Tamilnadu State Board New Syllabus Samacheer Kalvi 12th Accountancy Guide Pdf Chapter 8 Financial Statement Analysis Text Book Back Questions and Answers, Notes.

Tamilnadu Samacheer Kalvi 12th Accountancy Solutions Chapter 8 Financial Statement Analysis

12th Accountancy Guide Financial Statement Analysis Text Book Back Questions and Answers

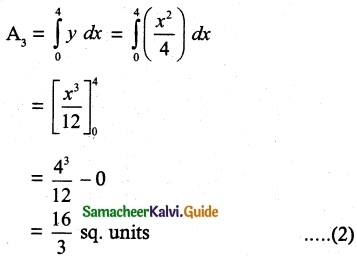

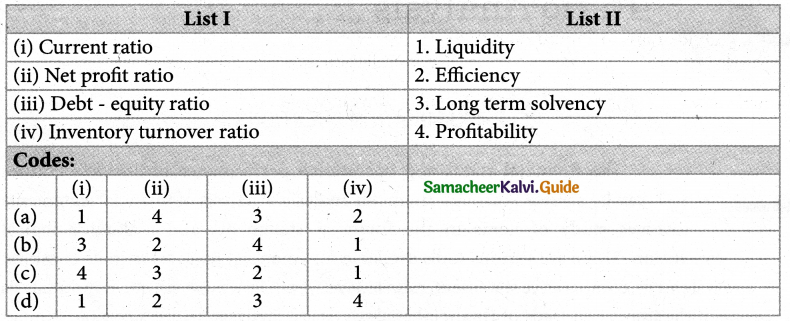

I Multiple Choice Questions

Choose the correct answer

Question 1.

Which of the following statements is not true?

(a) Notes and schedules also form part of financial statements.

(b) The tools of financial statement analysis include common -size statement

(c) Trend analysis refers to the study of movement of figures for one years

(d) The common-size statements show the relationship of various items with some common base, expressed as percentage of the common base.

Answer:

(c) Trend analysis refers to the study of movement of figures for one years

Question 2.

Balance sheet provides information about the financial position of a business concern

(a) Over a period of time

(b) As on a particular date

(c) For a period of time

(d) For the accounting period

Answer:

(b) As on a particular date

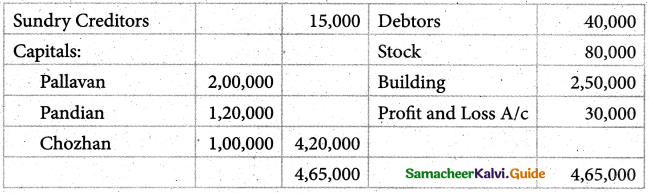

![]()

Question 3.

Which of the following tools of financial statement analysis is suitable when data relating to several years are to be analysed?

(a) Cash flow statement

(b) Common size statement

(c) Comparative statement

Answer:

(d) Trend analysis

Question 4.

The financial statements do not exhibit

(a) Non-monetary data

(b) Past data

(c) Comparative statement

(d) Standard costing

Answer:

(a) Non-monetary data

Question 5.

Which of the following is not a tool of financial statement analysis?

(a) Trend analysis

(b) Common size statement

(c) Comparative statement

Answer:

(d) Standard costing

![]()

Question 6.

The term fund’ refers to

(a) Current liabilities

(b) Working capital

(c) Fixed assets

(d) Non-current assets.

Answer:

(b) Working capital

Question 7.

Which of the following statement is not true?

(a) All the limitations of financial statements are applicable to financial statement analysis also.

(b) Financial statement analysis is only the means and not an end.

(c) Expert knowledge is not required in analyzing the financial statements

(d) Interpretation of the analysed data involves personal judgment.

Answer:

(c) Expert knowledge is not required in analyzing the financial statements

![]()

Question 8.

A limited company’s sales have increased from ‘ 1,25,000 to 1,50,000. How does this appear in the comparative income statement?

(a) +20%

(b) +120%

(c) -120%

(d) -20%

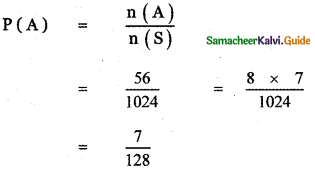

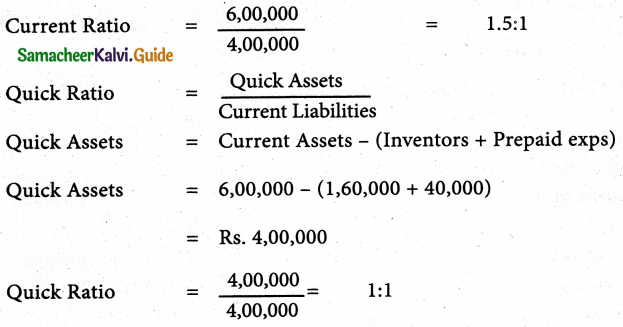

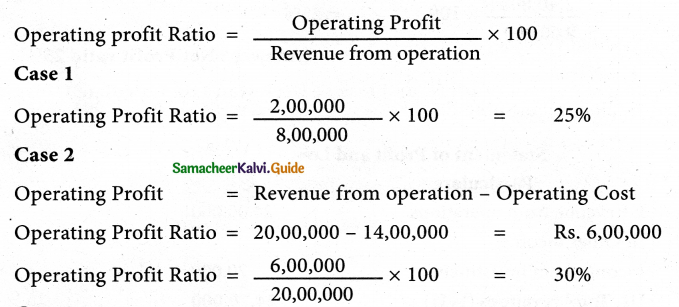

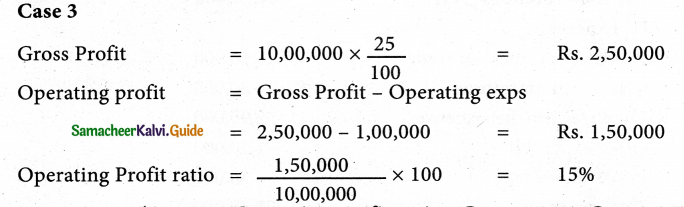

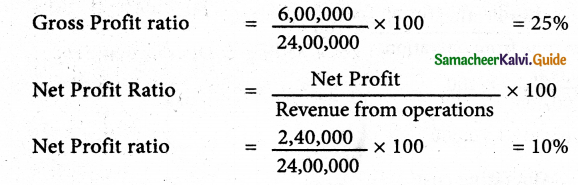

Hint:

Percentage increase or Decrease = \(\frac{\text { Absolute amount of increase or decrease }}{\text { Year } 1 \text { amount }}\) × 100

Sales increase = ₹ 1,25,000 – ₹ 1,50,000 = ₹ 25,000

\(\frac{25,000}{1,25,000}\) × 100 = +20% = 1,25,000

Answer:

(a) +20%

Question 9.

In a common-size balance sheet, if the percentage of non-current assets is 75, what would be the percentage of current assets?

(a) 175

(b) 125

(c) 25

(d) 100

Hint:

Let Assets = ₹ 100

Non current assets = ₹ 75

∴ Current assets = 100 – 75 = 25

Answer:

(c) 25

![]()

Question 10.

Expenses for a business for the first year were ₹ 80,000. In the second year, it was increased to ₹ 88,000. What is the trend percentage in the second year?

(a) 10%

(b) 110%

(c) 90%

(d) 11%

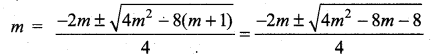

Hint:

Computation of trend percentage = \(\frac{\text { Other year }}{\text { Earliest base year }}\) × 100

Earliest base year x 100

For second year = \(\frac{88,000}{80,000}\) × 100 = 110%

Answer:

(b) 110%

II Very Short Answer Questions

Question 1.

What are the financial statements?

Answer:

Financial statements are the statements prepared by the business concerns at the end of the accounting period to ascertain the operating results and the financial position.

Question 2.

List the tools of financial statement analysis.

Answer:

- Comparative statement

- Common size statements

- Trend analysis

- Funds flow statement

- Cash flow analysis

![]()

Question 3.

What is working capital?

Answer:

The term ’fund’ refers to working capital. Working capital refers to the excess of current assets over current liabilities.

Question 4.

When is trend analysis preferred to other tools?

Answer:

Trend analysis discloses the changes in financial and operating data between specific periods when data for more than two years are to be analyzed. It may be difficult to use a comparative statement.

III Short Answer Questions

Question 1.

‘Financial statements are prepared based on past data’. Explain how this is a limitation.

Answer:

The nature of the financial statement is historical. Past cannot be the index of the future and cannot be cent percent basis for future estimation, forecasting, budgeting, and planning.

![]()

Question 2.

Write a short note on cash flow analysis?

Answer:

Cash flow analysis is concerned with the preparation of a cash flow statement which shows * the inflow and outflow of cash and cash equivalents in a given period of time. Cash includes cash in hand and demand deposits with banks. Cash equivalents denote short term investments which can be realized easily within a short period of time, without much loss in value. Cash flow analysis helps in assessing the liquidity and solvency of a business concern.

Question 3.

Briefly explain any three limitations of financial statements.

Answer:

- Lack of qualitative information: Qualitative information, that is non – monetary information is also important for business decisions. For example Efficiency of the employees and efficiency of the management. But this is ignored in financial statements.

- Record of historical data: Financial statement are prepared based on historical data. They may not reflect the current position.

- Ignores price level changes: Adjustments for price level changes are not made in the financial statements. Hence financial statements may not reveal the current position.

![]()

Question 4.

Explain the steps involved in preparing comparative statements?

Answer:

Following are the steps to be followed in preparation of the comparative statement:

- Column 1: In this column, particulars of items of income statement or balance sheet are written.

- Column 2: Enter absolute amount of year 1.

- Column 3: Enter absolute amount of year 2.

- Column 4: Show the difference in amounts between year 1 and year 2. If there is an increase in year 2, put plus sign and if there is decrease put minus sign.

- Column 5: Show percentage increase or decrease of the difference amount shown in column 4 by dividing the amount shown in column 4 (absolute amount of increase or decrease) by column 2 (year 1 amount).

That is,

Percentage increase or decrease = \(\frac{\text { Absolute amount of increase or decrease }}{\text { Year } 1 \text { amount }}\) × 100

Question 5.

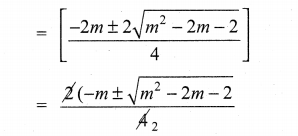

Explain the procedure for preparing a common – Size statement.

Answer:

Common-size statements can be prepared with three columns. Following are the steps to be followed in the preparation of the common – size statement.

- Column 1. In this column, the particulars of items of the income statement or balance sheet are written.

- Column 2. Enter the absolute amount.

- Column 3. Choose a common base as 100.

For example Revenue from operations can be taken as the base for income statement and total of the balance sheet can be taken as the base for the balance sheet. Work out the percentage for all the items of column 2 in terms of the common base and enter them in column 3.

![]()

IV Exercises

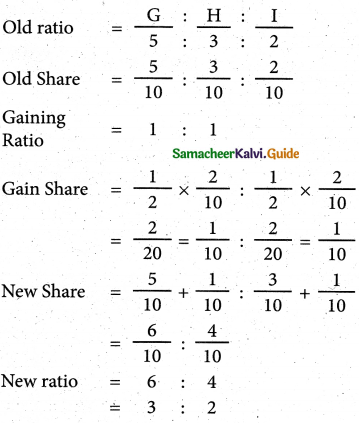

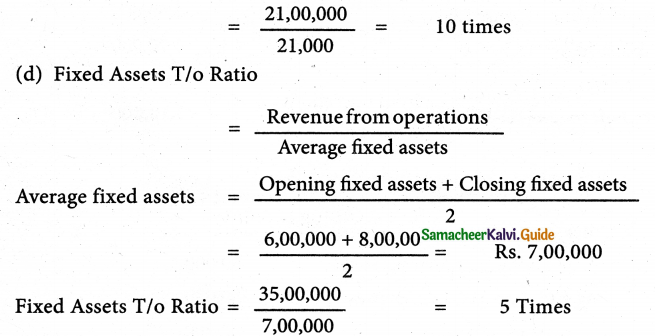

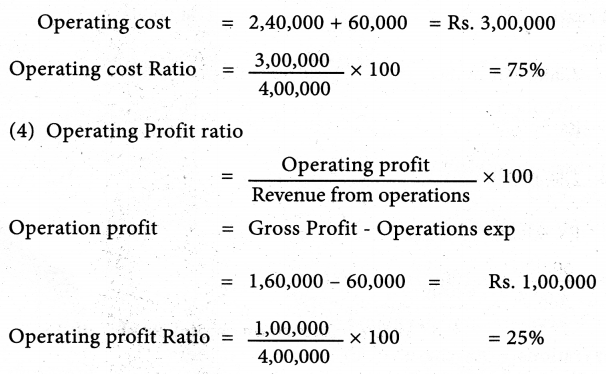

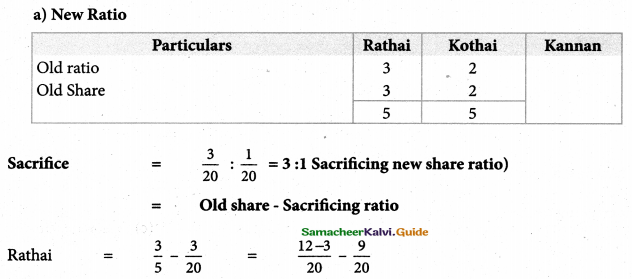

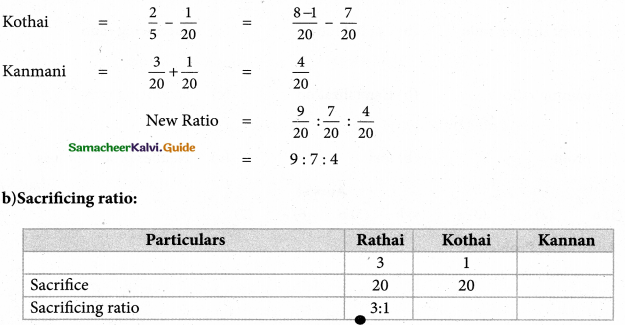

Comparative statement analysis

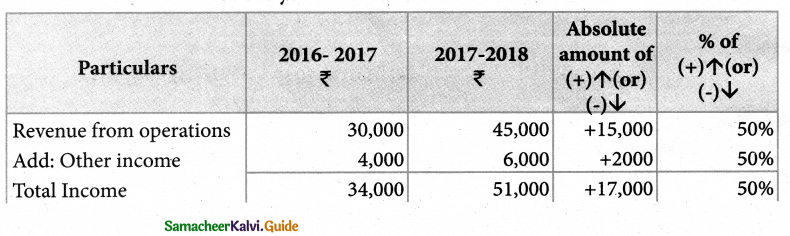

Question 1.

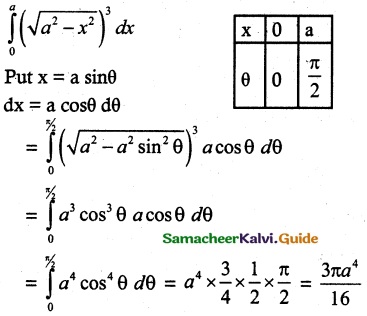

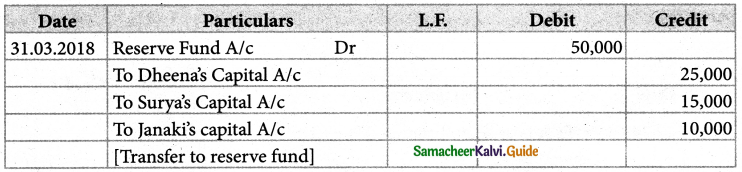

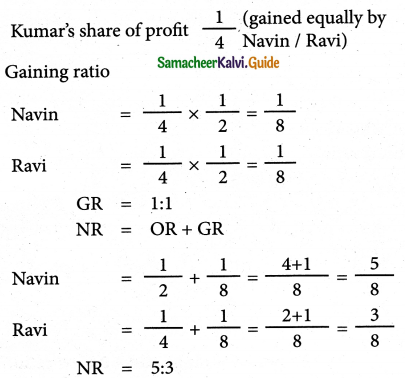

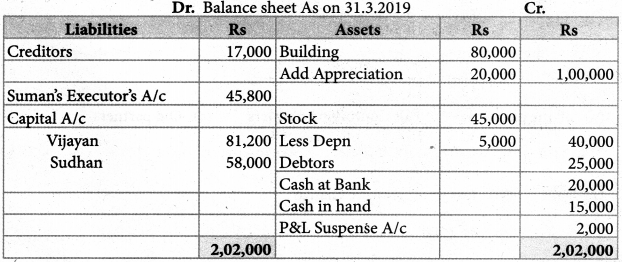

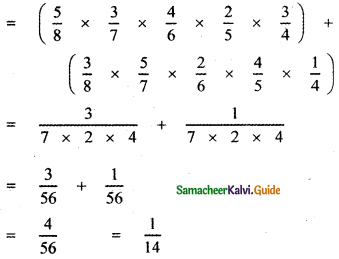

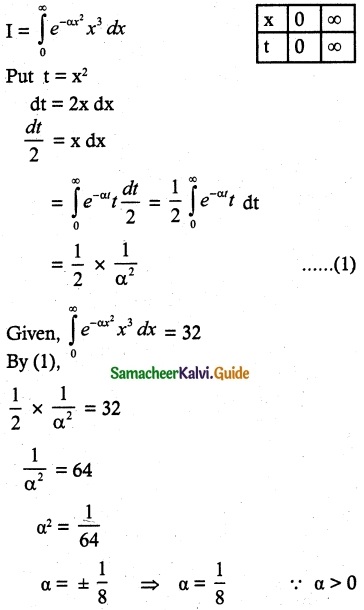

From the following particulars, prepare a comparative income statement of Arul Ltd.

| Particulars | 2016-17 ₹ | 2017-18 ₹ |

| Revenue from operations | 50,000 | 60,000 |

| Other income | 10,000 | 30,000 |

| Expenses | 40,000 | 50,000 |

Solution:

The comparative income statement of Arul Ltd for the year ended 31.3.16 & 31.3.17

Answer :

Revenue from operation: 20 %;

Other income: 200%;

Total revenue: 50%;

Expenses: 25%;

Profit before tax: 100%

![]()

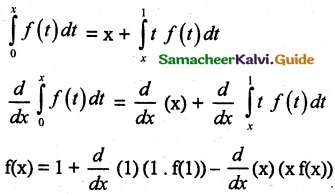

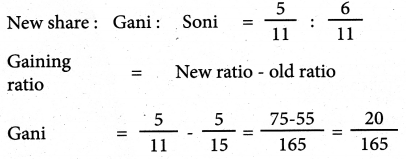

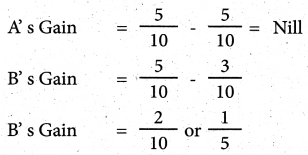

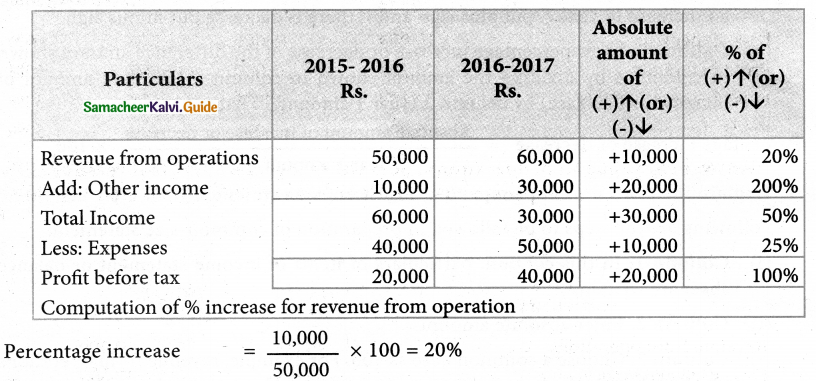

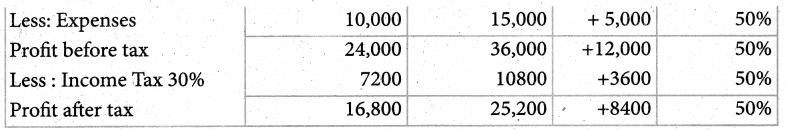

Question 2.

From the following particulars, prepare a comparative income statement of Barani Ltd.

| Particulars | 2016-17 ₹ | 2017-18 ₹ |

| Revenue from operations | 30,000 | 45,000 |

| Other income | 4,000 | 6,000 |

| Expenses | 10,000 | 15,000 |

| Income tax | 30% | 30% |

Solution:

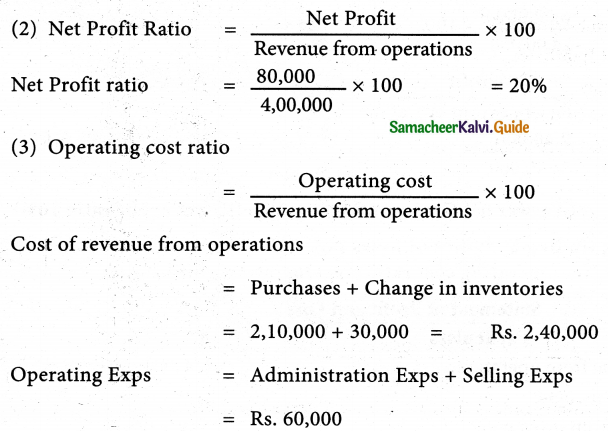

Computation of % increase for revenue from operation

Percentage increase = \(\frac{15,000}{30,000}\) × 100 = 50%

Comparative Income statement of Barani Ltd. for the year ended 31.3.17 & 31.3.18

Answer :

Revenue from operations: 50%

Other income: 50%

Total revenue: 50%

Expenses: 50%;

Profit before tax: 50%;

Profit after tax: 50%

![]()

Question 3.

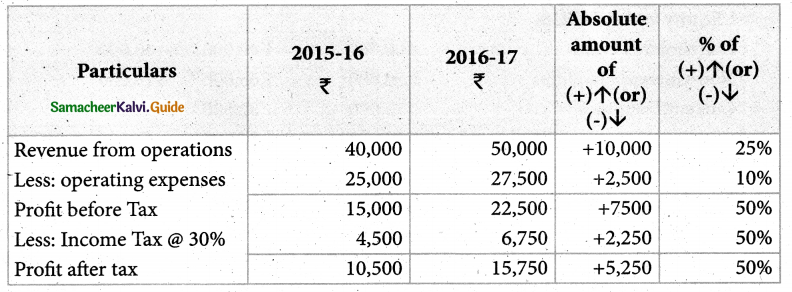

From the following Particulars, prepare comparative income ‘statement of Daniel Ltd.

| Particulars | 2015 -16 ₹ | 2016-17 ₹ |

| Revenue from operations | 40,000 | 50,000 |

| Operating expenses | 25,000 | 27,500 |

| Income tax (% of the profit before tax) | 30% | 30% |

Solution:

The comparative Income statement of Daniel Ltd. for the year ended 31.3.16 & 31.3.17

Answer :

Revenue from operations: 25%

Expenses: 10%

Tax: 50%;

Profit before tax: 50%;

Profit after tax: 50%

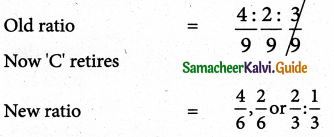

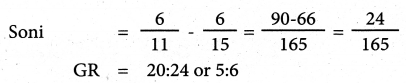

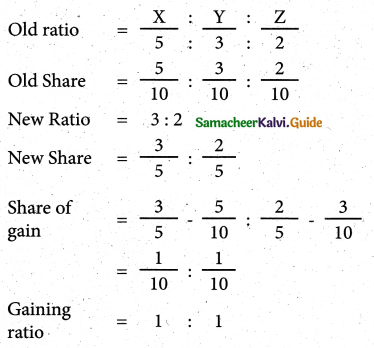

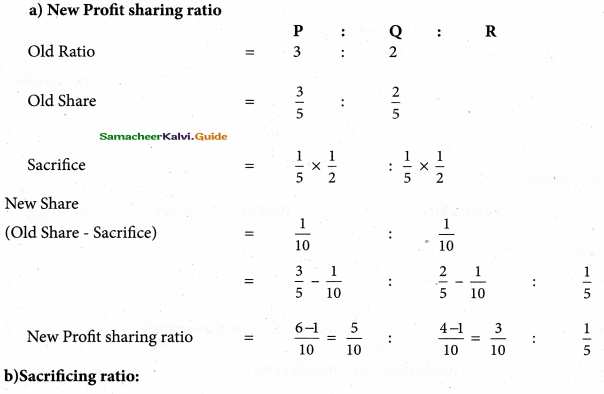

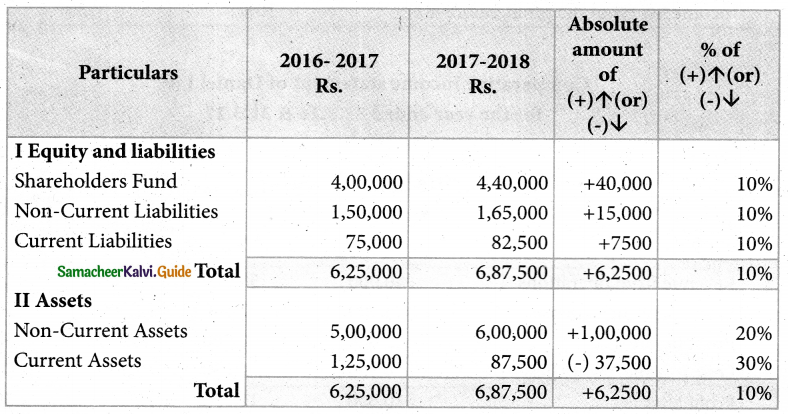

Question 4.

From the following particulars, prepare a comparative .statement of the financial position of Muthu Ltd.

| Particulars | 31st March 2017 ₹ | 31st March 2018 ₹ |

| I Equity and Liabilities | ||

| Shareholders’ Fund | 4,00,000 | 4,40,000 |

| Non-current liabilities | 1,50,000 | 1,65,000 |

| Current liabilities | 75,000 | 82,500 |

| Total | 6,25,000 | 6,87,500 |

| II Assets | ||

| Non-Current assets | 5,00,000 | 6,00,000 |

| Current assets | 1,25,000 | 87,500 |

| Total | 6,25,000 | 6,87,500 |

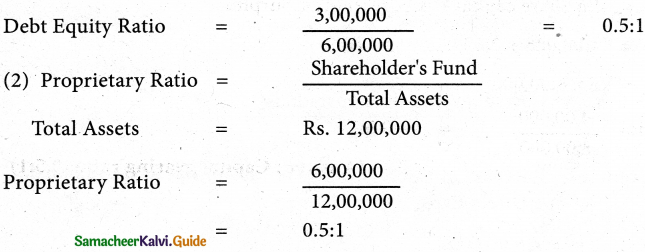

Solution:

Comparative B/s of Muthu Ltd. As on 31.3.17 & 31.3.18

Answer :

Shareholder’s fund: 10%;

Non-current liabilities: 10%

current liabilities: 10%

Total equity and liabilities: 10%;

Non -current assets: 20%;

Current assets: 30%

Total Assets: 10%

![]()

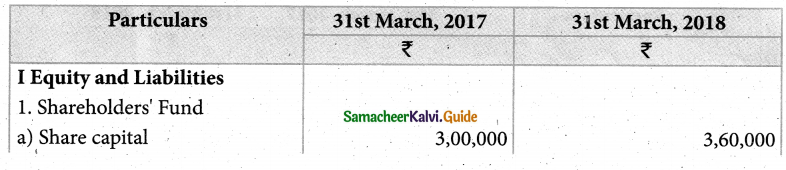

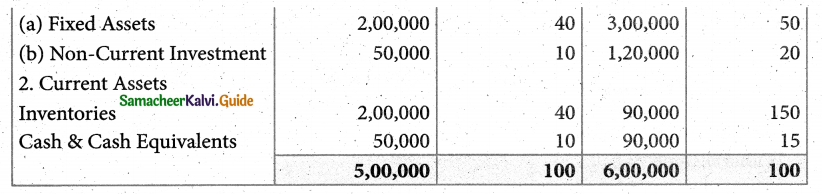

Question 5.

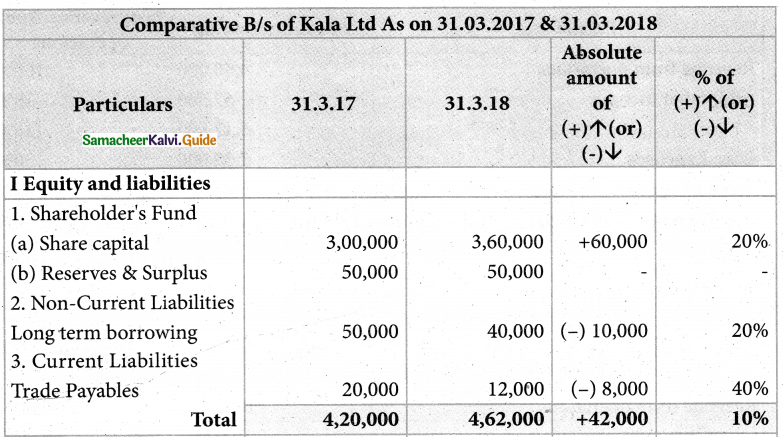

From the following particulars, prepare a comparative statement of the financial position of Kala Ltd.

Solution:

Answer :

Share capital: 20%;

Reserves and surplus: Nil.

Non-Current liabilities: -20%;

Current liabilities: -40%;

Total equity and liabilities: 10%;

Fixed assets: 16%;

Non-current investments: -20%;

Inventories: 25%;

Cash and cash equivalents: 20%;

total assets: 10%

![]()

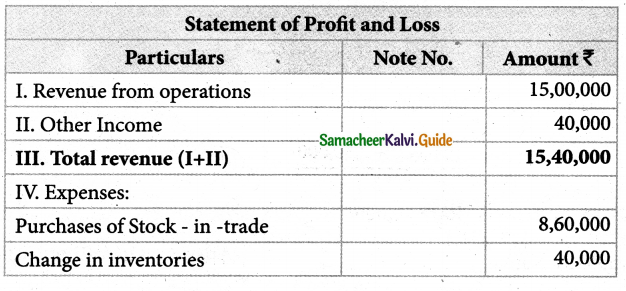

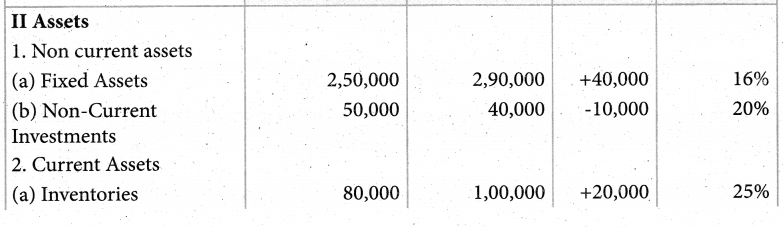

Question 6.

Prepare a common-size income statement for the following particulars Raja Ltd. for the year ended 31st March 2017.

| Particulars | 2016-17 ₹ |

| Revenue from operations | 4,50,000 |

| Other income | 67,500 |

| Expenses | 1,35,000 |

Solution:

Answer :

2016-2017:

Other income: 15%

total revenue: 115%

Expenses: 30%

Profit before tax: 85%

![]()

Question 7.

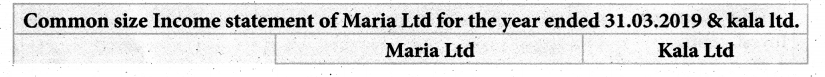

From the following particulars of Maria ltd and Kala Ltd. Prepare a common-Size income statement for the year ended 31st March 2019.

| Particulars | Maria Ltd ₹ | Kala Ltd ₹ |

| Revenue from operations | 1,00,000 | 2,00,000 |

| Other income | 10,000 | 30,000 |

| Expenses | 70,000 | 1,20,000 |

Solution:

Answer :

Maria Ltd: Other Income: 10%; total revenue: 110%; Expenses: 70%; Profit before tax:40%

Kala Ltd: Other income: 15%; Total revenue: 115% Expenses: 60%; Profit before tax:55%

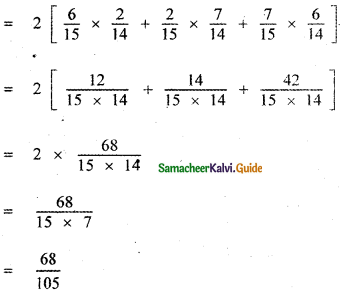

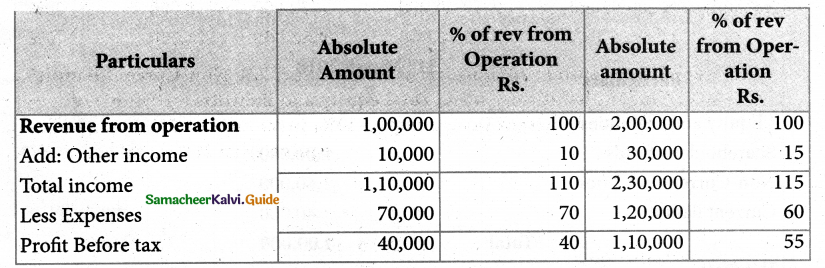

Question 8.

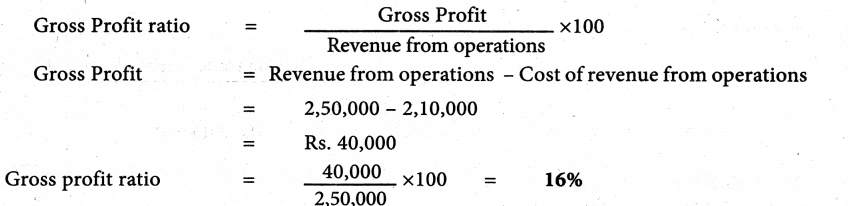

Prepare a common-size income statement for the following particulars of Sam Ltd. table

| Particulars | 2015-16 ₹ | 2016-17 ₹ |

| Revenue from operations | 4,00,000 | 5,00,000 |

| Other income | 80,000 | 50,000 |

| Expenses | 2,40,000 | 2,50,000 |

| Income Tax | 30% | 30% |

Solution:

Answer :

2015-16: Other income:20%; Total revenue: 120% Expenses:60%; Profit before tax:60%: Tax: 18%; Profit after tax:42%;

2016-17: Other income: 10%; total revenue: 110%; Expenses:50%; Profit before tax: 60%: Tax:18%;

Profit after tax:42%

![]()

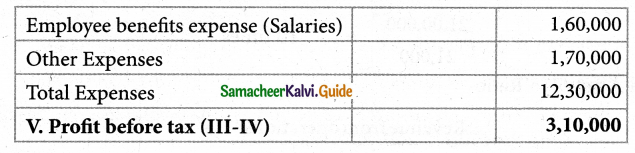

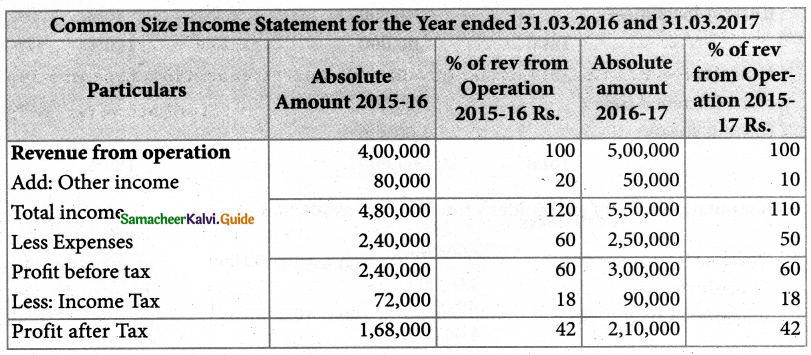

Question 9.

Prepare Common-size balance sheet of Meena Ltd. as of 31st March 2018.

| Particulars | 31st March 2018 |

| I Equity and Liabilities | |

| Shareholder’s Funds | 2,00,000 |

| Non-Current liabilities | 1,60,000 |

| Current liabilities | 40,000 |

| Total | 4,00,000 |

| II Assets | |

| Non- Current assets | 3,00,000 |

| Current assets | 1,00,000 |

| Total | 4,00,000 |

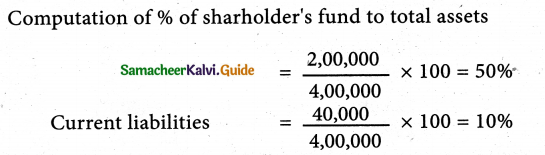

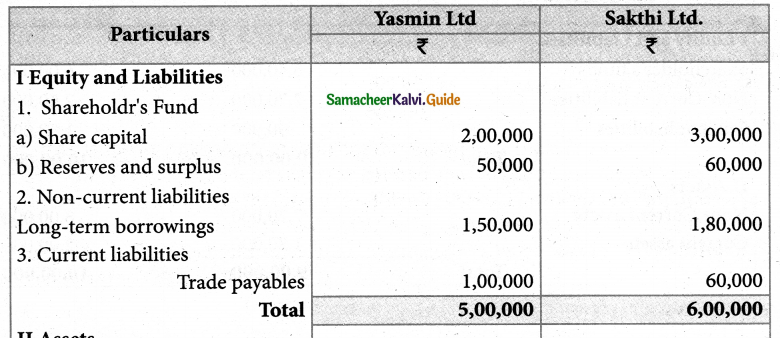

Solution:

Common size B/s Meena Ltd as on 31.3.18

Answer :

Shareholder’s fund:50%; Non-current liabilities: 40%; Current liabilities: 10%; Non-current assets:75%; current assets:25%

![]()

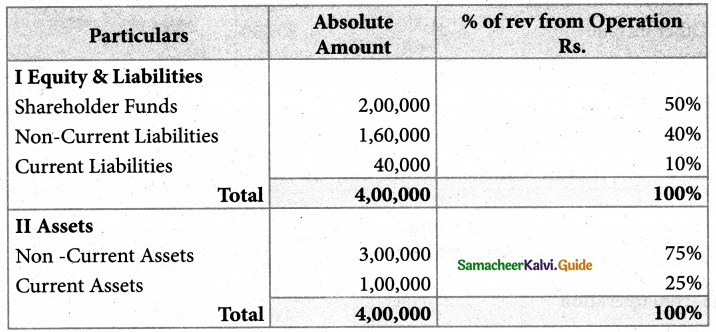

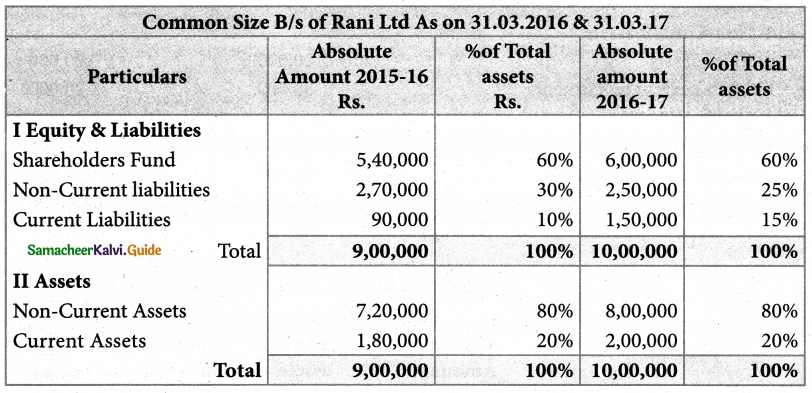

Question 10.

Prepare a common-size statement of financial position for the following particulars of Rani Ltd.

| Particulars | 31st March 2016 | 31st March 2017 |

| Shareholder’s funds | 5,40,000 | 6,00,000 |

| Non-Current liabilities | 2,70,000 | 2,50,000 |

| Current liabilities | 90,000 | 1,50,000 |

| Total | 9,00,000 | 10,00,000 |

| II Assets | ||

| Non- Current assets | 7,20,000 | 8,00,000 |

| Current assets | 1,80,000 | 2,00,000 |

| Total | 9,00,000 | 10,00,000 |

Solution:

Answer :

2015-16 Shareholder’s fund:60%; Non-current liabilities: 30%; Current liabilities: 10%; Non-current assets:80%; current assets:20%

2016-17 Shareholder’s fund:60%;Non-current liabilities: 25%; Current liabilities: 15%; Non-current assets:80%; Current assets:20%

![]()

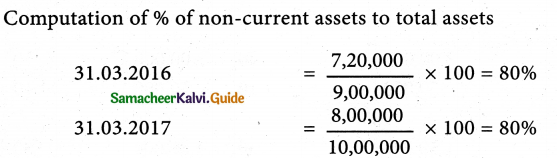

Question 11.

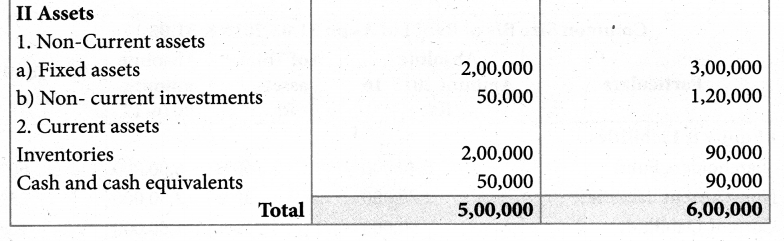

Prepare a common-size statement of financial position for the following particulars of Yasmin Ltd. and Sakthi Ltd.

Solution:

Answer:

Yasmin Ltd: Share capital 40%; Reserves and surplus: 10%; Noncurrent liabilities:30%; current liabilities:20%. Fixed assets:40%; Non -Current investments: 10% Inventories:40%; Cash & cash equivalents: 10% Sakthi Ltd: Share „ capital: 50%; Reserves and surplus: 10%; Non-current liabilities:30%; Current liabilities: 10%; Fixed assets:50% Non-current investmesits:20%; Inventories: 15% cash & cash equivalents: 15%

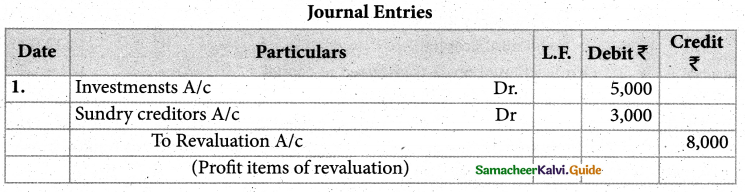

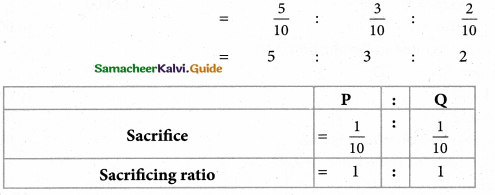

Trend Analysis:

![]()

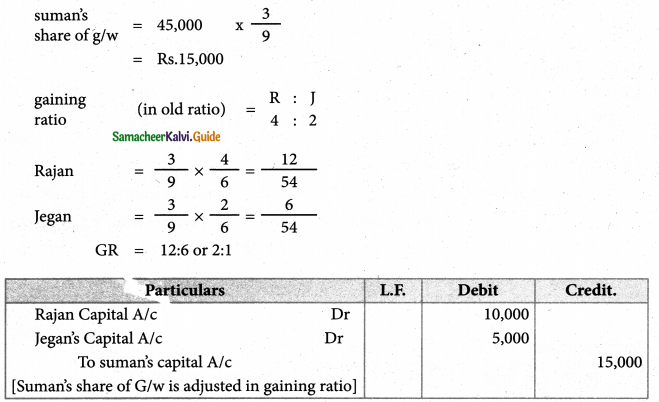

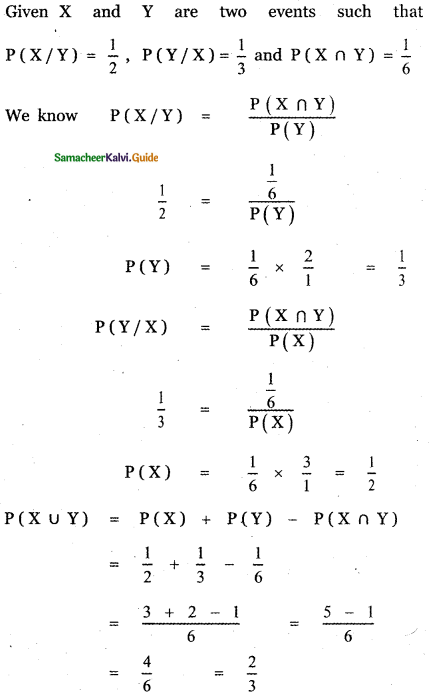

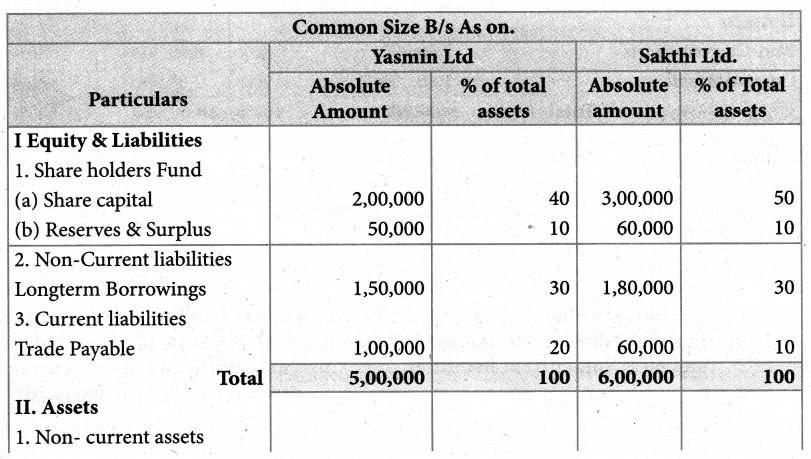

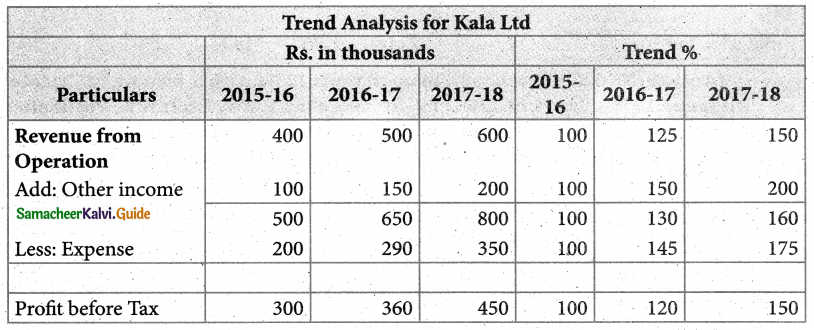

Question 12.

From the following particulars, calculate the trend percentages of Kala Ltd.

Solution:

Answer:

2016-17: Revenue from operations: 125%; Other income: 150%; Total revenue: 130% Expenses:145% Profit before tax: 120%

2017-18: Revenue from operations: 150%; Other income 200%; Total revenue: 160% Expenses:175%; Profit before tax: 150%

![]()

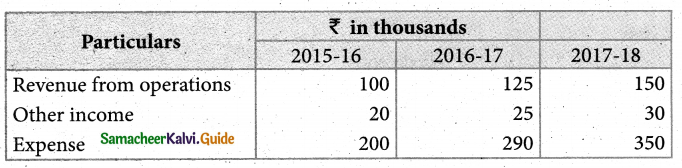

Question13.

From the following particulars, calculate the Trend percentages of Kavitha Ltd.

Solution:

Answer:

2016-17: Revenue from operations: 125%; Other income: 125%; total revenue:125%; Expenses: 120%; Profit before tax:150%; Tax :150%; Profit after tax: 150%;

2017-2018; Revenue from operations: 150%; Other income:150%; total revenue:150% Expenses:80%; Profit before tax: 500% Tax:500%; Profit after tax:500%

![]()

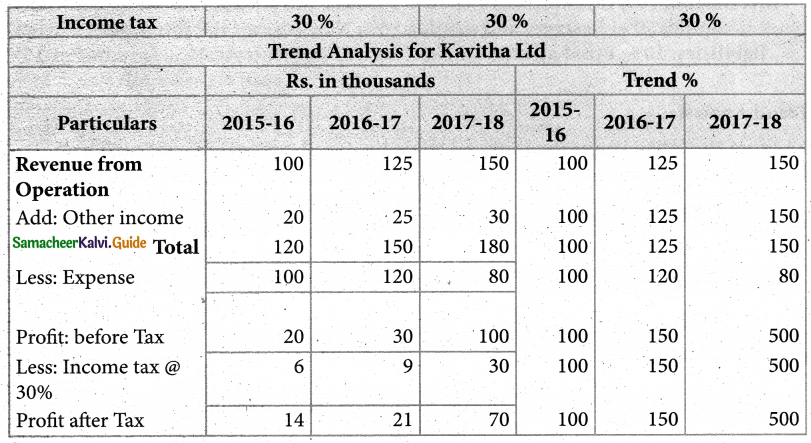

Question 14.

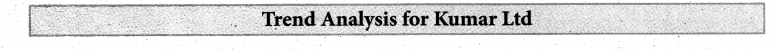

From the following particulars, calculate the trend percentage of Kumar Ltd.

Solution:

Answer :

Answer :

2016-17: Revenue from operations:90%; Other income: 160%; total revenue: 100%; Expenses:80%; Profit before tax: 150%; Tax: 150%; Profit after tax:150%;

2017-18: Revenue from operations:50%; Other income: 120%; total revenue:60%; Expenses:50%; Profit before tax: 85%; Tax:85%; Profit after tax:85%

![]()

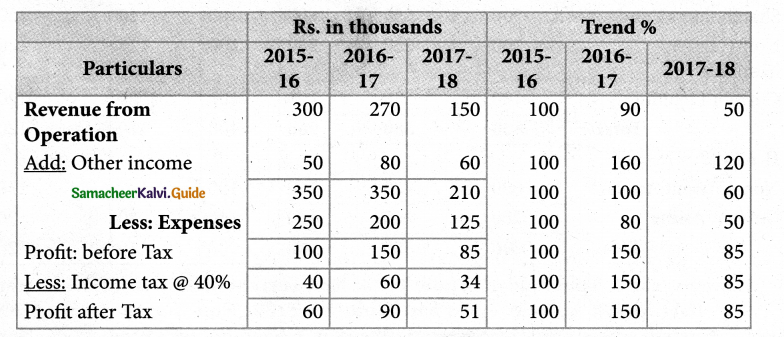

Question 15.

From the following particulars, calculate the trend percentages of Anu Ltd.

Solution:

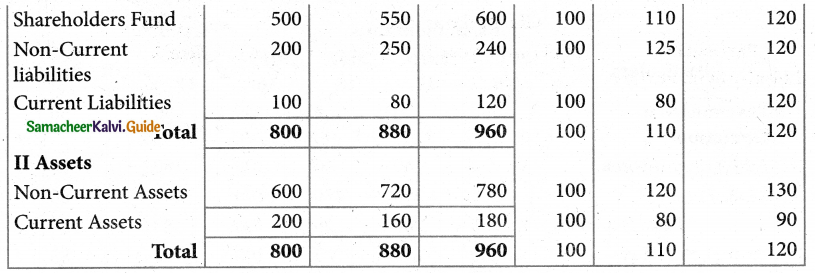

Answer :

year 2: Shareholder’s Fund: 110%, Non-current liabilities: 125%; Current liabilities:80%; Total equity and liabilities: 110%; Non-Current assets: 120%, Current assets:80%; total assets: 10%;

year 3: Shareholder’s fund: 120%; Non- current liabilities: 120%; Current liabilities: 120% Total equity and liabilities: 120%; Non-current assets: 130% Current assets:90%; total assets: 120%

![]()

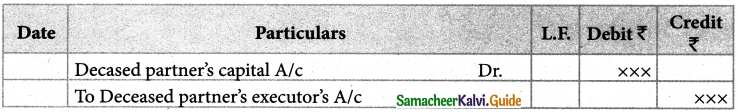

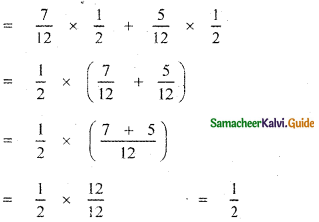

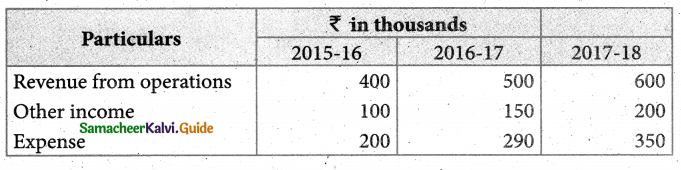

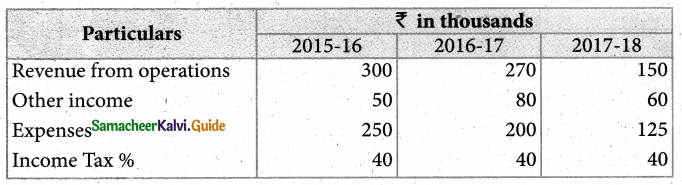

Question 16.

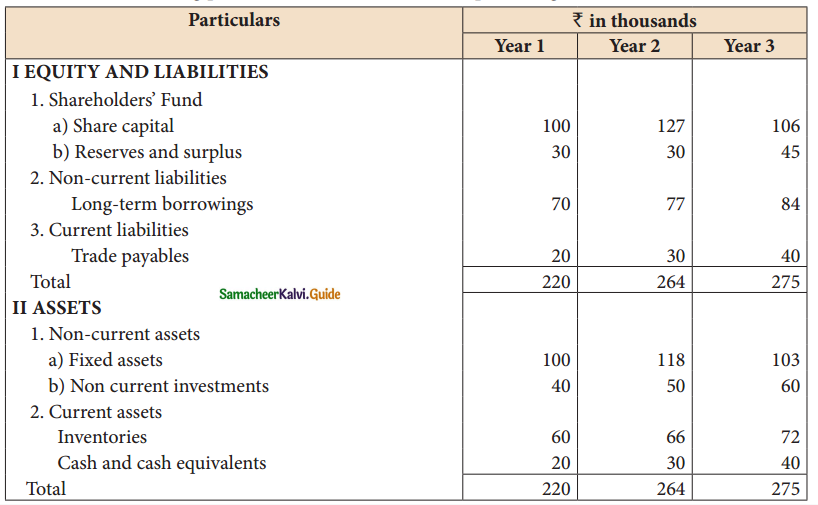

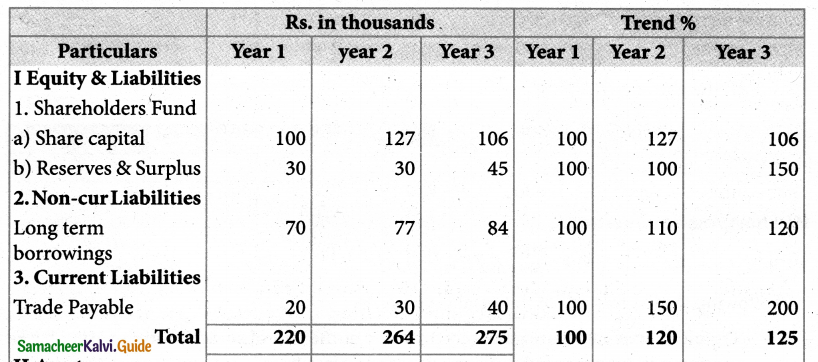

From the following particulars, calculate the trend percentages of Babu Ltd.

Solution:

![]()

Answer:

Year 2: Share capital: 127%; Reserves and surplus: 100%; Non-current liabilities: 110%; Current liabilities: 150% Total equity and liabilities: 120%; Fixed assets:118%; Non-current investments: 125%; Inventories:! 10%; Cash & cash equivalents: 150%; total assets:120%;

Year 3: Share capital: 106%; Reserves and surplus :150%; Non-current liabilities: 120%; Current liabilities: 200%; total equity and liabilities: 125%; Fixed assets:103%; Non – Current investments: 150%; Inventories: 120%; Cash & cash equivalents:200%; total assets: 125%

![]()

12th Accountancy Guide Financial Statement Analysis Additional Important Questions and Answers

Other Important questions & Answers

Question 1.

…………………………. are the tools of financial analaysis

(a) Comparative statements

(b) Trend analysis

(c) Common size statement

(d) all the above

Answer:

(d) all the above

Question 2.

Analysis of financial statements involves

(a) B/S

(b) Trading A/c

(c) All the above

Answer:

III Short Answer Questions

Question 1.

What are the features of a financial statement?

Answer:

Following are the features of financial statements:

- Financial statements are generally prepared at the end of an accounting period based on transactions recorded in the books of accounts.

- These statements are prepared for the organization as a whole.

- Information is presented in a meaningful way by grouping items of similar nature such as fixed assets.

- Financial statements are prepared based on historical cost.

- Financial statements are prepared based on accounting principle and Accounting Standards, which make financial statements comparable and realistic.

- Financial statements involve personal judgment in a certain case. For example, the selection of the method of depreciation, percentage of reserve, etc.

![]()

Question 2.

Explain the significance of financial statements.

Answer:

Financial statements reveal the operating results and financial position of the business concern. The significance of financial statements to various stakeholders is as follows:

- To Management: Financial statements provide information to the management to take decision and to have control over business activities, in various areas.

- To shareholders: Financial statements help the shareholders to know whether the business has potential for growth and to decide to continue their shareholding.

- To potential investors: Financial statements help to value the securities and compare it with those of other business concerns before making their investment decisions.

- To creditors: Creditors can get information about the ability of the business to repay the debts from financial statements.

- To bankers: Information given in the financial statements is significant to the bankers to assess whether there is adequate security to cover the amount of the loan or overdraft.

- To the government: Financial statements involve personal judgment in a certain case. For example, the selection of the method of depreciation, percentage of reserve, etc.

- To employees: Through the financial statements, the employees can assess the ability of the business to pay salaries and whether they have future growth in the concern.

Question 3.

Explain the provisions of the Indian Companies Act 2013 to be followed while preparing the financial statement of or company.

Answer:

Following provisions of the Indian Companies Act, 2013 have to be followed while preparing the financial statements of a company:

- As per Section 2(40), financial statements include balance sheet, profit and loss account/income and expenditure account, cash flow statement, statement of changes in equity and any explanatory note annexed to the above.

- Section 129 (1) of the Indian Companies Act, 2013 states that the financial statements shall give a true and fair view of the state of affairs of the company and shall comply with the Accounting Standards notified under section 133.

- Section 129 (1) also states that the financial statements shall be prepared in the form provided in schedule III of the Indian Companies Act, 2013.

![]()

Question 4.

What do you mean by financial statement analysis?

Answer:

Financial statement analysis is a comparison of the various items in the financial statement by establishing and evaluating relationships among them so that, it gives a better understanding of the performance and financial status of the business concern.

Question 5.

What are the objectives of financial statement analysis?

Answer:

Financial statement analysis may be done with any of the following objectives:

- To analyze profitability and earning capacity.

- To study the long term and short term solvency of the business.

- To determine the efficiency in operations and use of assets.

- To determine the efficiency of management and employees.

- To determine the trend in sales, production, etc.

- To forecast for the future and prepare budgets.

- To make inter-firm and intra-firm comparisons.

Question 6.

What are the limitations of fin. State analysis.

Answer:

Following are the limitations of financial statement analysis:

1. All the limitations of financial statements such as ignoring non-monetary information, ignoring price level changes, etc., are applicable to financial statement analysis also.

2. Financial statement analysis is only the means and not an end, that is, it is only a tool in the hands of management and other shareholders. Interpretation of the results has to be done only by the financial analysts with due regard to the internal and external environmental factors.

3. Expert knowledge is required in analyzing the financial statements.

4. Interpretation of the analyzed data involves personal judgments as different experts may give different views.

![]()

Question 7.

What do you mean by Horizontal analysis?

Answer:

Horizontal analysis

When figures relating to several years are considered for the purpose of analysis, the analysis is called horizontal analysis. Generally, one year is taken as the base year and the figures relating to the other years are compared with that of the base year. Comparative statements and trend percentages are examples of horizontal analysis.

Question 8.

What do you mean by vertical analysis?

Answer:

Vertical analysis

When figures relating to one accounting year alone are considered for the purpose of analysis, the analysis is called vertical analysis. Here, the relationship is established among items from various financial statements relating to the same accounting period. Preparation of common size statements and computation of ratios are examples of vertical analysis.