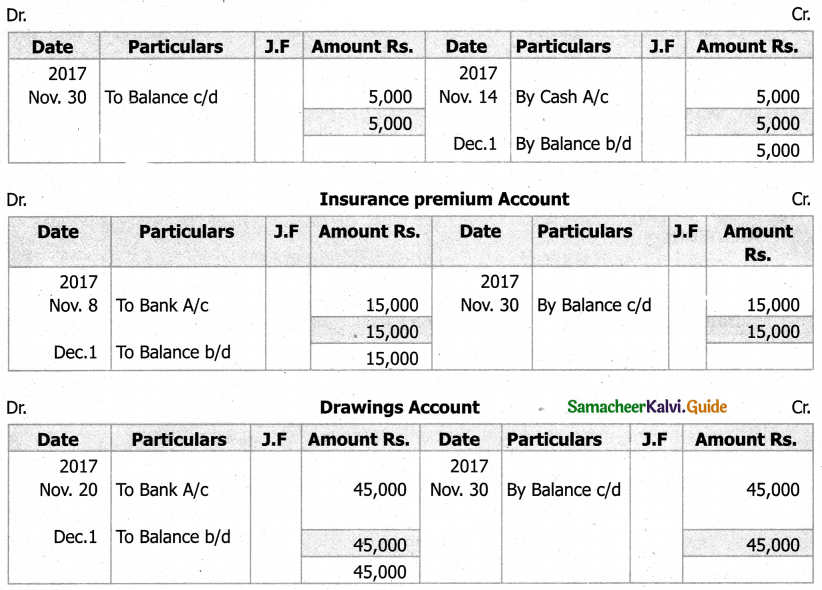

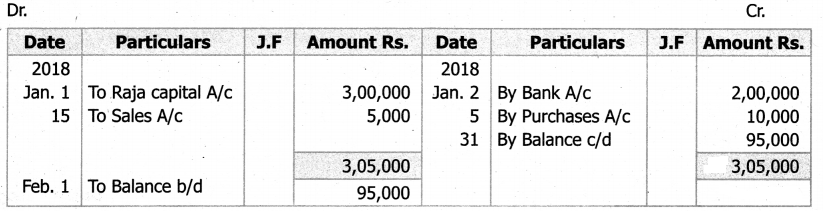

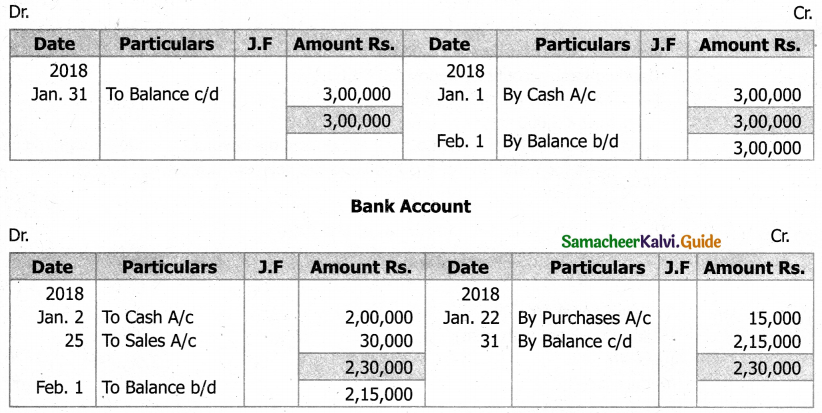

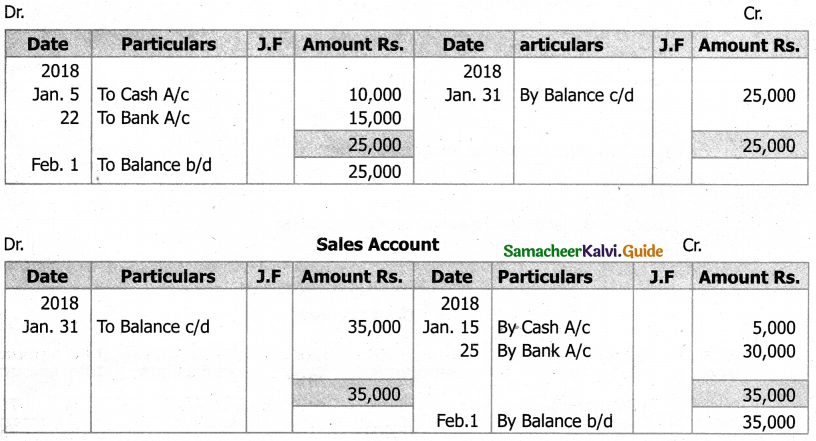

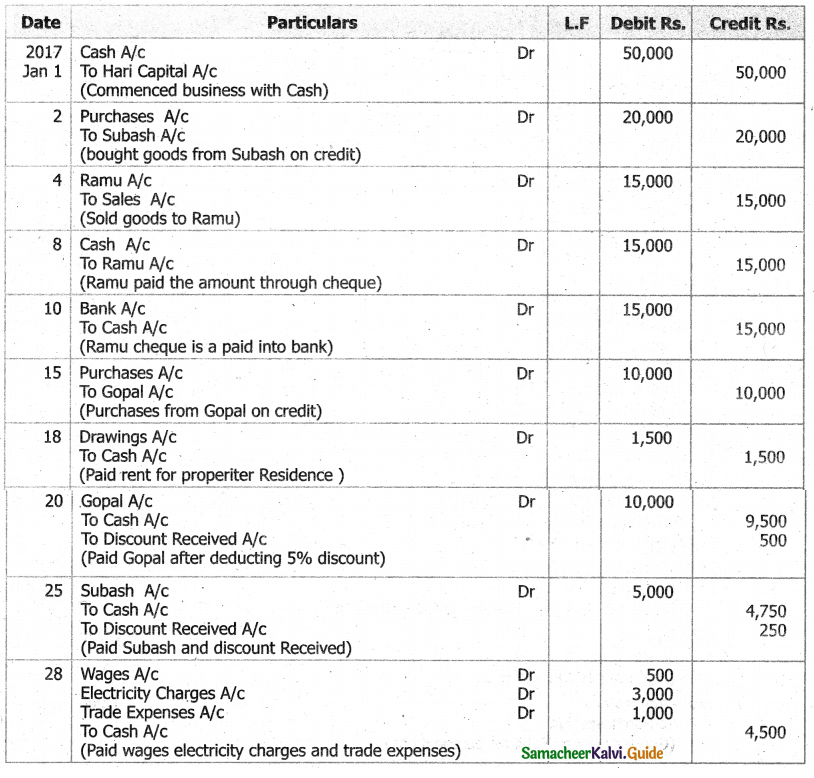

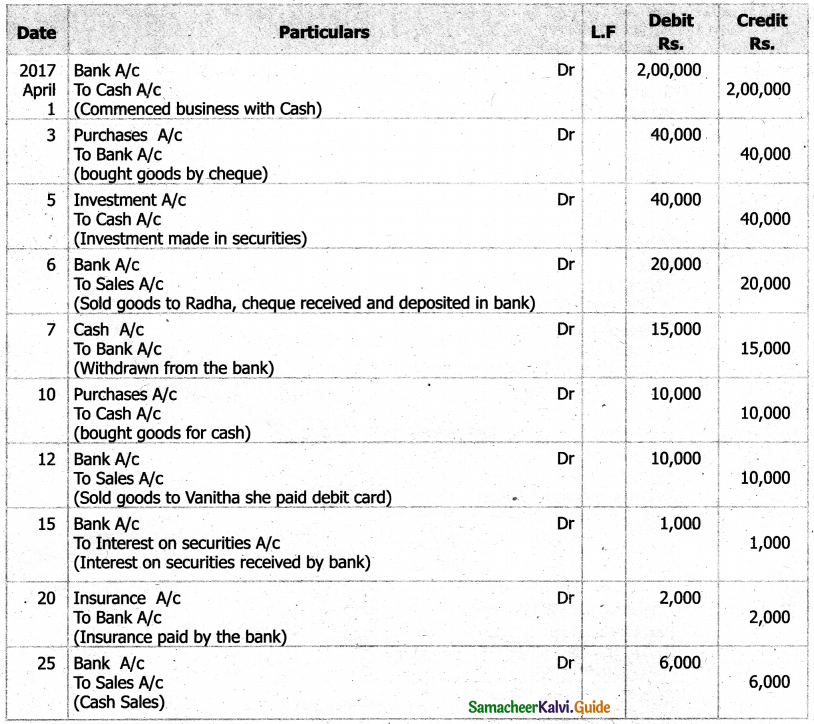

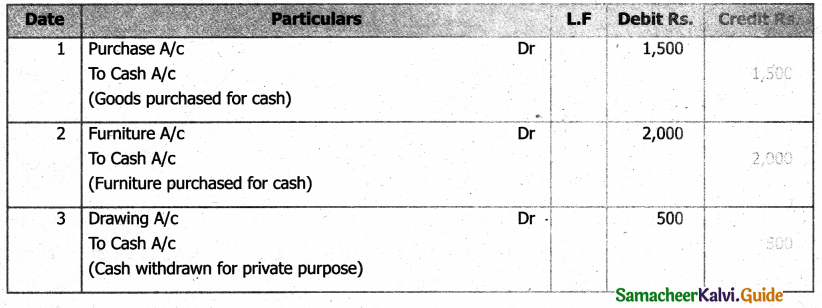

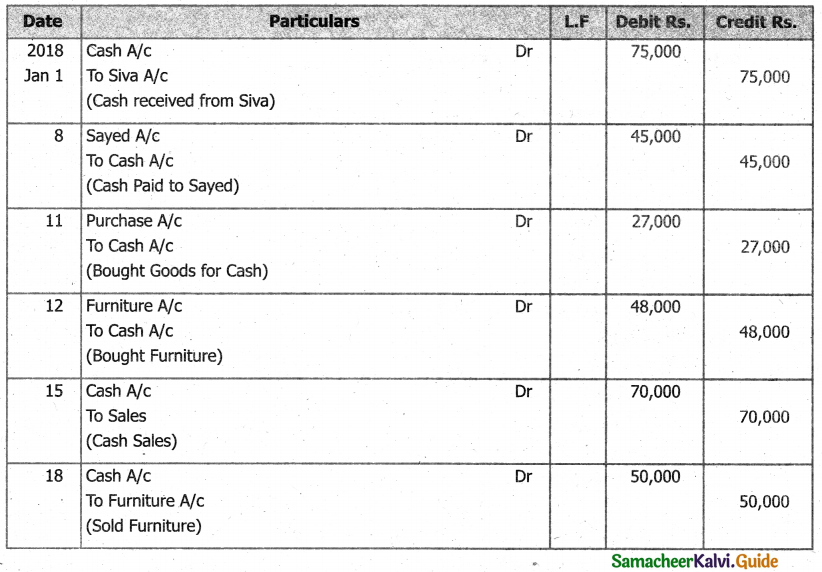

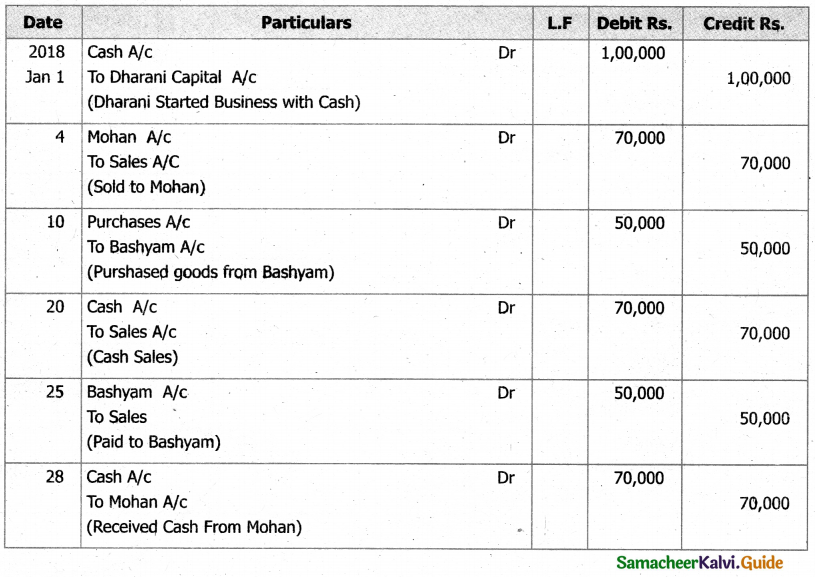

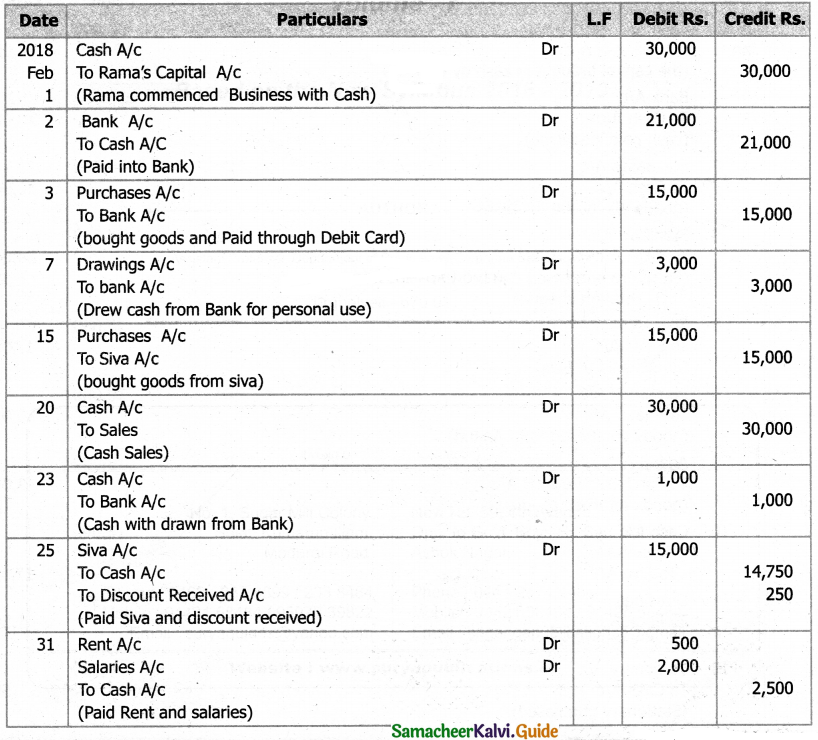

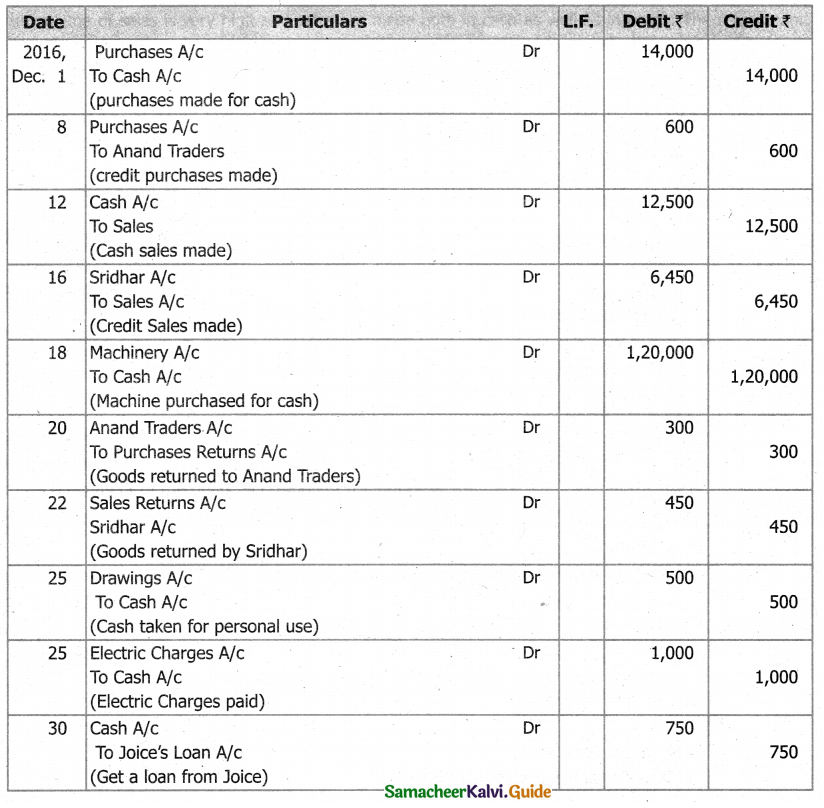

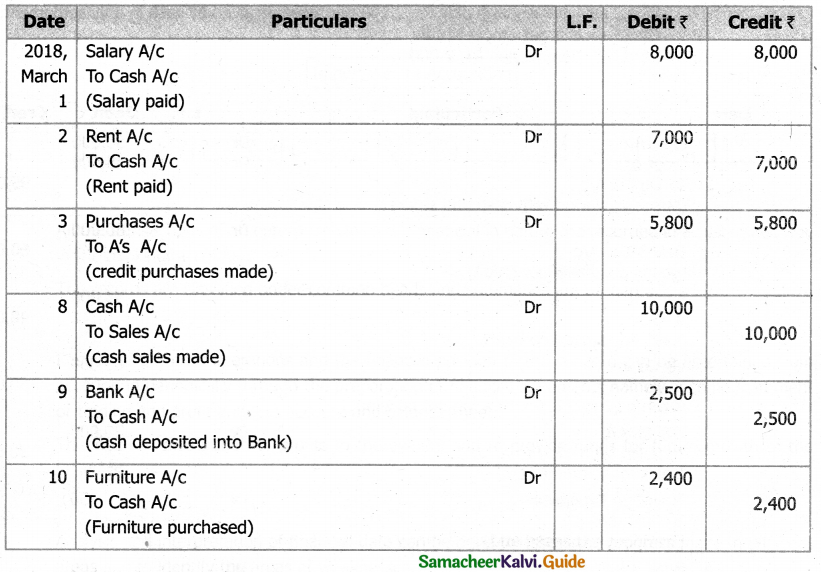

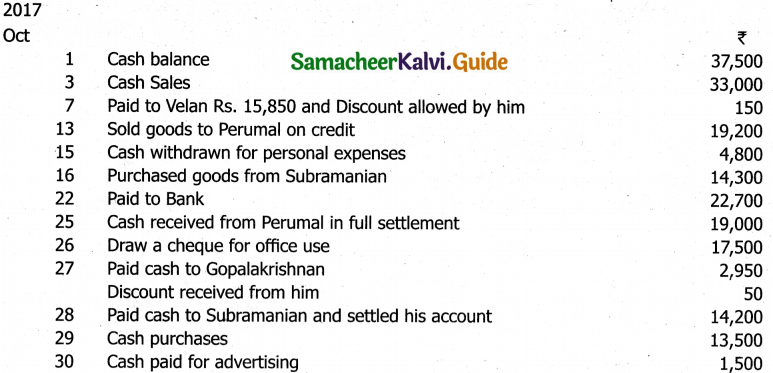

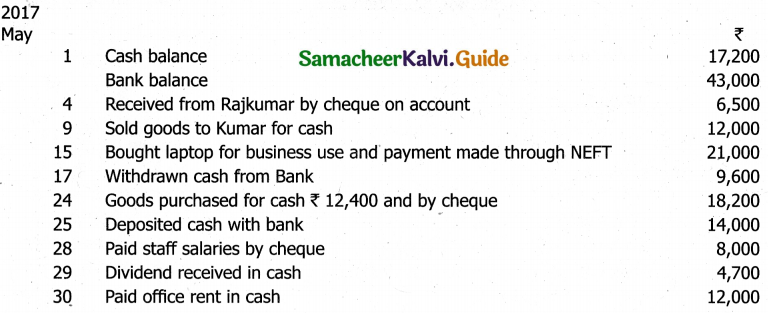

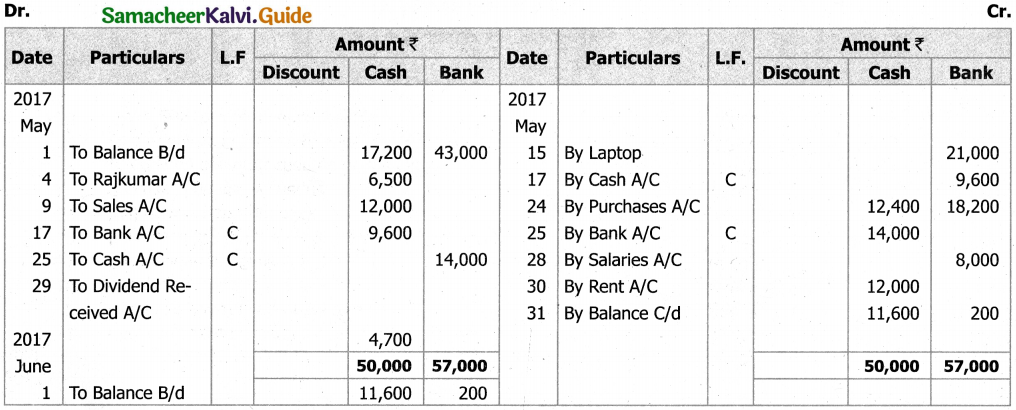

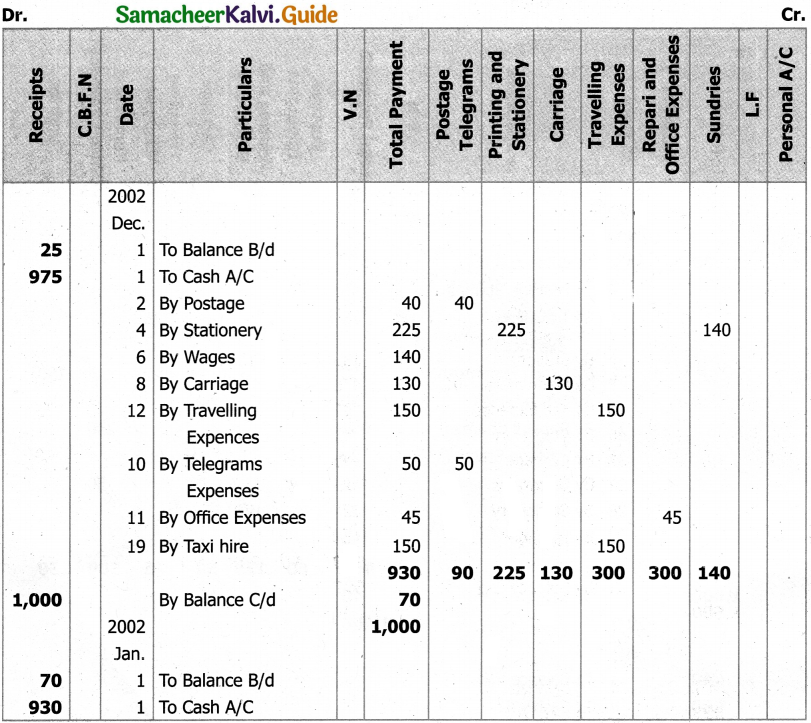

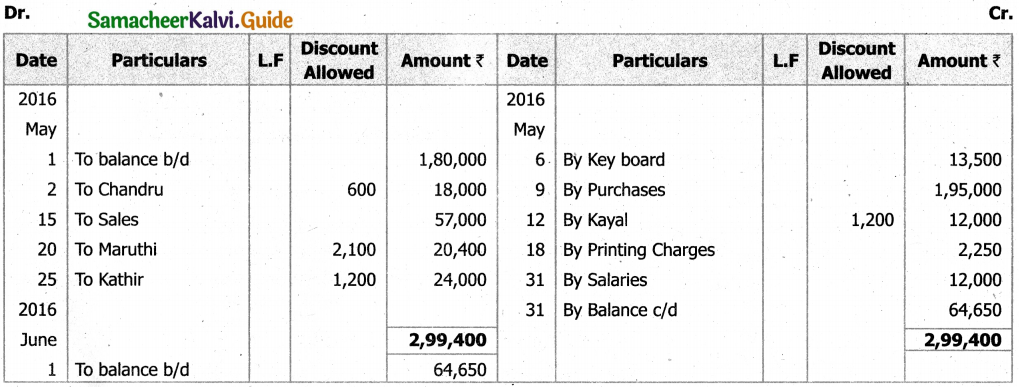

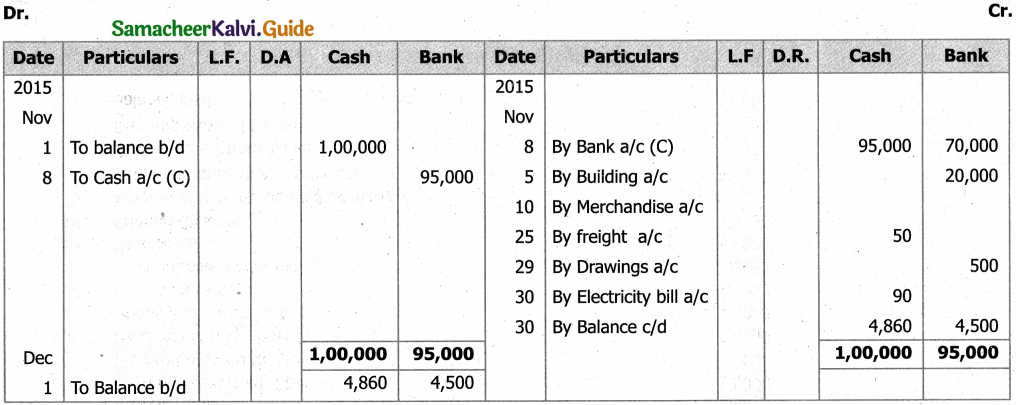

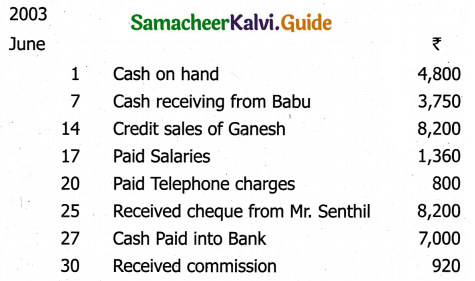

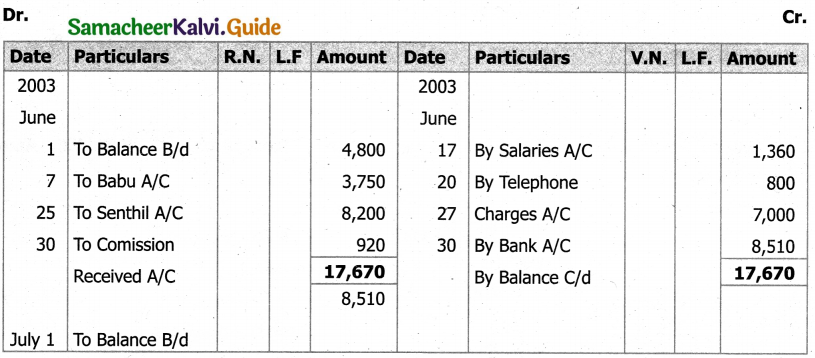

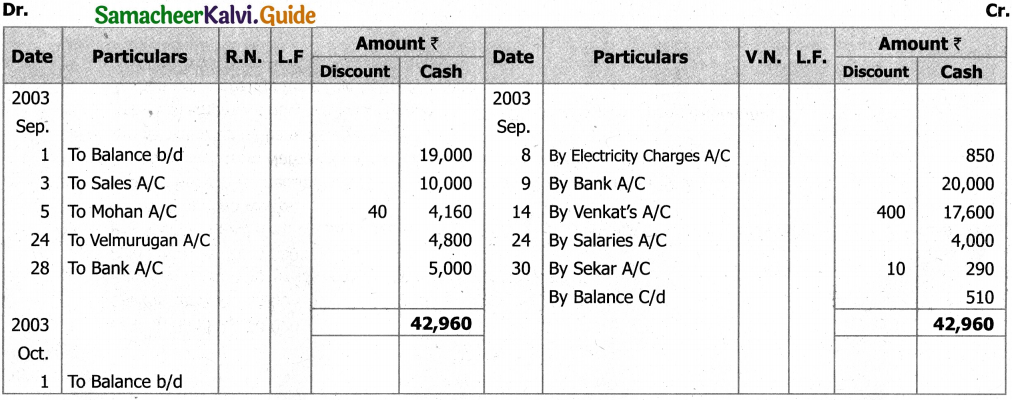

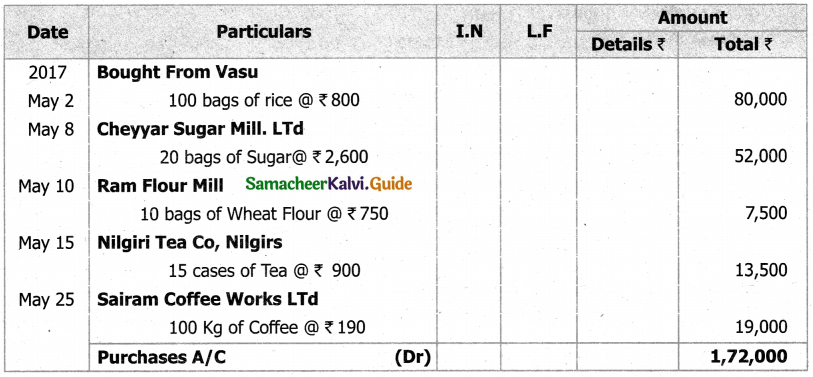

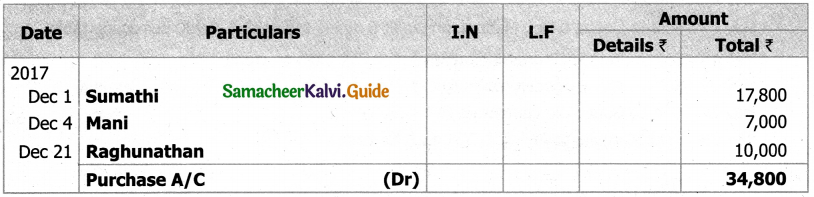

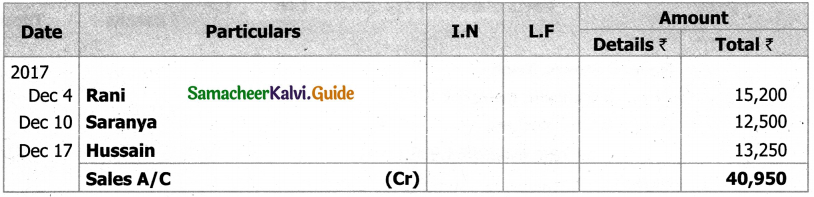

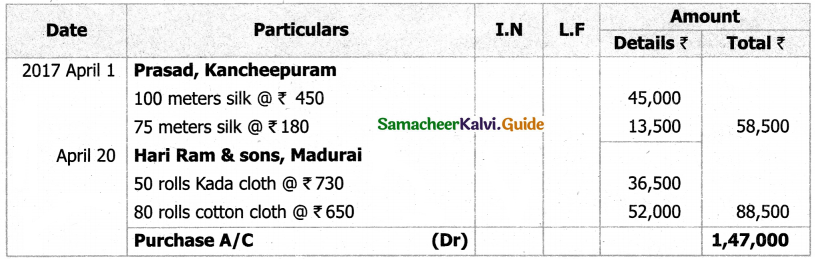

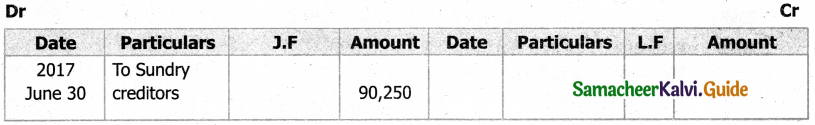

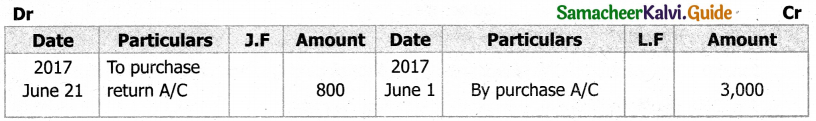

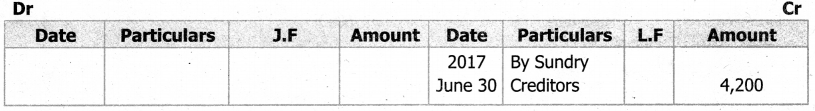

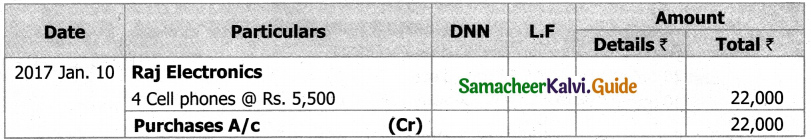

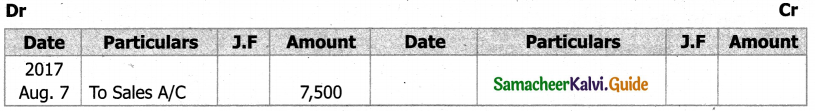

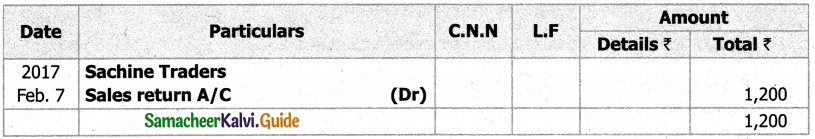

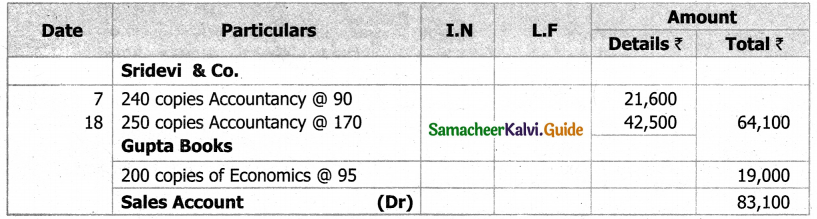

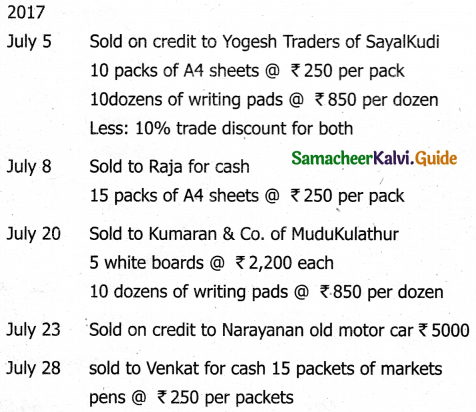

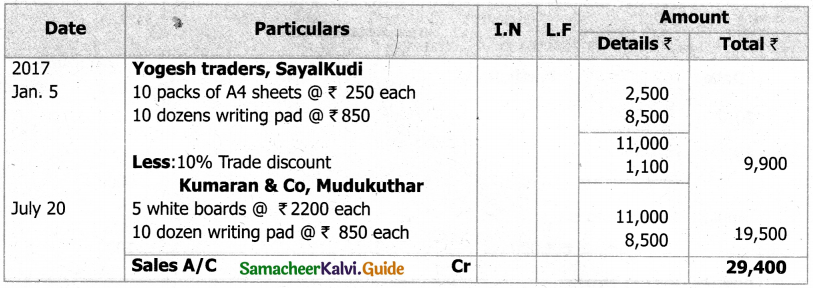

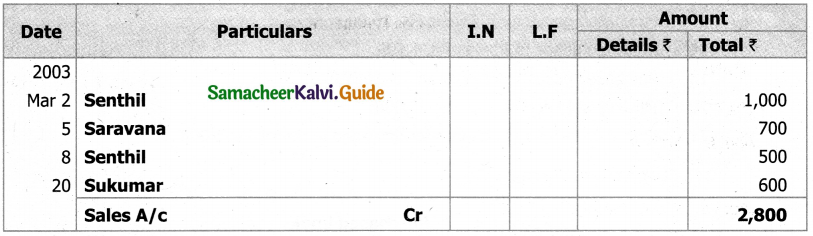

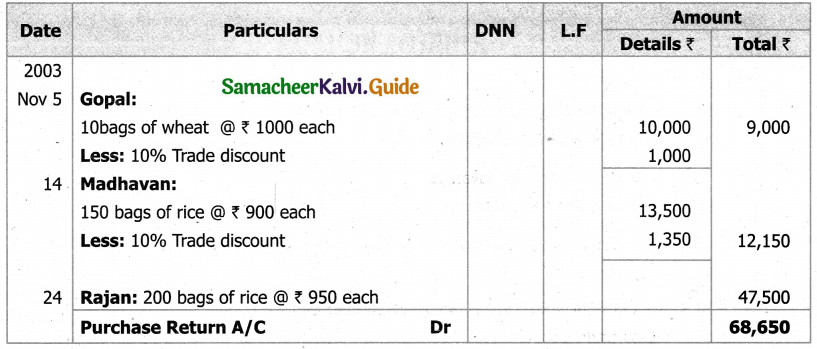

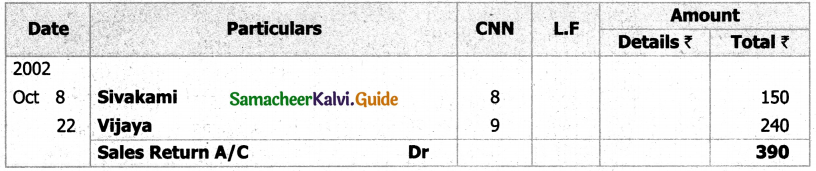

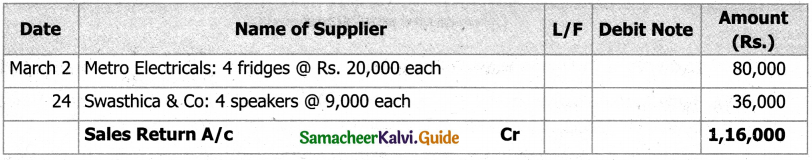

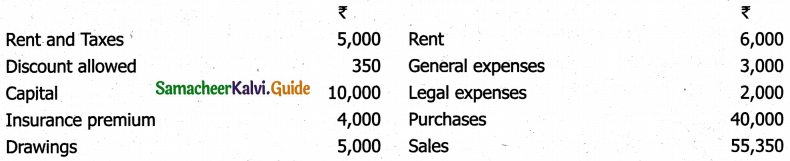

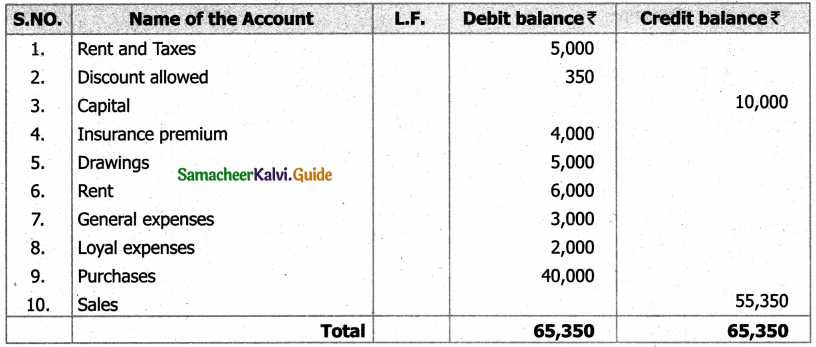

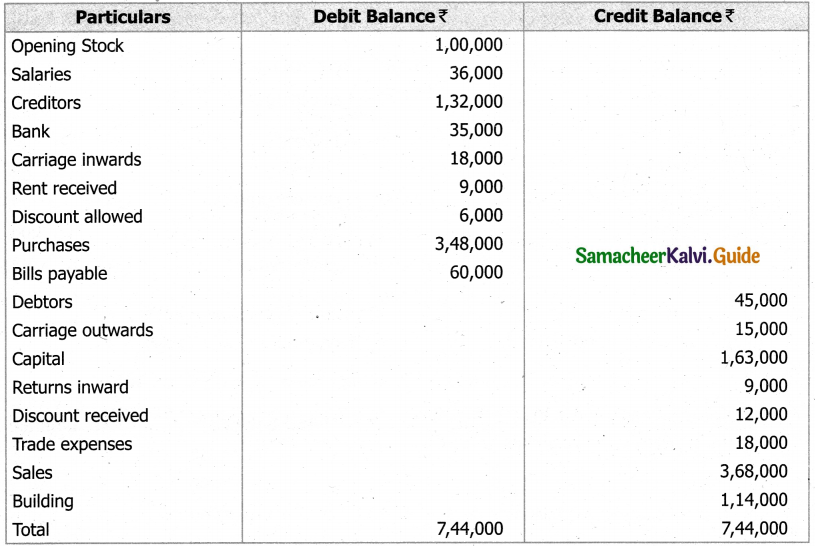

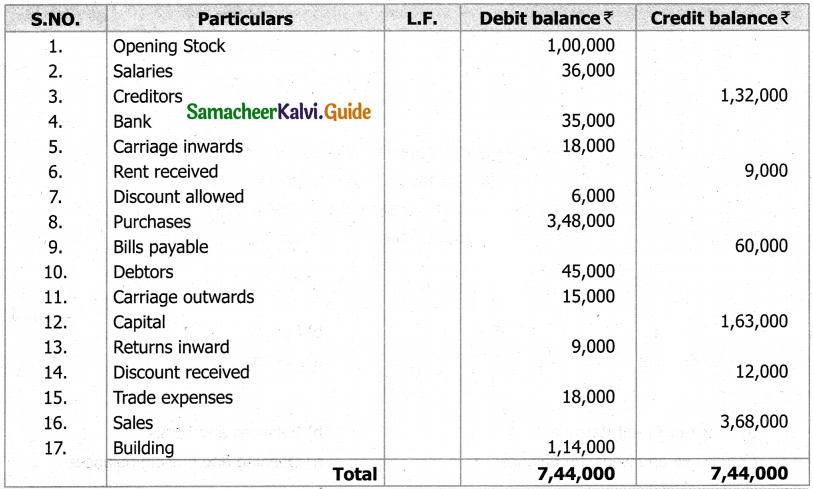

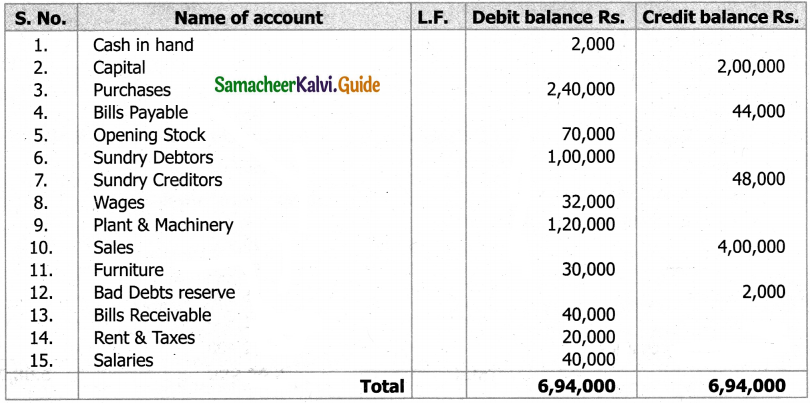

Solution: