Students can Download Tamil Nadu 12th Accountancy Model Question Paper 3 English Medium Pdf, Tamil Nadu 12th Accountancy Model Question Papers helps you to revise the complete Tamilnadu State Board New Syllabus, helps students complete homework assignments and to score high marks in board exams.

TN State Board 12th Accountancy Model Question Paper 3 English Medium

Instructions:

- The question paper comprises of four parts.

- You are to attempt all the parts. An internal choice of questions is provided wherever applicable.

- All questions of Part I, II. III and IV are to be attempted separately.

- Question numbers 1 to 20 in Part I are Multiple Choice Questions of one mark each. These are to be answered by choosing the most suitable answer from the given four alternatives and writing the option code and the corresponding answer.

- Question numbers 21 to 30 in Part II are two-mark questions. These are to be answered in about 50 words.

- Question numbers 31 to 40 in Part III are three-mark questions. These are to be answered in about 150 words.

- Question numbers 41 to 47 in Part IV are five-mark questions. These are to be answered in about 250 words. Draw diagrams wherever necessary.

Time: 2.30 Hours

Max Marks: 90

PART – I

Answer all the questions. Choose the correct answer.[Answers are in bold] [20 x 1 = 20]

Question 1.

The total assets of the proprietor are ? 5,00,000. His liabilities ? 3,50,000. Then his capital in the business is

(a) Rs 8,50,000

(b) Rs 1,50,000

(c) Rs 3,50,000

(d) Rs 4,25;000

Answer:

(b) Rs 1,50,000

Question 2.

A firm has assets worth Rs 60,000 and capital 45,000; then its liabilities is

(a) Rs 45,000

(b) Rs 1,05,000

(c) Rs 60,000

(d) Rs 15,000

Answer:

(d) Rs 15,000

![]()

Question 3.

Income and expenditure accounts show

(a) Cash available to an organization

(b) Closing capital of an organization

(c) Cash available in the bank account

(d) Surplus or deficit for the current accounting period

Answer:

(d) Surplus or deficit for the current accounting period

Question 4.

On what basis the receipts and payments account is prepared

(a) Cash basis

(b) Credit basis

(c) Both

(d) None of these

Answer:

(a) Cash basis

Question 5.

The balance in the appropriation account is transferred to the partner’s capital account in the

(a) Agree ratio

(b) Sacrifice ratio

(c) Profit sharing ratio

(d) Old ratio

Answer:

(c) Profit sharing ratio

Question 6.

Amount invested by partners in the partnership business is called

(a) Owner’s capital

(b) Partners capital

(c) Profit and loss appropriation

(d) None of these

Answer:

(b) Partners capital

Question 7.

The profit earning capacity of the firm determines the value of its

(a) Balance Sheet

(b) good will

(c) Profit and Loss Account

(d) All of these

Answer:

(b) good will

Question 8.

Goodwill acquired by making payment in cash or kind is called

(a) Purchased goodwill

(b) Self-generated goodwill

(c) Average goodwill

(d) (a) and (b)

Answer:

(a) Purchased goodwill

Question 9.

A new partner may be admitted to a partnership

(a) with the consent of all the partners

(b) with the consent of any one partner

(c) with the consent of two-third of the old partners

(d) with the consent of three-fourth of the old partners

Answer:

(a) with the consent of all the partners

Question 10.

An incoming partner is liable for all the acts of the firms dare

(a) Before his admission

(b) After his admission

(c) From six months prior to his admission

(d) None of these

Answer:

(b) After his admission

Question 11.

The profit or loss arising therefrom is transferred to the capital accounts of all the partners in the

(a) New profit sharing ratio

(b) Old profit sharing ratio

(c) Gaining ratio

(d) Sacrificing ratio

Answer:

(b) Old profit sharing ratio

Question 12.

The settlement is to be done in the manner prescribed in the

(a) Partnership-at-will

(b) Partnership deed

(c) Both (a) and (b)

(d) None of these

Answer:

(b) Partnership deed

Question 13.

Company is a voluntary association of persons which has separate

(a) legal entity

(b) voluntary association

(c) common seal

(d) limited liability

Answer:

(a) legal entity

Question 14.

The liability of the shareholders of the company is limited to the extent of face value of the shares held by the

(a) share holders

(b) card holders

(c) debenture holders

(d) None of these

Answer:

(a) share holders

Question 15.

The term fund refers to

(a) working capital

(b) opening capital

(c) closing capital

(d) None of these

Answer:

(a) working capital

![]()

Question 16.

When figure relating to several years are considered for the purpose of analysis, the analysis is called

(a) Horizontal analysis

(b) vertical analysis

(c) Trend analysis

(d) Cash flow analysis

Answer:

(a) Horizontal analysis

Question 17.

Which ratios measure the firm’s ability to meet its short term obligations in time?

(a) Profitability Ratios

(b) Liquidity Ratios

(c) Activity Ratios

(d) None of these

Answer:

(b) Liquidity Ratios

Question 18.

For Calculating Quick Assets – and- are excluded from current assets

(a) Debtors and inventory

(b) Inventory and Bills payable

(c) Cash and Bank balances

(d) Inventory and Prepaid Expenses

Answer:

(d) Inventory and Prepaid Expenses

Question 19.

Ideal current Ratio is

(a) 1 : 1

(b) 1 : 2

(c) 2 : 1

(d) 3 : 1

Answer:

(c) 2 : 1

Question 20.

Which of the following options is used to view Trial Balance from Gateway of Tally?

(a) Gateway of Tally → Reports → Trial Balance

(b) Gateway of Tally → Trial Balance

(c) Gateway of Tally → Reports → Display → Trial Balance

(d) None of these

Answer:

(c) Gateway of Tally → Reports → Display → Trial Balance

PART – II

Answer any seven questions in which question no. 30 is compulsory. [7 × 2 = 14]

Question 21.

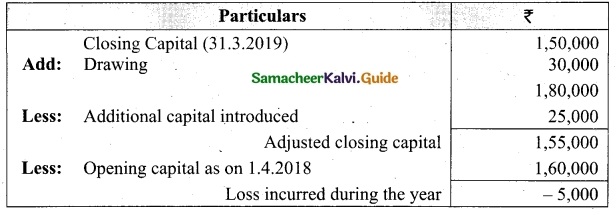

From the following particulars ascertain profit or loss?

Capital as on 1. 4. 2018 1,60,000

Capital as on 31. 3. 2019 1,50,000

Additional capital introduced 25,000

Drawings made during the year 30,000

Answer:

Statement of profit or loss for the year ended 31.3.2019

Question 22.

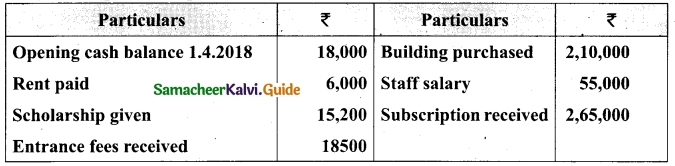

From the following particulars of Tamil Educational Society.

Prepare Receipts and Payments for the year ended 31.03.2019

Answer:

Question 23.

What is partners current account?

Answer:

Under fixed capital method, Capital account and current accounts are maintained. In current account all adjustments relating to partners are recorded on the credit side of current account viz: Interest on capital, Share of profits, Salary and commission etc are recorded.

On the debit side drawings interest on drawings, share of loss are recorded. Current account sometimes show credit or debit balance.

Question 24.

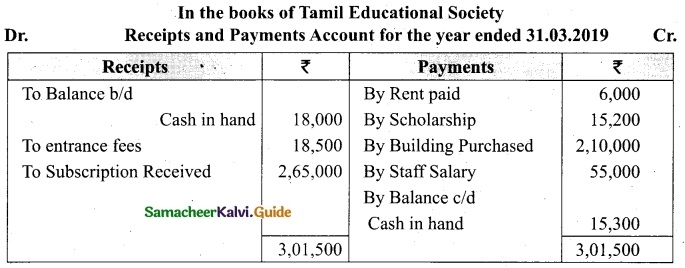

The following are the profits of a firm in the last five years 2014 – Rs 4,000, 2015 – Rs 3,000, 2016 – Rs 5,000, 2017 – Rs 4,500, 2018 – Rs 3,500. Calculate the value of goodwill at 3 years purchase of average profit of five year.

Answer:

Goodwill = Average profit × No. of years of purchase

Good will = Average profit × No. of years of purchase

= Rs 4,000 × 3

Goodwill = Rs 12,000

![]()

Question 25.

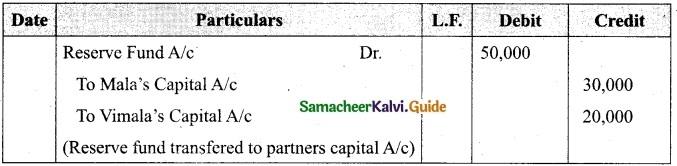

Mala and Vimala were partners sharing profit and losses in the ratio of 3 : 2. On 31.3.2017. Varshini was admitted as a partner. On the date of admission. The book of the firm showed a reserve fund of Rs 50,000. Pass the journal entry to distribute the reserve fund.

Answer:

Journal Entry

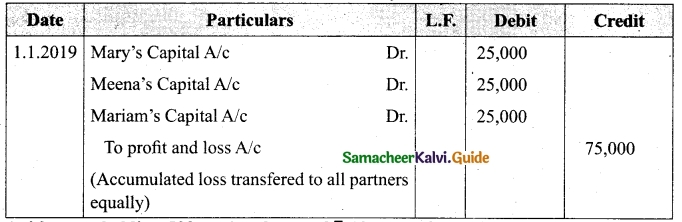

Question 26.

Mary, Vleena, Mariam are partners of a firm sharing profit and losses equally. Many retired from the partnership on 1.1.2019. On that date, their balance sheet showed accumulated loss of Rs 75,000. On the assets side of Balance Sheet. Give the journal entry to distribute the accumulated loss.

Answer:

Journal Entry

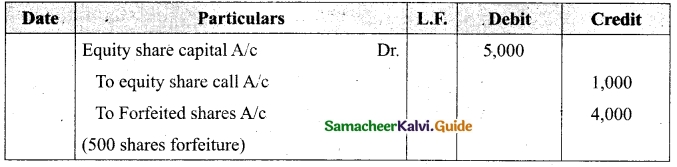

Question 27.

Anitha was holding 500 equity shares of Rs 10 each of Thanjavur Motors Ltd. issued at par. She paid Rs 3 on application Rs 5 on allotment but could not pay the first and final call of Rs 2. The directors forfeited the shares for non payment of call money. Give Journal Entry for forfeiture of shares.

Answer:

Journal Entry

Question 28.

What is working capital?

Answer:

Working capital statement or schedule of changes in working is prepared to disclose net changes in working capitals on two specific dates (generally two balance sheet dates). It is prepared from current assets and current liabilities.

Working Capital = Current Assets – Current Liabilities

Question 29.

What is meant by accounting ratio?

Answer:

Ratio is a mathematical expression of relationship between two related or interdependent items. It is the numerical or quantitative relation ship between two items. It is calculated by dividing one item by the other related item. When ratios are calculated on the basis of accounting information, these are called ‘accounting ratio’.

Question 30.

What are accounting reports?

Answer:

Accounting report is a compilation of accounting information that are derived from the accounting records of a business concern. Accounting reports may be classified as routine reports and special purpose reports.

PART – III

Answer any seven questions in which question No. 40 is compulsory. [7 x 3 = 21]

Question 31.

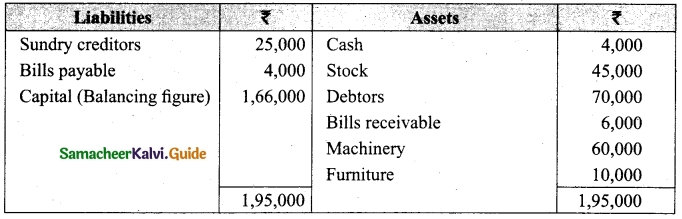

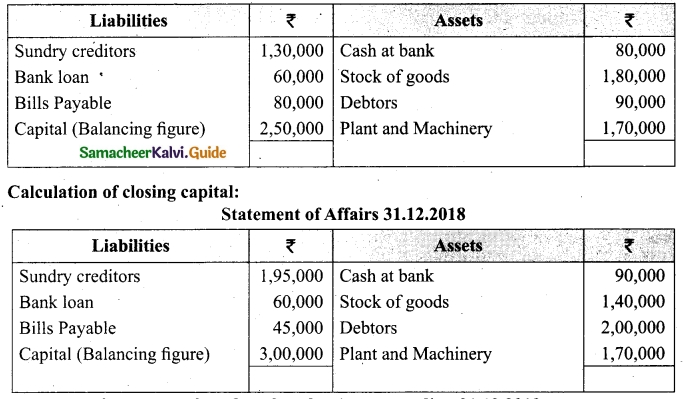

Following are the balances of Shanthi as on 31.12.2018

Answer:

Prepare a statement of affairs as on 31.12.2018 and calculate capital as at that date.

![]()

Question 32.

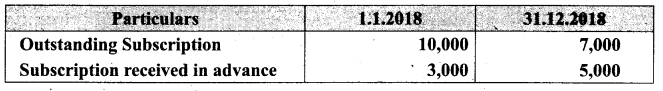

Compute income from subscription for the 2018 from the following particulars relatiiig to a club.

Answer:

Subscription received during the year 2018 Rs 1,50,000

Calculation of incomes from subscription for 2018

Question 33.

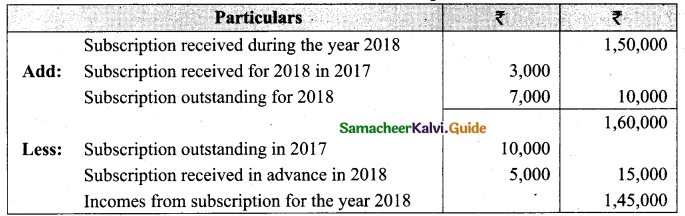

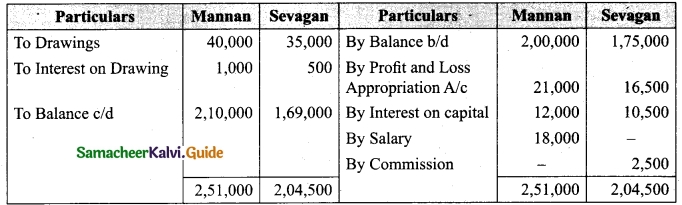

From the following information prepare capital accounts of partners Mannan and Sevagan when their capitals are fluctuating.

Answer:

Partners Capital Account

Question 34.

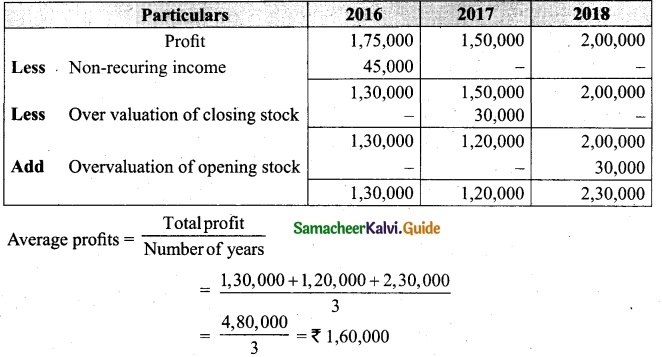

From the following information relating to Sridevi Enterprises, calculate the value of goodwill on the basis of 4 years purchase of the average profit of 3 years.

(a) Profits for the year ending 31st December 2016, 2017 and 2018 were Rs 1,75,000, 1,50,000 and Rs 2,00,000 respectively.

(b) A non – recuring income of Rs 45,000 is included in the profits of the year 2016.

(c) The closing stock of the year 2017 was overvalued by Rs. 30,000

Answer:

Calculation of adjusted profit

Goodwill = Average profit × Number of years of purchase

= 1,60,000 × 4

= Rs 6,40,000

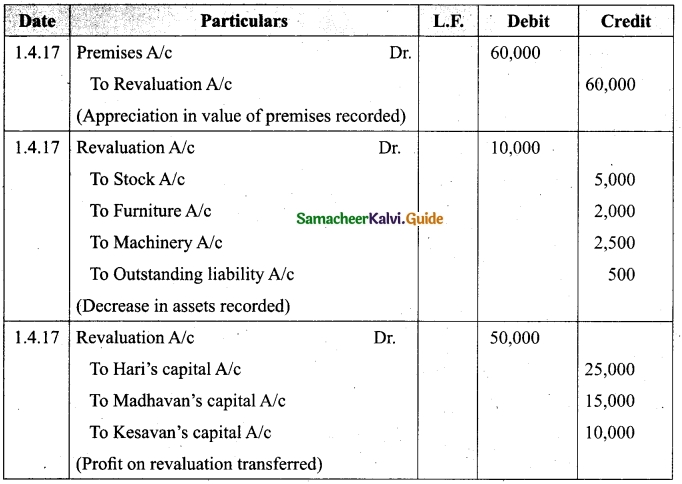

Question 35.

A, B and C were partners. Sharing profits and losses in the ratio of 5 : 3 : 2. D is admitted into a partnership. The following adjustments are to be made.

(a) Increase the value of premises by Rs 60,000

(b) Depreciate stock by Rs 5,000; Furniture by Rs 2,000 and Machinery by Rs 2,500.

(c) Provide for an outstanding liabilities of Rs 500. Pass the journal entries.

Answer:

Journal Entries

Question 36.

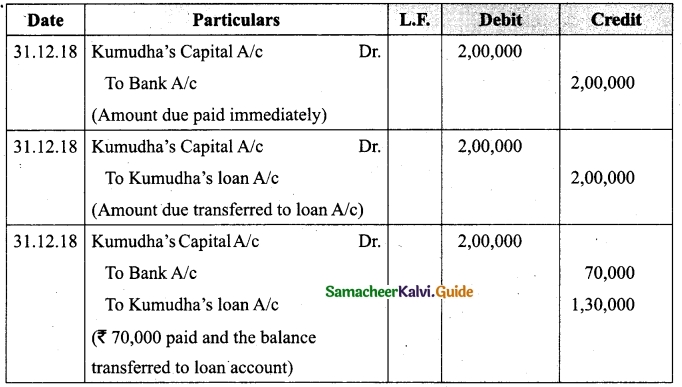

Kavitha, Kumudha and Lalitha are partners sharing profit and losses in the ratio of 5 : 3 : 3 respectively. Kumudha retires on 31st Dec 2018. On the date of retirement, her capital account shows a credit balance of Rs 2,00,000 pass journal entries of

(i) The amount due is paid off immediately by cheque.

(it) The amount due is not paid immediately

(iii) Rs 70,000 is paid immediately by cheque

Answer:

![]()

Question 37.

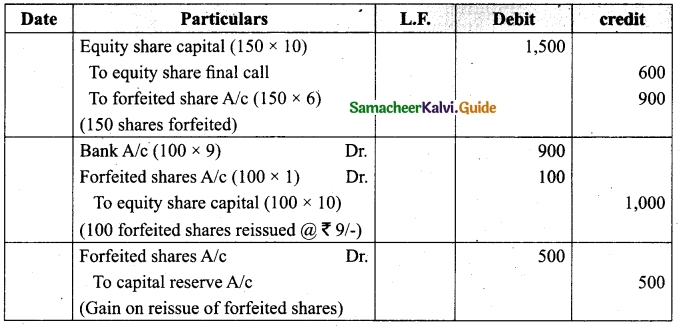

Maruthu Ltd. forfeited 150 equity shares @ Rs 10 each for non-payment of final call of Rs 4/- per share of these 100 shares were reissued @ Rs 9/- per share. Pass journal entries for forfeiture and reissue.

Answer:

Journal entries

Forfeited shares:

150 shares = Rs 900

100 shares \(\frac{900}{150}\) × 100 = Rs 600

Gain or loss = Amount forfeited – loss on reissue

= Rs 600 – 100 = Rs 500

Question 38.

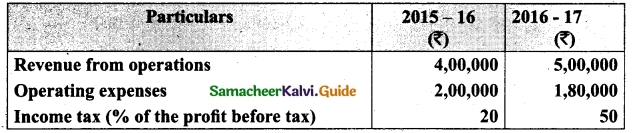

From the following particulars prepare comparative income statement of Mary Co. Ltd.

Answer:

Comparative income statement of Mary Co. Ltd. for the year ended 31st March 2016 and 31st March 2017

Note: Calculation of income tax

For 2015-16 = 2,00,000 × 20% = Rs 40,000;

For 2016-17 = 3,20,000 × 50% = Rs 1,60,000

Question 39.

Explain the objectives of ratio analysis?

Answer:

Following are the objectives of ratio analysis.

- To Simplify accounting figures

- To Facilitate analysis of financial statements

- To analyses the operational efficiency of a business.

- To help in budgeting and forecasting

- To facilitate intro firm and inter firm comparison of performance.

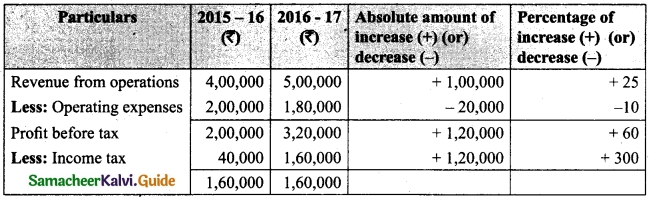

Question 40.

Mention the commonly used voucher types in Tally ERP.9. Following are some of the major accounting vouchers used in an organisation.

Answer:

- Receipt voucher

- Payment voucher

- Contra voucher

- Purchase voucher

- Sales voucher

- Journal voucher

PART – IV

Answer all the following questions. [7 × 5 = 35]

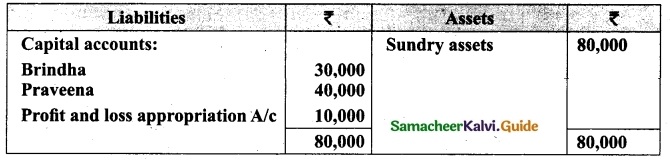

Question 41 (a).

Raju does not keep proper books of accounts. Following details are taken from his records.

During the year introduced further capital of? 50,000 and withdraw ? 2,500 per month from the business for his personal use. Prepare statement of profit or loss with above information.

Answer:

Statement of affairs as on 1.1.2018

![]()

[OR]

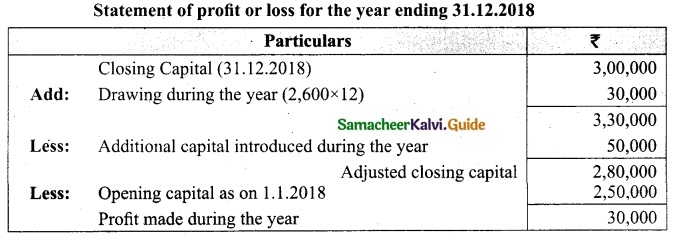

(b) From the following particular calculate total purchases.

Answer:

Total Purchases = Cash Purchases + Credit Purchases

= Rs 3,20,000 + Rs 4,80,000

= Rs 8,00,000

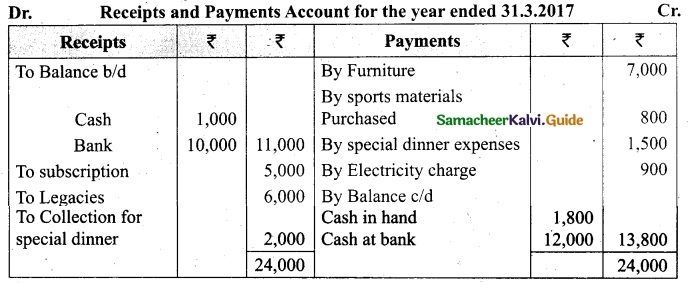

Question 42(a).

From the following Receipts and Payments Account of Friends Football club for the year ending 31st March 2017. Prepare income and expenditure Account for the year ending 31.3.2017.

Additional information:

(i) The club had furniture of Rs 12,000 on 1.4.2016. Ignore depreciation on furniture

(ii) Subscription outstanding for 2016-17- Rs 600

(iii) Stock of sports material on 31.03.2017- Rs 100

(iv) Capital Fund as on 1st April 2016 was Rs 23,000

Answer:

Income and Expenditure Account for the year ended 31.03.17

[OR]

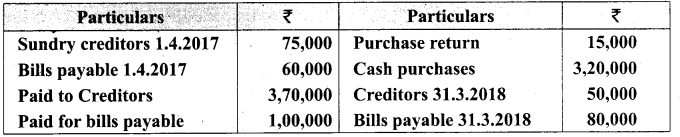

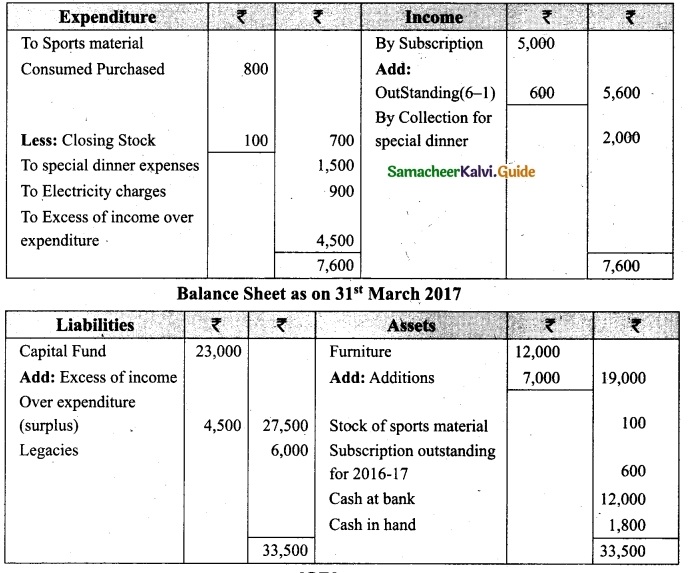

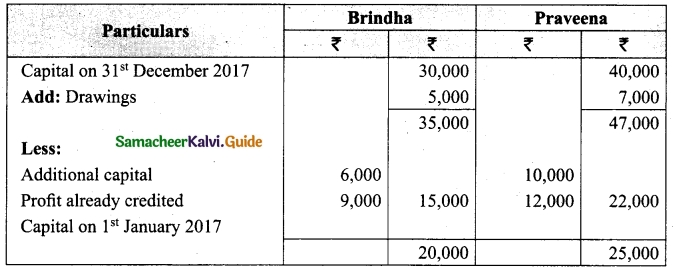

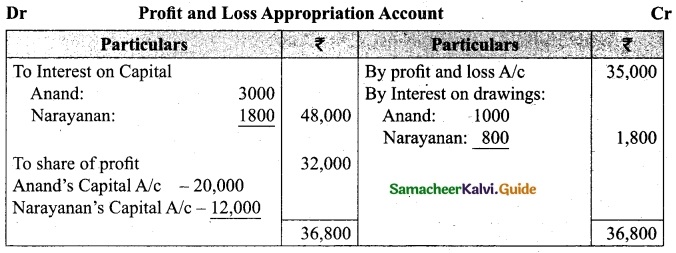

(b) From the following balance sheets of Brindha and Praveena who share profits and losses in the ratio of 3 : 4, calculate interest on capital at 6% p.a. for the year ending 31st December 2017.

Balance sheet as on 31st December 2017

On 1st July 2017, Brindha introduced an additional capital of Rs 6,000 and on 1st October 2017, Praveena introduced Rs 10,000. Drawings of Brindha and Praveena during the year were Rs 5,000 and Rs 7,000 respectively. Profit earned during the year was Rs 31,000.

Answer:

Profit credited = Profit earned Rs 31,000 – Balance profit as per balance sheet Rs 10,000 = Rs 21,000. This amount is distributed in their profit sharing ratio of 3 : 4.

Calculation of interest on capital:

![]()

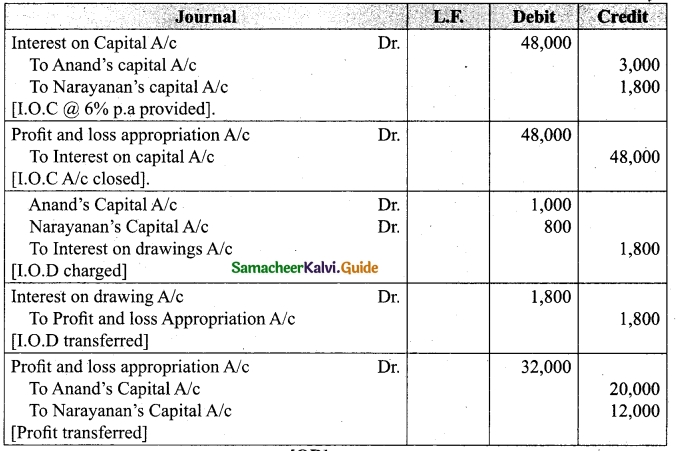

Question 43(a).

Anand and Narayanan are partners in a firm sharing profits and losses in the ratio of 5 : 3. On 1st January 2018, their capitals were Rs 50,000 and Rs 30,000 respectively. The partnership deed specifies the following:

(a) Interest on capital is to be allowed at 6% per annum.

(b) Interest on drawings charged to Anand and Narayanan are Rs 1,000 and Rs 800 respectively.

(c) The net profit of the firm before considering interest on capital and interest on drawings amounted to Rs 35,000.

Give necessary journal entries and prepare profit and loss appropriation account as on 31st December 2018. Assume that the capitals are fluctuating.

Answer:

[OR]

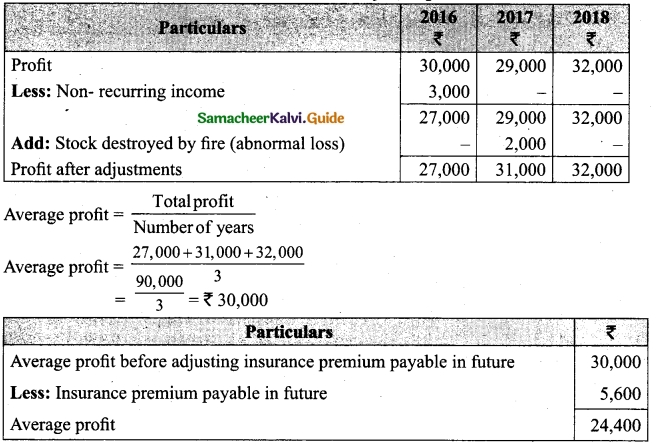

(b) The following particulars are available in respect of a business carried on by a partnership firm:

(i) Profits earned: 2016: Rs 30,000; 2017: Rs 29,000 and 2018: Rs 32,000.

(ii) Profit of 2016 includes a non-recurring income of Rs 3,000.

(iii) Profit of 2017 is reduced by Rs 2,000 due to stock destroyed by fire.

(iv) The stock is not insured. But, it is decided to insure the stock in future. The insurance premium is estimated at Rs 5,600 per annum.

You are required to calculate the value of goodwill on the basis of 2 years purchase of average profits of the last three years.

Answer:

Goodwill = Average profit × Number of years of purchase

= 24,400 × 2 = Rs 48,800

Question 44(a).

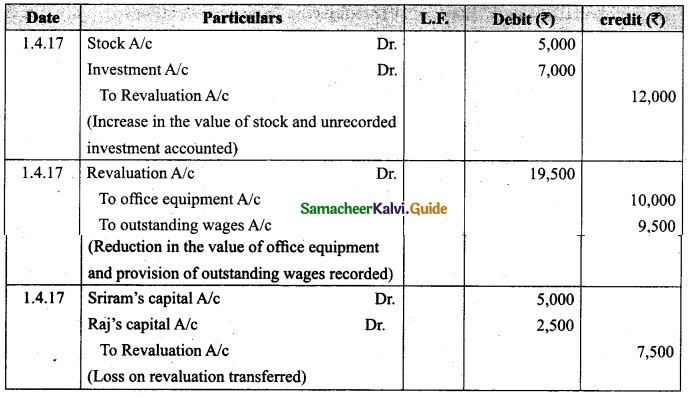

Sri Ram and Raj are partners sharing profits and losses in the ratio of 2 : 1. Nelson joins as a partner on 1st April 2017. The following adjustments are to be made.

(i) Increase the value of stock by Rs 5,000

(ii) Bring into record investment of Rs 7,000 which had not been recorded in the books of the firm.

(iii) Reduce the value of office equipment by Rs 10,000

(iv) A provision would also be made for outstanding wages for Rs 9,500. Give journal entries and prepare revaluation account.

Answer:

Journal Entries

![]()

[OR]

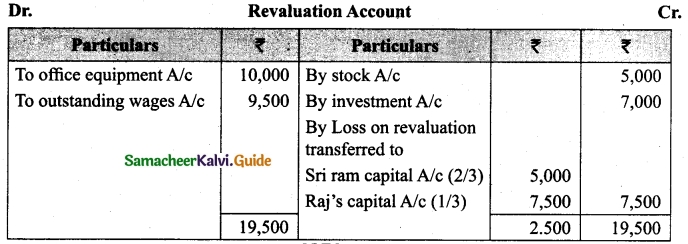

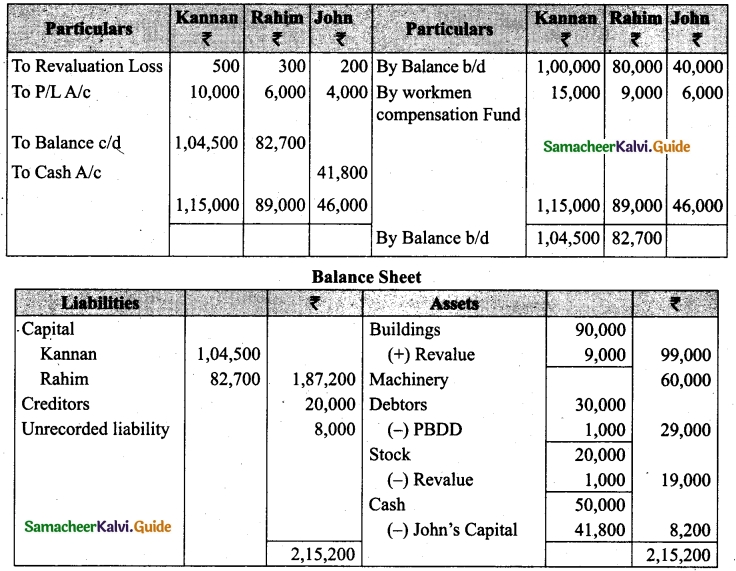

(b) Kannan, Rahim and John are partners in a firm sharing profit and losses in the ratio of 5 : 3 : 2. The balance sheet as on 31st December, 2017 was as follows:

John retires on 1st January 2018, subject to following conditions:

(i) To appreciate building by 10%

(ii) Stock to be depreciated by 5%

(iii) To provide Rs 1,000 for bad debts

(iv) An unrecorded liability of Rs 8,000 have been noticed

(v) The retiring partner shall be paid immediately

Prepare revaluation account, partners capital account and the balance sheet of the firm after retirement.

Answer:

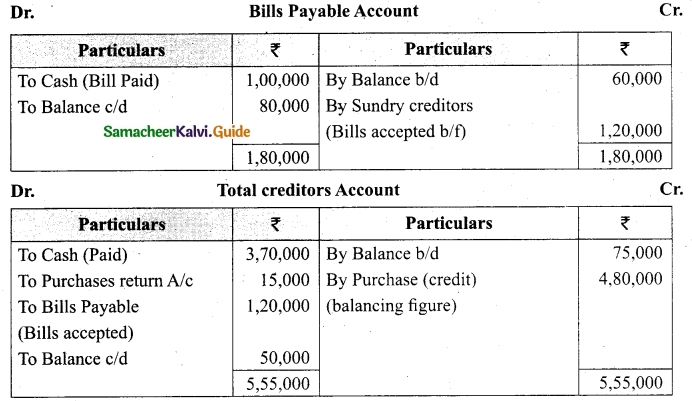

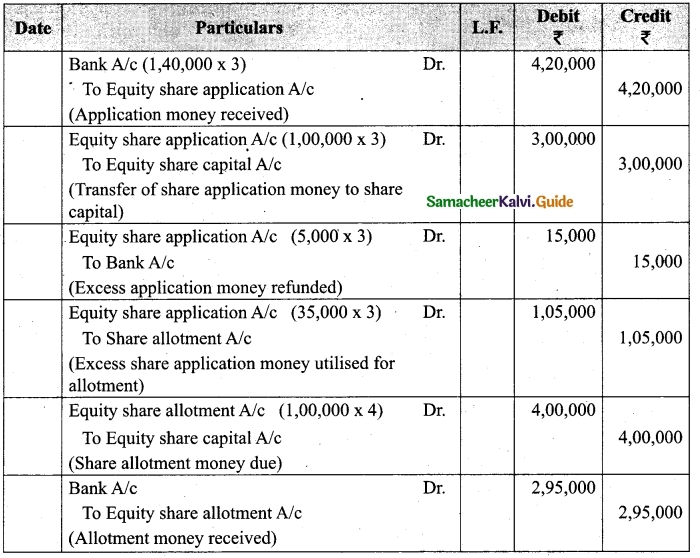

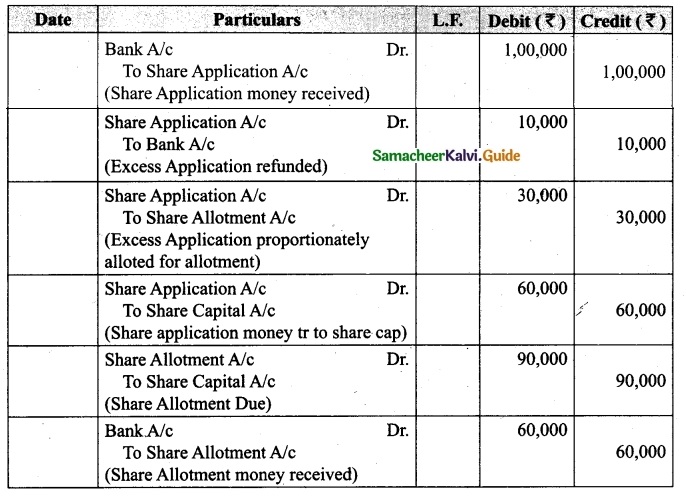

Question 45(a).

Sudha Ltd. offered 1,00,000 shares of Rs 10 each to the public payable Rs 3 on application, Rs 4 on share allotment and the balance when required. Applications for 1,40,000 shares were received on which the directors allotted as:

Applicants for 60,000 shares – Full

Applicants for 75,000 shares – 40,000 shares (excess money will be utilised for allotment)

Applicants for 5,000 shares – Nil

All the money due was received. Pass journal entries upto the receipt of allotment.

Answer:

In the books of Sudha Ltd. Journal entries

Working note

![]()

[OR]

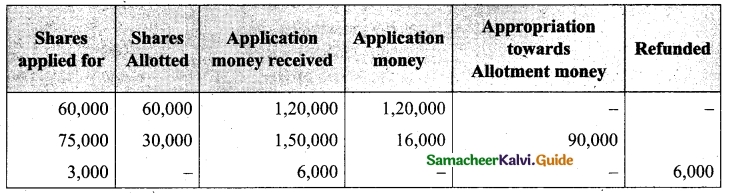

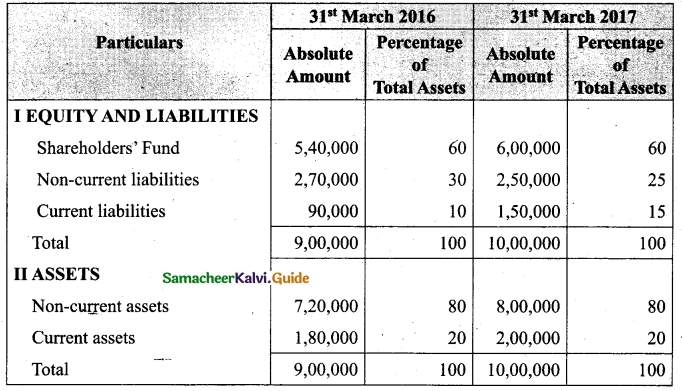

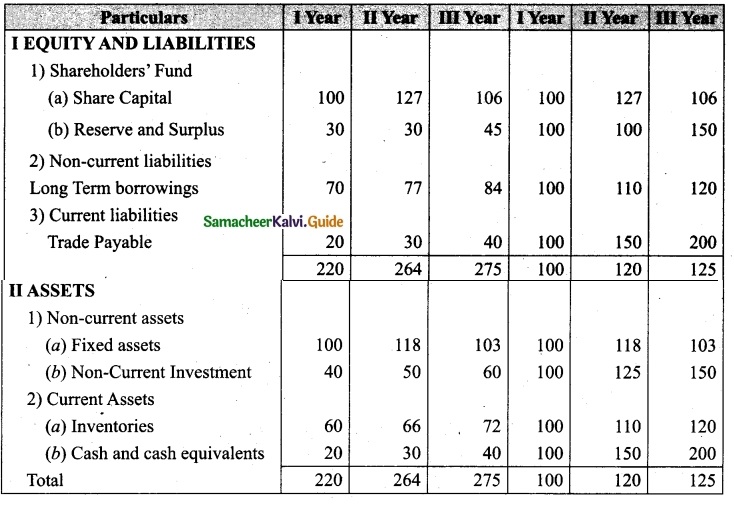

(b) Prepare common-size statement of financial position for the following particulars of Rani Ltd.

Answer:

Common Size Balance sheet of Rani Ltd. as on 31st March 2016 to 31st March 2017

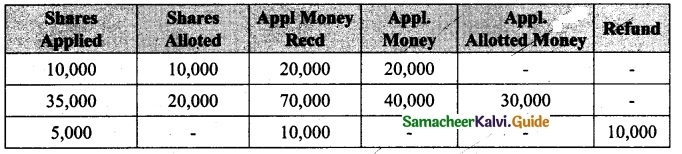

Question 46(a).

Lalitha Ltd. offered 30,000 equity shares of Rs 10 each to the public payable Rs 2 per share on application, Rs 3 on share allotment and the balance when required. Applications for 50,000 shares were received on which the directors allotted as:

Applicants for 10,000 shares – Full

Applicants for 35,000 shares – 20,000 shares (excess money will be utilised for allotment)

Applicants for 5,000 shares – Nil

All the money due was received. Pass journal entries upto the receipt of allotment.

Answer:

Journal Entries

![]()

[OR]

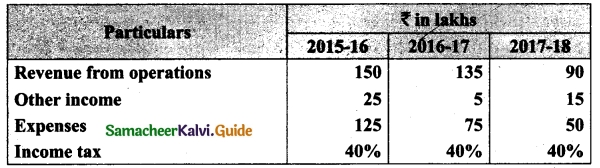

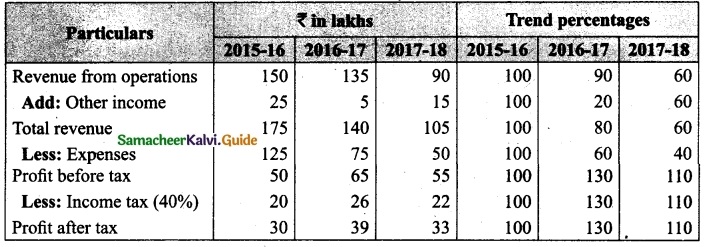

(b) From the following particulars of Neithal Ltd, calculate trend percentages.

Answer:

Trend analysis for Neithal Ltd

Question 47 (a).

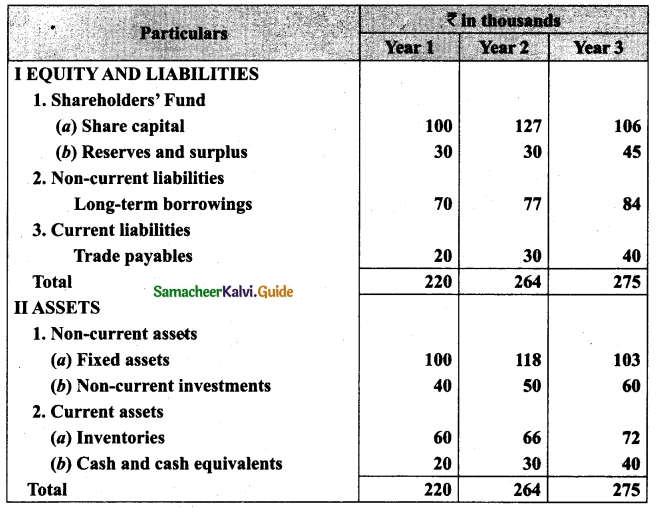

From the following particulars, calculate the trend percentages of Babu Ltd.

Answer:

Trend Percentage of Babu Ltd. (In Thousands)

![]()

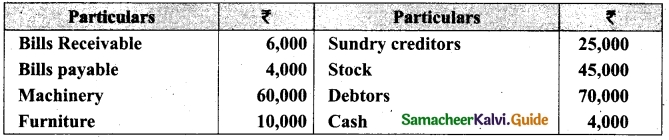

[OR]

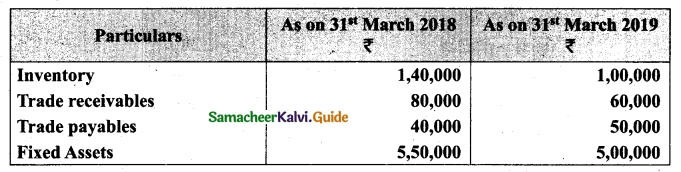

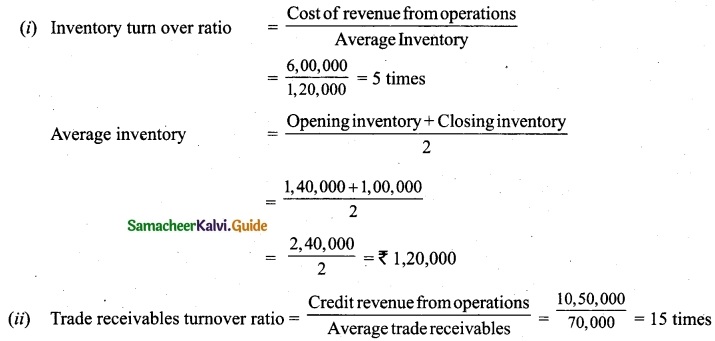

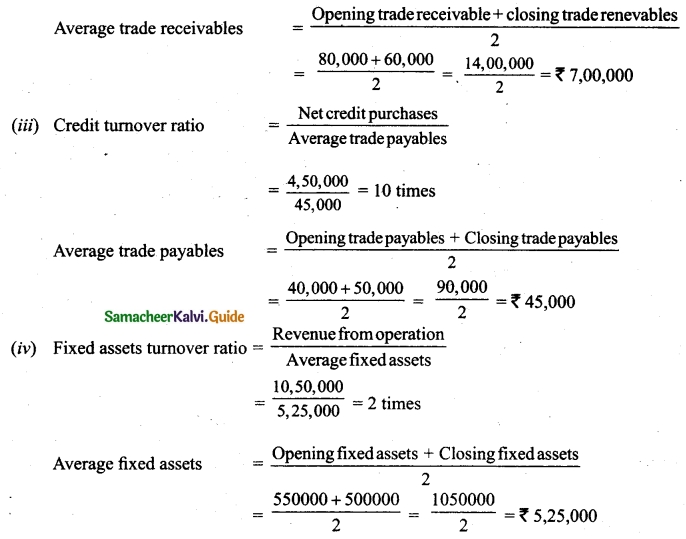

(b) Calculate

(i) Inventory turnover ratio

(ii) Trade receivable turnover ratio

(iii) Trade payable turnover ratio and

(iv) Fixed assets turnover ratio from the following information obtained from Delphi Ltd.

Additional information:

Revenue from operations for the year Rs 10,50,000

Purchases for the year Rs 4,50,000

Cost of revenue from operations Rs 6,00,000

Assume that sales and purchase are for credit

Answer:

![]()