Tamilnadu State Board New Syllabus Samacheer Kalvi 11th Commerce Guide Pdf Chapter 32 Direct Taxes Text Book Back Questions and Answers, Notes.

Tamilnadu Samacheer Kalvi 11th Commerce Solutions Chapter 32 Direct Taxes

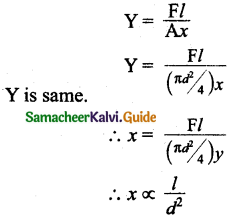

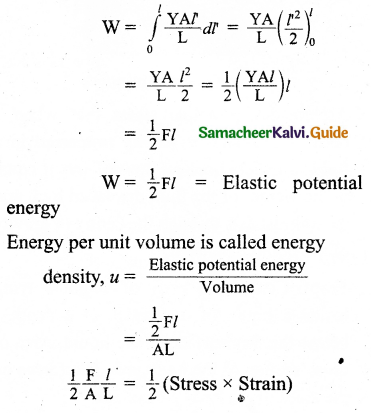

11th Commerce Guide Direct Taxes Text Book Back Questions and Answers

I. Choose the Correct Answer

Question 1.

Income Tax is ………………

a) a business tax

b) a direct tax

c) an indirect tax

d) none of these

Answer:

b) a direct tax

Question 2.

Period of assessment year is …………

a) 1 st April to 31 st March

b) 1st March to 28th Feb

c) 1st July to 30th June

d) 1st Jan. to 31st Dec

Answer:

a) 1 st April to 31 st March

![]()

Question 3.

The year in which income is earned is known as …………………

a) Assessment Year

b) Previous Year

c) Light Year

d) Calendar Year

Answer:

b) Previous Year

Question 4.

The aggregate income under five heads is termed as ……………….

(a) Gross Total Income

(b) Total Income

(c) Salary Income

(d) Business Income

Answer:

(b) Total Income

![]()

Question 5.

Agricultural income earned in India is ……………

a) Fully Taxable

b) Fully Exempted

c) Not Considered for Income

d) None of the above

Answer:

b) Fully Exempted

II. Very Short Answer Questions

Question 1.

What is Income tax?

Answer:

Income tax is a direct tax under which tax is calculated on the income, gains, or profits earned by a person such as individuals and. other artificial entities (a partnership firm, company, etc.).

Question 2.

What is meant by the previous year?

Answer:

The year in which income is earned is called the previous year. It is also called as financial year.

![]()

Question 3.

Define the term person?

Answer:

The term ‘person’ has been defined under the Income-tax Act. It includes individual, Hindu, Undivided Family, Firm, Company, local authority, Association of Person or Body of Individual or any other artificial juridical persons.

Question 4.

Define the term assessed?

Answer:

As per S. 2(7) of the Income Tax Act, 1961, the term “assessee” means a person by whom any tax or any other sum of money is payable under this Act. Assess includes individual, HUF, Firm, Company, Local authority, AOP, BOJ or any other artificial juridical persons.

![]()

Question 5.

What is an assessment year?

Answer:

The term has been defined under section 2(9). The year in which tax is paid is called the assessment year. It normally consists of a period of 12 months commencing on 1st April every year and ending on 31st March of the following year.

III. Short Answer Questions

Question 1.

What is Gross Total Income?

Answer:

According to section 80 B (5) Income computed under the following heads shall be aggregated after adjusting past and present losses and the total so arrived is known as ‘Gross Total income’.

- Income from Salaries

- Income from House Property

- Income from Business or Profession

- Income from Capital Gain

- Income from Other Sources

Question 2.

List out the five heads of Income.

Answer:

The five heads of income are:

- Income from‘Salaries’ [Sections 15 – 17];

- Income from ‘House Property’ [Sections 22 – 27];

- Income from ‘Profits and Gains of Business or Profession’ [Sections 28 – 44];

- Income from ‘Capital Gains’ [Sections 45 – 55]; and

- Income from other Sources’ [Sections 56 – 59].

![]()

Question 3.

Write a note on Agricultural Income.

Answer:

According to Section 2(1 A) of the Income Tax Act 1961, Agricultural Income includes, “Any rent or revenue derived from land which is situated in India and is used for agriculture purposes”.

Question 4.

What do you mean by Total income?

Answer:

Out of Gross Total Income, Income Tax Act 1961 allows certain deductions under section 80. After allowing these deductions the figure which we arrive at is called ‘Total Income’ and on this figure tax liability is computed at the prescribed rates.

- Gross Total Income

- Less: Deductions (Sec. 80C to 80U)

- Total Income (T.I.)

![]()

Question 5.

Write short notes on:

Answer:

a. Direct Tax:

If a tax levied on the income or wealth of a person and is paid by that person (or his office) directly to the Government, it is called direct tax e.g. Income-Tax, Wealth Tax, Capital Gains Tax, Securities Transaction Tax. Fringe Benefits Tax (from 2005), Banking Cash Transaction Tax (for Rs.50,000 and above -from 2005), etc. In India all direct taxes are levied and administered by Central Board of Direct Taxes.

b. Indirect Tax:

If tax is levied on the goods or services of a person (seller). It is collected from the buyers and is paid by seller to the Government. It is called indirect tax. e.g. GST.

IV. Long Answer Questions

Question 1.

Elucidate any five features of Income Tax.

Answer:

Features of Income Tax in India:

1. Levied as Per the Constitution Income tax is levied in India by virtue of entry No. 82 of List I (Union List) of Seventh Schedule to Article 246 of the Constitution of India.

2. Levied by Central Government Income tax is charged by the Central Government on all incomes other than agricultural income. However, the power to charge income tax on agricultural income has been vested with the State Government as per entry 46 of List II, i.e., State List.

3. Direct Tax Income tax is a direct tax. It is because the liability to deposit and ultimate burden are on the same person. The person earning income is liable to pay income tax out of his own pocket and cannot pass on the burden of tax to another person.

4. Annual Tax Income tax is an annual tax because it is the income of a particular year which is chargeable to tax.

5. Tax on Person It is a tax on income earned by a person. The term ‘person’ has been defined under the Income-tax Act. It includes individual, Hindu Undivided Family, Firm, Company, local authority, Association of Person or Body of Individual or any other artificial juridical persons. The persons who are covered under Income-tax Act are called ‘assessees’.

![]()

Question 2.

Define Tax. Explain the term direct tax and indirect tax with an example.

Answer:

A tax is a compulsory financial contribution imposed by a government to raise revenue, levied on the income or property of persons or organizations, on the production costs or sales prices of goods and services etc.

a. Direct Tax:

A direct tax is paid directly by an individual or organization to an imposing entity. A taxpayer, for example pays direct taxes to the government for different purposes, including real property tax, personal property tax, income tax or taxes on assets.

b. Indirect Tax:

If tax is levied on the goods or services of a person(seller), it is known as indirect tax. It is , collected from the buyers and is paid by the seller to the government. It is paid to the government by one entity in the supply chain. Example: GST.

Question 3.

List out any ten kinds of incomes chargeable under the head income tax.

Answer:

- Profits and gains of business or profession.

- Dividend

- Voluntary contribution received by a charitable / religious trust or university/education institution or hospital/electoral trust[ w.e.f. 01.04.2010]

- Value of perquisite or profit in lieu of salary taxable u/s 17 and social allowance or benefit specifically granted either to meet personal expenses or for performance Of duties of an office or employment of profit.

- Export incentives, like duty drawback, cash compensatory support, sale of licenses, etc.

- Interest, salary, bonus, commission, or remuneration earned by a partner of a firm from such firm.

- Capital gains chargeable u/s 45.

- Profits and gains from the business of banking carried on by a cooperative society with its members.

- Winnings from lotteries, crossword puzzles, races including horse races, card games, and other games of any sort or from gambling or betting of any form or nature whatsoever.

- Deemed income u/s 41 or 59.

Question 4.

Discuss the various kinds of assessments.

Answer:

The following are the different types of assesses:

- Individual

- Partnership firm

- Hindu Undivided Family

- Companies

- Association of Persons

- Body of Individual.

![]()

11th Commerce Guide Direct Taxes Additional Important Questions and Answers

I. Choose the Correct Answer:

Question 1.

How many heads of income are there to compute Gross total income?

a. Six

b. Five

c. Four

d. Three

Answer:

b. Five

Question 2.

Income Tax Act came into force on ……………

a.1.4.1932

b. 1.4.1962

c. 1.4.1947

d. 1.4.1954

Answer:

b. 1.4.1962

![]()

Question 3.

The compensation received for loss of trading asset is a ……………….

a. Capital receipt

b. Revenue receipt

c. a casual receipt

d. None of the above

Answer:

a. Capital receipt

Question 4.

The legislative powers of the Union Government and the State Governments are given in the …………………….. of the Indian Constitution.

a. Article 246 (VII schedule)

b. Article 246 (VI schedule)

c. Article 264 (VII schedule)

d. Article 446 (VII schedule)

Answer:

a. Article 246 (VII schedule)

![]()

Question 5.

Tax charged on Long Term Capital Gain is ……………..

a. 20%

b. 15%

c. 25%

d. 30%

Answer:

a. 20%

II. Very Short Answer Questions:

Question 1.

What do you mean by Tax?

Answer:

Tax is a compulsory contribution to state revenue by the Government. It is levied on the income or profits from the business of individuals and institutions.

Question 2.

What is the reasoñ for collecting tax?

Answer:

The revenue earned through tax is utilized for the expenses of civil ädministration, internal and external security, building infrastructure, etc.

![]()

III. Short Answer Questions

Question 1.

Who do income tax is treated as annual tax?

Answer:

Income tax is an annual tax because it is the income of a particular year which is chargéable to tax.

Question 2.

What are all the tax rates prescribed for LTCG, STCG, and lottery income?

Answer:

The following tax rates have been prescribed under Income Tax Act. ‘

- Tax on long term capital gain @ 20% (Section 112);

- Tax on short term capital gain on shares covered under STT @15% (Section 111A).

- Tax on lottery income @ 30% (Section 11 5BB)

Question 3.

What do you mean by the previous year?

Answer:

According to Section (3) of the Income Tax Act 1961, “The year in which income is earned is called the previous year”. It is also normally consisting of a period of 12 months commencing on 1 st April every year and ending on 31 st March of the following year. It is also called as financial year’ immediately following the assessment year.

![]()

IV. Long Answer Questions

Question 1.

Write a note on the structure of the Indian Taxation system:

Answer:

The Indian taxation system is one of the largest systems in the world. The authority to levy tax is derived from the Indian constitution and is well-structured. The tax administration has a clear demarcation between Central Government and State Governments and then between state Governments and Local Bodies. Article 246 (Seventh Schedule) of the Indian constitution contains the legislative powers (including taxation) of the Union government and the State Governments.

Question 2.

Write a note on Heads of Income under Income Tax Act:

Answer:

Section 14 of the Income Tax Act 1961 provides for the computation of the total income of an assessee which is divided into five heads of income. Each head of income has its own method of computation. These five heads are;

- Income from ‘Salaries’ [Sections 15-17]

- Income from ‘House Property’ [Sections 22-27]

- Income from ‘Profits and Gains of Business or Profession’ [Sections 28- 44]

- Income from ‘Capital Gains’ [Sections 45-55] and

- Income from ‘Other Sources’ [Sections 56-59].

![]()

Question 3.

Write a note on slab raite of Income-tax charged on Individual:

Answer:

According to the Assessment year 2018-2019 the following rates will be charged:

Total Income (Rs) | Income Tax Rate |

| Up to 2,50,000 | Nil |

| 2,50,001 – 5,00,000 | 5% |

| 5,00,000 – 10,00,000 | 20% |

| Above 10,00,000 | 30% |