Students get through the TN Board 12th Economics Important Questions Chapter 9 Fiscal Economics which is useful for their exam preparation.

TN State Board 12th Economics Important Questions Chapter 9 Fiscal Economics

Very short answer questions

Question 1.

How is public revenue classified?

Answer:

Public revenue can be classified into two types.

- Tax Revenue,

- Non-Tax Revenue

Question 2.

Name the tax revenue sources.

Answer:

They are income tax, corporate tax, sales tax, surcharge tax, and cess.

![]()

Question 3.

What do you mean by escheats?

Answer:

It refers to the claim of the state to the property of persons who die without legal heirs or documentary bills.

Question 4.

What is tax evasion?

Answer:

The burden of direct tax is so heavy that taxpayers always try to evade taxes.

This leads to the generation of black money which is harmful to the economy.

Question 5.

Write the nature of sales tax, VAT, and GST.

Answer:

- Sales tax was multipoint tax with cascading effect.

- VAT was multipoint tax without cascading effect:

- GST is one point tax without cascading effect.

Question 6.

What do you mean by internal public debt?

Answer:

Internal public debt is a loan taken by the Government from the citizens or from different institutions within the country. It only involves the transfer of wealth.

Question 7.

What is the budget?

Answer:

The origin of the word budget is from French which means ‘A small Leather bag’. A budget is an annual financial statement that shows the estimated income and expenditure of the Government for the forthcoming financial years.

![]()

Question 8.

How are Government accounts maintained?

Answer:

They are maintained as

- Consolidate fund,

- Contingency fund and

- Public accounts

Question 9.

Name the accounting committee of the Government.

Answer:

Public accounts committee and the estimates committee.

Question 10.

Name the types of the budget deficit.

Answer:

- Revenue Deficit

- Budget Deficit

- Fiscal Deficit and

- Primary Deficit

Question 11.

Name the local bodies of India.

Answer:

- Village Panchayat

- District Boards or Zila Parished

- Municipalities and

- Municipal Cooperations

Question 12.

Name the source of the village panchayat.

Answer:

- General property tax,

- Tax on land,

- Profession tax and

- Tax on animals and vehicles.

![]()

Question 13.

What do you mean by the fiscal policy?

Answer:

Fiscal policy means the budgetary manipulations affecting the macroeconomic variables – output, employment, saving, investment, etc.

Short answer questions

Question 1.

How does the modern state control monopoly?

Answer:

The concentration of monopoly has to be controlled by Government. So the state intervenes through control of monopolies and restrictive trade practices to curb the concentration of economic power. The Government can play three kinds of roles. They are:

- As per producer of goods and services

- As suppliers of public goods and social goods

- As the regulator of the system

Question 2.

Write a note on GST.

Answer:

- GST is an indirect tax that has replaced many indirect taxes in India. The goods and services taxes was passed in the parliament on 29th March 2017 and it came into effect on 1st July 2017. The GST in India is a comprehensive multi-stage, destination-based tax that is levied on every value addition.

- GST has replaced many indirect tax laws.

- GST is one indirect tax for the entire country.

- Under the GST region, the tax will be levied at the final point of sale. In the case of intrastate sales, Central GST and State GST will be charged. Inter-state sales will be chargeable to Integrated GST.

Question 3.

What are the advantages of GST?

Answer:

- GST will remove the cascading effect on the sale of goods and services.

It will directly impact the cost of goods. Since the tax on tax is eliminated in this regime, the cost of goods decreases. - GST is also mainly technologically driven. All activities like registration, return filing, application for a refund, and response to notice need to be done online on the GST portal. This will speed up the process.

![]()

Question 4.

What are the main sources of internal public debt?

Answer:

- Individually purchase Government bonds and securities.

- Banks, both private and public, buy bonds from the Government.

- Non-financial institutions like UTI, LIC, GIC, etc also buy Government bonds.

- A central bank can lend the Government in form of a money supply. The central bank can also issue money to meet the expenditure of the Government.

Question 5.

Balanced budget vs unbalanced budget – explain.

Answer:

Balanced budget: It is a situation in which the estimated revenue of the Government during the year is equal to its anticipated expenditure.

Government’s Estimated Revenue = Government’s Proposed Expenditure.

Unbalanced budget: The Budget in which revenue and expenditure are not equal to each other is known as an unbalanced Budget. It is of two types. They are surplus and deficit budgets.

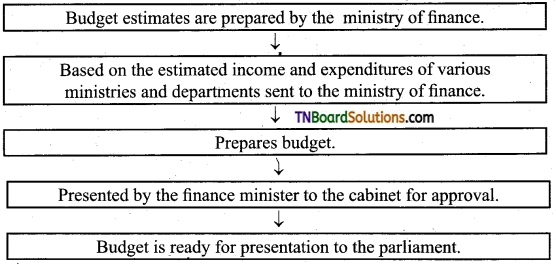

Question 6.

What is the process in the preparation of the budget?

Answer:

Long answer questions

Question 1.

What are the classifications of public expenditure?

Answer:

I. Classification on the basis of benefit

- Public expenditure benefiting the entire society. Eg: Defence

- Public expenditure conferring a special benefit on certain people and at the same time common benefit on community Eg: Administration of justice.

- Public expenditure directly benefiting a particular group of persons and indirectly the entire society. Eg: Public welfare.

- Public expenditure conferring a special benefit to some individual. Eg: Subsidy.

![]()

II. Classification basis of function

- Protection function: To protect from external invasion and internal disorder. Eg: defense.

- Commercial function: Development of trade and commerce. Eg: transport and communication

- Development function: Public expenditure incurred for the development infrastructure and industry.

Question 2.

Merits of direct taxes – explain.

Answer:

- Equity: Indirect taxes, the rate of tax varies according to the tax base.

Eg: income tax. - Certainty: It can be ensured by direct taxes Eg: income taxpayers know when and what rate he has to pay income tax?

- Elasticity: Direct taxes also satisfy the canon of elasticity. Income tax is income elastic in nature. As income level increases, the tax revenue to the Government also increases automatically.

- Economy: The cost collection of direct taxes is relatively low. The taxpayers pay the tax directly to the state.

Activity

Question 1.

Collect various bills and tabulate different rates of GST for different goods and services.

Answer:

Note: This activity is an eye-opener for the students.

It is the goods and services tax.

- It helps the students to know the method of taxation.

- It helps the students to know how and when it is levied.

- Helps them to identify the rate of taxation on different goods.

- Helps them to realize the importance of taxation.

- Helps them to understand the value of services and the importance of tax payment.

Multiple-choice questions

1. Fiscal economics is also known as:

(a) Public finance

(b) Public expenditure

(c) Increase expenditure

(d) Federal finance

Answer:

(a) Public finance

2. Financial operations of the Government is done by:

(a) Bill of exchange

(b) Cheques

(c) Treasury

(d) RBI

Answer:

(c) Treasury

![]()

3. The term fiscal means in Greek:

(a) Flower

(b) Money

(c) Basket

(d) Tax

Answer:

(c) Basket

4. Main objectives of the public sector are to provide ………… in the economy.

(a) Demand

(b) Social benefit

(c) Supply

(d) Production

Answer:

(b) Social benefit

5. The Government has to administer fiscal policy and monetary policy to achieve ……….. goals.

(a) Micro Economic

(b) Fiscal Economic

(c) Managerial Economic

(d) Macro Economic

Answer:

(d) Macro Economic

6. ………. classified Public expenditure on the basis of functions of Government.

(a) Adam Smith

(b) Ricardo

(c) Marshall

(d) Mill

Answer:

(a) Adam Smith

7. There are more than ………. cities above one million population.

(a) 44

(b) 54

(c) 64

(d) 34

Answer:

(b) 54

![]()

8. According to Dalton the term ……….. has two senses that is wide and narrow.

(a) Public debt

(b) Public expenditure

(c) Public income

(d) Public finance

Answer:

(c) Public income

9. Public revenue can be classified into ……….. types.

(a) 2

(b) 3

(c) 5

(d) 6

Answer:

(a) 2

10. Central Board of Direct Taxes (CBDT) comes under:

(a) Defence ministry

(b) Ministry of foreign affairs

(c) Ministry of finance

(d) Ministry of health

Answer:

(c) Ministry of finance

11. ………… is paid by a shopkeeper or a retailer.

(a) Excise duty

(b) Sales Tax

(c) Custom duty

(d) Entertainment tax

Answer:

(b) Sales Tax

12. GST is ………. tax.

(a) Road tax

(b) Direct tax

(c) Custom tax

(d) Indirect tax

Answer:

(d) Indirect tax

![]()

13. The GST act was passed in the parliament in the year:

(a) 2016

(b) 2017

(c) 2001

(d) 2018

Answer:

(b) 2017

14. During ………. period private investment is lacking.

(a) Inflation

(b) War

(c) Depression

(d) Business cycle

Answer:

(c) Depression

15. The process of repaying a public debt is called:

(a) Budgetary surplus

(b) Redemption

(c) Capital levy

(d) Conversion

Answer:

(b) Redemption

16. Sinking fund was first introduced in:

(a) Lebanon

(b) the USA

(c) England

(d) India

Answer:

(c) England

![]()

17. Performance budget is also known as:

(a) Union budget

(b) Outcome budget

(c) State budget

(d) Deficit budget.

Answer:

(b) Outcome budget

18. The performance budget was first made in:

(a) London

(b) the USA

(c) USSR

(d) India

Answer:

(b) the USA

Pick the odd one out.

1. Right to print currency involves ………….. of currency.

(a) Creation

(b) Deposit

(c) Distribution

(d) Monitoring

Answer:

(b) Deposit

2. Public finance future investment include:

(a) Building of schools

(b) Banks

(c) Hospitals

(d) Infrastructure

Answer:

(b) Banks

3. It is the duty of the state to make provisions for:

(a) Inflation

(b) Education

(c) Health

(d) Sanitation

Answer:

(a) Inflation

![]()

4. Protection function is to protect the citizen:

(a) defense

(b) police

(c) watchman

(d) court

Answer:

(c) watchman

5. The Government has been providing subsidies on a number of items like:

(a) Fertilisers

(b) Exports

(c) Banks

(d) Education

Answer:

(c) Banks

6. The Government has been tender taking ……….. various development projects is:

(a) Irrigation

(b) Machinery

(c) Human resource

(d) Telecommunication

Answer:

(c) Human resource

7. Fine is imposed on an individual for violation of law example:

(a) Traffic rules

(b) Payment of income tax

(c) Payment after the stipulated time

(d) Illiteracy

Answer:

(d) Illiteracy

8. Non-financial institution is like:

(a) UTI

(b) LIC

(c) Moneylender

(d) GIC

Answer:

(c) Moneylender

![]()

9. The main source of external public debt are:

(a) IMF

(b) IDA

(c) HDFC

(d) ADB

Answer:

(c) HDFC

10. Revenue expenditure includes:

(a) Defence expenditure

(b) Subsidies

(c) Interest payment on debt

(d) Foreign currency

Answer:

(d) Foreign currency