Students get through the TN Board 11th Commerce Important Questions Chapter 20 International Finance which is useful for their exam preparation.

TN State Board 11th Commerce Important Questions Chapter 20 International Finance

Very short answer questions

Question 1.

Give the full form of GDR and ADR.

Answer:

GDR – Global Depository Receipts ADR – American Depository Receipts

Question 2.

What is trade credit?

Answer:

Trade credit is the credit extended by one trader to another for the purchase of goods and services.

![]()

Question 3.

What is Debenture?

Answer:

A Debenture is a document or certificate which is issued under the common seal of the company, acknowledging its debt to the holders at given terms and conditions.

Question 4.

State two factors affecting the working capital requirement of a firm.

Answer:

Nature of business and speed of sales

Question 5.

State two factors affecting the fixed capital requirement of a firm.

Answer:

Size of business and nature of business

Question 6.

Why preferences are given to preferential shares.

Answer:

They are given some preferences because they are not given voting rights.

![]()

Question 7.

Who regulates the acceptance of public deposits?

Answer:

Reserve Bank of India.

Short answer questions

Question 1.

List sources of raising long-term and short-term finance.

Answer:

Sources of raising long and short term finance are shown in the chart given below:

Long term Finance sources:

- Equity shares,

- Retained shares,

- Preference shares,

- Debentures,

- Long from financial institutions,

- Long from a bank.

Short term Finance sources:

- Trade credit,

- Factoring,

- Banks,

- Commercial papers.

Question 2.

What is Foreign Direct Investment (FDI).

Answer:

It is an investment made by the company or an individual in one country with business interests in another country in the form of either establishing business operations or acquiring business assets in the other country such as ownership or controlling interest in a foreign country.

![]()

Question 3.

What are forms to take foreign direct investment?

Answer:

- Establishment of a new enterprise in a Foreign country.

- Expression of existing branch or subsidiary in a Foreign country.

- Acquisition of enterprise located in a Foreign country.

Question 4.

What are the sources from where the funds generated?

Answer:

- Commercial Banks.

- Depositary receipts.

- International Agencies and development Banks,

- International capital markets.

Long answer questions

Question 1.

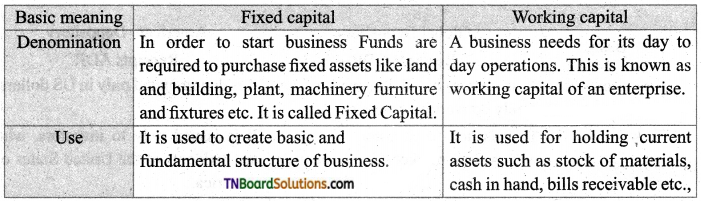

Differentiate between fixed capital and working capital.

Answer:

![]()

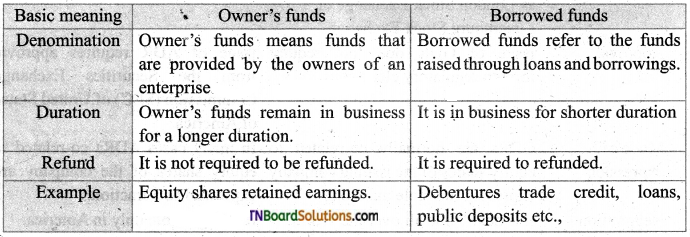

Question 2.

Differentiate between owner’s funds and borrowed funds.

Answer:

Question 3.

What are the steps in the process of issuing GDR?

Answer:

There are four steps in the process of issuing GDRs as follows.

- The company issuing GDRs hands over its shares to one Domestic Custodian Bank (DCB).

- The DCB requests the Overseas Depository Bank (ODB) situated in the foreign country for issuing the shares as GDR.

- The ODB converts the shares shown in rupees into GDR which are denominated in US dollars.

- Finally, ODB issues them to the intending investors.

Question 4.

What is ADR and what are the steps in process of issuing ADRs.

Answer:

- First of all, a company hands over the shares to a Domestic Custodian Bank (DCB)

- Then DCB requests the American Depository Bank (ADB) to issue the shares in the form of ADRs

- ADB converts the issue which are in rupees into US dollars

- Finally, ADB issues them to the intending investors.

![]()

For Own Thinking

1. Role of World Bank in globalization.

Answer:

The Bretton woods institutions the IMF and World Bank have an important role to play in making globalization work better. They were created in 1944 to help restore and sustain the benefits of global integration by promoting international economic cooperation.

2. The concept of Hot Money.

Answer:

Hot money refers to funds that are controlled by investors who actively seek short-term returns. These investors scan the market for short-term, high-interest-rate investment opportunities. A typical short-term- investment opportunity that attracts hot money is the certificate of deposit.

For Future learning

1. Possibilities of making the western and American countries in favour of Indian Depository Receipt (IDR).

Answer:

An IDR is meant to diversify your holding across regions to free you from a region bias or the risk of a portfolio getting too concentrated in the home market you need to study the firms. Financials before you buy its IDR.

2. Petrodollar system and its future.

Answer:

If you have never heard of the petrodollar system. It will not surprise me. It is certainly not a topic that makes its way out of Washington and wall street circles too often. The mainstream media rarely if ever discusses the inner working of the petrodollar system.

![]()

Multiple choice questions

1. Name of the Indian companies which have raised money through the issue of GDRS:

(a) HDFC

(b) ICICI

(c) SBI

(d) Indian bank

Answer:

(b) ICICI

2. Public deposits are the deposits raised by organizations directly from the public:

(a) HDFC

(b) ICICI

(c) IDBI

(d) SBI

Answer:

(c) IDBI

3. Equity shareholders are called the of the company.

(a) Owners

(b) Consumers

(c) Public

(d) Bankers

Answer:

(a) Owners

![]()

4. Who regulates the acceptance of public deposits?

(a) RBI

(b) SBI

(c) UTI

(d) ICICI

Answer:

(a) RBI

5. Debenture holders are ……… of the company.

(a) Creditors

(b) Debtors

(c) Owners

(d) Customers

Answer:

(a) Creditors

6. Internal sources of capital are:

(a) Generated through outsiders such as suppliers

(b) Generated through loans from commercial banks

(c) Generated through the issue of shares

(d) Generated wit in the business

Answer:

(d) Generated wit in the business

7. Public deposits are the deposits that are raised directly from:

(a) the public

(b) the directors

(c) the auditors

(d) the owners

Answer:

(a) the public

![]()

8. ADRs are issued in:

(a) Canada

(b) China

(c) India

(d) the USA

Answer:

(d) the USA

9. Funds required for purchasing current assets is an example of:

(a) fixed capital requirement

(b) ploughing back of profits

(c) working capital requirement

(d) none of the above

Answer:

(c) working capital requirement

10. Trade credit is the example of:

(a) long term finance

(b) medium-term finance

(c) short term finance

(d) All of the above

Answer:

(d) All of the above