Tamilnadu State Board New Syllabus Samacheer Kalvi 12th Business Maths Guide Pdf Chapter 2 Integral Calculus I Ex 2.6 Text Book Back Questions and Answers, Notes.

Tamilnadu Samacheer Kalvi 12th Business Maths Solutions Chapter 2 Integral Calculus I Ex 2.6

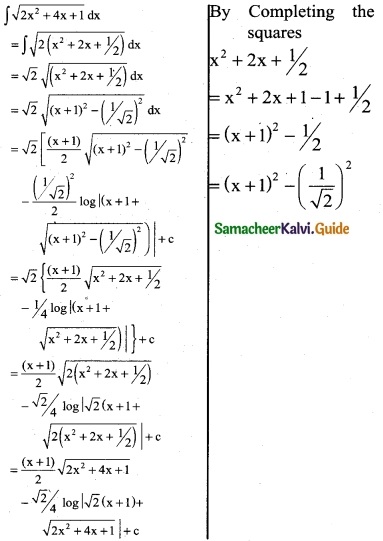

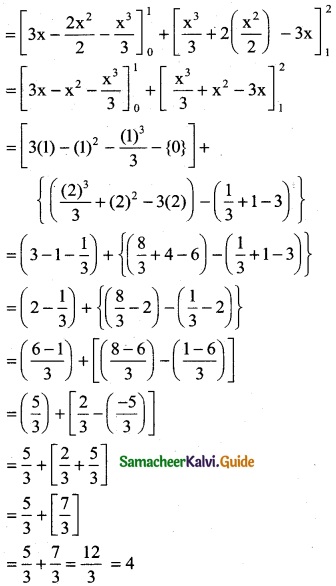

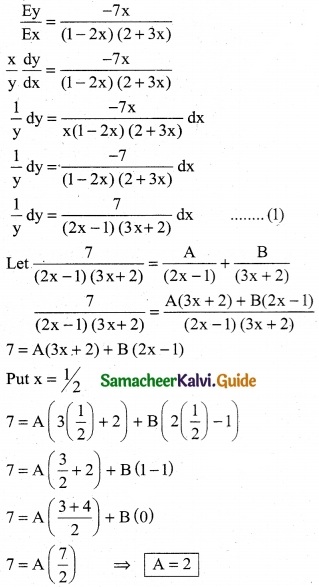

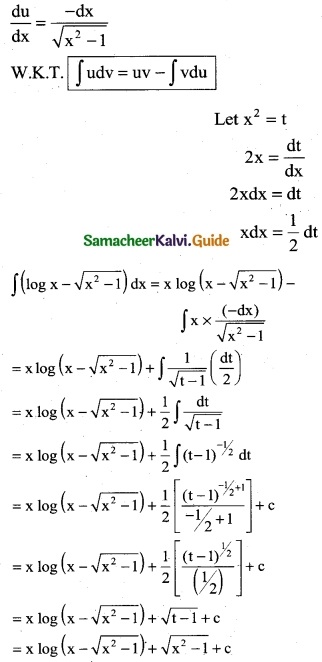

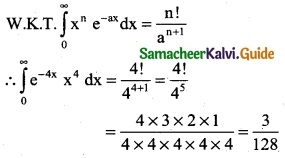

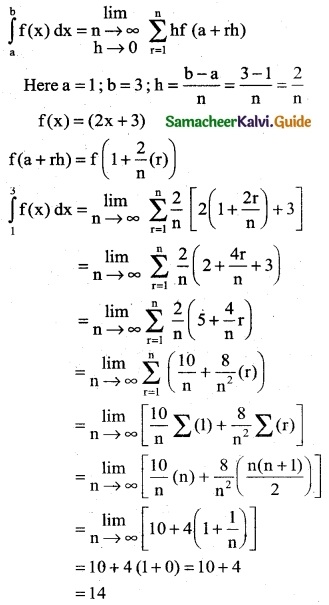

Question 1.

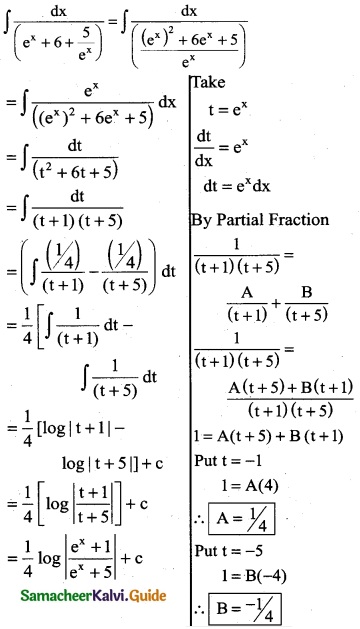

Integrate the following with respect to x.

\(\frac { 2x+5 }{x^2+5x-7}\)

Solution:

∫\(\frac { 2x+5 }{x^2+5x-7}\) dx

∫\(\frac { 1 }{z}\) dz

= log |z| + c

= log |x² + 5x – 7| + c

Take z = x² + 5x – 7

\(\frac { dz }{dx}\) = 2x + 5

dz = (2x + 5)dx

![]()

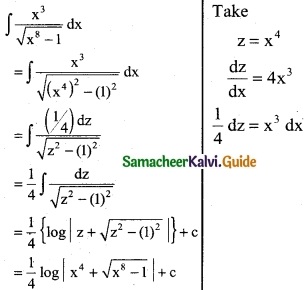

Question 2.

\(\frac { e^{3logx} }{x^4+1}\)

Solution:

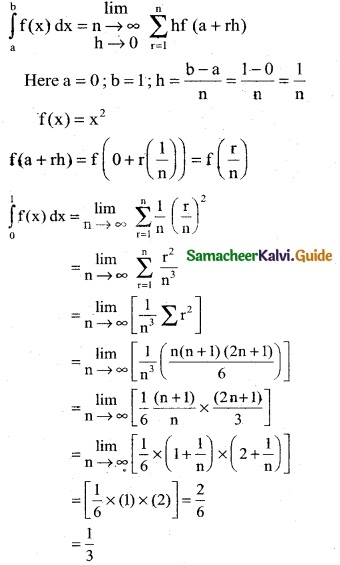

Question 3.

\(\frac { e^{2x} }{e^{2x}-2}\)

Solution:

Question 4.

\(\frac { (logx)^3 }{x}\)

Solution:

![]()

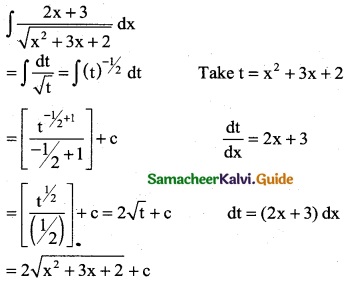

Question 5.

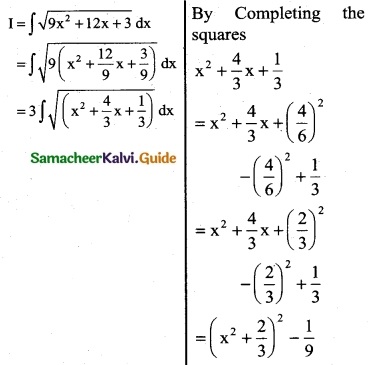

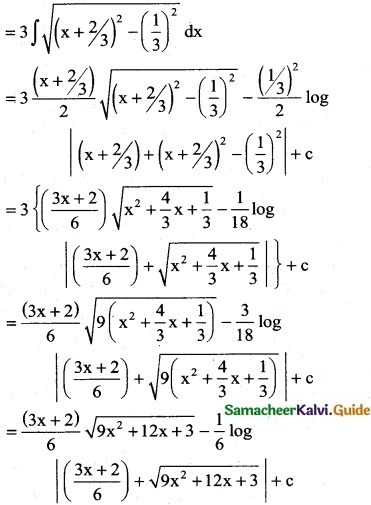

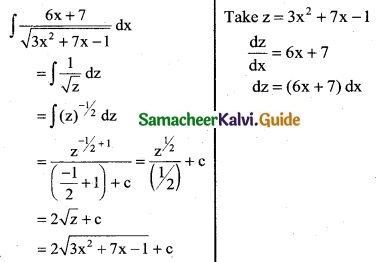

\(\frac { 6x+7 }{\sqrt{3x^2+7x-1}}\)

Solution:

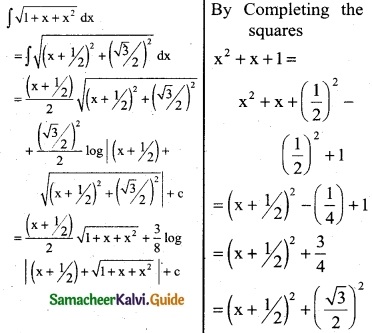

Question 6.

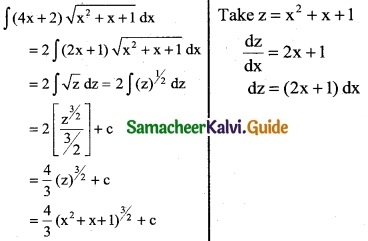

(4x + 2) \(\sqrt {x^2+x+1}\)

Solution:

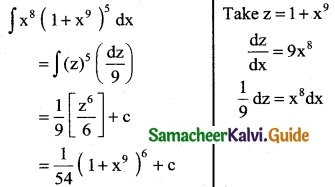

Question 7.

x8 (1 + x9)5

Solution:

![]()

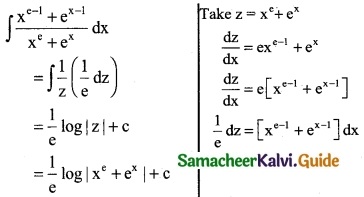

Question 8.

\(\frac { x^{e-1}+e^{x-1} }{x^e+e^x}\)

Solution:

Question 9.

\(\frac { 1 }{x log x}\)

Solution:

∫\(\frac { 1 }{x log x}\) dx

∫\(\frac { 1 }{z}\) dz

= log |z| + c

= log |log x| + c

Take z = log x

\(\frac { 1 }{z}\) = \(\frac { 1 }{x}\)

dz = \(\frac { 1 }{x}\) dx

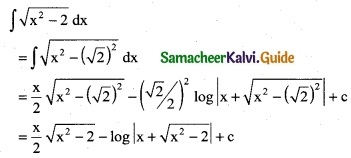

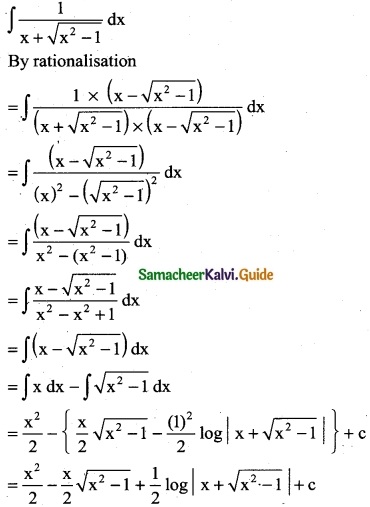

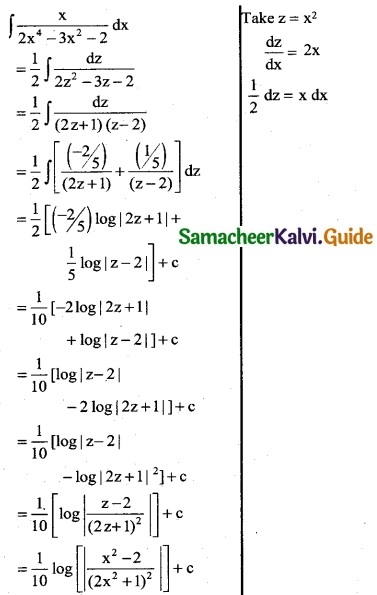

Question 10.

\(\frac { x }{2x^4-3x^2-2}\)

Solution:

![]()

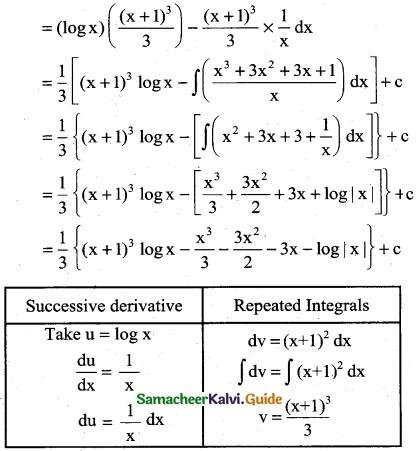

Question 11.

ex (1 + x) log (xex)

Solution:

ex (1 + x) log(x ex) = (ex + x ex) log (x ex)

Let z = x ex, Then dz = d(x ex)

dz = (x ex + ex) dx (Using product rule)

So ∫ ex (1 + x) log (x ex) dx

= ∫ log (x ex) (ex + x ex) dx

= ∫ log z dz

= z (log z – 1) + c

= x ex [log (x ex) – 1] + c

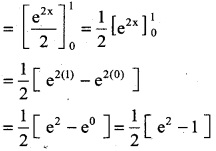

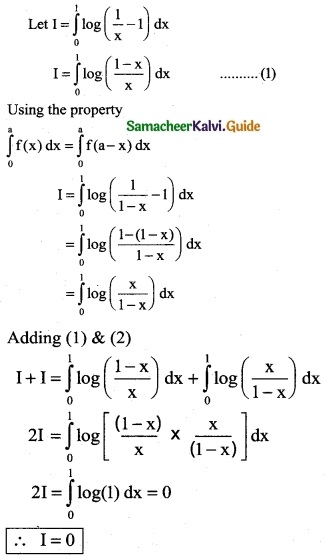

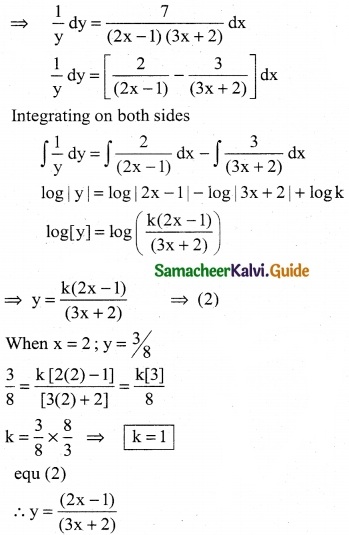

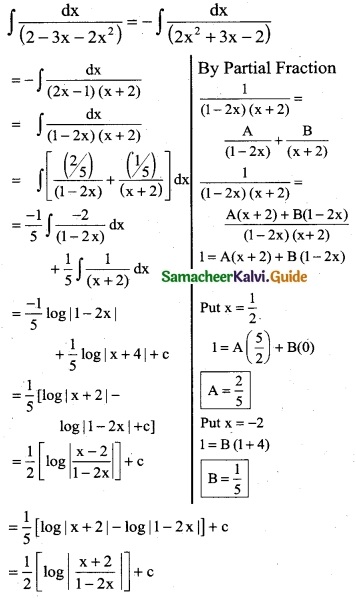

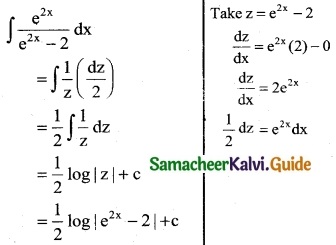

Question 12.

\(\frac { 1 }{x(x^2+1)}\)

Solution:

Put x = 0

1 = A(1)

A = 1

Put x = 1

1 = A(2) + 1(B + C)

1 = (1)2 + B + C

B + C = -1 …….. (1)

Put x = -1

1 = A[(-1)² + 1] + (-1)[B(-1) + C]

1 = A(2) – (-B + C)

1 = 2A + B – C

1 = 2(1) + B – C

B – C = -1 ………. (2)

Adding (1) & (2)

2B = -2

B = -1

C = 0

![]()

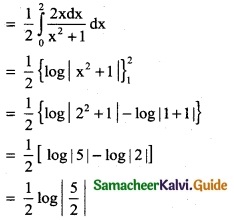

Question 13.

ex [ \(\frac { 1 }{x^2}\) – \(\frac { 2 }{x^3}\) ]

Solution:

∫ex [ \(\frac { 1 }{x^2}\) – \(\frac { 2 }{x^3}\) ] dx

= ∫ex [f(x) + f'(x)] dx

= ex f(x) + c

= ex [ \(\frac { 1 }{x^2}\) ] + c

Take

f(x) = \(\frac { 1 }{x^2}\)

f'(x) = \(\frac { -2 }{x^3}\)

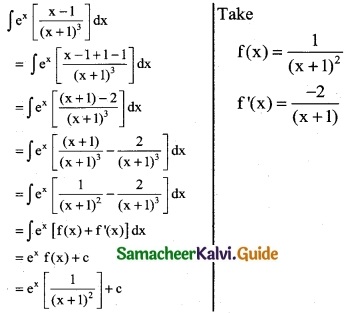

Question 14.

ex [ \(\frac { x-1 }{(x+1)^3}\) ]

Solution:

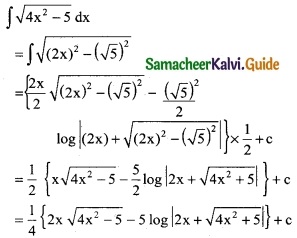

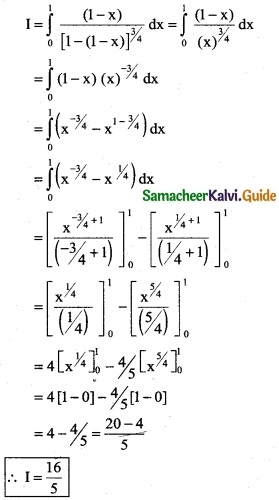

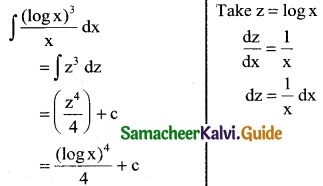

Question 15.

e3x [ \(\frac { 3x-1 }{9x^2}\) ]

Solution:

![]()

Read More: