Tamilnadu State Board New Syllabus Samacheer Kalvi 12th Economics Guide Pdf Chapter 9 Fiscal Economics Text Book Back Questions and Answers, Notes.

Tamilnadu Samacheer Kalvi 12th Economics Solutions Chapter 9 Fiscal Economics

12th Economics Guide Fiscal Economics Text Book Questions and Answers

PART-A

Multiple Choice questions

Question 1.

The modern state is

a) Laissez-faire state

b) Aristocratic state

c) Welfare state

d) Police state

Answer:

c) Welfare state

Question 2.

One of the following is NOT a feature of private finance

a) Balancing of income and expenditure

b) Secrecy

c) Saving some part of income

d) Publicity

Answer:

d) Publicity

![]()

Question 3.

The tax possesses the following characteristics

a) Compulsory

b) No quid pro quo

c) Failure to pay is offence

d) All the above

Answer:

d) All the above

Question 4.

Which of the following canons of taxation was not listed by Adam smith?

a) Canon of equality

b) Canon of certainty

c) Canon of convenience

d) Canon of simplicity

Answer:

d) Canon of simplicity

![]()

Question 5.

Consider the following statements and identify the correct ones.

i. Central government does not have exclusive power to impose tax which is not mentioned in state or concurrent list.

ii.The Constitution also provides for transferring certain tax revenues from union list to states.

a) i only

b) ii only

c) both

d) none

Answer:

b) ii only

Question 6.

GST is equivalence of

a) Sales tax

b) Corporation tax

c) Income tax

d) Local tax

Answer:

a) Sales tax

![]()

Question 7.

The direct tax has the following merits except

a) equity

b) convenient

c) certainty

d) civic consciousness

Answer:

b) convenient

Question 8.

Which of the following is a direct tax?

a) Excise duty

b) Income tax

c) Customs duty

d) Service tax

Answer:

b) Income tax

![]()

Question 9.

Which of the following is not a tax under Union list?

a) Personal Income tax

b) Corporation tax

c) Agricultural Income tax

d) Excise duty

Answer:

c) Agricultural Income tax

Question 10.

” Revenue Receipts” of the government do not include

a) Interest

b) Profits and dividents

c) Recoveries and loans

d) Rent from property

Answer:

d) Rent from property

![]()

Question 11.

The difference between revenue expenditure and revenue receipts is

a) Revenue deficit

b) Fiscal deficit

c) Budget deficit

d) primary deficit

Answer:

a) Revenue deficit

Question 12.

The difference between total expenditure and total receipts including loans and other liabilities is called

a) Fiscal deficit

b) Budget deficit

c) Primary deficit

d) Revenue deficit

Answer:

a) Fiscal deficit

![]()

Question 13.

The primary purpose of deficit financing is

a) Economic development

b) Economic stability

c) Economic equality

d) Employment generation

Answer:

a) Economic development

Question 14.

Deficit budget means

a) An excess of government’s revenue over expenditure

b) An excess of government’s current expenditure over its current revenue

c) An excess of government’s total expenditure over its total revenue

d) None of above

Answer:

c) An excess of government’s total expenditure over its total revenue

![]()

Question 15.

Methods of repayment of public debt is

a) Conversion

b) Sinking fund

c) Funded debt

d) All these

Answer:

d) All these

Question 16.

Conversion of public debt means exchange of

a) new bonds for the old ones

b) low interest bonds for higher interest bonds

c) Long term bonds for short term bonds

d) All the above

Answer:

b) low interest bonds for higher interest bonds

![]()

Question 17.

The word budget has been derived from the French word ” bougette” which means

a) A small bag

b) An empty box

c) A box with papers

d) None of the aboye

Answer:

a) A small bag

Question 18.

Which one of the following deficits does not consider borrowing as a receipt?

a) Revenue deficit

b) Budgetary deficit

c) Fiscal deficit

d) Primary deficit

Answer:

c) Fiscal deficit

![]()

Question 19.

Finance commission determines

a) The finances of Government of India

b) The resources transfer to the states

c) The resources transfer to the various departments

d) None of the above

Answer:

b) The resources transfer to the states

Question 20.

Consider the following statements and identify the right ones.

i. The finance commission is appointed by the president

ii. The tenure of finance commission is five years.

a) i only

b) ii only

c) both

d) none

Answer:

c) both

![]()

PART -B

Two Mark Questions

Question 21.

Define Public finance.

Answer:

Public finance is an investigation into the nature and principles of state revenue and expenditure. – Adam Smith

Question 22.

What is public revenue?

Answer:

Public Revenue:

Public revenue deals with the methods of raising public revenue such as tax and non-tax, the principles of taxation, rates of taxation, impact, incidence and shifting of taxes and their effects.

![]()

Question 23.

Differentiate tax and fee.

Answer:

A tax is a compulsory payment made to the government. But, there is no compulsion involved in the case of fees.

Question 24.

Write a short note on a Zero-based budget.

Answer:

Zero Base Budget:

- The Government of India presented Zero-Base-Budgeting (ZBB first) in 1987-88.

- It involves fresh evaluation of expenditure in the Government budget, assuming it as a new item.

- The review has been made to provide justification or otherwise for the project as a whole in the light of the socio-economic objectives which have been already set up for this project and as well as in view of the priorities of the society.

Question 25.

Give two examples for direct tax.

Answer:

- Income Tax

- Corporation Tax.

![]()

Question 26.

What are the components of GST?

Answer:

- CGST – collected by the central government on an intrastate sale SGST – collected by the state government on an intrastate sale.

- IGST – collected by the central government for interstate sale.

Question 27.

What do you mean by public debt?

Answer:

- The state has to supplement the traditional revenue sources with borrowing from individuals, and institutions within and outside the country.

- The amount of borrowing is huge in the underdeveloped countries to finance development activities.

- The debt burden is a big problem and most of the countries are in a debt trap.

PART -C

Three Mark Questions

Question 28.

Describe canons of Taxation.

Answer:

According to Adam Smith, there are four canons or maxims of taxation. They are as follows:

Canons of Taxation:

- Economical

- Equitable

- Convenient

- Certain

- (Efficient and Flexible)

1. Canon of Ability:

- The Government should impose a tax in such a way that the people have to pay taxes according to their ability.

- In such a case, a rich person should pay more tax compared to a middle-class person or a poor person.

2. Canon of Certainty:

- The Government must ensure that there is no uncertainty regarding the rate of tax or the time of payment.

- If the Government collects taxes arbitrarily, then these will adversely affect the efficiency of the people and their working ability too.

3. Canon of Convenience:

- The method of tax collection and the timing of the tax payment should suit the convenience of the people.

- The Government should make convenient arrangements for all the taxpayers to pay the taxes without difficulty.

4. Canon of Economy:

- The Government has to spend money for collecting taxes, for example, salaries are given to the persons who are responsible for collecting taxes.

- The taxes, where collection costs are more are considered bad taxes.

- Hence, according to Smith, the Government should impose only those taxes whose collection costs are very less and cheap.

Question 29.

Mention any three similarities between public finance and private finance.

Answer:

- Rationality: Both public finance and private finance are based on rationality. Maximization of welfare and least cost factor combination underlie both.

- Limit to borrowing: Both have to apply restraint with regard to borrowing. There is a limit to deficit financing by the state also.

- Resource utilization: Both the private and public sectors have limited resources at their disposal and make optimum use of it.

![]()

Question 30.

What are the functions of a modern state?

Answer:

The functions of a modem state are.

- Defense – To protect the people

- Judiciary – Rendering Justice and settlement of disputes

- Enterprises – Regulation and control of the private enterprise

- Social welfare – provision of social goods.

- Infrastructure – Creating social and economic infrastructure

- Macroeconomic policy

- Social Justice – Redistribution of income

- Control of monopoly

Question 31.

State any three characteristics of taxation.

Answer:

Characteristics of Tax:

- A tax is a compulsory payment made to the government. People on whom a tax is imposed must pay the tax. Refusal to pay the tax is a punishable offense.

- There is no quid pro quo between a taxpayer and public authorities. This means that the taxpayer cannot claim any specific benefit against the payment of a tax.

- Every tax involves some sacrifice on part of the taxpayer.

- A tax is not levied as a fine or penalty for breaking the law.

Question 32.

Point out any three differences between direct tax and indirect tax.

Answer:

|

Direct Tax |

Indirect Tax |

| 1. progressive tax | Regressive tax |

| 2. Tax evasion is possible | Tax evasion is hardly possible |

| 3. cannot be shifted | cannot be shifted |

Question 33.

What is the primary deficit?

Answer:

Primary Deficit:

- Primary deficit is equal to fiscal deficit minus interest payments.

- It shows the real burden of the government and it does not include the interest burden on loans taken in the past.

- Thus, primary deficit reflects the borrowing requirement of the government exclusive of interest payments.

- Primary Deficit (PD) = Fiscal deficit (PD) – Interest Payment (IP)

Question 34.

Mention any three methods or redemption of public debt.

Answer:

- Budgetary surplus: When the government presents a surplus budget, it can be utilized for repaying the debt.

- Terminal Annuity: In this method, the government pays off the public debt on the basis of terminal annuity in equal annual installments.

- Reduction in Rate of Interest: Another method of debt redemption is the compulsory reduction in the rate of interest, during the time of financial crisis.

PART – D

Five Mark Questions

Question 35.

Explain the scope of public finance.

Answer:

In modern times, the subject ‘Public Finance includes five major subdivisions, they are

- Public Revenue:

Public revenue deals with the methods of raising public revenue such as tax and non-tax, the principles of taxation, rates of taxation, impact, incidence and shifting of taxes and their effects. - Public Expenditure:

This part studies the fundamental principles that govern government expenditure, effects of public expenditure, and control of public expenditure. - Public Debt:

Public debt deals with the methods of raising loans from internal and external sources. The burden, effects, and redemption of public debt fall under this head. - Financial Administration:

This part deals with the study of the different aspects of public budget. The budget is the Annual master financial plan of the government. - Fiscal policy:

Taxes, Subsidies, public debt and public expenditure are the instruments of fiscal policy.

![]()

Question 36.

Bring out the merits of indirect taxes over direct taxes.

Answer:

Merits of Direct Taxes:

(I) Equity:

- Direct taxes are progressive i.e. rate of tax varies according to tax base.

- For example, income tax satisfies the canon of equity.

(II) Certainty:

- Canon of certainty can be ensured by direct taxes.

- For example, an income tax payer knows when and at what rate he has to pay income tax.

(III) Elasticity:

- Direct taxes also satisfy the canon of elasticity.

- Income tax is income elastic in nature. As income level increases, the tax revenue to the Government also increases automatically.

(IV) Economy:

- The cost of collection of direct taxes is relatively low.

- The tax payers pay the tax directly to the state.

Merits of Indirect Taxes:

(I) Wider Coverage:

- All the consumers, whether they are rich or poor, have to pay indirect taxes.

- For this reason, it is said that indirect taxes can cover more people than direct taxes.

- For example, in India everybody pays indirect tax as against just 2 percent paying income tax.

(I) Equitable:

The indirect tax satisfies the canon of equity when higher tax is imposed on luxuries used by rich people.

(II) Economical:

- Cost of collection is less as producers and retailers collect tax and pay to the Government.

- The traders act as honorary tax collectors.

(IV) Checks harmful consumption:

- The Government imposes indirect taxes on those commodities which are harmful to health

- e.g. tobacco, liquor etc.

- They are known as sin taxes.

(V) Convenient:

- Indirect taxes are levied on commodities and services.

- Whenever consumers make a purchase, they pay tax along with the price.

- They do not feel the pinch of paying tax.

![]()

Question 38.

State and Explain instruments of fiscal policy:

Answer:

Fiscal policy is implemented through fiscal instruments also called’ fiscal tools’ or fiscal levers.

1. Taxation:

Taxes transfer income from the people to the Government. Taxes are either direct or indirect. An increase in tax reduces disposable income. So taxation should be raised to control inflation. During the depression, taxes are to be reduced.

2. Public Expenditure:

Public expenditure raises wages and salaries of the employees and thereby the aggregate demand for goods and services. Hence public expenditure is raised to fight recession and reduced to control inflation.

3. Public debt:

When government borrows by floating a loan, there is transfer of funds from the public to the Government At the time of interest payment and repayment of public debt, funds are transferred from Government to public.

Question 39.

Explain the principles of federal finance.

Answer:

Principles of Federal Finance:

In the case of a federal system of finance, the following main principles must be applied:

- Principle of Independence.

- Principle of Equity.

- Principle of Uniformity.

- Principle of Adequacy.

- Principle of Fiscal Access.

- Principle of Integration and coordination.

- Principle of Efficiency.

- Principle of Administrative Economy.

- Principle of Accountability.

1. Principle of Independence:

(i) Under the system of federal finance, a Government should be autonomous and free about the internal financial matters concerned.

(ii) It means each Government should have separate sources of revenue, authority to levy taxes, to borrow money and to meet the expenditure.

3. The Government should normally enjoy autonomy in fiscal matters.

2. Principle of Equity:

From the point of view of equity, the resources should be distributed among the different states so that each state receives a fair share of revenue.

3. Principle of Uniformity:

In a federal system, each state should contribute equal tax payments for federal finance.

4. Principle of Adequacy of Resources:

- The principle of adequacy means that the resources of each Government i.e. Central and State should be adequate to carry out its functions effectively.

- Here adequacy must be decided with reference to both current as well as future needs.

- Besides, the resources should be elastic in order to meet the growing needs and unforeseen expenditure like war, floods etc.

5. Principle of Fiscal Access:

(i) In a federal system, there should be possibility for the Central and State Governments to develop new source of revenue within their prescribed fields to meet the growing financial needs.

(ii) In nutshell, the resources should grow with the increase in the responsibilities of the . Government.

6. Principle of Integration and coordination:

- The financial system as a whole should be well integrated.

- There should be perfect coordination among different layers of the financial system of the country.

- Then only the federal system will survive.

- This should be done in such a way to promote the overall economic development of the country.

7. Principle of Efficiency:

- The financial system should be well organized and efficiently administered.

- Double taxation should be avoided.

8. Principle of Administrative Economy:

- Economy is the important criterion of any federal financial system.

- That is, the cost of collection should be at the minimum level and the major portion of revenue should be made available for the other expenditure outlays of the Governments.

9. Principle of Accountability:

Each Government should be accountable to its own legislature for its financial decisions i.e. the Central to the Parliament and the State to the Assembly.

![]()

Question 40.

Describe the various types of deficit in budget.

Answer:

1. Revenue Deficit:

It refers to the excess of the government revenue expenditure over revenue re

ceipts. It does not consider capital receipts and capital expenditure. Revenue deficit implies that the government is living beyond its means to conduct day- today operations.

Revenue deficit (RD) =

Total Revenue Expenditure (RE) – Total Revenue Receipts (RR)

When RE – RR >0

2. Budget Deficit:

Budget deficit is the difference between total receipts and total expenditure.

Budget deficit = Total Expenditure – Total Revenue

3. Fiscal deficit ,

Fiscal deficit (FD) =

Budget deficit + Governments Market borrowing and liabilities.

4. Primary deficit:

Primary deficit = Fiscal deficit (FD) – Interest payment (IP)

It shows the real burden of the government and it does not include the interest burden on loans taken in the past. Thus, primary deficit reflects borrowing requirement of the government exclusive of interest payment.

Question 41.

What are the reasons for the recent growth in public expenditure?

Answer:

Causes for the Increase in Government Expenditure:

The modem state is a welfare state. In a welfare state, the government has to perform several functions viz Social, economic and political. These activities are the cause for increasing public expenditure.

(I) Population Growth:

1. During the past 67 years of planning, the population of India has increased from 36.1 crore in 1951, to 121 crore in 2011.

2. The growth in population requires massive investment in health and education, law and order, etc.

3. Young population requires increasing expenditure on education & youth services, whereas the aging population requires transfer payments like old age pension, social security & health facilities.

(II) Defence Expenditure:

- There has been enormous increase in defence expenditure in India during planning period.

- The defence expenditure has been increasing tremendously due to modernisation of defence equipment.

- The defence expenditure of the government was 10,874 crores in 1990-91 which increased significantly to 2,95,511 crores in 2018-19.

(III) Government Subsidies:

1. The Government of India has been providing subsidies on a number of items such as food, fertilizers, interest on priority sector lending, exports, education, etc.

2. Because of the massive amounts of subsidies, public expenditure has increased manifold.

(IV) Debt Servicing:

The government has been borrowing heavily both from internal and external sources, As a result, the government has to make huge amounts of repayment towards debt servicing.

(V) Development Projects:

1. The government has been undertaking various development projects such as irrigation, iron and steel, heavy machinery, power, telecommunications, etc.

2. The development projects involve huge investments.

(VI) Urbanisation:

- There has been an increase in urbanization.

- In 1950 – 51 about 17% of the population was urban-based.

- Now the urban population has increased to about 43%.

- There are more than 54 cities above one million population.

- The increase in urbanization requires heavy expenditure on law and order, education and civic amenities.

(VII) Industrialisation:

- Setting up of basic and heavy industries involves a huge capital and long gestation period.

- It is the government which starts such industries in a planned economy.

- The underdeveloped countries need a strong infrastructure like transport, communication, power, fuel, etc.

(VIII) Increase in grants in aid to state and union territories:

There has been a tremendous increase in grant-in-aid to state and union territories to meet natural disasters.

![]()

12th Economics Guide Fiscal Economics Additional Important Questions and Answers

I. Choose the best Answer

Question 1.

“Public finance is one of those subjects that lie on the borderline between Economics and ……………………….

(a) Finance

(b) Investment

(c) Politics

(d) Money

Answer:

(c) Politics

Question 2.

…………… includes Public Revenue, Expenditure, Debt and Financial Administration.

a) Public Expenditure

b) Public Revenue

c) Public Finance

d) Public Debt

Answer:

c) Public Finance

![]()

Question 3.

The compulsory charge levied by the government is ……………………….

(a) Tax

(b) Loan

(c) Licence

(d) Gifts and grants

Answer:

(a) Tax

Question 4.

As per the 2011 census, the population of India is …………..crore’

a) 112

b) 121

c) 211

d) 36.7

Answer:

b) 121

![]()

Question 5.

………………………. means different sources of government income.

(a) Public finance

(b) Public revenue

(c) Public expenditure

(d) Public credit

Answer:

(b) Public revenue

Question 6.

………………… is a compulsory payment by the citizens to the government to meet the public expenditure.

a) Revenue

b) Tax

c) Debt

d) None of the above

Answer:

b) Tax

![]()

Question 7.

The revenue obtained by the government from sources other than tax is called

a) Non – Tax Revenue

b) Tax

c) Debt

d) Income tax

Answer:

a) Non – Tax Revenue

Question 8.

………………………. deals with the study of income, expenditure, borrowing, and financial administration of the government.

(a) Public Finance

(b) Public Revenue

(c) Public Expenditure

(d) Public Debt

Answer:

(a) Public Finance

Question 9.

The process of repaying a public debt is called …………………

a) Sinking fund

b) Conversion

c) Redemption

d) Annuity

Answer:

c) Redemption

![]()

Question 10.

The modem state is a state.

(a) Revenue

(b) Defence

(c) Government

(d) Welfare

Answer:

(d) Welfare

Question 11.

The Government of India presented Zero – Base Budgeting in …………

a) 1987 -88

b) 1986 – 87

c) 1950 – 51

d) 1978 – 79

Answer:

a) 1987 – 88

![]()

Question 12.

In ………………….. budget, the estimated government expenditure is more than expected revenue.

a) Surplus

b) Balanced

c) Deficit

d) Performance

Answer:

c) Deficit

Question 13.

The first finance commission was set up in ……………………

a) 1950

b) 1951

c) 1956

d) 1960

Answer:

b) 1951

![]()

Question 14.

…………………….. such as irrigation, iron and steel, heavy machinery, power, telecommunications, etc.

(a) Development projects

(b) Investment projects

(c) Finance project

(d) Monetary projects

Answer:

(a) Development projects

Question 15.

The rate of tax increases with the increase in the tax base

a) Regressive tax

b) Progressive tax

c) Direct tax

d) Indirect tax

Answer:

b) Indirect tax

Question 16.

……………………….. is an Indirect tax levied on the supply of goods and services.

(a) Direct Tax

(b) Regressive Tax

(c) GST

(d) Progressive Tax

Answer:

(c) GST

Question 17.

………………………… institutions like UTI, LIC, GIC, etc. also buy the Government bonds.

(a) Financial

(b) Non – Financial

(c) Government

(d) Private

Answer:

(a) Financial

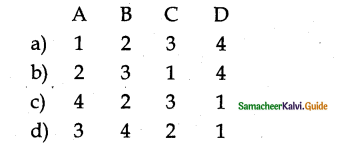

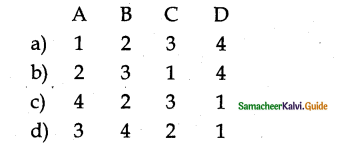

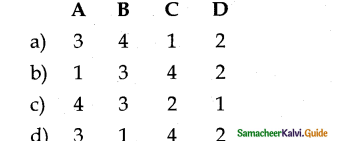

II. Match the following.

Question 1.

A) Public finance – 1) Tax for tax

B) Tax – 2) Fiscal Economics

C) Cess – 3) GST

D) Indirect tax – 4) Compulsory payment

Answer:

b) 2 3 1 4

Question 2.

A) GST – 1) a small leather Bag

B) VAT – 2) Quasi-judicial Body

C) Bougett – 3) Goods and services tax

D) Finance commission – 4) Value Added Tax

Answer:

c) 3 4 12

Question 3.

A) Panchayat – 1) Keynes

B) District Boards – 2) Adam smith

C) New Economics – 3) Revenue village

D) Canons of Taxation – 4) Zila Parishad

Answer :

a) 3 4 12

III. Choose the Correct Pair:

Question 1.

a) Article 282 – Finance commission

b) 15th Finance commission – November 2018

c) State Tax – Customs Tax

d) Central Government Tax – Income tax

Answer:

d) Central Government Tax – Income tax

![]()

Question 2.

a) Balanced Budge – Government Income > Expenditure

b) Performance Budget – Outcome Budget

c) Supplementary Budget – Lame-duck budget

d)Bougett – a small box

Answer:

b) Performance Budget – Outcome Budget

Question 3.

a) Sinking Fund – Walpole

b) Debt conversion – J.M. Keynes

c) Article 112 – State Budget

d) Article 202 – Union Budget

Answer:

a) Sinking Fund – Walpole

IV. Choose the Incorrect Pair:

Question 1.

a) CGST – Collected by the Central Government

b) SGST – Collected by the state Government

c) IGST – Collected by both central and state Government

d) GST – Indirect tax

Answer:

c) IGST – Collected by both central and state Government

![]()

Question 2.

a) Revenue Deficit Total Revenue Expenditure – Total Revenue Receipts

b) Budget Deficit Total Expenditure – Total Revenue

c) Fiscal Deficit Budget deficit + Government‘s market borrowings and liabilities.

d) Primary Deficit – Fiscal Deficit + Interest Payment

Answer:

d) Primary Deficit Fiscal Deficit + Interest Payment

Question 3.

a) Article 269 – Taxes levied and collected by the union but Assigned to the states.

b) Article 268 – Duties levied by the Union but collected and appropriated by the states. .

c) Article 270 – Taxes which are levied, collected, and appropriated by the union.

d) Article 280 – Functions of the Finance committee.

Answer:

c) Article 270- Taxes which are levied, collected, and appropriated by the union.

V. Choose the Correct Statement:

Question 1.

a) Public finance and private finance are similar in operational aspects.

b) “Public finance is an investigation into the nature and principles of the state revenue and expenditure” – Huge Dalton.

c) The Government of India presented Zero – Base – Budgeting in 1987 – 88.

d) Direct taxes are levied on goods and services.

Answer:

c) The Government of India presented Zero – Base – Budgeting in 1987 – 88.

![]()

Question 2.

a) Direct tax is levied on a person’s income and wealth.

b) Direct taxes are regressive in nature.

c) In Indirect tax, the tax burden can be easily shifted to another person.

d) Direct tax is imposed on those commodities which are harmful to health.

Answer:

a) Direct tax is levied on a person’s income and wealth.

Question 3.

a) GST – Central Goods and service tax

b) CGST – Goods and Service Tax

c) SGST – State Goods and Service Tax

d) IGST – Union Territory Goods and Service Tax

Answer :

c) SGST – State Goods and Service Tax

VI. Choose the Incorrect Statement:

Question 1.

a) Taxes on commodities like tobacco, liquor, etc is called sintax.

b) VAT is a one-point tax without cascading effect.

c) Revenue expenditure is classified as plan revenue expenditure and non-plan revenue expenditure.

d) According to the Indian constitution, all money bills must be initiated in the Lower House.

Answer:

b) VAT is a one-point tax without cascading effect.

![]()

Question 2.

a) Revenue deficit is equal to fiscal deficit minus interest payments.

b) Local finance refers to the finance of local bodies in India.

c) During the depression, the Government, increase its spending and reduce taxation.

d) Progressive rates in taxation help to reduce the gap between rich and poor

Answer:

a) Revenue deficit is equal to fiscal deficit minus interest payments.

Question 3.

a) Fluctuations in international trade cause movements in the exchange rate.

b) Taxation reduces disposable income and so aggregate demand.

c) Dalton emphasized government intervention to get the economies out of the Depression.

d) Government expenditure, taxation, and borrowing are the fiscal tools.

Answer:

c) Dalton emphasized government intervention to get the economies out of the Depression.

VII. Pick the odd one out:

Question 1.

a) Canon of Ability

b) Canon of flexibility,

c) Canon of certainty

d) Canon of Economy

Answer:

b) Canon of flexibility

Question 2.

a) Public revenue

b) Public expenditure

c) Financial Administration

d) Social Justice

Answer:

d) Social Justice

![]()

Question 3.

The characteristics of Direct Tax are:

a) Progressive in nature.

b) Incidence and impact on different person.

c) Tax Evasion is possible

d) Helps to control inflation.

Answer:

b) Incidence and impact on different person.

VIII. Choose the Incorrect Statement:

Question 1.

Assertion (A): Dalton says under indirect taxes 2 + 2 is not 4 but 3 or even less than 3.

Reason (R): The rise in indirect taxes increases the price and reduces the demand for goods. Therefore the Government is uncertain about the expected revenue collection.

Answer:

a) Assertion (A) and Reason (R) both are true, and (R) is the correct explanation of (A).

![]()

Question 2.

Assertion (A): Tax is a compulsory payment by the citizens to the government to meet the public expenditure.

Reason (R): It is legally imposed by the government on the taxpayer and in no case, taxpayer can refuse to pay taxes to the government.

Answer:

a) Assertion (A) and Reason (R) both are true, and (R) is the correct explanation of (A).

Option:

a) Assertion (A) and Reason (R) both are true, and (R) is the correct explanation of (A).

b) Assertion (A) and Reason (R) both are true but (R) is the correct explanation of (A).

c) Both (A) and (R) are false.

d) (A) is true but (R) is false.

IX. Two Mark Questions

Question 1.

What do you mean by Public Finance?

Answer:

- Public finance is a study of the financial aspects of Government.

- It is concerned with the revenue and expenditure of the public authorities and with the adjustment of the one to the other.

Question 2.

What is Private finance?

Answer:

Private finance is the study of income, expenditure, borrowing, and financial administration of individual or private companies.

![]()

Question 3.

Define “Public Expenditure”?

Answer:

Public expenditure can be defined as, “The expenditure incurred by public authorities like central, state and local governments to satisfy the collective social wants of the people is known as public expenditure”.

Question 4.

Name the classification of Public Revenue.

Answer:

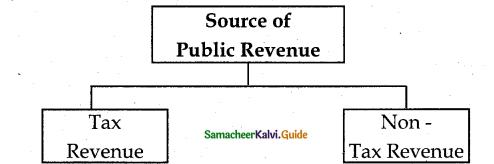

Question 5.

What is the classification of Public Revenue?

Answer:

Public revenue can be classified into two types.

- Tax Revenue

- Non-Tax Revenue

Question 6.

What are the canons or maxims of taxation?

Answer:

- Economical

- Equitable

- Convenient

- Certain

- Efficient and Flexible.

![]()

Question 7.

Define “Tax Revenue”?

Answer:

1. “A Tax is a compulsory payment made by a person or a firm to a government without reference to any benefit the payer may derive from the government.” – Anatol Murad

2. “A Tax is a compulsory contribution imposed by public authority, irrespective of the exact amount of service rendered to the taxpayer in return and not imposed as a penalty for any legal offense.” – Dalton

Question 8.

Name some of the types of Indirect Taxes.

Answer:

- Excise Duty

- Sales Tax

- Custom Duty

- Entertainment Tax

- Service Tax.

Question 9.

State the merits and demerits of Indirect Taxes.

Answer:

Merits:

- Wider coverage

- Equitable

- Economical

- Checks harmful consumption

Demerits:

- The higher cost of collection

- Inelastic

- Regressive

- Uncertainty

- No civic consciousness.

![]()

Question 10.

Sate the nature of sales tax, VAT, and GST.

Answer:

- Sales Tax: Multipoint tax with cascading effect.

- VAT: Multipoint tax without cascading effect.

- GST: One point tax without cascading effect.

Question 11.

Mention any two advantages of GST.

Answer:

- GST removes the cascading effect on the sale of goods and services.

- GST is also mainly technologically driven. All the activities are done online on the GST portal. This will speed up the processes.

Question 12.

Define Public Debt.

Answer:

“The Debt is the form of promises by The Treasury to pay to the holders of these promises a principal sum and in most instances interest on the principal. Borrowing resorts in order to provide funds for financing a current deficit” – Philip E. Taylor.

![]()

Question 13.

What are the types of Public Debt?

Answer:

- Internal Public Debt.

- External Public Debt.

Question 14.

What are the sources of internal public debt?

Answer:

- Individuals who purchase government bonds and securities.

- Banks, both public and private, buy bonds from the Government.

- Non-financial institutions like UTI, LIC, GIC, etc. also buy the Government bonds

- The central banks can lend to the Government in the form of the money supply.

- The Central Bank can also issue money to meet the expenditures of the Government.

Question 15.

State the causes for the increase in public debt.

Answer:

- War and preparation of war.

- Social obligations

- Economic Development and Deficit

- Employment

- Controlling inflation

- Fighting depression.

Question 16.

Name the types of budgets.

Answer:

- Revenue Budget

- Capital Budget

- Supplementary Budget

- Vote-on-Account

- Zero Base Budget

- Performance Budget <

- Balanced and Unbalanced Budget.

![]()

Question 17.

What is a Budget Balanced?

Answer:

A balanced Budget is a situation, in which the estimated revenue of the government during the year is equal to its anticipated expenditure.

Question 18.

What is an Unbalanced budget?

Answer:

The budget in which Revenue and Expenditure are not equal to each other is known as an unbalanced budget.

- Surplus Budget – the estimated revenues of the year are greater than anticipated expenditures.

- Deficit Budget – the estimated government expenditure is more than expected revenue.

Question 19.

What are Budgetary procedures?

Answer:

- Preparation of the Budget

- Presentation of the Budget

- Execution of the Budget.

Question 20.

What is the method of maintaining Government Accounts in India?

Answer:

- Consolidated Fund

- Contingency Fund

- Public Accounts

Question 21.

Name the parliamentary committees that control budget accounts.

Answer:

- The Public Accounts Committee

- The Estimates Committee.

![]()

Question 22.

Name the types of Local Bodies.

Answer:

- Village panchayats

- District Boards or Zila Parishad

- Municipalities

- Municipal corporations.

Question 23.

What are the sources of revenue of village panchayats?

Answer:

- general property tax

- taxes on land

- profession tax

- tax on animals and vehicles.

Question 24.

What are the sources of revenue of District Boards?

Answer:

- Grants – in – aid from the state government

- Land cesses

- Toll fees etc.

- Income from the property and loans from the state governments

- Grants for the centrally sponsored schemes relating to development work.

- Income from fairs and exhibitions.

- Property tax and other taxes which the state governments may authorize the district boards.

![]()

Question 25.

What are the sources of revenue of municipalities?

Answer:

- Taxes on property

- Taxes on goods, particularly octroi and terminal tax.

- personal taxes, taxes on profession, trades, and employment

- taxes on vehicles and animals

- theatre or show tax

- grants – in – aid from the state government.

Question 26.

State the sources of revenue of corporations.

Answer:

- tax on property

- tax on vehicles and animals

- tax on trades, calling, and employment

- theatre and show tax

- taxes on goods brought into the cities for sale

- taxes on advertisements

- octroi and terminal tax.

![]()

Question 27.

Define Fiscal policy.

Answer:

“By fiscal policy is meant the use of public finance or expenditure, taxes, borrowing, and financial administration to further our national economic objectives.” – Buehler.

Question 28.

What are the objectives of Fiscal policy?

Answer:

- Full employment

- Price stability

- Economic growth

- Equitable distribution

- External stability

- Capital formation

- Regional balance.

Question 29.

What is a lame-duck budget?

Answer:

The existing Government may or may not continue for the year on account of the fact that elections are due, then the Government places a ‘lame duck budget’. This is also called ‘ vote-on-account Budget’.

Question 30.

What is the share taxes between central and state Government?

Answer:

- Share to State Governments – 42%

- Share to Central Government – 58%

- 50% of GST collection is given to State Governments.

![]()

Question 31.

What is Goods and Services tax?

Answer:

Goods and Service Tax is an indirect tax levied on the supply of goods and services.

Question 32.

What are Progressive and Regressive taxes?

Answer:

Progressive Tax: The rate of tax increases with the increase in the tax base.

Regressive Tax: High rate of tax is levied on the poor and a low rate is levied on the rich.

Question 33.

What are the functions of the Finance Commission of India?

Answer:

- The distribution between the union and the states of the net proceeds of taxes, which may be divided between them and the allocation among the states of the respective shares of such proceeds.

- To determine the quantum of grants – in – aid to be given by the center to states and to evolve the principles governing the eligibility of the state for such grant – in – aid.

- Several issues like debt relief, financing of calamity relief of states, additional excise duties, etc., have been referred to the commission invoking this clause.

![]()

X. 5 Mark Questions

Question 1.

What are the similarities between Public and Private Finance?

Answer:

(I) Rationality:

- Both public finance and private finance are based on rationality.

- Maximization of welfare and least cost factor combination underlie both.

(II) Limit to borrowing:

- Both have to apply restraint with regard to borrowing.

- The Government also cannot live beyond its means.

- There is a limit to deficit financing by the state also.

(III) Resource utilisation:

- Both the private and public sectors have limited resources at their disposal.

- So both attempt to make optimum use of resources.

(IV) Administration:

- The effectiveness of measures of the Government as well as private depends on the administrative machinery.

- If the administrative machinery is inefficient and corrupt it will result in wastages and losses.

![]()

Question 2.

Explain the sources of tax revenue of the State Government.

Answer:

- Capitation tax

- Duties in respect of succession to agricultural land.

- Duties of excise on certain goods produced or manufactured in the state such as alcoholic, liquids, opium, etc.,

- Estate duty in respect of agricultural land.

- Fees in respect of any of the matters in the state list, but not including fees taken in any court.

- Land Revenue.

- Rates of the stamp duty in respect of documents other than those specified in the union list.

- Taxes on Agricultural income.

- Taxes on land and buildings.

- Taxes on mineral rights, subject to limitations imposed by parliament relating to mineral development.

- Taxes on the consumption or sale of electricity.

- Taxes on the entry of goods into a local area for consumption use or sale therein.

- Taxes on the sale and purchase of goods other than newspapers.

- Taxes on the advertisements other than those published in newspapers.

- Taxes on vehicle

- Taxes on animals and boats.

- Tolls.

Question 3.

Explain the sources of Non-Tax Revenue?

Answer:

The sources of non-tax revenue are:

(I) Fees:

- Fees are another important source of revenue for the government.

- A fee is charged by public authorities for rendering a service to the citizens.

- Unlike a tax, there is no compulsion involved in the case of fees.

- The government provides certain services and charges certain fees for them.

- For example, fees are charged for issuing passports, driving licenses, etc.

(II) Fine:

- A fine is a penalty imposed on an individual for violation of the law.

- For example, violation of traffic rules, payment of income tax after the stipulated time, etc.

(III) Earnings from Public Enterprises:

- The Government also gets revenue by way of surplus from public enterprises.

- Some of the public sector enterprises do make a good amount of profits.

- The profits or dividends which the government gets can be utilized for public expenditure.

(IV) Special assessment of betterment levy:

1. It is a kind of special charge levied on certain members of the community who are beneficiaries of certain government activities or public projects.

2. For example, due to a public park or due to the construction of a road, people in that locality may experience an appreciation in the value of their property or land.

(V) Gifts, Grants, and Aids:

- A grant from one government to another is an important source of revenue in the modem days.

- The government at the Centre provides grants to State governments and the State governments provide grants to the local government to carry out their functions.

- Grants from foreign countries are known as Foreign Aid.

- Developing countries receive military aid, food aid, technological aid, etc. from other countries.

(VI) Escheats:

It refers to the claim of the state to the property of persons who die without legal heirs or documented will.

![]()