Students can download 11th Economics Chapter 10 Rural Economy Questions and Answers, Notes, Samcheer Kalvi 11th Economics Guide Pdf helps you to revise the complete Tamilnadu State Board New Syllabus, helps students complete homework assignments and to score high marks in board exams.

Tamilnadu Samacheer Kalvi 11th Economics Solutions Chapter 10 Rural Economy

Samacheer Kalvi 11th Economics Rural Economy Text Book Back Questions and Answers

PART – A

Multiple Choice Questions:

Question 1.

Which is considered as the basic unit for rural areas?

(a) Panchayat

(b) Village

(c) Town

(d) Municipality

Answer:

(b) Village

![]()

Question 2.

Which feature is identified with rural areas?

(a) Low population density

(b) High population density

(c) Low natural resources

(d) Low human resources

Answer:

(a) Low population density

Question 3.

Identity the feature of rural economy?

(a) Dependence on agriculture

(b) High population density

(c) Low level of population

(d) Low level of inequality

Answer:

(a) Dependence on agriculture

![]()

Question 4.

What percentage of the total population live in rural area, as per 2011 censes?

(a) 40

(b) 50

(c) 60

(d) 70

Answer:

(c) 60

Question 5.

How do you term people employed in excess over and above the requirements?

(a) Unemployment

(b) Underemployment or Disguised Unemployment

(c) Full employment

(d) Self – employment

Answer:

(b) Underemployment or Disguised Unemployment

![]()

Question 6.

What is the term used to denote the coexistence of two different features in an economy?

(a) Technology

(b) Dependency

(c) Dualism

(d) Inequality

Answer:

(c) Dualism

Question 7.

The process of improving the rural areas, rural people and rural living is defined as ………………………….

(a) Rural economy

(b) Rural economics

(c) Rural employment

(d) Rural development

Answer:

(d) Rural development

![]()

Question 8.

Identify the agriculture related problem of rural economy.

(a) Poor communication

(b) Small size of landholding

(c) Rural poverty

(d) Poor banking network

Answer:

(b) Small size of landholding

Question 9.

The recommended nutritional intake per person in rural areas.

(a) 2100 calories

(b) 2200 calories

(c) 2300 calories

(d) 2400 calories

Answer:

(d) 2400 calories

Question 10.

Indicate the cause for rural poverty.

(a) Lack of non-farm employment

(b) High employment

(c) Low inflation rate

(d) High investment

Answer:

(a) Lack of non-farm employment

![]()

Question 11.

What is the other name for concealed unemployment?

(a) Open

(b) Disguised

(c) Seasonal

(d) Rural

Answer:

(b) Disguised

Question 12.

How do you term the employment occurring only on a particular season?

(a) Open

(b) Disguised

(c) Seasonal

(d) Rural

Answer:

(c) Seasonal

Question 13.

Identify an example for rural industries?

(a) Sugar factory

(b) Mat making industry

(c) Cement industry

(d) Paper industry

Answer:

(b) Mat making industry

![]()

Question 14.

How much share of rural families in India is in debt?

(a) Half

(b) One fourth

(c) Two third

(d) Three fourth

Answer:

(d) Three fourth

Question 15.

Identify the cause for rural indebtedness in India.

(a) Poverty

(b) High population

(c) High productivity

(d) Full employment

Answer:

(a) Poverty

Question 16.

In which year, Regional Rural Banks came into existence?

(a) 1965

(b) 1970

(c) 1975

(d) 1980

Answer:

(c) 1975

![]()

Question 17.

Identify the year of launch of MUDRA Bank?

(a) 1995

(b) 2000

(c) 2010

(d) 2015

Answer:

(d) 2015

Question 18.

Identify the year in which National Rural Health Mission was launched.

(a) 2000

(b) 2005

(c) 2010

(d) 2015

Answer:

(b) 2005

Question 19.

Identify the advantages of rural roads.

(a) Rural marketing

(b) Rural employment

(c) Rural development

(d) All the above

Answer:

(d) All the above

![]()

Question 20.

“An Indian farmer is bom in debt, lives in debt, dies in debt and bequeaths debt”-who said this?

(a) Adam Smith

(b) Gandhi

(c) Amartya Sen

(d) Sir Malcolm Darling

Answer:

(d) Sir Malcolm Darling

PART – B

Answer the following questions in one or two sentences.

Question 21.

Define Rural Economy?

Answer:

Rural economy refers to villages. Rural economics deals with the application of economic principles in understanding and developing rural areas.

![]()

Question 22.

What do you mean by Rural Development?

Answer:

- Rural Development is defined as an overall improvement in the economies and social well being of villagers and the institutional and physical environments in which they live.

- According to the World Bank “Rural Development is a strategy designed to improve the economic and social life of a specific group of people – rural poor.

- Rural Development is a process of improving the rural areas, rural people, and rural living.

Question 23.

Rural Poverty – Define?

Answer:

Rural poverty refers to the existence of poverty in rural areas. Poverty in India is the situation in which an individual fails to earn sufficient income to buy the basic minimum of subsistence.

![]()

Question 24.

Define Open Unemployment?

Answer:

- Open Unemployment: Unemployed persons are identified as they remain without work.

- This type of unemployment is found among agricultural labourers, rural artisans, and literate persons.

Question 25.

What is meant by Disguised Unemployment?

Answer:

- Many are employed below their productive capacity and even if they are withdrawn from work the output will not diminish. It is also called Disguised Unemployment or Underemployment. This type of unemployment is found among small and marginal farmers, livestock rearers, and rural artisans.

- Disguised unemployment in rural India is 25 percent to 30 percent.

![]()

Question 26.

Define Cottage Industry?

Answer:

- Cottage Industries are generally associated with agriculture and provide both part-time and full-time jobs are in rural areas.

- Cottage Industries are mat, coir and basket making industries.

- The principal cottage industries of India are hand-loom weaving [Cotton, Silk, Jute, etc.] pottery, washing soap making, conch shell, handmade paper, horn button, mother of pearl button, Cutlery, lock, and key making industries. These are almost similar to the cottage industries.

Question 27.

What do you mean by Micro Finance?

Answer:

Microfinance is a financial service that offers loans, savings, and insurance to entrepreneurs and small business owners.

![]()

Question 28.

State any two causes of the housing problem in rural areas?

Answer:

- House is one of the basic needs of every family. The provision of better housing facilities increases the productivity of labour. The housing problem is getting aggravated due to the rapid adaptation of nuclear families.

- Housing does not mean the provision of a house alone but also proper water supply, good sanitation, proper disposal of sewage, etc.

Question 29.

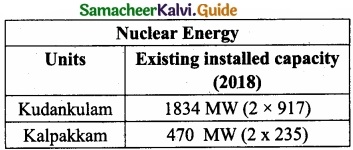

Define Rural Electrification?

Answer:

- Rural Electrification refers to providing electrical power to rural areas.

- The main aims of rural electrification are to provide electricity to agricultural operations and to enhance agricultural productivity.

- To increase cropped area, to promote rural industries, and to lighting the villages.

- In order to improve this facility, the supply of electricity is almost free for agricultural purposes in many states, and the electricity tariff is charged in rural areas is kept very low.

![]()

Question 30.

State any two factors hindering Rural Electrification in India?

Answer:

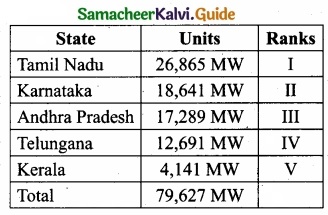

The factors hindering the progress of rural electrification in India are:

- Lack of Funds: The generation and transmission of power involve huge expenditure and the fund allocation is low.

- Inter-State Disputes: As there are inter-state disputes in managing power projects, power distribution is affected.

- Uneven Terrain: As rural topography is uneven without proper connection, developing new lines are costlier and difficult.

- High Transmission Loss: Transmission loss in power distribution is almost 25 percent in rural areas.

- Power Theft: Unauthorized use and diversion of power are evil practices adopted by affluent people that hinder the rural electrification process.

PART – C

Answer the following questions in about a paragraph.

Question 31.

State the importance of Rural Development?

Answer:

- India cannot be developed by retaining rural as backward

- As the rural economy supports the urban sector, the backwardness of the rural sector would be a major impediment to the overall progress of the economy.

- Improvements in education, health, and sanitation in villages can help avoid many urban problems.

- To provide gainful employment and improve food production.

- The evils of brain drain and rural-urban migration can be reduced.

- For the better utilization of resources.

- To minimize the gap between rural and urban areas.

![]()

Question 32.

Explain the causes for Rural Backwardness?

Answer:

- The evils of brain-drain and rural-urban migration can be reduced if rural areas are developed.

- In order to better utilize the unused and under-utilized resources, there is a need to develop the rural economy.

- Rural Development should minimize the gap between rural and urban areas in terms of the provision of infrastructural facilities. It was called PURA by former President Abdul Kalam.

- In order to improve the nation’s status in the global arena in terms of economic indicators like,

- Human Development Index [HDI]

- Woman Empowerment Index [WEI]

- Gender Disparity Index [GDI]

- Physical Quality of Life Index [PQLI] and

- Gross National Happiness Index [GNHI] should be given due attention.

![]()

Question 33.

Enumerate the remedial measures of Rural poverty?

Answer:

The creation of employment opportunities would support the elimination of poverty. The poverty eradication schemes implemented in India are

- 20 point programme.

- Integrated Rural Development Programme (IRDP)

- Training Rural Youths for Self Employment (TRYSEM)

- Food for Work Programme (FWP)

- National Rural Employment Programme (NREP)

- RLEGP, JRY and MGN REGS

![]()

Question 34.

What are the remedial measures for Rural unemployment?

Answer:

Remedial measures for Rural unemployment:

In order to reduce rural unemployment in the country, there is a need to take integrated and coordinated efforts from various levels. A few remedial measures are listed below: Subsidiary

Occupation:

To reduce seasonal unemployment rural people should be encouraged to adopt subsidiary occupations. Loans should be granted and proper arrangements should be made for marketing their products.

Rural Works Programme:

Rural Works Programme such as construction and maintenance of roads, digging of drains, canals, etc., should be planned during the off-season to provide gainful employment to the unemployed.

Irrigation Facilities:

Since rainfall is uncertain irrigation facilities should be expanded to enable the farmers to adopt multiple cropping.

Rural Industrialization:

To provide employment new industries should be set up in rural areas. Technical Education: Employment oriented courses should be introduced in schools and colleges to enable the literate youth to start their own units.

![]()

Question 35.

Write a note on Regional Rural Banks?

Answer:

Regional rural banks came into existence in 1975. RRBs are recommended with a view to developing the rural economy by providing credit and other facilities to the small and marginal farmers, agricultural labourers, artisans, and small entrepreneurs.

RRBs are set up by the joint efforts of the center and state governments and commercial banks. At present, there are 64 RRBs in India. RRBs confine their lending only to the weaker sections and their lending rates are at par with the prevailing rate of cooperative societies.

![]()

Question 36.

Mention the features of SHGs?

Answer:

Major features of SHGs [Self Help Groups]

- SHG is generally an economically homogeneous group formed through a process of self-selection based upon the affinity of its members.

- Most SHGs are women’s groups with membership ranging between 10 and 20.

- SHGs have well-defined rules and by-laws, hold regular meetings and maintain records and savings and credit discipline.

- SHGs are self-managed institutions characterized by participatory and collective decision making.

![]()

Question 37.

List out the objectives of MUDRA Bank?

Answer:

- Regulate the lender and the borrower of microfinance and bring stability to the microfinance system.

- Extend finance and credit support to microfinance institutions.

- Register all MFIs and introduce a system of performance rating and accreditation for the last time.

- Offer a credit guarantee scheme for providing guarantees to loans being offered to micro-businesses.

- Introduce appropriate technologies to assist in the process of efficient lending, borrowing, and monitoring of distributed capital.

PART – D

Answer for each question in about a page.

Question 38.

‘The features of Rural Economy are peculiar’- Argue?

Answer:

Features of Rural Economy:

1. Village is an Institution:

The villagers a primary institution and it satisfies almost all the needs of the rural community. The rural people have a feeling of belongingness and a sense of unity towards each other.

2. Dependence on Agriculture:

The rural economy depends much on nature and agricultural activities. Agriculture and allied activities are the main occupations in rural areas.

3. Life of Rural people:

Lifestyles in villages are very simple. Public services like education, housing, health and sanitation, transport and communication, banking, roads, and markets are limited and unavailable.

The standards of living of the majority of rural people are poor and pitiable. In terms of methods of production, social organization, and political mobilization, the rural sector is extremely backward and weak.

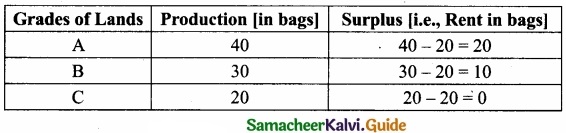

4. Population Density:

Population density, measured by the number of persons living per sq. km is very low and houses are scattered in the entire villages.

5. Employment:

There exists unemployment, seasonal unemployment, and underemployment in rural areas.

6. Poverty:

Poverty is a condition where the basic needs of the people like food, clothing, and shelter are not being met.

7. Indebtedness:

People in rural areas are highly indebted owing to poverty and underemployment, lack of farm and non-farm employment opportunities, low wage employment, seasonality in production, poor marketing network, etc.

8. Rural Income:

The income of the rural people is constrained as the rural economy is not sufficiently vibrant to provide for them.

9. Dependency:

Rural households are largely dependent on social grants and remittances from family members working in urban areas and cities.

10. Dualism:

Dualism means the co-existence of two extremely different features like developed and underdeveloped. These characteristics are very common in rural areas.

11. Inequality:

The distributions of income, wealth, and assets are highly skewed among rural people. Land, livestock and other assets are owned by a few people.

12. Migration:

Rural people are forced to migrate from villages to urban areas in order to seek gainful employment for their livelihood.

![]()

Question 39.

Discuss the problems of the Rural Economy?

Answer:

The problems of the rural economy are.

1. People related problems: The problem consists of illiteracy, lack of technical know-how, low level of confidence, dependence on sentiments and beliefs, etc.

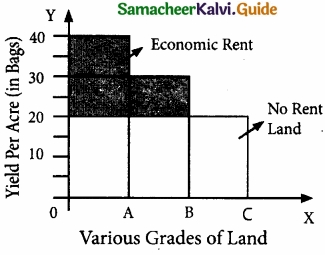

2. Agriculture related problems: This include lack of awareness, knowledge, skill, and attitude, unavailability of inputs, poor marketing facility, an insufficient extension of staff and services, small size of landholding, absence of infrastructure, primitive technology, reduced public investment, and absence of a role for farmers in fixing the prices for their own products.

3. Infrastructural-related problems: Poor infrastructure facilities like water, electricity, transport, educational institutions communication, health, employment are found in rural areas.

4. Economics related problems: Inability to adopt high-cost technology, high cost of inputs, underprivileged rural industries, low income, indebtedness, and existence of inequality in landholdings and assets.

5. Leadership related problems: Leadership among the hands of inactive and incompetent people, the self-interest of leaders, biased political will, less bargaining power, and negotiation skills, and dominance of political leaders.

6. Administrative problems: Political interference, lack of motivation and interest, low wages in villages, improper utilization of budget, and absence of monitoring and implementation of the rural development programme.

![]()

Question 40.

Analyze the causes for Rural Indebtedness?

Answer:

The Causes for Rural Indebtedness:

1. Poverty of Farmers:

- The vicious circle of poverty forces the farmers to borrow for consumption and cultivation.

- Thus poverty, debt, and high rates of interest hold the farmer in the grip of money lenders.

2. Failure of Monsoon:

- Frequent failure of monsoon is a curse to the farmers and they have to suffer due to the failure of nature.

- Farmers find it difficult to identify good years to repay their debts.

3. Litigation:

- Due to land disputes litigation in the court compels them to borrow heavily.

- Being uneducated and ignorant they are caught in the litigation process and dry away their savings and resources.

4. Money Lenders and High Rate of Interest:

- The rate of interest charged by the local money lenders is very high and the compounding of interest leads to perpetuating indebtedness of the farmer.

Samacheer Kalvi 11th Economics Rural Economy in India Additional Important Questions and Answers

PART – A

Multiple Choice Questions:

Question 1.

Educated and skilled persons who may not accept casual work. This is called unemployment ………………………

(a) Closed

(b) Open

(c) Both

(d) None of the above

Answer:

(b) Open

![]()

Question 2.

The existence of a joint family system in India promotes ……………………….. unemployment.

(a) Open

(b) Weekly status

(c) Daily status

(d) Disguised

Answer:

(b) Weekly status

Question 3.

………………………… based poverty lines are used in many countries.

(a) Food

(b) Income

(c) Nutrition

(d) None of the above.

Answer:

(c) Nutrition

![]()

Question 4.

IRDP means

(a) Internal Rural Development Programme

(b) Indian Rural Development Programme

(c) International Rural Development Programme

(d) Integrated Rural Development Programme

Answer:

(d) Integrated Rural Development Programme

Question 5.

The problem of rural unemployment can be solved only by …………………….. agriculture.

(a) Cost production

(b) Green Revolution

(c) Innovative

(d) Modernising

Answer:

(d) Modernising

![]()

Question 6.

In which year the Rural Landless Employment Guarantee Programme was set up?

(a) 1982

(b) 1983

(c) 1984

(d) 1985

Answer:

(b) 1983

Question 7.

…………………….. legislation has been passed by the State governments, which aim at improving the economic conditions of agricultural landless labourers.

(a) Green Revolution

(b) Ceiling of landholding

(c) Land Reforms

(d) Zamindari System

Answer:

(c) Land Reforms

Question 8.

Agriculture in India offers ………………………. employment.

(a) Seasonal

(b) Under

(c) Sub

(d) Partly

Answer:

(a) Seasonal

![]()

Question 9.

The farmers are poor for long then we call it ………………………. poverty.

(a) Urban

(b) Rural

(c) Primary

(d) Chronic (or) Structural

Answer:

(d) Chronic (or) Structural

Question 10.

……………………….. poverty means people work for few months and get low wages.

(a) Urban

(b) Rural

(c) Primary

(d) None of the above

Answer:

(b) Rural

PART – B

Answer the following questions in one or two sentences.

Question 1.

Define “Migration”?

Answer:

- Rural people are forced to migrate from villages to urban areas in order to seek gainful employment for their livelihood.

- This character of the development gives rise to the formation of cities.

- Enmity and lack of basic amenities in rural areas also push the people to migrate to urban areas.

![]()

Question 2.

What do you mean by features of Rural Indebtedness?

Answer:

- Nearly three fourth of rural families in the country is in debt.

- The amount of debt is heavier in the case of small farmers.

- Cultivators are more indebted than the non-cultivators.

- Most of the debts taken are short term and of unproductive nature.

- The proportion of debts having higher rates of interest is relatively high.

- Most of the villagers are indebted to private agencies particularly money lenders.

Question 3.

Mention the major advantages of Micro Finance?

Answer:

Microfinance offers loans, savings, and insurance to entrepreneurs and small business owners. Who does not have access to traditional sources of capital, like banks or investors?

PART – C

Answer the following questions in about a paragraph.

Question 1.

Mention the causes for Rural Poverty?

Answer:

Causes for Rural Poverty:

- Unequal distribution of Land: The distribution of land is highly skewed in rural areas. Therefore, the majority of rural people work as hired labour to support their families.

- Lack of Non-farm employment: Non-farm employment opportunities do not match the increasing labour force. The excess supply of labour in rural areas reduces the wages and increases the incidence of poverty.

- Lack of public sector Investment: The root cause of rural poverty in our country is the lack of public sector investment in human resource development.

- Inflation: Steady increase in prices affects the purchasing power of the rural poor leading to rural poverty.

- Low productivity: Low productivity of rural labour and farm activities is a cause as well as the effect of poverty.

- Unequal Benefit of Growth: Major gains of economic development are enjoyed by the urban rich people leading to a concentration of wealth. Due to defective economic structure and policies, gains of growth are not reaching the poor and the contributions of poor people are not accounted for properly.

- Low Rate of Economic Growth: The fate of the growth of India is always below the target and it has benefited the rich. The poor are always denied the benefits of the achieved growth and development of the country.

- More Emphasis on Large Industries: Huge investment in large industries catering to the needs of middle and upper classes in urban areas are made in India. Such industries are capital-intensive and do not generate more employment opportunities. Therefore, the poor are not in a position to get employed and to come out of poverty in villages.

- Social evils: Social evils prevalent in the society like custom, believes, etc. increase unproductive expenditure.

![]()

Question 2.

Explain the causes for Rural Unemployment?

Answer:

Causes for Rural Unemployment:

- Absence of skill development and employment generation: Lack of Government initiatives to give required training and then to generate employment opportunities.

- Seasonal Nature of Agriculture: Agricultural operations are seasonal in nature and depend much on nature and rainfall. Therefore, the demand for labour becomes negligible during the offseason. So, non-farm employment opportunities must be created.

- Lack of subsidiary occupation: Rural people are not able to start subsidiary occupations such as poultry, rope making, piggery, etc. Due to shortages of funds for investment and lack of proper marketing arrangements.

- Mechanization of Agriculture: The landlords are the principal source of employment to the farm labour. Mechanization of agricultural operations like ploughing, irrigation, harvesting, threshing, etc. reduces employment opportunities for farm labour.

- Capital-Intensive Technology: The expanding private industrial sector is largely found in urban areas and not creating additional employment opportunities due to the application of capital intensive technologies. The government must establish firms to absorb surplus labor-power.

- Defective System of Education: The present system of education has also aggravated the rural unemployment problem. A large number of degree-producing institutions have come in recent years. Students also want to get degrees only, not any skill. Degrees should be awarded only on the basis of skills acquired. The unemployed youth should get sufficient facilities to update their skills.

![]()

Question 3.

Mention the Important characteristics of cottage Industries?

Answer:

Characteristics of Cottage Industries:

- These Industries are carried out by artisans in their own homes at their own risk and for their own benefits.

- Artisans may combine this work with another regular job.

- Little outside labour is employed. Normally, the members of the household provide the necessary labour.

- These industries are generally hereditary and traditional in character.

- Little power is used.

- These industries usually serve the local market and generally work on the orders placed by other Industries.

- The principal cottage industries of India are hand-loom weaving (cotton, silk, jute, etc.) pottery, washing soap making, conch shell, handmade paper, horn button, mother-of-pearl button, cutlery, lock and key making industries.

PART – D

Answer for each question in about a page.

Question 1.

Discuss the requirements for Rural Industries?

Answer:

Requirements for Rural Development:

Rural industries embrace all industries which are run by rural people in rural areas. These industries are based primarily on the utilization of locally available raw materials, skills, and a small amount of capital. The rural industries can be broadly classified into a) cottage industries, b) village industries, c) small industries, d) tiny industries and e) agro-based industries.

Cottage Industries:

- Cottage industries are generally associated with agriculture and provide both part-time and full-time jobs in rural areas.

- Little outside labour is employed. Normally, the members of the household provide the necessary labour.

- These industries are generally hereditary and traditional in character.

- Little power is used.

- These industries usually serve the local market and generally work on the orders placed by other industries.

- Examples of cottage industries are mat, coir and basket making industries. The principal cottage industries of India are hand-loom weaving (cotton, silk, jute, etc.) pottery, washing soap making, conch shell, handmade paper, horn button, mother-of-pearl button, cutlery, lock and key making industries.

Village Industries:

1. Village industries are traditional in nature and depend on local raw-material. They cater to the needs of the local population. Examples of village industries are gur and khandsari, cane and bamboo baskets, shoemaking, pottery, and leather tanning. These are almost similar to the cottage industries.

2. Small Scale Industries (SSIs):

Most small scale industries are located near urban centers. They produce goods for local as well as foreign markets. Examples of such small-scale industries are the manufacture of sports goods, soaps, electric fans, footwear, sewing machines and handloom weaving.

SSIs are also known as Micro, Small & Medium Enterprises (MSMEs). They are defined and categorized by the Micro, Small & Medium Enterprises Development Act, 2006. The Act categorizes different scale of industries on the basis of investment in plant and machinery in case of manufacturing industries and on the basis of investment in equipment in case of service sector industries.

3. Agro-based Industries:

These industries are based on the processing of agricultural produce. Agro-based industries may be organized on a cottage-scale, small-scale, and large-scale. These industries tend to develop household settlements around them as they employ more labour on a regular basis. Examples are textile, sugar, paper, vegetable oil, tea, and coffee industries.

![]()

Question 2.

Mention the Rural Roads and Rural Market?

Answer:

- Road Market refers to the infrastructure created to buy and sell the products produced in rural areas and also to purchase the needed products and farm inputs produced in urban and other regions.

- Rural marketing is still defective as farmers lack bargaining power, a long chain of middlemen, lack of organization, insufficient storage facilities, poor transport facilities, absence of grading, inadequate information, and poor marketing arrangements.

- Road transport is an important constituent of the transport system.

- Rural Roads constitute the very lifeline of the rural economy.

- A well-constructed road network in rural areas would bring several benefits including the linking of remote villages with urban centers, reduction in the cost of transportation of agricultural inputs, and promotion of marketing for rural produces.

- It helps the farmers to bring their produce to the urban markets and to have access to distant markets and other services.