Students can Download Tamil Nadu 11th Accountancy Model Question Paper 1 English Medium Pdf, Tamil Nadu 11th Accountancy Model Question Papers helps you to revise the complete Tamilnadu State Board New Syllabus, helps students complete homework assignments and to score high marks in board exams.

TN State Board 11th Accountancy Model Question Paper 1 English Medium

General Instructions:

- The question paper comprises of four parts.

- You are to attempt all the parts. An internal choice of questions is provided wherever applicable.

- All questions of Part I, II, III and IV are to be attempted separately.

- Question numbers 1 to 20 in Part I are Multiple Choice Questions of one mark each.

These are to be answered by choosing the most suitable answer from the given four alternatives and writing the option code and the corresponding answer - Question numbers 21 to 30 in Part II are two-mark questions. These are to be answered in about one or two sentences.

- Question numbers 31 to 40 in Part III are three-mark questions. These are to be answered in above three to five short sentences.

- Question numbers 41 to 47 in Part IV are five-mark questions. These are to be answered in detail Draw diagrams wherever necessary.

Time: 3:00 Hours

Maximum Marks: 90

PART – I

Answer all the questions. Choose the correct answer: [20 × 1 = 20]

Question 1.

Which one is the function of Accounting?

(a) Decision making

(b) Systematic records

(c) Legal evidence

(d) Preparation of balance sheet

Answer:

(a) Decision making

![]()

Question 2.

………………….. is the capability of a person or an enterprise to pay the debts.

(a) Solvency

(b) Creditor

(c) Bad debts

(d) Income

Answer:

(a) Solvency

Question 3.

The first step in the accounting process is …………………….. and recording.

(a) Book – keeping

(b) Identifying

(c) Accountancy

(d) Journal

Answer:

(b) Identifying

![]()

Question 4.

………………………. concept implies that only those transactions, which can be expressed in terms of money are recorded in the accounts.

(a) Money measurement concept

(b) Business entity concept

(c) Going concern concept

(d) Cost concept

Answer:

(a) Money measurement concept

Question 5.

CDM expands ……………………..

(a) Cash Deposit Machine

(b) Credit Debts Method

(c) Commerce Document Mode

(d) None of these

Answer:

(a) Cash Deposit Machine

![]()

Question 6.

Which one is the owner’s equity?

(a) Creditors

(b) Bank

(c) Capital

(d) Debtors

Answer:

(c) Capital

Question 7.

The process of recording in the ledger is called ………………………

(a) Journal

(b) Journalising

(c) Ledger

(d) Posting

Answer:

(d) Posting

Question 8.

Total of debit = Total of credit = ?

(a) Debit balance

(b) Credit balance

(c) Nil balance

(d) To balance bld

Answer:

(c) Nil balance

![]()

Question 9.

Which one is in correct order (ascending)?

(a) Journal, ledger, trial balance

(b) Trial balance, journal, ledger

(c) Ledger, journal, trial balance

(d) Trial balance, ledger, journal

Answer:

(a) Journal, ledger, trial balance

Question 10.

Subsidiary books (special journal) for entering ……………………..

(a) Cash transactions

(b) Non – cash transactions

(c) Both

(d) Journal proper

Answer:

(b) Non – cash transactions

Question 11.

………………………. serves as both journal and ledger.

(a) Cash book

(b) Sales book

(c) Purchases book

(d) All of these

Answer:

(a) Cash book

![]()

Question 12.

Cash book shows debit balance means ……………………..

(a) Favourable balance

(b) Overdraft

(c) Negative balance

(d) None of these

Answer:

(a) Favourable balance

Question 13.

The total of sales book ₹9,240 was debited in the sales account as ₹9,420.

(a) Error of commission

(b) Error of omission

(c) Error of partial omission

(d) Error of principle

Answer:

(a) Error of commission

Question 14.

……………………… assets have a long span of life.

(a) Bank

(b) Cash

(c) Debtors

(d) Fixed assets

Answer:

(d) Fixed assets

![]()

Question 15.

The amount of depreciation goes on decreasing year after year …………………….

(a) Revaluation method

(b) Written down value method

(c) Straight line method

(d) Depletion method

Answer:

(b) Written down value method

Question 16.

Overhaul expenses is an example for …………………………

(a) Capital expenditure

(b) Revenue expenditure

(c) Deferred revenue expenditure

(d) Capital receipts

Answer:

(a) Capital expenditure

![]()

Question 17.

……………………….. is the arrangement of various assets and liabilities in a proper order.

(a) Marshalling

(b) Balance sheet

(c) Assets

(d) Liabilities

Answer:

(a) Marshalling

Question 18.

Income tax paid by the business is not a business expenditure and is treated as ………………………..

(a) Capital

(b) Drawings

(c) Revenue

(d) Expense

Answer:

(b) Drawings

Question 19.

……………………….. is the programming software.

(a) DOS

(b) Windows

(c) UBUNTU

(d) PASCAL

Answer:

(d) PASCAL

![]()

Question 20.

………………………. is the application software.

(a) PASCAL

(b) COBOL

(c) DOS

(d) MS – Office

Answer:

(d) MS – Office

PART – II

Answer any seven questions in which question No. 21 is compulsory: [7 × 2 = 14]

Question 21.

Define Accounting?

Answer:

American Accounting Association has defined accounting as “the process of identifying, measuring and communicating economic information to permit informed judgements and decisions by users of the information.”

![]()

Question 22.

What are source documents?

Answer:

Source documents are the authentic evidences of financial transactions. These documents show the nature of transactions the date, the amount and the parties involved. Source documents include cash receipts, invoice, debit note, credit note, pay-in-slip, salary bills, wage bills, cheque record slips etc.

Question 23.

What are the methods of preparation of trial balance?

Answer:

- Balance method

- Total method

- Total and balance method

![]()

Question 24.

Mention four types of subsidiary books?

Answer:

- Purchases book

- Sales book

- Purchases return book

- Sales return book

Question 25.

What is meant by Bank overdraft?

Answer:

It is not possible to have unfavourable cash balance in the cash book. But, it is possible to have unfavourable balance in the bank account. When the business is not having sufficient money in its bank account, it can borrow money from the bank.

Question 26.

What is meant by rectification of errors?

Answer:

Correction of errors in the books of accounts is not done by erasing, rewriting or striking the figures which are incorrect. Correcting the errors that has occured is called rectification. Appropriate entry is passed or suitable explanatory note is written in the respective account or accounts to neutralise the effect of errors.

![]()

Question 27.

What is meant by depreciation?

Answer:

The process of allocation of the relevant cost of fixed asset over its useful life is known as depreciation. It is an allocation of cost against the benefit derived from a fixed asset during an accounting period.

Question 28.

What is meant by revenue expenditure?

Answer:

The expenditure incurred for day to day running of the business or for maintaining the earning capacity of the business is known as revenue expenditure. It is recurring in nature. It is incurred to generate revenue for a particular accounting period.

![]()

Question 29.

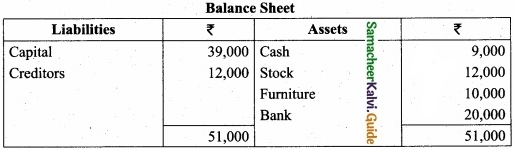

Prepare Trading account in the books of Siva Shankar from the following figures:

Opening Stock ₹1,500; Šales ₹4,600; Purchases ₹3,500; Closing Stock ₹1,300:

Answer:

Question 30.

What is CAS?

Answer:

Computerised Accounting System (CAS) refers to the system of maintaining accounts using computers. It involves the processing of accounting transactions through the use of hardware and software in order to keep and produce accounting records and reports.

PART – III

Answer any seven questions in which question No. 31 is compulsory: [7 × 3 = 21]

Question 31.

How can we classify the components of CAS?

Answer:

- Hardware

- Software

- People

- Procedure

- Data

- Connectivity

![]()

Question 32.

Classify the following items into capital or revenue?

- ₹50,000 spent for railway siding.

- Loss on sale of old furniture ₹200.

- Carriage paid on goods sold ₹500.

Answer:

- Capital

- Revenue

- Revenue

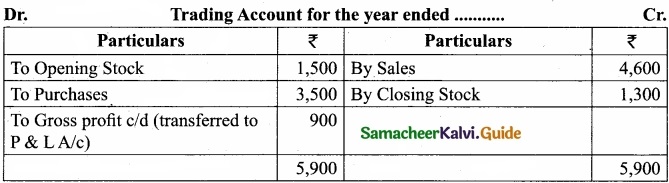

Question 33.

An asset is purchased for ₹50,000. The rate of depreciation is 15% p.a. Calculate the annual depreciation for the first two years under diminishing balance method?

Answer:

Caluculation of depreciation for first two years. (On diminishing balance method).

![]()

Question 34.

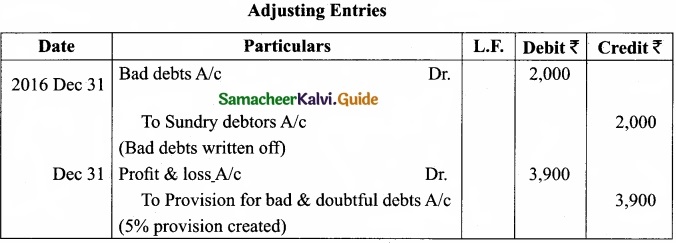

On 1st January, 2016, provision for doubtful debts account had a balance of ₹3,000. On December 31, 2016 sundry debtors amounted to ₹80,000. During the year, bad debts

to be written off were ₹2,000. A provision for 5% was required for next year. Pass adjusting journal entries?

Answer:

Question 35.

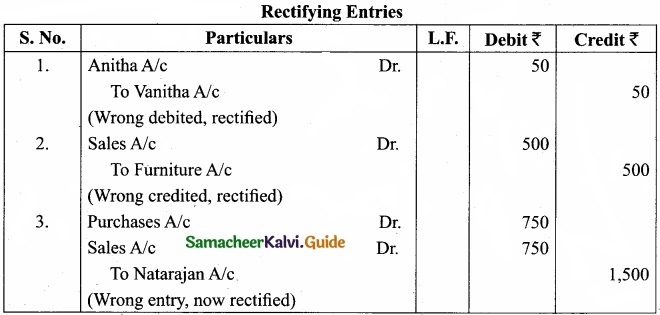

The following errors were located after the preparation of the trial balance. Rectify them.

- Paid ₹50 to Anitha was wrongly debited to Vanitha account.

- Sale of furniture for ₹500 was credited to sales account.

- Purchased goods from Natarajan on credit for ₹750 was wrongly passed through sales book.

Answer:

![]()

Question 36.

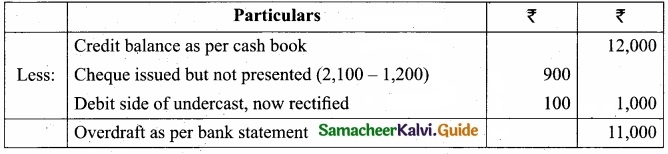

From the following particulars of Siva and company, prepare a bank reconciliation statement as on 31st December, 2017.

- Credit balance as per cash book ₹12,000.

- A cheque of ₹1,200 issued and presented for payment to the bank, wrongly credited in the cash book as ₹2,100.

- Debit side of bank statement was undercast by ₹100.

Answer:

Bank Reconciliation Statement of Siva & company as on 31st December, 2017

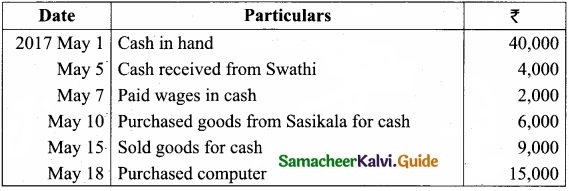

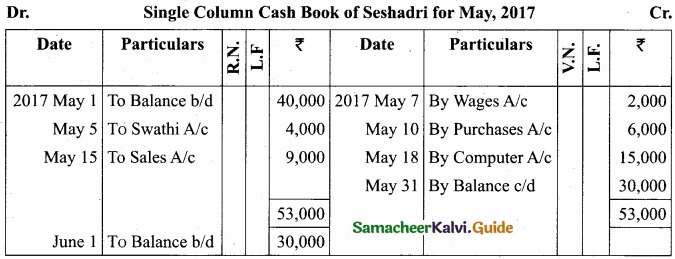

Question 37.

Enter the following transactions in a single column cash book of Seshadri for May, 2017?

Answer:

![]()

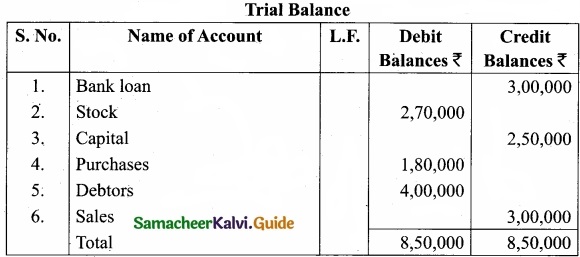

Question 38.

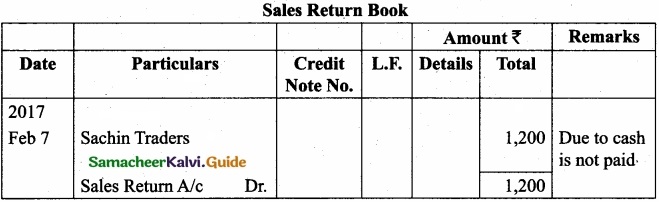

Prepare the trial balance from the following information:

Bank loan ₹3,00,000; Stock ₹2,70,000; Capital ₹2,50,000; Purchases ₹1,80,000; Debtors ₹4,00,000; ₹Sales 3,00,000.

Answer:

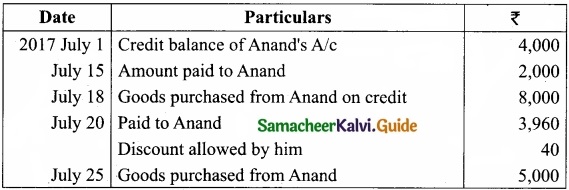

Question 39.

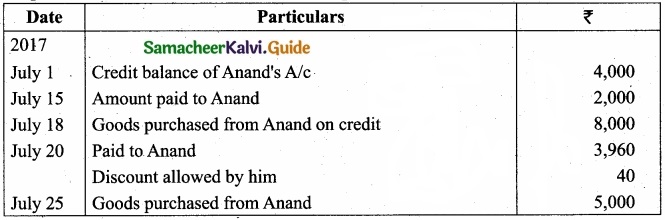

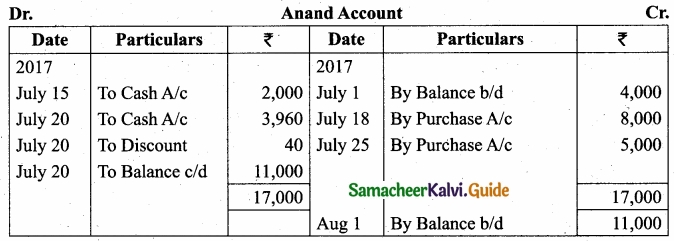

Prepare Anand’s account from the following data:

Answer:

![]()

Question 40.

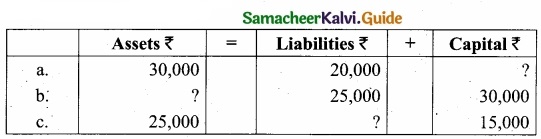

Complete the followings:

Answer:

Completed informations:

PART – IV

Answer all the questions: [7 × 5 = 35]

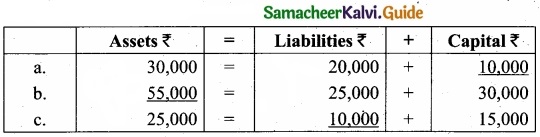

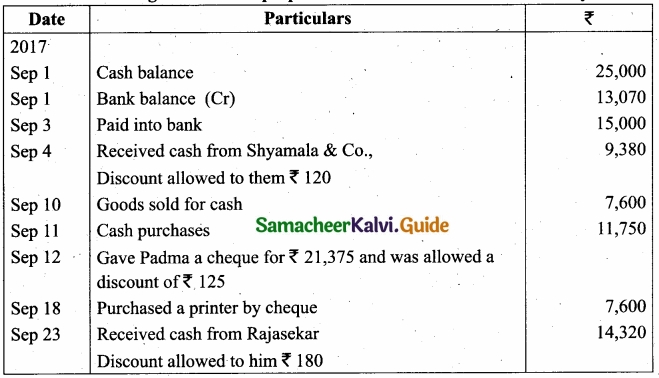

Question 41 (a).

Mr. Vivek took a loan of ₹2,00,000 from State Bank of India, Chennai and number of installments is 84 months. Calculate the rate assuming payments ₹3,300 per month using appropriate function?

Answer:

Procedure:

1. Open a new spread sheet in MS – Excel

2. Enter values in the cells as given below

3. Compare RATE in the cell B6 by the formula

= RATE (B1, B2, B3, B4, B5) * 12

Answer 10%

[OR]

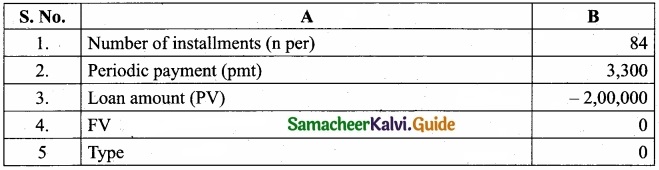

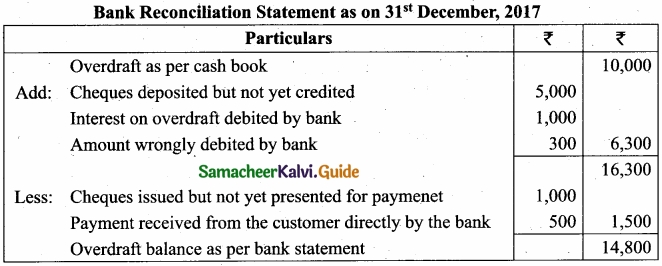

(b) From the following information, prepare bank reconciliation statement as on 31st December, 2017 to find out the balance as per bank statement?

Answer:

![]()

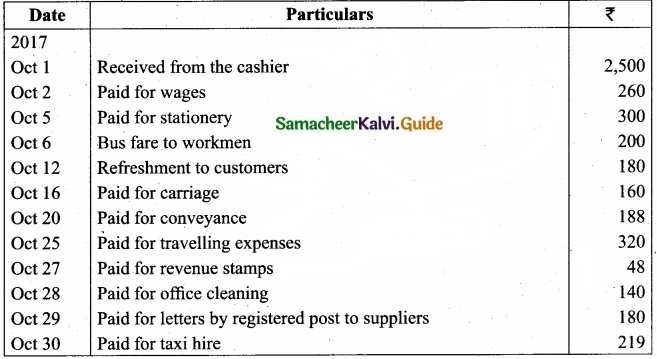

Question 42 (a).

From the following information prepare an analytical Petty cash book under imprest system?

Answer:

[OR]

(b) Rectify the following errors assuming that the trial balance is yet to be prepared?

- Sales book was undercast by ₹400.

- Sales returns book was overcast by ₹500.

- Purchases book was undercast by ₹600.

- Purchases returns book was overcast by ₹700.

- Bills receivable book was undercast by ₹800.

Answer:

- Sales account should be credited with ₹400.

- Sales returns account should be credited with ₹500.

- Purchases account should be debited with ₹600.

- Purchases returns account should be debited with ₹700.

- Bills receivable account should be debited with ₹800.

![]()

Question 43 (a).

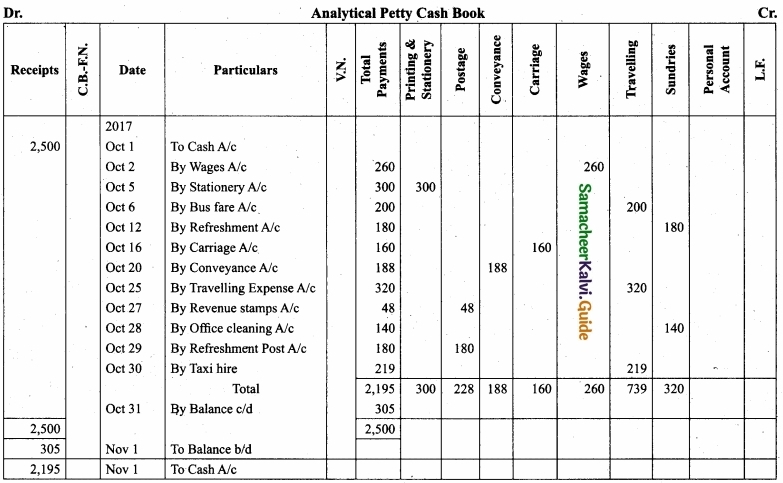

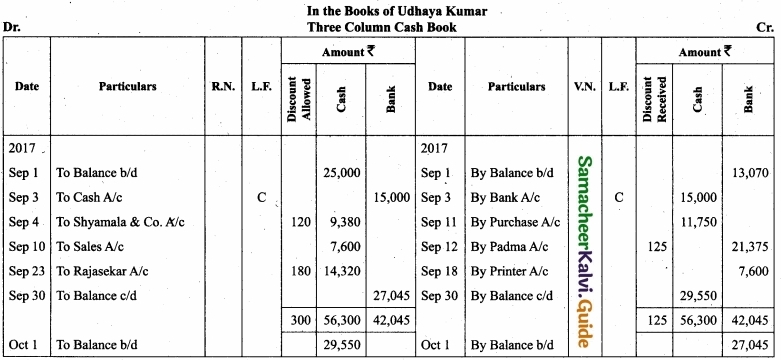

From the following transactions prepare three column cash book of Udhayakumar?

Answer:

[OR]

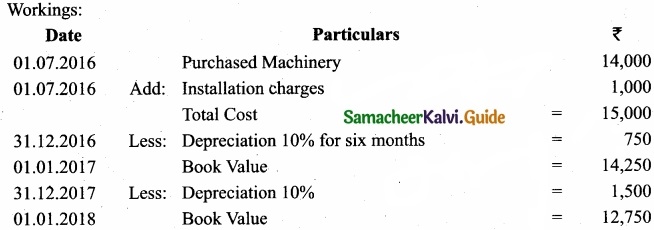

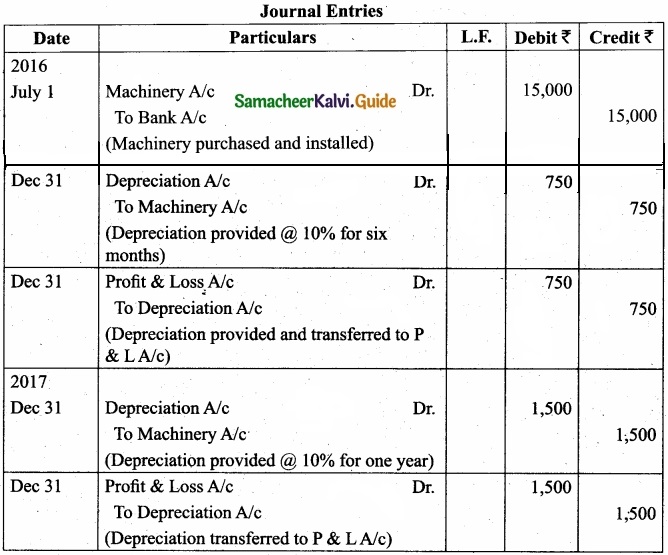

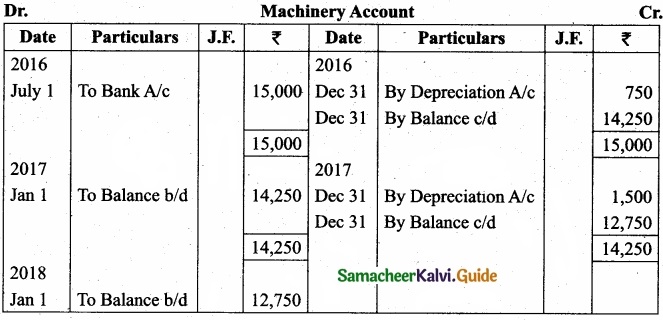

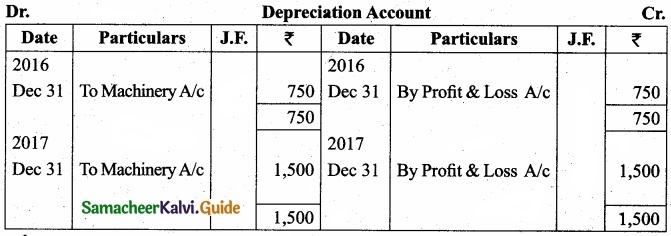

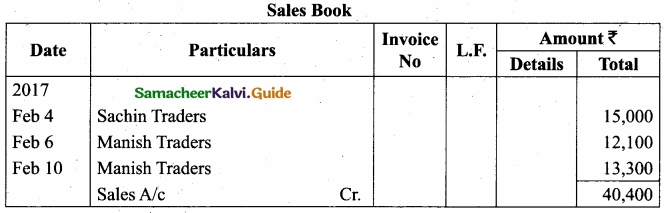

(b) Ramu Brothers purchased a machine on 1st July 2016 at a cost of ₹14,000 and spent ₹1,000 on its installation. The firm writes off depreciation at 10% of original cost every year. The books are closed on 31st December every year. Give journal entries and prepare machinery account and depreciation account for 2 years?

Answer:

![]()

Question 44 (a).

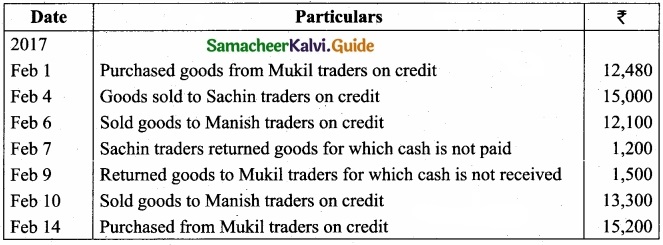

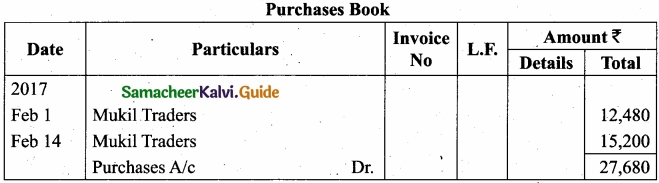

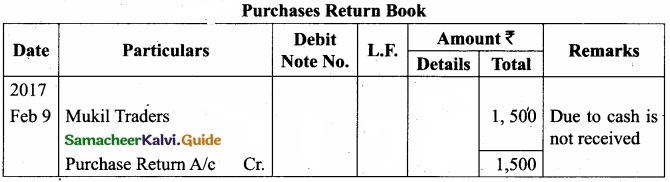

Prepare necessary subsidiary books in the books of Niranjan from the following transactions for the month of February, 2017?

Answer:

(b) Classify the following receipts into capital and revenue?

- Sale proceeds of goods ₹75,000.

- Loan borrowed from bank ₹2,50,000.

- Sale of investment ₹1,20,000.

- Commission received ₹30,000.

- ₹1,400 wages paid in connection with the erection of new machinery.

Answer:

- Revenue

- Capital

- Capital

- Revenue

- Capital

![]()

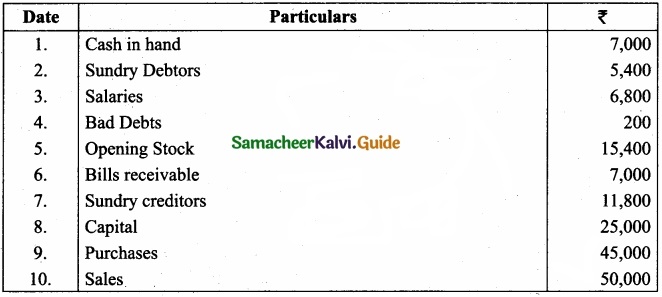

Question 45 (a).

Prepare the trial balance from the following balances of Babu as on 31st March, 2016?

Answer:

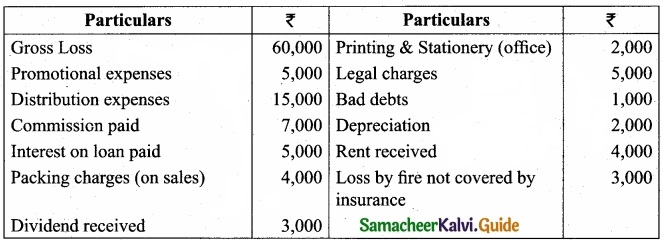

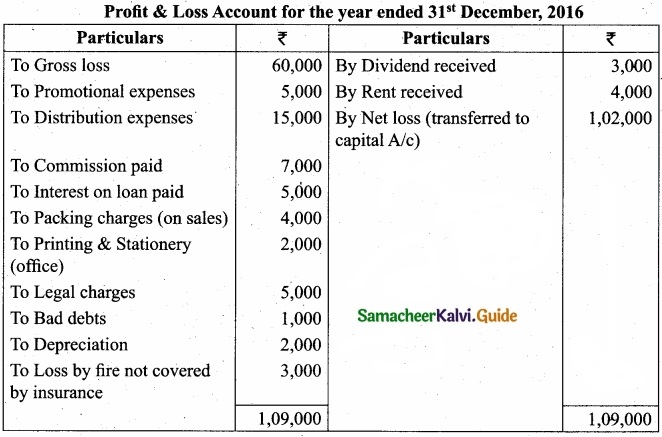

(b) From the following information, prepare Profit & Loss account for the year ending 31st December,2016?

Answer:

![]()

Question 46 (a).

Prepare Anand’s account from the following details?

Answer:

[OR]

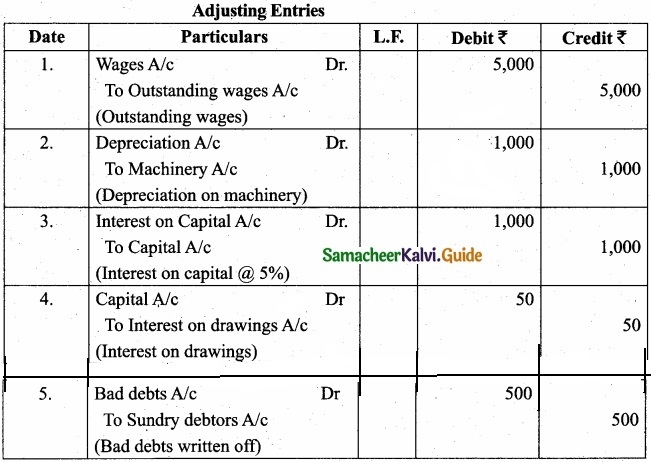

(b) From the following adjustments, pass adjusting entries?

- Outstanding wages ₹5,000.

- Depreciation on machinery ₹1,000.

- Interest on capital @ 5% on capital ₹20,000.

- Interest on drawings ₹50.

- Write off bad debts ₹500.

Answer:

![]()

Question 47 (a).

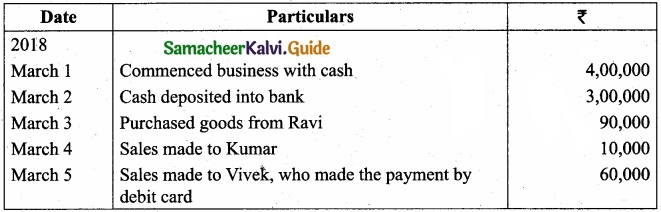

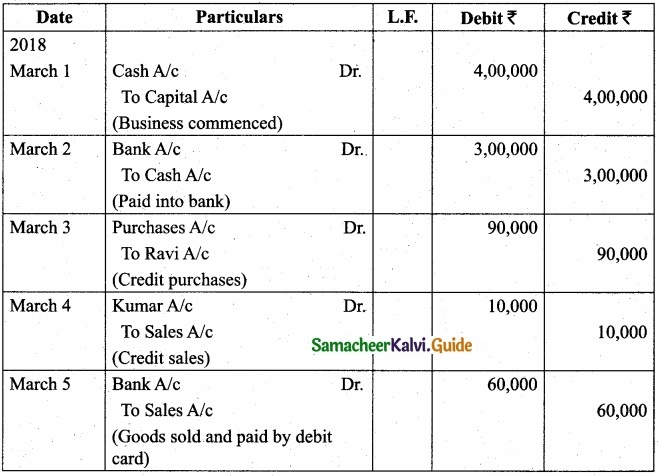

Pass Journal entries for the following transactions for the month of March, 2018?

Answer:

[OR]

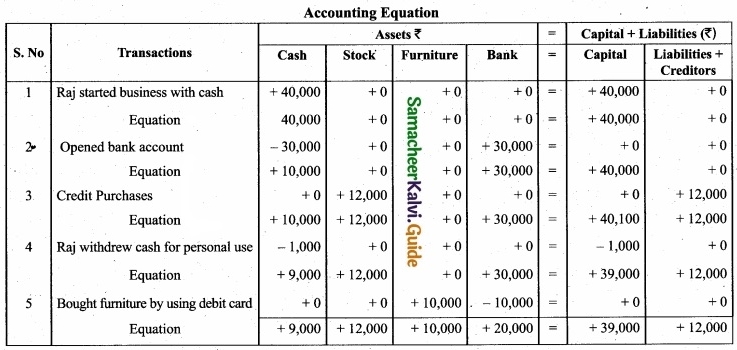

(b) Prepare accounting equation from the following transactions and show balance sheet also?

- Raj started business with cash ₹40,000.

- Opened bank account with a deposit of ₹30,000.

- Bought goods from Han on credit for ₹12,000

- Raj withdrew cash for personal use ₹1,000.

- Bought furniture by using debit card ₹10,000.

Answer: